District of Columbia Custom Software Development Agreement

Description

How to fill out Custom Software Development Agreement?

It is feasible to spend hours online searching for the authentic document template that fulfills the state and federal requirements you need.

US Legal Forms provides thousands of authentic templates that are reviewed by experts.

You can easily download or print the District of Columbia Custom Software Development Agreement from my service.

If you wish to find another version of the form, use the Search field to locate the template that fits your needs.

- If you have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, edit, print, or sign the District of Columbia Custom Software Development Agreement.

- Every authentic document template you purchase is yours permanently.

- To get another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the basic instructions listed below.

- First, ensure that you have selected the correct document template for the state/area of your choice.

- Review the form details to confirm you have picked the appropriate type.

Form popularity

FAQ

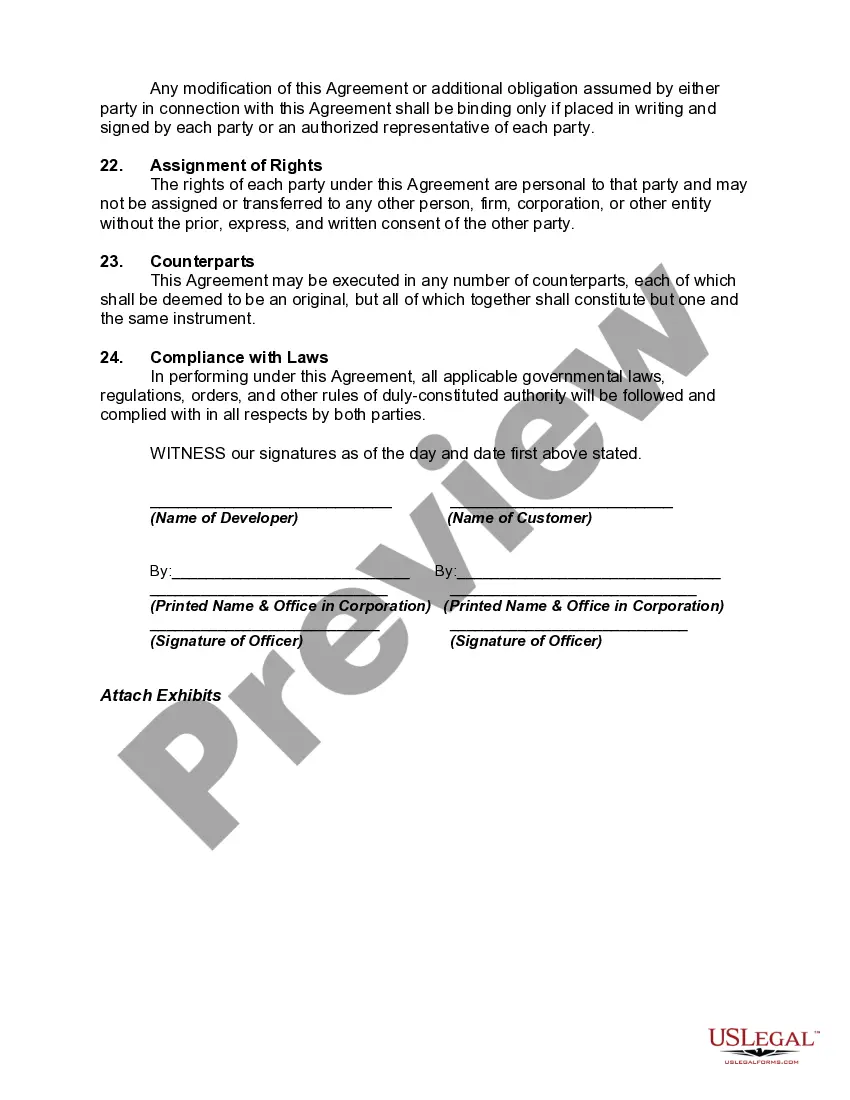

Contracts in software development outline the expectations and responsibilities of all parties involved. They typically specify the scope of work, payment terms, and timelines, ensuring everyone understands their obligations. A District of Columbia Custom Software Development Agreement is particularly effective as it tailors itself to the unique needs of the project, minimizing misunderstandings. Such agreements foster a strong working relationship and pave the way for successful project completion.

For Agile development, a flexible contract type such as a District of Columbia Custom Software Development Agreement works best. This type allows for iterative progress and adapts to changing requirements. It promotes collaboration between you and the development team, ensuring all parties remain aligned with the project goals. By emphasizing open communication and regular feedback, this agreement can enhance the overall development process.

The best type of contract often depends on the specific project details and goals. For software development projects in the District of Columbia, a District of Columbia Custom Software Development Agreement can provide clarity on deliverables, timelines, and payment structures. It should reflect the needs of both parties involved, ensuring everyone is on the same page. Always consider consulting with a legal expert to determine the most suitable option for your situation.

In the District of Columbia, software can be subject to sales tax depending on how it is sold and licensed. Custom software developed under a District of Columbia Custom Software Development Agreement may have different tax implications compared to off-the-shelf software. To navigate this effectively, consult local tax regulations or use platforms like uslegalforms for guidance on tax obligations related to software sales.

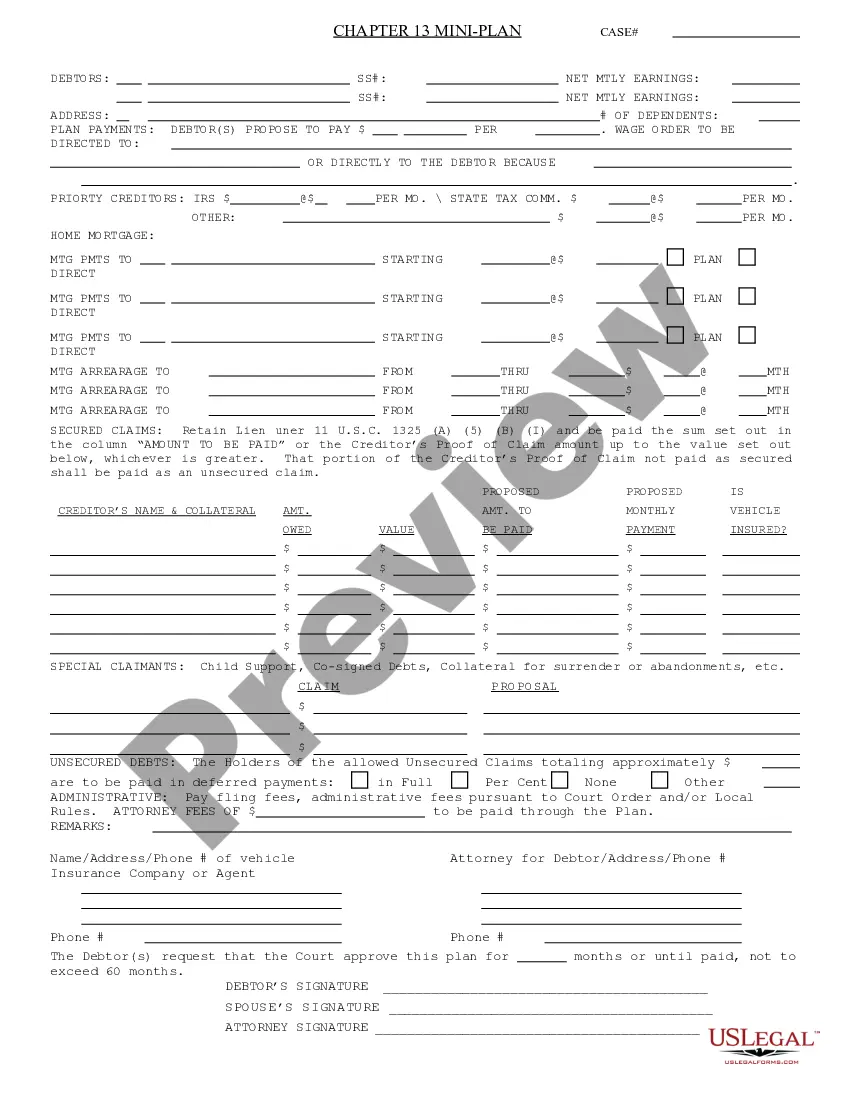

To file a DC extension, you must submit Form D-40 to the District of Columbia Office of Tax and Revenue. This form allows you to request more time to file your tax return, which can be particularly helpful if you are finalizing details on a District of Columbia Custom Software Development Agreement. It’s essential to file your extension on time to avoid any late fees or penalties.

Form D-65 is used for partnership income tax returns, while Form D-30 is specifically for corporations. If your business is structured around providing services through a District of Columbia Custom Software Development Agreement, you need to ensure you're using the correct form based on your legal structure. Choosing the right form is vital for fulfilling your tax responsibilities accurately.

The DC D-30 tax return is a form used by corporations doing business in the District of Columbia to report their income and compute taxes owed. This return is essential for compliance and is particularly relevant if your operations include a District of Columbia Custom Software Development Agreement. Completing this form accurately helps ensure your business meets local tax regulations.

Gross income represents the total income earned before any deductions, while net income is what you take home after all expenses and taxes are subtracted. Understanding this distinction is crucial for anyone dealing with a District of Columbia Custom Software Development Agreement, as it can affect profit calculations. Accurate distinctions help in financial planning and tax reporting.

Yes, the DC D-30 tax return can be filed electronically. This digital option simplifies the submission process and helps ensure your information is submitted accurately and on time. For those managing a District of Columbia Custom Software Development Agreement, electronic filing can streamline your overall tax compliance. Using e-filing tools helps reduce the risk of errors and provides confirmation of your submission.

Any business or individual engaged in commerce in the District of Columbia must file the DC FR-500 form. This includes companies that provide services or products and those that are legally required to report their income. If you have a District of Columbia Custom Software Development Agreement, your business may fall under this requirement. Filing ensures compliance with local tax obligations.