District of Columbia Agreement Between Board Member and Close Corporation

Description

How to fill out Agreement Between Board Member And Close Corporation?

Are you situated in a location where you require documents for possibly organizational or personal reasons almost daily.

There are numerous legal document templates accessible online, but finding reliable versions can be challenging.

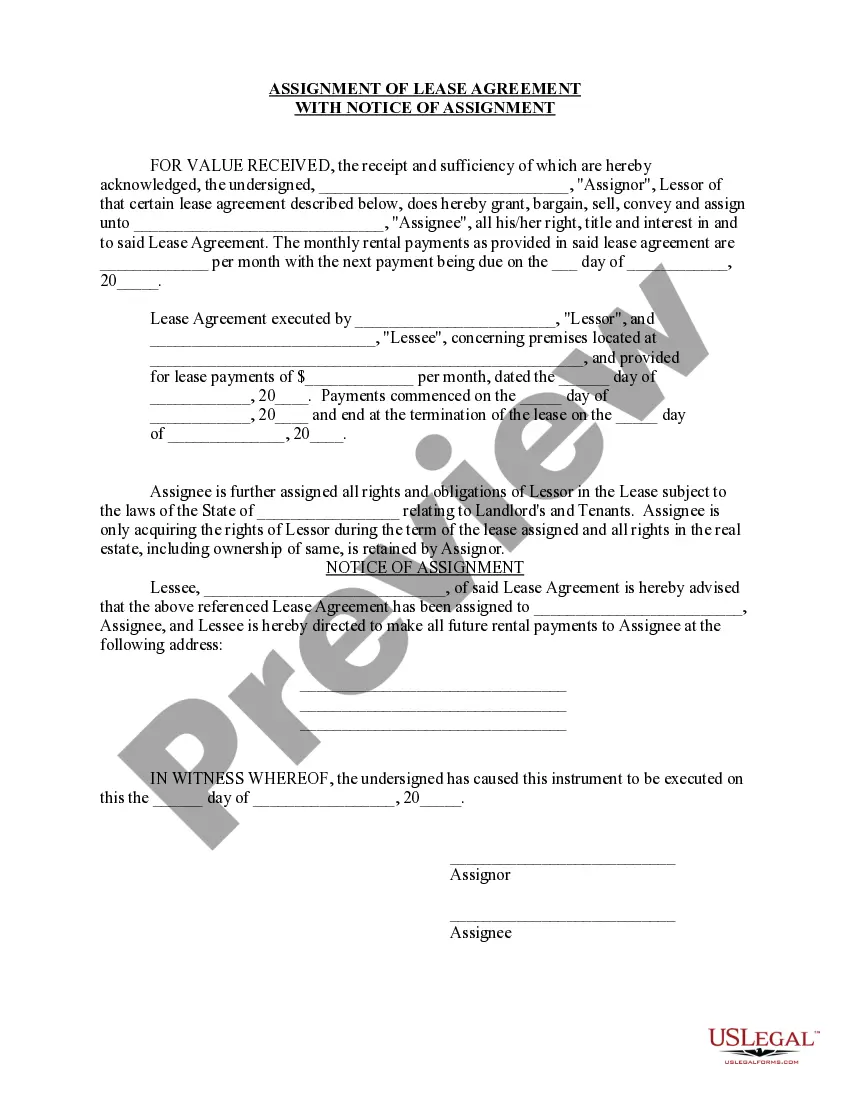

US Legal Forms provides thousands of form templates, including the District of Columbia Agreement Between Board Member and Close Corporation, designed to comply with federal and state regulations.

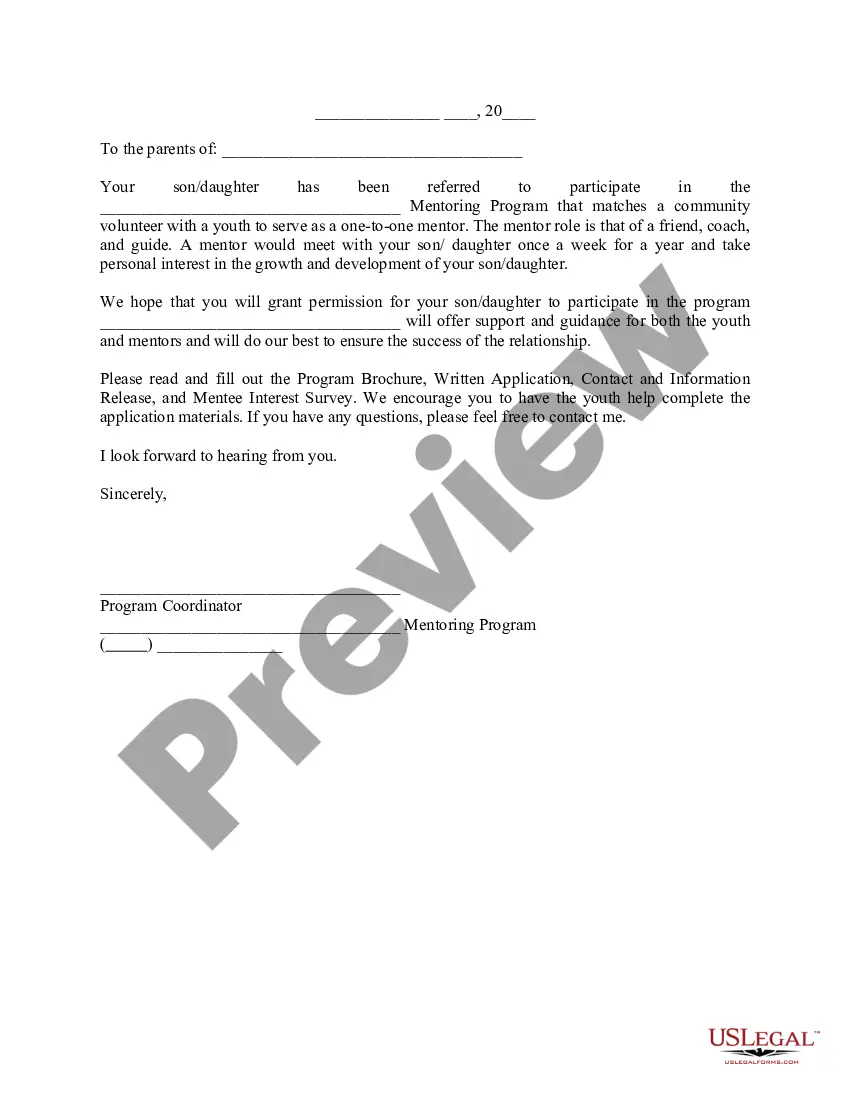

Once you identify the correct form, click Buy now.

Select the pricing plan you desire, enter the required information to create your account, and place your order using PayPal or Visa or MasterCard.

- If you are already accustomed to the US Legal Forms website and possess your account, simply Log In.

- Subsequently, you can download the District of Columbia Agreement Between Board Member and Close Corporation template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

- Use the Review button to examine the form.

- Read the description to ensure you have selected the appropriate form.

- If the form isn’t what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

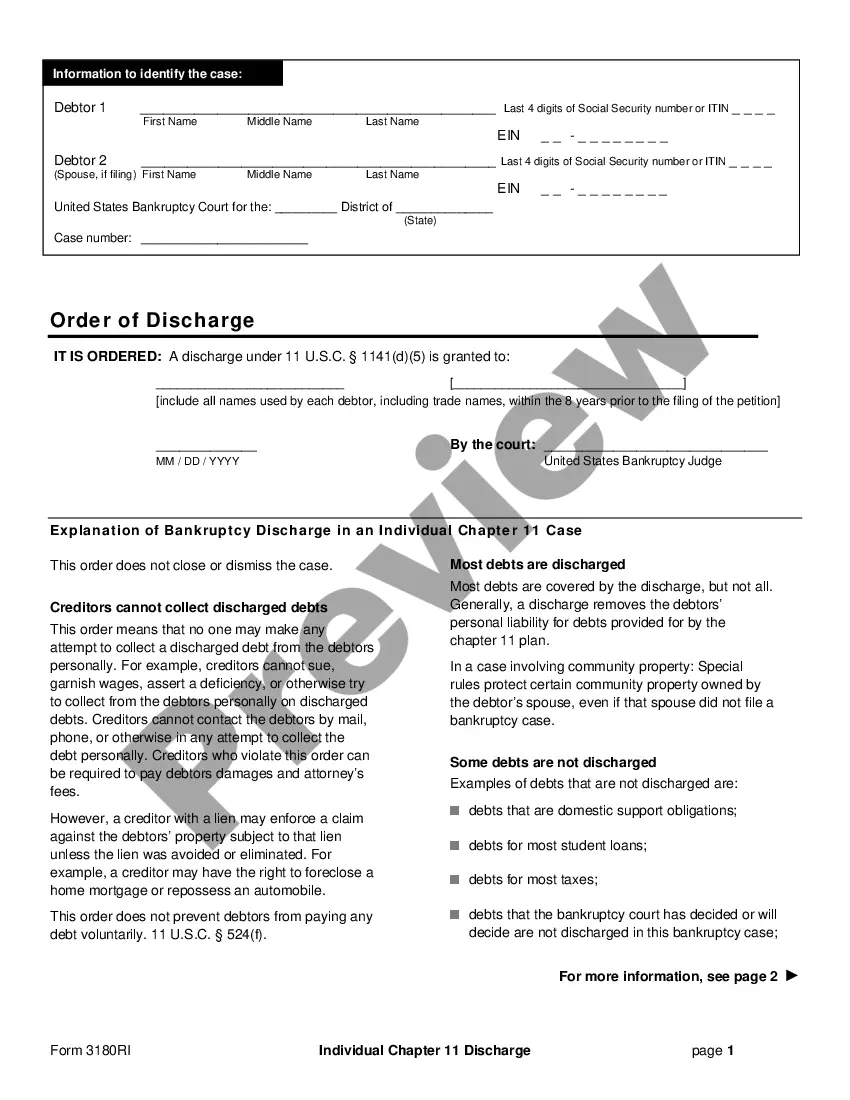

To establish an LLC in the District of Columbia, file the Articles of Organization with the Department of Consumer and Regulatory Affairs. It's important to create an operating agreement that addresses the management structure, possibly referencing the District of Columbia Agreement Between Board Member and Close Corporation. This will provide clarity on governance moving forward.

If your business is a corporation, then you are required by law to have a board of directors. Depending on your particular corporate structure and your state, one or two directors may be all that's legally required.

The articles of incorporation of a close corporation may provide that the business of the corporation shall be managed by the stockholders of the corporation rather than by a board of directors.

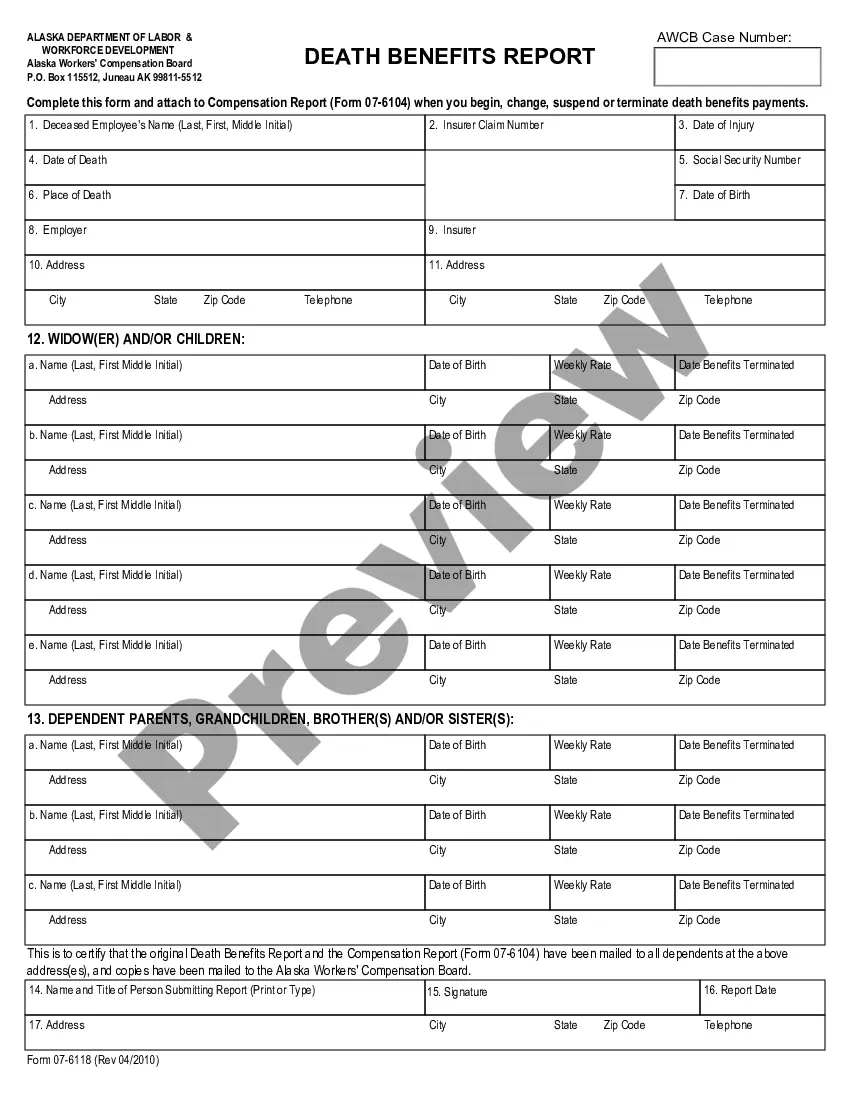

Can a close corporation or a company be a member of a close corporation? No, only a natural person or a inter vivos trust/testamentary trust can become a member.

The following elements must be shown to prove200b usurping: 1) the opportunity was presented to the director or officer in his or her corporate200b capacity; 2) the opportunity is related to or connected with the200b corporation's current or proposed200b business; 3) the corporation has the financial ability to take advantage of

ORC § 1701.591 entitled Close Corporation Agreement provides a mechanism for shareholders of a close corporation to agree in advance on issues related to the internal management and business operations of their corporation and the relations between and among themselves as shareholders.

Different states have different rules for the organization of their S corporations and C corporations, but all for-profit and nonprofit corporations are required by law to have boards of directors. The rules of the state in which you incorporate determine when they must be named and how many directors are required.

Disadvantages to a Close CorporationClose corporations do not exist in all states.A close corporation often costs more money to organize.While shareholders have the benefit of greater control over the sale of shares, shareholders in a close corporation are also burdened with increased responsibility.More items...

A close corporation is a legal entity much like a company. A CC is run and administered by its members, who must be natural persons (i.e. not other legal entities). A close corporation's members are like a company's shareholders.

A Close Corporation has members and a Company has shareholders and directors. The Close Corporation has its own estate seperate from its members.