District of Columbia Certificate of Incorporation

Description

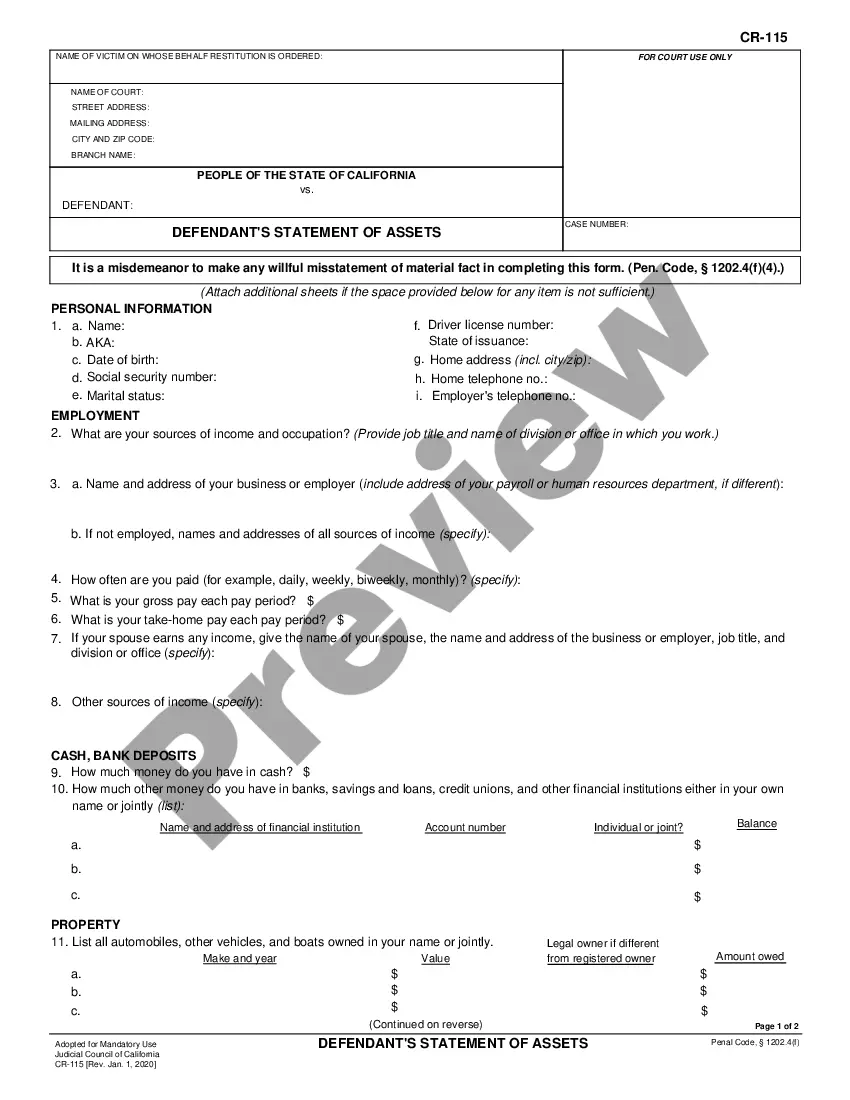

(It is a legal document serving as a formal record of a company's formation.)"

How to fill out Certificate Of Incorporation?

Are you in a situation that you will need papers for either company or personal purposes virtually every time? There are a variety of legal papers themes available on the Internet, but locating ones you can rely on is not easy. US Legal Forms offers a huge number of develop themes, just like the District of Columbia Certificate of Incorporation, that are written in order to meet federal and state requirements.

Should you be currently acquainted with US Legal Forms internet site and get your account, just log in. After that, you are able to down load the District of Columbia Certificate of Incorporation design.

Should you not have an account and need to start using US Legal Forms, adopt these measures:

- Get the develop you require and make sure it is for the correct town/county.

- Utilize the Review button to analyze the shape.

- Look at the explanation to actually have selected the proper develop.

- If the develop is not what you are trying to find, utilize the Look for discipline to obtain the develop that fits your needs and requirements.

- If you get the correct develop, just click Purchase now.

- Select the costs prepare you would like, fill out the necessary info to create your account, and pay money for your order using your PayPal or bank card.

- Choose a practical document file format and down load your duplicate.

Locate all the papers themes you possess bought in the My Forms menus. You may get a extra duplicate of District of Columbia Certificate of Incorporation any time, if needed. Just click on the required develop to down load or print the papers design.

Use US Legal Forms, one of the most substantial assortment of legal types, in order to save some time and avoid errors. The support offers professionally manufactured legal papers themes which can be used for an array of purposes. Generate your account on US Legal Forms and commence producing your lifestyle a little easier.

Form popularity

FAQ

You can file Personal Property Tax Form FP-31 online by signing up for a MyTax.DC.gov account. The deadline for filing and paying your return via MyTaxDC.gov is July 31 every year. Even if your personal property's value is $225,000 or less, you must still file the Personal Property Tax return.

The Federal/State E-File program allows taxpayers to file their federal and DC returns electronically at the same time. (Electronic filing does not increase the probability of being audited).

To register a foreign LLC in the District of Columbia, you'll need to file a Foreign Registration Statement with the DCRA and pay the $220 filing fee. The process is called foreign qualification, and it allows you to do business in DC without having to form an entirely new LLC.

How do I amend my DC return after I discover an error? To file an amended return for the current year, fill in the amended return oval, and complete the tax forms with the corrected information explaining the changes. Do not file an amended return with any other return.

On the MyTax.DC.gov homepage, locate the Business section. Click ?Register a New Business ? Form FR-500?. You will be navigated to our FR-500 New Business Registration Form.

To start a corporation in DC, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Department of Licensing and Consumer Protection. You can file this document online, in person, or by mail. The articles cost a minimum of $99 to file.

DC. Option 2: If you owe D.C. income taxes, you will either have to submit a D.C. tax return or extension by the tax deadline in order to avoid late filing penalties. You can only eFile and IRS tax extension, but not a Washington, D.C. extension.

To start a corporation in the District of Columbia, you must file Articles of Incorporation with the Department of Consumer and Regulatory Affairs (DCRA). You can file the document online or by mail. The Articles of Incorporation cost a minimum of $220 to file.