District of Columbia Affidavit of Domicile for Stock Transer

Description

How to fill out Affidavit Of Domicile For Stock Transer?

Are you currently in the place in which you need papers for sometimes enterprise or individual reasons almost every day? There are a variety of lawful document web templates available on the net, but finding types you can trust isn`t effortless. US Legal Forms gives 1000s of kind web templates, much like the District of Columbia Affidavit of Domicile for Stock Transer, that happen to be created to satisfy state and federal specifications.

When you are already familiar with US Legal Forms internet site and have an account, simply log in. Next, it is possible to obtain the District of Columbia Affidavit of Domicile for Stock Transer template.

If you do not provide an accounts and need to begin using US Legal Forms, adopt these measures:

- Obtain the kind you need and ensure it is to the right town/state.

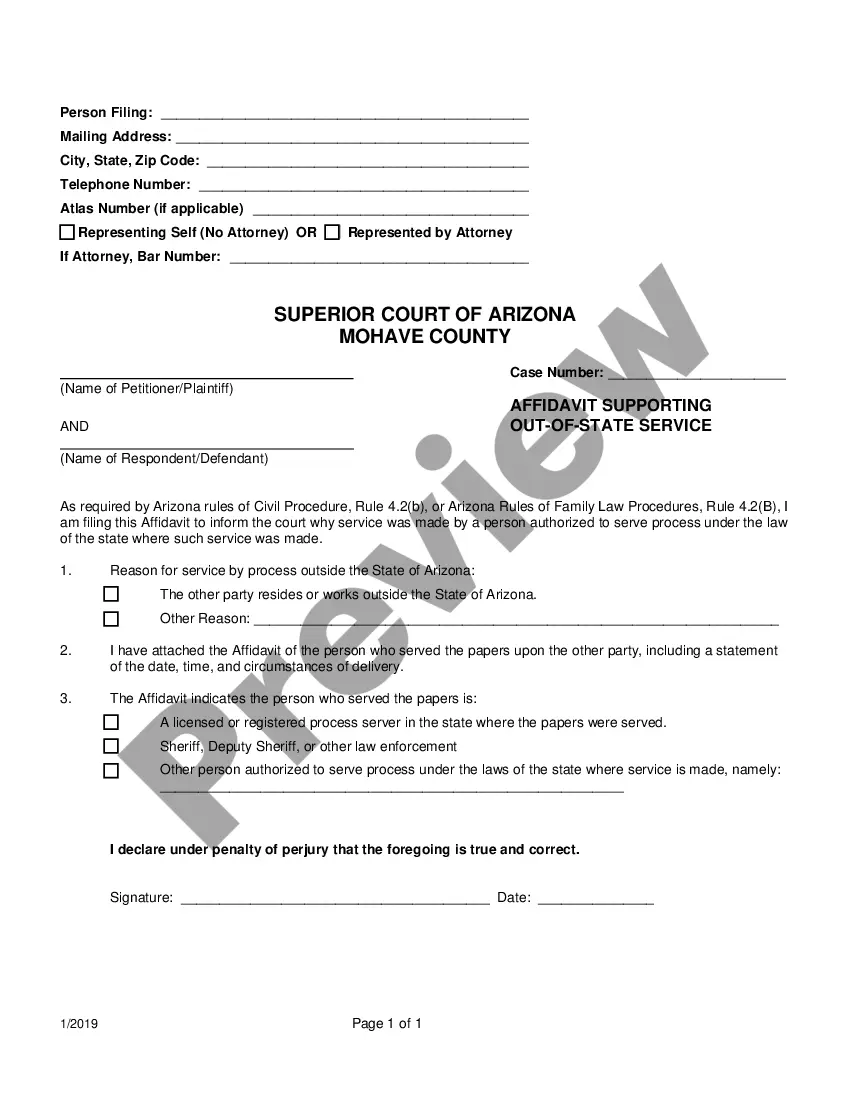

- Utilize the Preview key to analyze the form.

- Browse the description to ensure that you have selected the appropriate kind.

- When the kind isn`t what you`re searching for, use the Look for industry to discover the kind that meets your requirements and specifications.

- Whenever you obtain the right kind, click on Get now.

- Pick the pricing program you want, fill in the required info to make your bank account, and pay for the order using your PayPal or Visa or Mastercard.

- Choose a hassle-free document file format and obtain your duplicate.

Discover every one of the document web templates you possess bought in the My Forms food list. You can obtain a more duplicate of District of Columbia Affidavit of Domicile for Stock Transer at any time, if possible. Just click on the essential kind to obtain or print out the document template.

Use US Legal Forms, probably the most comprehensive selection of lawful kinds, to save time as well as stay away from mistakes. The assistance gives skillfully created lawful document web templates which you can use for a variety of reasons. Produce an account on US Legal Forms and begin making your lifestyle a little easier.

Form popularity

FAQ

To prove, establish or reestablish domicile, a sponsor must set up and maintain a principal residence in the United States. An individual must demonstrate ties to a house or apartment in the United States that are consistent with ties that a resident with legal domicile would possess.

A DC Resident is an individual that maintains a place of abode within DC for 183 days or more. If the individual is domiciled in the state at anytime, you are considered to be a DC resident. A DC Nonresident is an individual that did not spend any time domiciled in the state.

?Domicile? is a term that, for immigration and tax purposes, refers to your country of residence. It can be either where you currently live, or where you plan on living for the long-term.

Knowing where the decedent's domicile (where the decedent had his or her primary residence) was at date of death is key when figuring out where you must probate the assets and what state you must pay taxes to (although real estate is subject to state estate or inheritance tax, if any, in the state in which it's located ...

A "domicile" is a person's true, fixed, and permanent home where a person intends to remain permanently and indefinitely and to which a person has the intention of returning, whenever absent.

What's the Difference between Residency and Domicile? Residency is where one chooses to live. Domicile is more permanent and is essentially somebody's home base. Once you move into a home and take steps to establish your domicile in one state, that state becomes your tax home.

It can be either where you currently live, or where you plan on living for the long-term. If you are sponsoring a spouse or family member for a green card, then you need to prove that you have ?domicile? in the United States ? as in, the United States is your permanent home.

The sponsor living abroad must establish the following in order to be considered domiciled in the United States: He/she departed the United States for a limited and not indefinite period of time, He/she intended to maintain a domicile in the United States, and. He/she has evidence of continued ties to the United States ...