District of Columbia Articles of Association of Unincorporated Charitable Association

Description

How to fill out Articles Of Association Of Unincorporated Charitable Association?

Have you ever found yourself in a situation where you need documents for either business or personal activities almost every day.

There are numerous legitimate document templates available online, but finding ones you can trust is not straightforward.

US Legal Forms provides thousands of form templates, such as the District of Columbia Articles of Association of Unincorporated Charitable Association, designed to meet federal and state regulations.

When you locate the appropriate form, click Get now.

Choose the payment plan you prefer, fill out the required information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the District of Columbia Articles of Association of Unincorporated Charitable Association template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

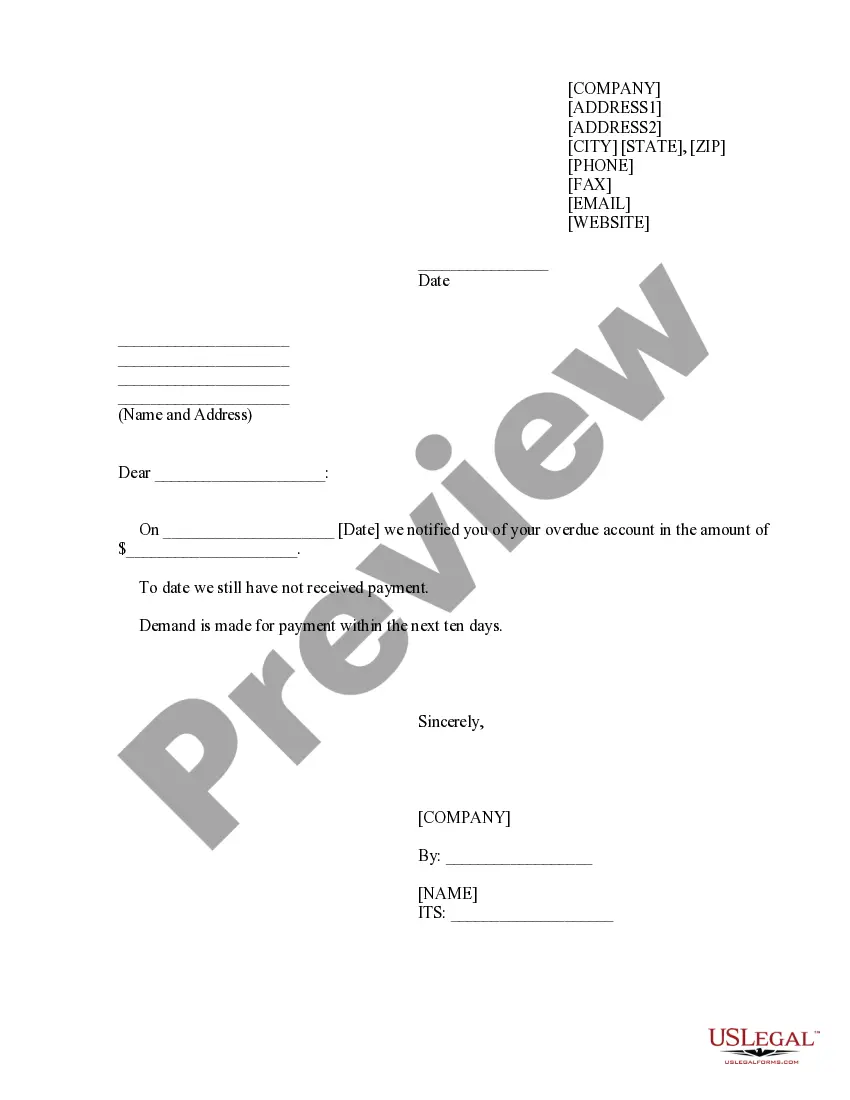

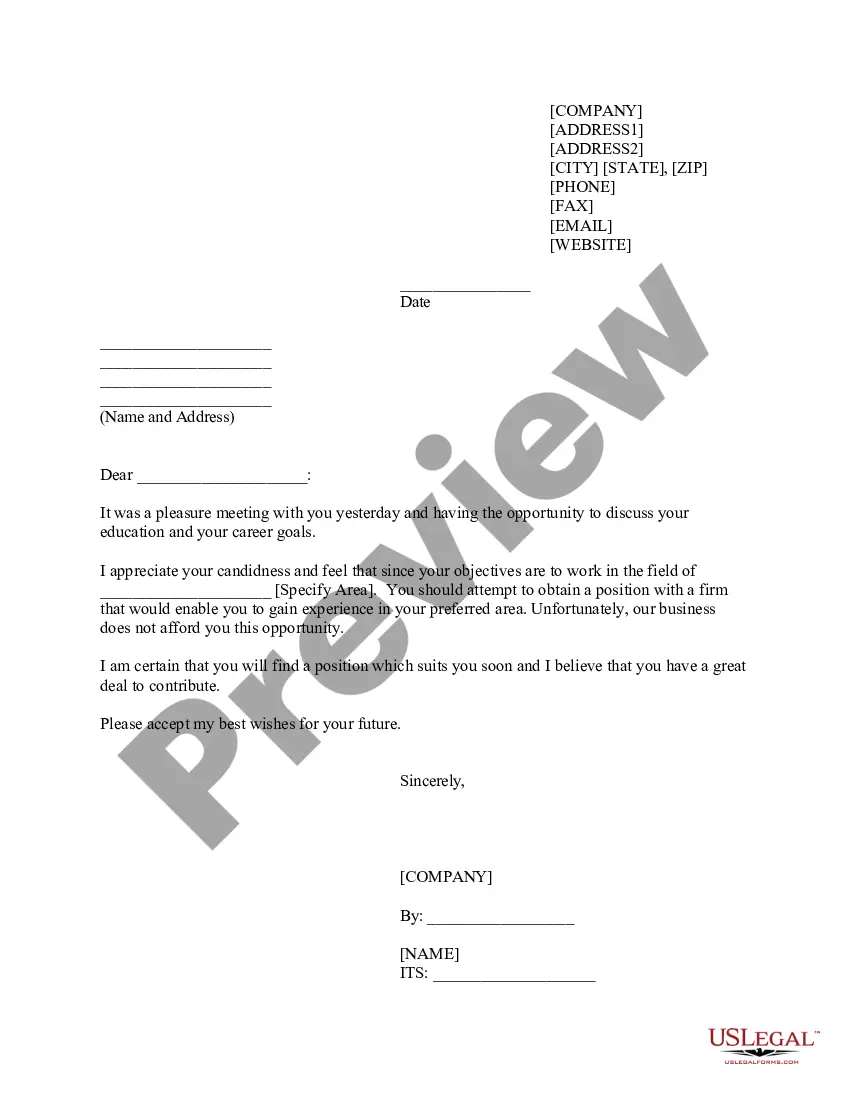

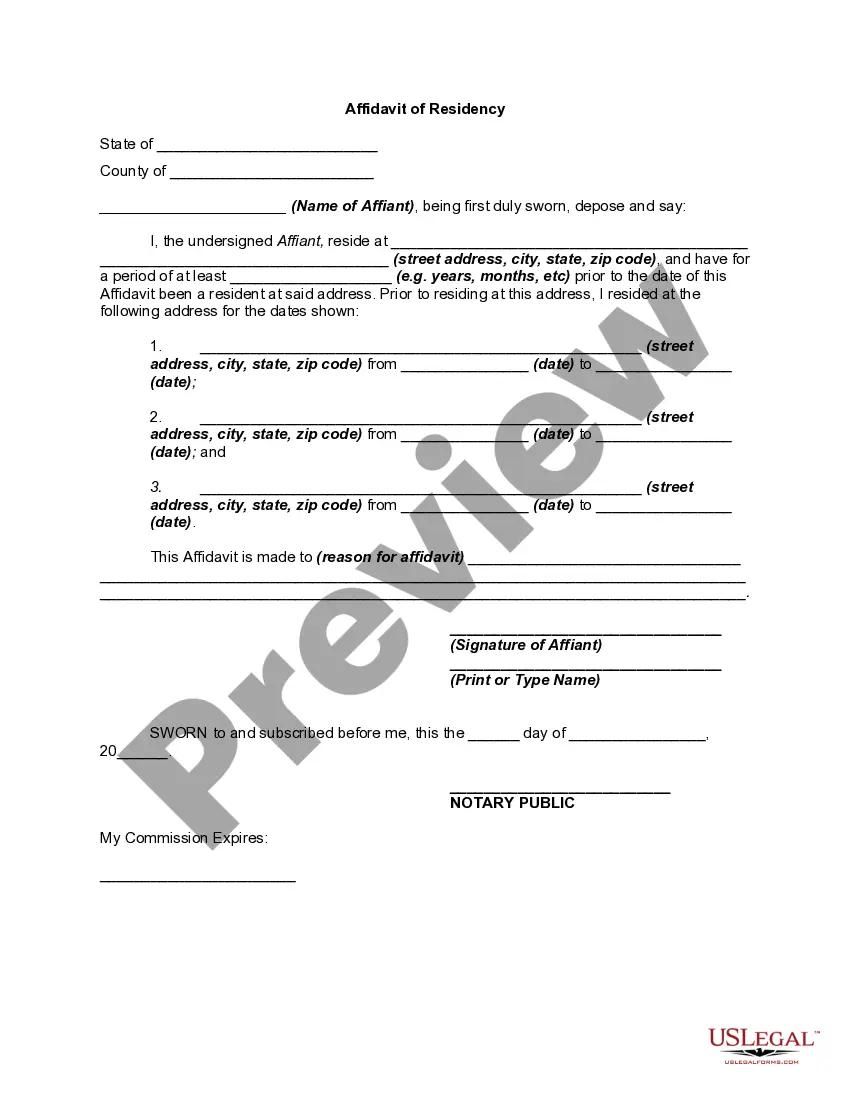

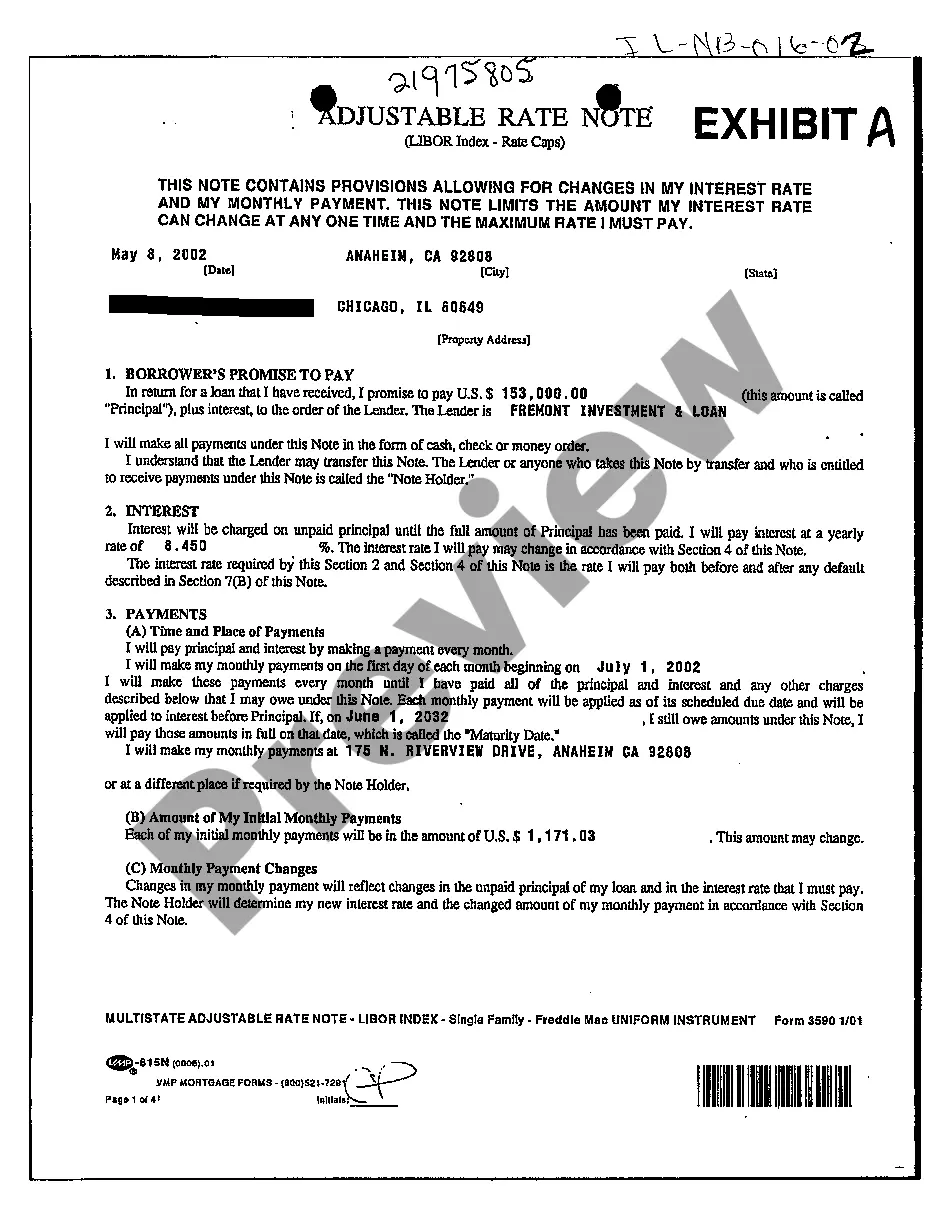

- Use the Review button to check the form.

- Read the description to confirm that you have selected the right form.

- If the form is not what you're looking for, use the Search box to find the form that fits your needs.

Form popularity

FAQ

Most nonprofits must file articles of incorporation to gain legal recognition. Without this, they may miss out on benefits such as limited liability and the ability to apply for grants. Unincorporated associations can operate without incorporation but may face limitations in fundraising and tax-exempt applications. Consulting the District of Columbia Articles of Association of Unincorporated Charitable Association can guide you through the necessary steps for compliance.

An unincorporated association often requires an Employer Identification Number (EIN) if it has employees or needs to open a bank account. Obtaining an EIN simplifies the process of managing finances and fulfilling tax obligations. Furthermore, having an EIN is beneficial even for smaller organizations with minimal income. Consider referencing the District of Columbia Articles of Association of Unincorporated Charitable Association when navigating EIN applications.

An unincorporated association and a nonprofit organization are not identical terms. While many unincorporated associations operate as nonprofits focused on charitable goals, not all unincorporated associations qualify for nonprofit status. Therefore, it is essential to understand both concepts clearly. Using the District of Columbia Articles of Association of Unincorporated Charitable Association can help you differentiate and ensure proper classification.

Generally, unincorporated associations do not file taxes as separate entities. Instead, income may be reported on the personal tax returns of the members. Certain circumstances may necessitate filing, so it is vital to acknowledge IRS requirements. Aligning your association’s operations with the guidelines outlined in the District of Columbia Articles of Association of Unincorporated Charitable Association can clarify tax obligations.

Yes, a 501(c)(3) organization can function as an unincorporated association. This designation allows tax-exempt charities to operate without formal incorporation. However, they must still follow specific operational guidelines to maintain their tax-exempt status. Understanding the implications of the District of Columbia Articles of Association of Unincorporated Charitable Association can help in structuring compliance.

Yes, you can start and run a nonprofit organization by yourself, but there are important principles you must follow. Even as a sole member, you need to have a governing structure in place, as detailed in the District of Columbia Articles of Association of Unincorporated Charitable Association. Having a diverse board is often recommended for better decision-making and compliance.

A 501(c)(3) is a specific type of nonprofit organization that is recognized as tax-exempt by the IRS. While all 501(c)(3) organizations are nonprofits, not all nonprofits qualify for this tax-exempt status. Understanding this distinction is crucial when creating your District of Columbia Articles of Association of Unincorporated Charitable Association and your funding strategies.

The governing document of an organization outlines its structure, operations, and rules. For unincorporated charitable associations, this is often the District of Columbia Articles of Association of Unincorporated Charitable Association, which defines how the organization will function. This document plays a key role in ensuring accountability and guiding decision-making.

Unincorporated associations may need to file a tax return depending on their income and activities. While they don’t contribute taxes like a corporation, they must comply with IRS requirements for reporting income over a certain threshold. It is vital to understand these responsibilities when drafting your District of Columbia Articles of Association of Unincorporated Charitable Association.

Yes, an unincorporated association typically needs an Employer Identification Number (EIN) if it plans to open a bank account or hire employees. Obtaining an EIN is straightforward and is an important step in formalizing your organization. As you prepare your District of Columbia Articles of Association of Unincorporated Charitable Association, ensure you are also factoring in your EIN application.