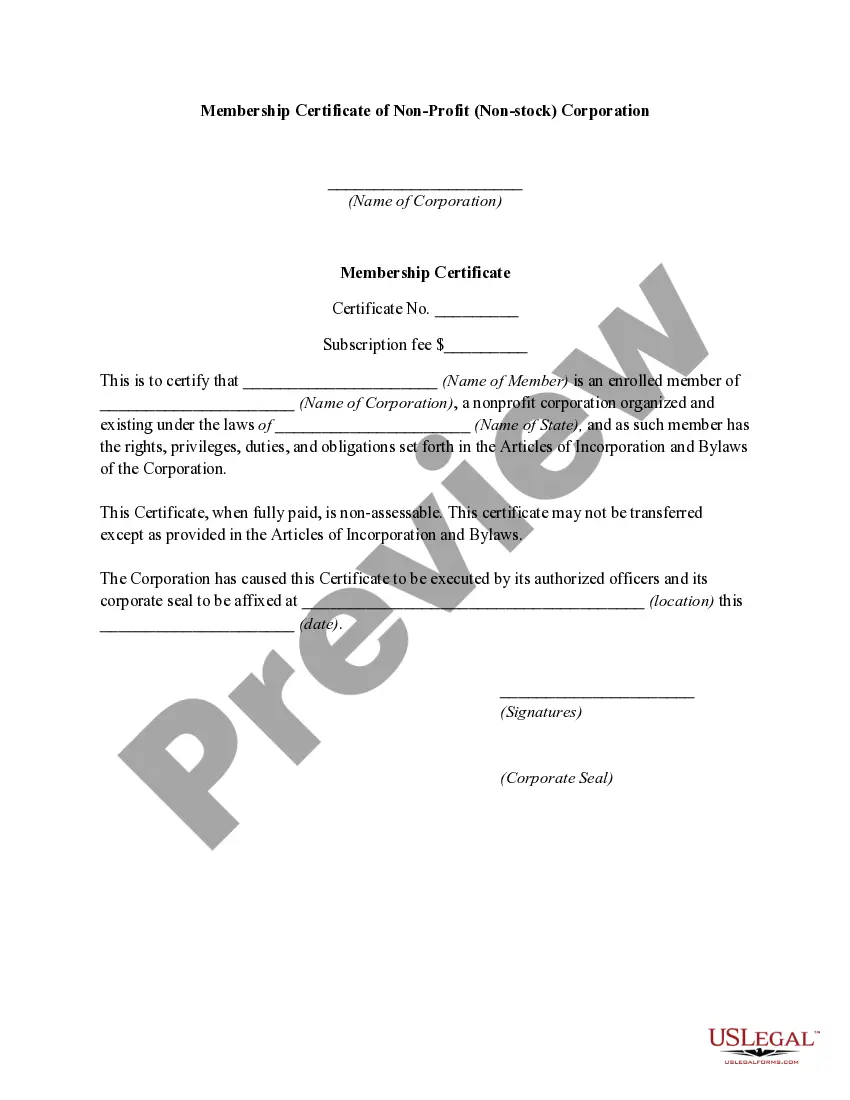

District of Columbia Membership Certificate of Nonprofit or Non Stock Corporation

Description

How to fill out Membership Certificate Of Nonprofit Or Non Stock Corporation?

You are able to spend time on the Internet attempting to find the legitimate document format that meets the federal and state specifications you will need. US Legal Forms supplies thousands of legitimate kinds that happen to be analyzed by professionals. It is possible to down load or print the District of Columbia Membership Certificate of Nonprofit or Non Stock Corporation from our services.

If you already possess a US Legal Forms accounts, you may log in and click the Acquire button. After that, you may full, change, print, or indication the District of Columbia Membership Certificate of Nonprofit or Non Stock Corporation. Every legitimate document format you buy is your own forever. To have an additional copy of the obtained type, go to the My Forms tab and click the corresponding button.

If you are using the US Legal Forms website initially, stick to the easy directions beneath:

- Very first, be sure that you have selected the proper document format to the county/area of your liking. Browse the type explanation to ensure you have selected the right type. If readily available, utilize the Preview button to look throughout the document format also.

- If you want to get an additional edition of the type, utilize the Search discipline to find the format that meets your requirements and specifications.

- Upon having identified the format you desire, click Get now to proceed.

- Pick the costs prepare you desire, key in your credentials, and register for your account on US Legal Forms.

- Total the transaction. You can use your bank card or PayPal accounts to purchase the legitimate type.

- Pick the structure of the document and down load it for your device.

- Make adjustments for your document if possible. You are able to full, change and indication and print District of Columbia Membership Certificate of Nonprofit or Non Stock Corporation.

Acquire and print thousands of document templates making use of the US Legal Forms Internet site, which provides the largest selection of legitimate kinds. Use skilled and condition-specific templates to take on your company or specific requires.

Form popularity

FAQ

Being a 501(c)(3) nonprofit means your organization is exempt from paying most taxes at the federal level. However, being recognized as tax-exempt by the IRS does not automatically mean your organization is exempt from local D.C. taxes including income, franchise, sales, use, and personal property taxes.

How To Start A Nonprofit In Washington DC Choose your DC nonprofit filing option. File DC nonprofit articles of incorporation. Get a Federal EIN from the IRS. Adopt your nonprofit's bylaws. Apply for federal and/or state tax exemptions. Apply for any required state licenses. Open a bank account for your DC nonprofit.

Every business in D.C., including nonprofit organizations, must have a Basic Business License. You must first complete the prerequisites for the license, including registration with the Office of Tax and Revenue. You may submit your application online or submit a paper application.

§ 29?406.03. (a) A board of directors shall consist of 3 or more directors, with the number specified in or fixed in ance with the articles of incorporation or bylaws.

Every business in D.C., including nonprofit organizations, must have a Basic Business License. You must first complete the prerequisites for the license, including registration with the Office of Tax and Revenue. You may submit your application online or submit a paper application.

To register domestic nonprofit corporation in the District, customer shall deliver articles of incorporation form DNP-1 to the Superintendent for filing either by web or by mail / walk-in. NOTE: Walk-in Customers will be charged expedited fee for one day service in the amount of $100 in addition to regular filing fees.

Another difference between non-profit corporations and benefit corporations is that the stock certificates of the latter must be clearly marked with the words ?Benefit Corporation.? A non-profit company has no shareholders and therefore no stock certificates.

Corporations Division Fees - Nonprofit CorporationEntity TypeFee DescriptionFee AmountDomestic Nonprofit CorporationArticles of incorporation$80.00Domestic Nonprofit CorporationStatement of domestication$80.00Domestic Nonprofit CorporationAbandonment of domestication$80.0029 more rows