District of Columbia Cash Receipts Control Log

Description

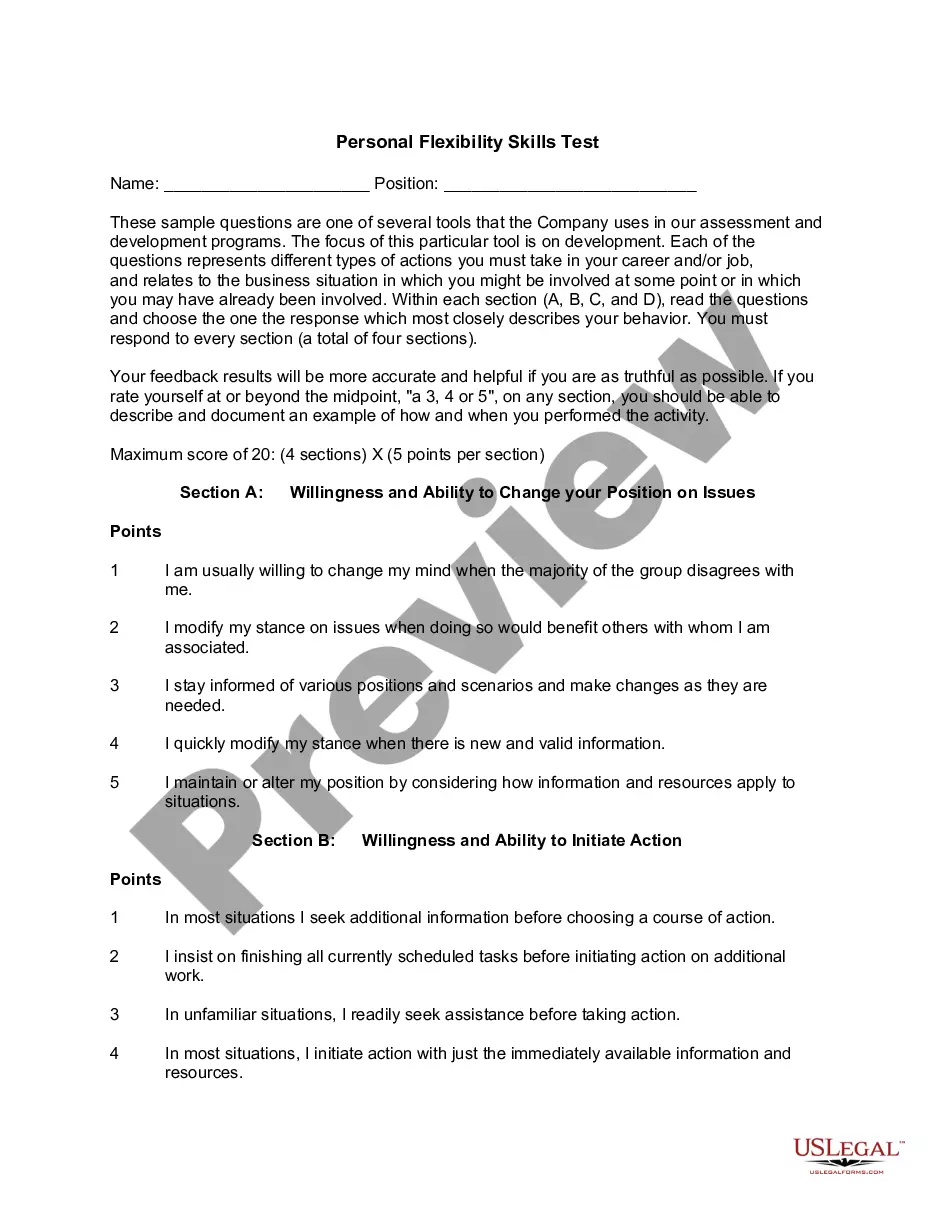

How to fill out Cash Receipts Control Log?

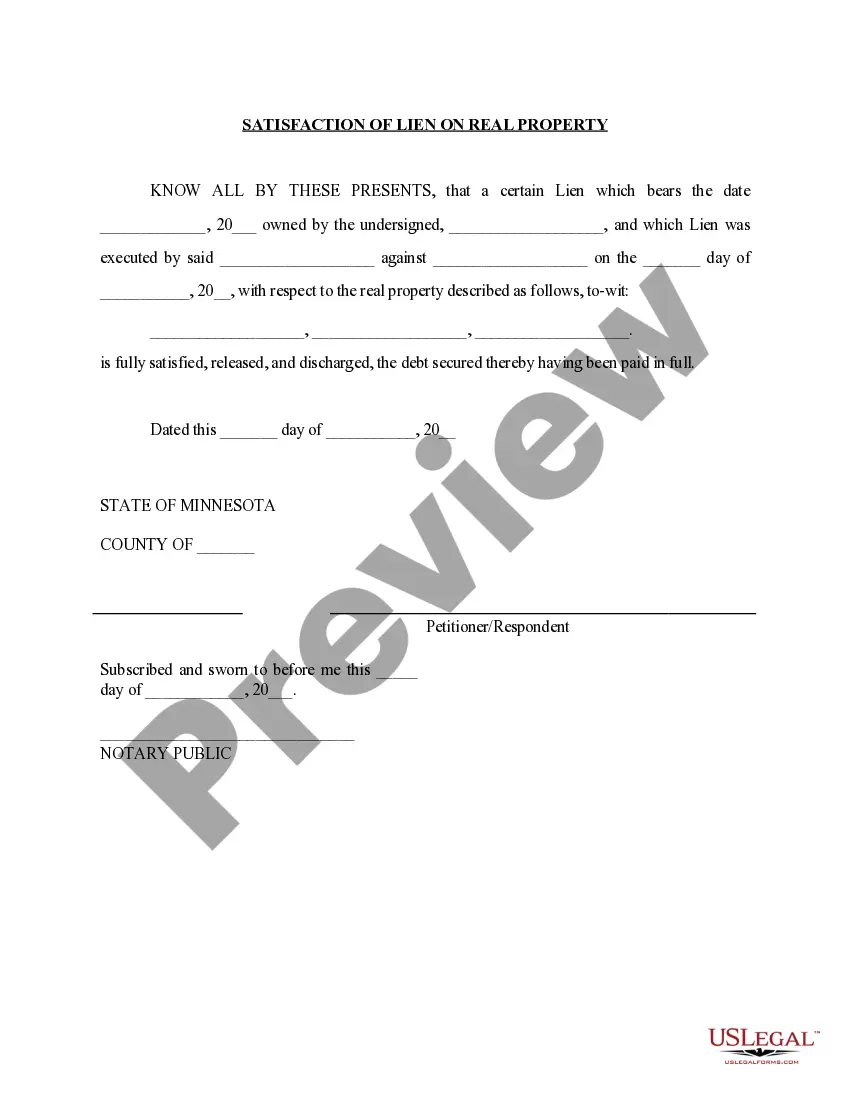

US Legal Forms - one of the largest compilations of legal documents in the USA - offers an extensive selection of lawful document templates that you can download or create.

By using the platform, you will find thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can access the latest versions of forms such as the District of Columbia Cash Receipts Control Log In just a few seconds.

Review the form outline to confirm you have chosen the right document.

If the form does not meet your needs, utilize the Search field at the top of the page to find one that does.

- If you already have a monthly subscription, Log In and access the District of Columbia Cash Receipts Control Log from the US Legal Forms library.

- The Acquire button will appear on every form you view.

- You can find all previously saved forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some simple steps to help you get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to examine the form's details.

Form popularity

FAQ

Failing to file your taxes by April 18th can result in penalties and interest charges. The District of Columbia assesses these fees based on the amount owed and the amount of time you remain unfiled. Additionally, you could lose any potential refunds if you do not file in time. It's crucial to file taxes on time to maintain compliance and avoid these issues.

Filing your taxes late can lead to various consequences. The District of Columbia may impose penalties and interest on the amount owed. If you delay too long, you could face more severe penalties, including the risk of enforcement actions. It's essential to address your tax obligations promptly to avoid these complications.