This form is a trust used to provide supplemental support for a disabled beneficiary without loss of government benefits. It may be revocable or irrevocable, as the funds are contributed by a third party, and not the beneficiary. The Omnibus Budget Reconciliation Act of 1993 established the supplemental needs trusts.

District of Columbia Supplemental Needs Trust for Third Party - Disabled Beneficiary

Description

How to fill out Supplemental Needs Trust For Third Party - Disabled Beneficiary?

Have you ever found yourself in a scenario where you require paperwork for various business or personal reasons almost all the time.

There are numerous trustworthy document templates accessible online, but locating ones you can rely on isn't straightforward.

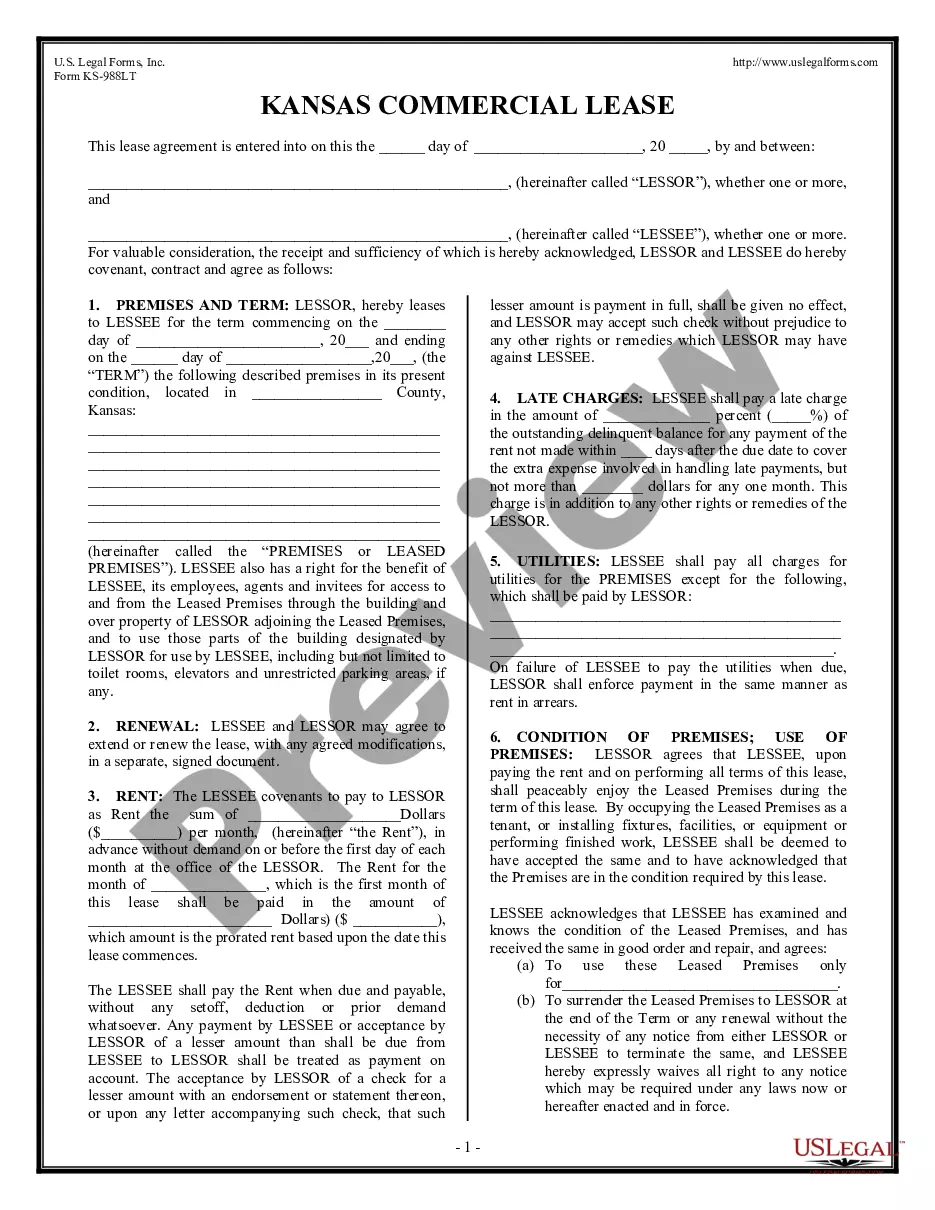

US Legal Forms provides an extensive collection of form templates, such as the District of Columbia Supplemental Needs Trust for Third Party - Disabled Beneficiary, which can be completed to satisfy state and federal requirements.

Once you find the correct form, click Get now.

Select the pricing plan you prefer, fill in the required details to create your account, and purchase the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the District of Columbia Supplemental Needs Trust for Third Party - Disabled Beneficiary template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Use the Review option to examine the form.

- Check the details to ensure you have selected the right form.

- If the form isn't what you're looking for, use the Research field to find the form that meets your needs and requirements.

Form popularity

FAQ

Yes, a supplemental needs trust can be designated as the beneficiary of an IRA, allowing for strategic asset distribution. By naming the District of Columbia Supplemental Needs Trust for Third Party - Disabled Beneficiary, you can ensure that the trust receives funds directed to enhance the beneficiary's life. This approach provides a way to manage IRA assets while protecting the financial interests of the disabled beneficiary.

The beneficiary of a supplemental needs trust is typically a disabled individual, designed to provide financial support without affecting their eligibility for public assistance programs. In this context, the District of Columbia Supplemental Needs Trust for Third Party - Disabled Beneficiary serves as a crucial tool to improve the quality of life for these individuals. It is essential for families to correctly designate the beneficiary to ensure proper fund allocation.

Indeed, a special needs trust can serve as a beneficiary of an IRA. Utilizing the District of Columbia Supplemental Needs Trust for Third Party - Disabled Beneficiary within your estate plan ensures that funds are directed toward the needs of the disabled individual without jeopardizing their eligibility for government benefits. This arrangement aptly protects the beneficiary's financial future.

Yes, a trust can be named as a beneficiary of an IRA. When the District of Columbia Supplemental Needs Trust for Third Party - Disabled Beneficiary is established as the IRA beneficiary, it allows the trust to receive funds upon the owner's passing. This strategy provides financial security for the disabled beneficiary while also adhering to specific legal and tax requirements.

The best trust for a disabled person is often the District of Columbia Supplemental Needs Trust for Third Party - Disabled Beneficiary. This type of trust allows you to provide financial support to the disabled beneficiary without affecting their eligibility for government assistance programs. It covers a range of expenses that improve their quality of life, such as medical care and education. To determine the best option for your situation, consider consulting with legal experts or utilizing services like uslegalforms for guidance tailored to your needs.

Setting up a trust fund for a disabled person involves several steps. First, you need to determine the appropriate type of trust, such as the District of Columbia Supplemental Needs Trust for Third Party - Disabled Beneficiary, which is designed to enhance the quality of life for the beneficiary without jeopardizing government benefits. Next, you will need to select a trustee who will manage the funds and distribute them according to the trust terms. Finally, consult with a legal professional or use platforms like uslegalforms to ensure you meet all legal requirements and properly fund the trust.

A District of Columbia Supplemental Needs Trust for Third Party - Disabled Beneficiary offers numerous advantages, especially in providing financial security. This trust allows assets to be set aside for the disabled beneficiary while preserving access to government benefits. It can enhance the quality of life by funding special needs that government programs do not cover. Additionally, creating such a trust may alleviate financial burdens for family members, ensuring the beneficiary's future needs are met.

In a District of Columbia Supplemental Needs Trust for Third Party - Disabled Beneficiary, one disadvantage is the potential complexity involved in managing the trust. This complexity can lead to misunderstandings among family members about how funds can be spent. Furthermore, improper management can jeopardize benefits the disabled beneficiary receives, such as Medicaid or Supplemental Security Income. It's essential to seek guidance from experts to navigate these challenges effectively.

When a beneficiary of a District of Columbia Supplemental Needs Trust for Third Party - Disabled Beneficiary passes away, the trust typically designates how remaining funds are handled. Often, the trust will specify that the assets should be distributed to other beneficiaries, which might include family members or charitable organizations. It's crucial to have clear instructions within the trust document to ensure a smooth transition of assets. Engaging with professionals can help ensure that the trust's terms are followed properly.

To set up a District of Columbia Supplemental Needs Trust for Third Party - Disabled Beneficiary, start by determining the desired assets and goals for the beneficiary. Engage with a qualified attorney who specializes in special needs trusts to draft the necessary documents. Once established, the trust can be funded, providing continued support for the disabled individual without jeopardizing essential government benefits.