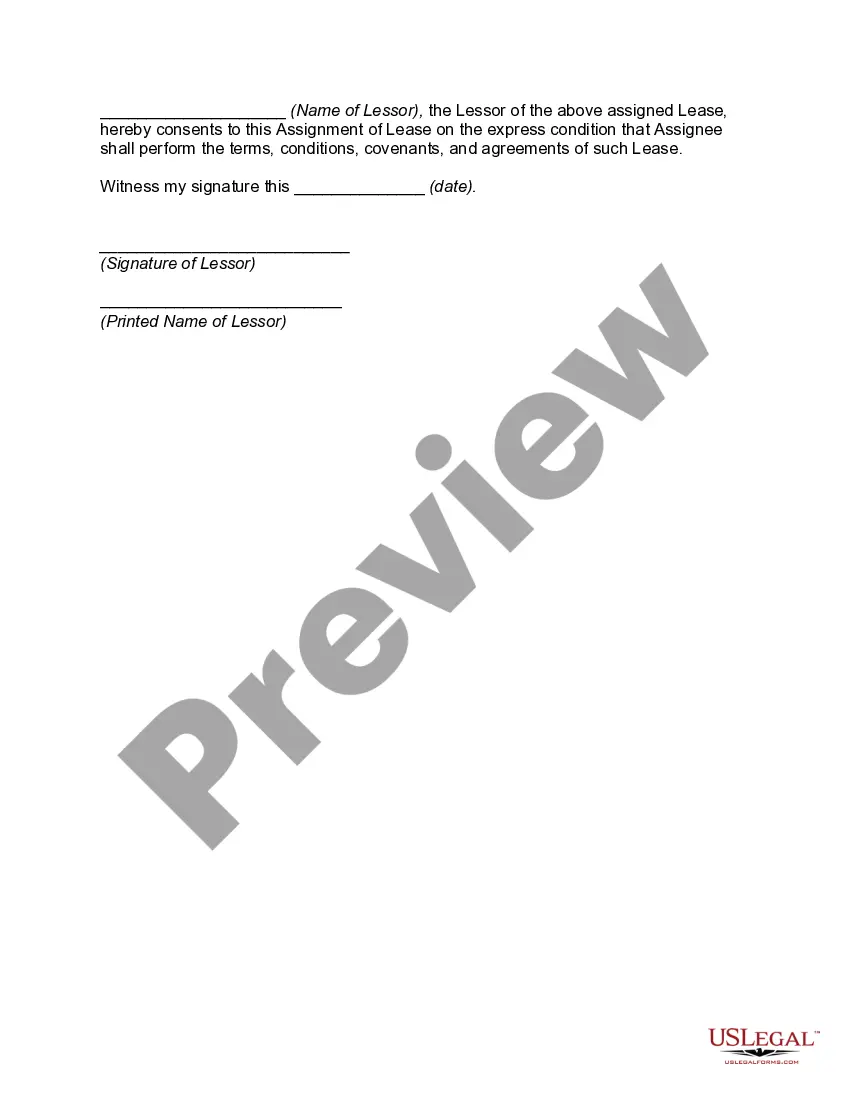

District of Columbia Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor

Description

How to fill out Assignment Of Personal Property Lease With Acceptance And Assumption Of Obligations Of Lessee And Consent Of Lessor?

If you require exhaustive, download, or print sanctioned document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and efficient search to locate the documents you need.

Various templates for business and personal use are organized by categories and states, or keywords.

Step 4. After locating the form you need, click the Purchase now option. Choose the pricing plan you prefer and input your credentials to register for the account.

Step 5. Complete the transaction. You can utilize your credit card or PayPal account to finalize the purchase.Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the District of Columbia Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor.

Every legal document template you acquire is yours permanently. You will have access to every form you downloaded within your account. Select the My documents section and choose a form to print or download again.

Complete and download, and print the District of Columbia Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor using US Legal Forms. There are millions of specialized and state-specific forms available for your business or personal requirements.

- Utilize US Legal Forms to obtain the District of Columbia Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor with just a few clicks.

- If you are already a customer of US Legal Forms, Log In to your account and select the Acquire option to obtain the District of Columbia Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor.

- You can also access forms you previously submitted electronically in the My documents tab of your account.

- If you are a first-time user of US Legal Forms, adhere to the guidelines below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to examine the content of the form. Be sure to read the description.

- Step 3. If you are not content with the form, use the Search field at the top of the page to find alternate versions of the legal form template.

Form popularity

FAQ

Filing a DC personal property tax return online is a straightforward process. First, access the Office of Tax and Revenue's website and select the personal property tax forms. This method is essential for property owners and businesses, particularly those dealing with the District of Columbia Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor, to maintain compliance with their tax requirements.

In Washington, DC, the depreciation rate for personal property generally follows a straight-line method over a defined period. This helps businesses calculate the potential tax benefits associated with their assets. When dealing with the District of Columbia Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor, knowing the depreciation can assist in effective financial planning.

Tangible personal property tax in DC is levied on personal property owned by individuals or businesses, which includes furniture, machinery, and equipment. This tax is assessed annually based on the fair market value of the property. Understanding your obligations, especially in relation to agreements like the District of Columbia Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor, can help you manage your expenses effectively.

To file the DC FP 31 online, visit the Office of Tax and Revenue's web portal and navigate to the forms section. You'll find guidance to complete the form accurately. This online method is particularly useful for those involved in properties governed by the District of Columbia Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor, as it may simplify your tax reporting needs.

Yes, the DC D 30 can be filed electronically, making it easier for individuals and businesses to manage their tax obligations. Electronic filing allows for a convenient and efficient submission process. Ensure you verify your information before submission, especially if you are managing properties related to agreements such as the District of Columbia Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor.

The DC FP 31 is specifically for businesses that operate within the District of Columbia and maintain personal property. If your business uses tangible personal property for income generation, you are likely required to file this form. This includes situations involving the District of Columbia Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor, which may have tax implications that need to be addressed.

Any individual or business that owns tangible personal property in Washington, DC must file a personal property tax return. This includes anyone leasing personal property under agreements such as the District of Columbia Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor. If you meet the criteria, ensure your return is accurate and submitted on time to remain compliant.

Filing DC sales tax requires you to complete the appropriate forms and submit them to the Office of Tax and Revenue. You can do this electronically through the Office’s site, which streamlines the process significantly. Ensure your filings are timely to avoid penalties, especially when dealing with lease agreements like the District of Columbia Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor.

The FP-31 is a tax form related to personal property in Washington, D.C., specifically for reporting personal property taxes. This form helps businesses accurately declare and value their personal property, allowing for proper taxation. When creating a document like the District of Columbia Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor, it is essential to understand the implications of the FP-31, ensuring that both parties meet local regulations and protect their rights.

Filling out a commercial lease agreement can be straightforward when you understand the document's key sections. First, clearly identify the parties involved and provide accurate property details. Next, outline the lease terms, including the duration, rental amount, and responsibilities, such as maintenance and utilities. For tenants and landlords in the District of Columbia, using a District of Columbia Assignment of Personal Property Lease with Acceptance and Assumption of Obligations of Lessee and Consent of Lessor ensures you cover all necessary legal aspects and protects everyone's interests.