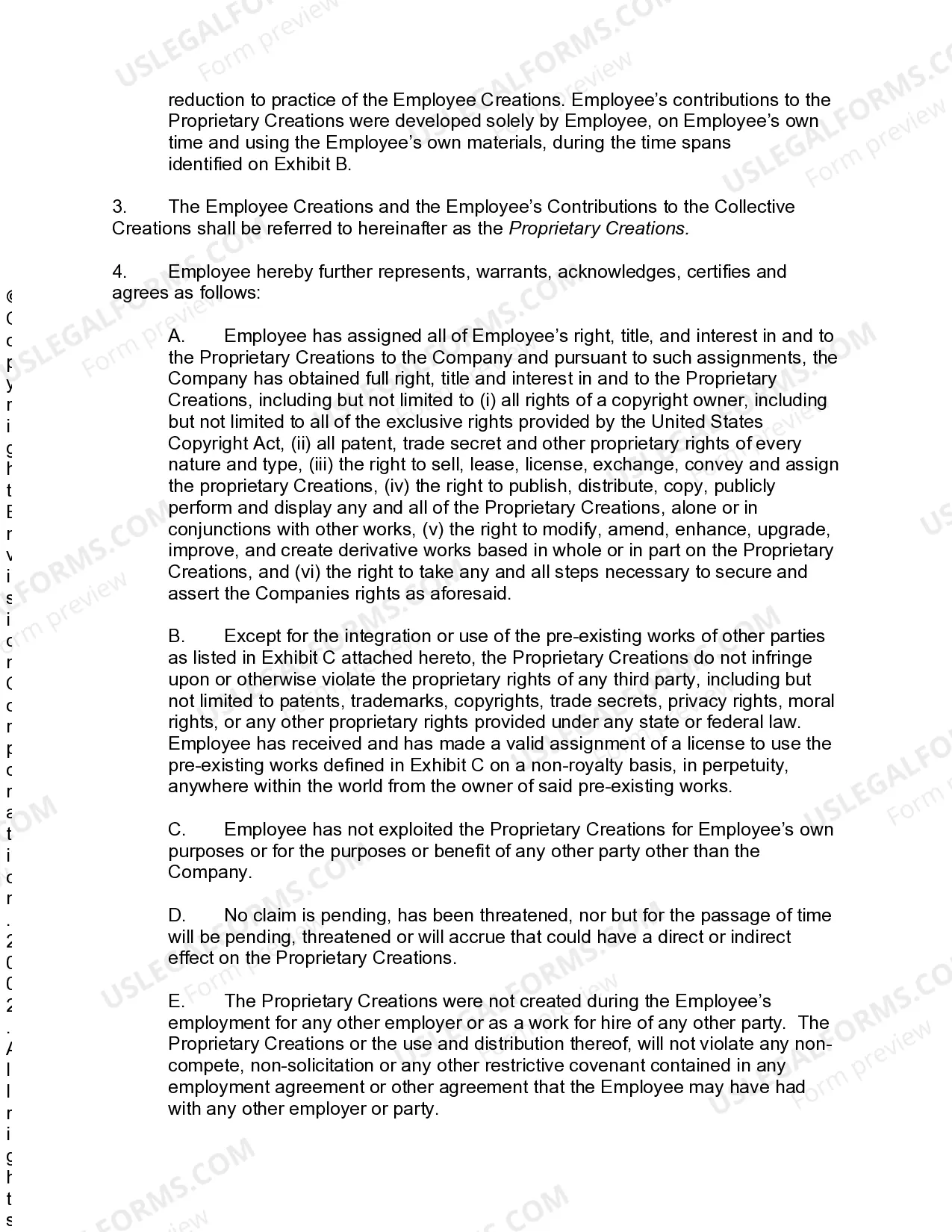

District of Columbia Employee Authorship Certificate

Description

How to fill out Employee Authorship Certificate?

It is possible to spend hrs on-line trying to find the legal record design which fits the state and federal requirements you need. US Legal Forms supplies a large number of legal kinds that happen to be examined by professionals. You can easily acquire or printing the District of Columbia Employee Authorship Certificate from our assistance.

If you currently have a US Legal Forms profile, it is possible to log in and click the Down load option. Next, it is possible to full, change, printing, or signal the District of Columbia Employee Authorship Certificate. Every single legal record design you get is the one you have forever. To get one more duplicate of any obtained develop, go to the My Forms tab and click the corresponding option.

If you work with the US Legal Forms website initially, follow the basic recommendations beneath:

- First, ensure that you have selected the right record design for that state/area of your liking. Look at the develop description to ensure you have picked out the appropriate develop. If accessible, make use of the Preview option to search throughout the record design at the same time.

- In order to find one more version from the develop, make use of the Look for discipline to discover the design that suits you and requirements.

- When you have located the design you want, click Buy now to move forward.

- Select the pricing prepare you want, key in your credentials, and register for a merchant account on US Legal Forms.

- Complete the transaction. You can utilize your credit card or PayPal profile to fund the legal develop.

- Select the file format from the record and acquire it to your gadget.

- Make adjustments to your record if possible. It is possible to full, change and signal and printing District of Columbia Employee Authorship Certificate.

Down load and printing a large number of record templates making use of the US Legal Forms Internet site, that offers the largest selection of legal kinds. Use professional and status-specific templates to handle your company or personal requires.

Form popularity

FAQ

Unincorporated businesses (Partnership and Sole Proprietors), with gross incomes of more than $12,000 from District sources, must file Form D-30 (whether or not it has net income). This includes any business carrying on and/or engaging in any trade, business, or commercial activity in DC with income from DC sources.

You can get a Certificate of Good Standing in person or online from the D.C. Department of Licensing and Consumer Protection. Online: Go to to CorpOnline and create an account. Once your account is created you can choose ?Request a Certificate of Good Standing.?

In Washington, D.C., you can establish a sole proprietorship without filing any legal documents with the D.C. Department of Licensing and Consumer Protection (DLCP). Though no action is required to legally create a sole proprietorship, you should follow four simple steps to start your business: Choose a business name.

If you are a corporation, partnership or limited liability company (domestic or foreign), you must be registered and in good standing with the Corporations Division. You must also have a Registered Agent.

FR-500 New Business Registration (new registrations only)

The persons subject to the Ballpark Fee (?feepayers?) are persons that have income of $5,000,000 or more in annual District gross receipts and either are subject to filing franchise tax returns (whether Corporate or Unincorporated) or are employers required to make unemployment insurance contributions.

DC non-resident (Non-Logon) applicants must request a Clean Hands Certificate on MyTax.DC.gov web portal by following the following instructions: Page 2 1. From the MyTax.DC.gov homepage, request a ?Certificate of Clean Hands? from the Individuals column.

Q: For how long is a Certificate of Clean Hands valid? A: A Certificate of Clean Hands can be validated in real-time by using our system at MyTax.DC.gov. As such, the certificates do not expire.