District of Columbia Agreement for Development of Software to Specifications

Description

How to fill out Agreement For Development Of Software To Specifications?

If you are looking to obtain, download, or print legal document templates, make use of US Legal Forms, the leading repository of legal forms available online.

Utilize the site's straightforward and convenient search feature to locate the documents you need.

A wide array of templates for business and personal applications are categorized by type and jurisdiction, or keywords.

Step 4. Once you have located the form you need, click the Purchase now option. Choose the pricing plan you prefer and provide your credentials to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Employ US Legal Forms to access the District of Columbia Agreement for Development of Software to Specifications with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click on the Download button to obtain the District of Columbia Agreement for Development of Software to Specifications.

- You can also view forms you have previously obtained in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, please follow the instructions outlined below.

- Step 1. Ensure you have selected the correct form for the appropriate city/state.

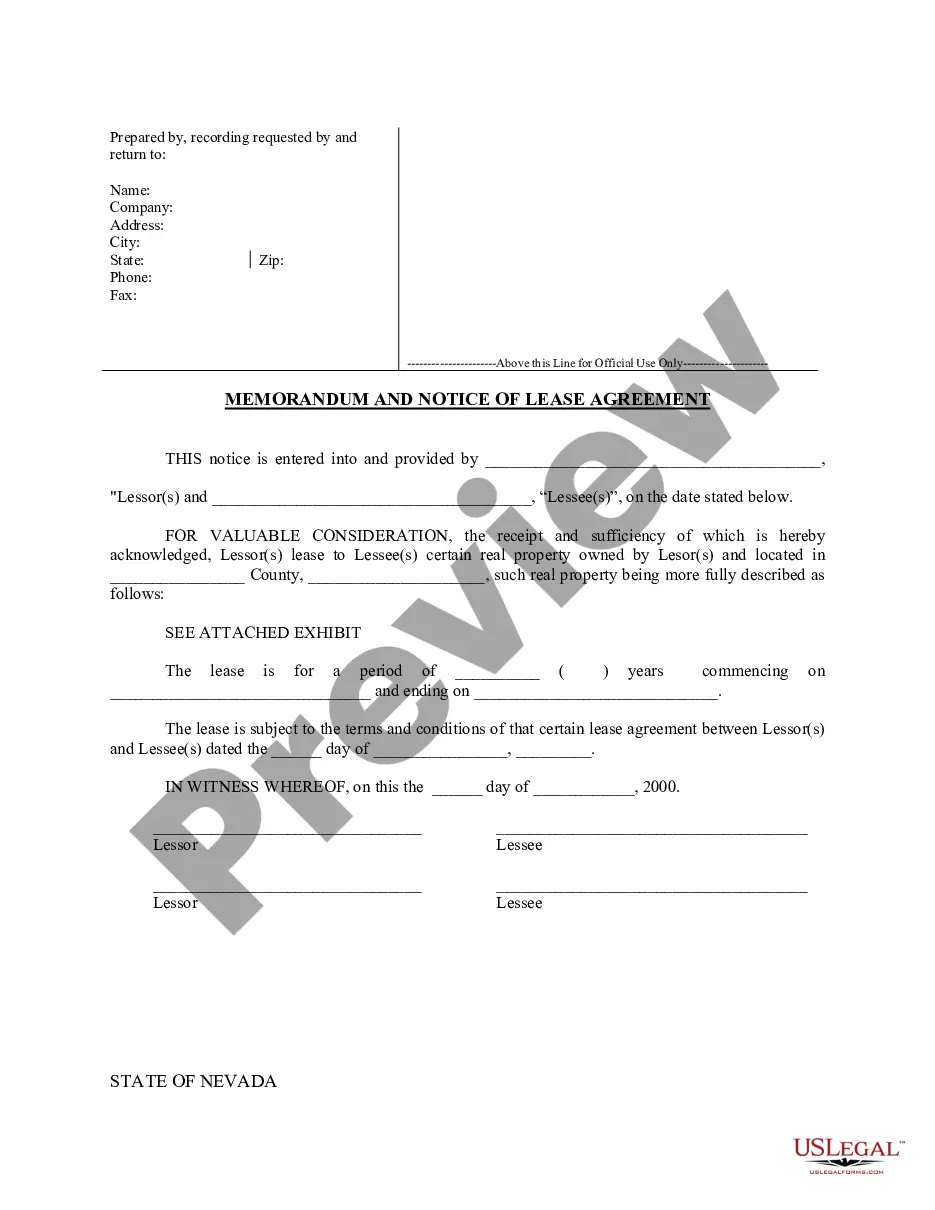

- Step 2. Use the Preview option to review the form's details. Be sure to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Some forms are not eligible for electronic filing in the District of Columbia. Typically, certain paper forms or applications that require additional documentation must be submitted by mail. Always check the latest guidelines to understand which forms are eligible for electronic submission to ensure compliance with eventual district regulations.

Yes, the District of Columbia accepts federal tax extensions. However, be sure to understand the specific requirements and timelines that apply. It is crucial to adhere to both federal and DC guidelines to ensure compliance with your District of Columbia Agreement for Development of Software to Specifications.

Yes, Virginia allows for electronic filing of amended returns. Utilizing a digital platform streamlines this process, making it quick and efficient for taxpayers. It is essential to follow the correct procedures and use the right forms to ensure your amendments meet both Virginia and District of Columbia tax standards.

To file the DC D-30 form, begin by gathering all necessary financial information for your corporation. Next, access the appropriate tax software or platform that supports the D-30 eFiling process. Completing the form accurately ensures that you comply with all District of Columbia regulations, including the stipulations of the District of Columbia Agreement for Development of Software to Specifications.

Yes, the D-30 form can be filed electronically. This option simplifies the submission process for corporations operating in the District of Columbia. By using compatible tax software, you can conveniently complete and submit your District of Columbia Agreement for Development of Software to Specifications.

Yes, you can electronically file a District of Columbia tax return. eFiling options make the process simpler and more efficient for taxpayers. It is important to ensure that you are using the correct software and forms for your filing to meet the requirements set forth by the District of Columbia.

The District of Columbia D-65 form is used for reporting individual income tax for partnerships, while the D-30 form is specifically designed for reporting corporate income. Each form serves distinct purposes and applies to different types of entities. Understanding the differences is vital to ensure compliance and correctly submit your tax obligations.