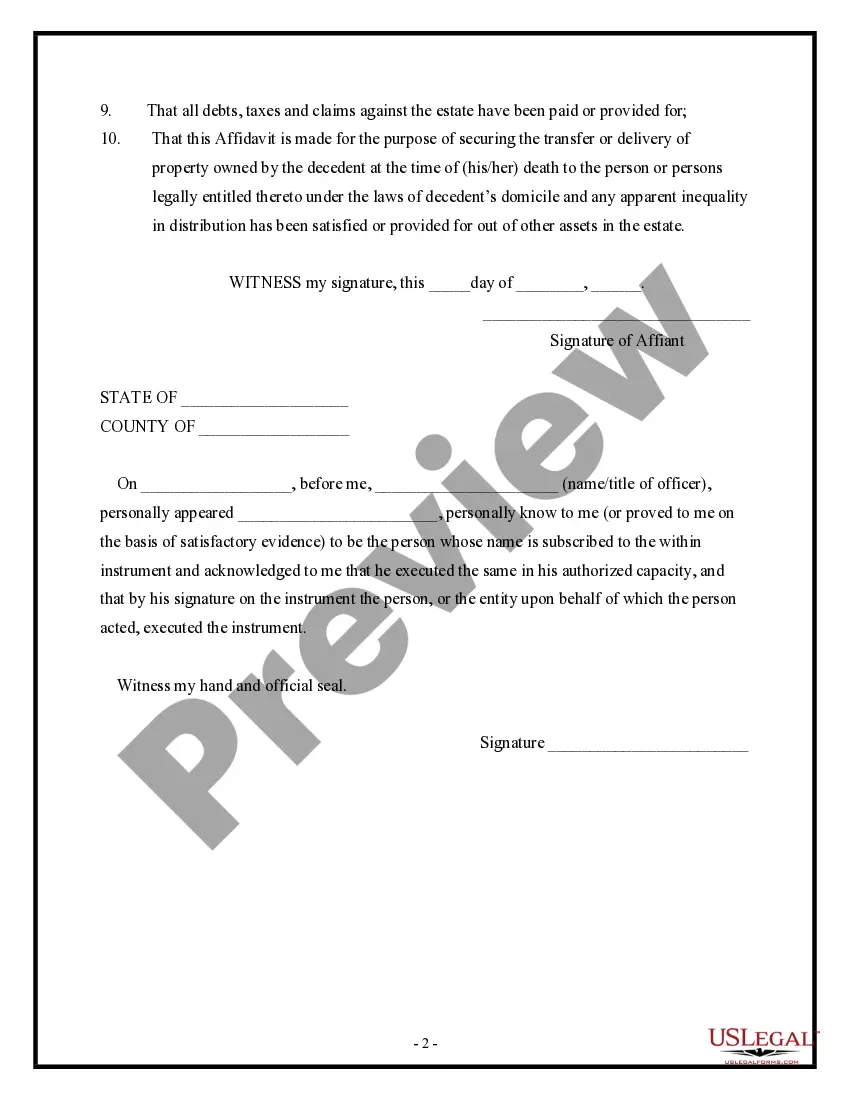

District of Columbia Affidavit of Domicile

Description

How to fill out Affidavit Of Domicile?

US Legal Forms - one of several most significant libraries of lawful forms in the States - offers a wide array of lawful papers themes you are able to down load or print out. Utilizing the internet site, you may get a huge number of forms for business and individual purposes, sorted by types, suggests, or search phrases.You will discover the newest types of forms like the District of Columbia Affidavit of Domicile within minutes.

If you already possess a subscription, log in and down load District of Columbia Affidavit of Domicile through the US Legal Forms local library. The Obtain button will appear on every single develop you look at. You have accessibility to all earlier delivered electronically forms within the My Forms tab of the accounts.

If you would like use US Legal Forms initially, listed below are basic directions to get you began:

- Make sure you have picked the best develop to your city/county. Click on the Review button to analyze the form`s information. Read the develop outline to actually have selected the appropriate develop.

- In case the develop doesn`t fit your specifications, utilize the Look for field near the top of the display to find the one which does.

- When you are pleased with the form, confirm your option by clicking the Buy now button. Then, pick the pricing strategy you prefer and supply your credentials to register for an accounts.

- Procedure the transaction. Use your credit card or PayPal accounts to accomplish the transaction.

- Select the format and down load the form on your product.

- Make modifications. Complete, edit and print out and indicator the delivered electronically District of Columbia Affidavit of Domicile.

Each design you included with your money lacks an expiration date and is your own property eternally. So, if you wish to down load or print out an additional version, just proceed to the My Forms area and click on around the develop you will need.

Get access to the District of Columbia Affidavit of Domicile with US Legal Forms, the most substantial local library of lawful papers themes. Use a huge number of specialist and condition-certain themes that meet your organization or individual demands and specifications.

Form popularity

FAQ

(a) A resident of the District of Columbia is one who is living in the District of Columbia voluntarily and not for a temporary purpose; that is, one with no intention of presently removing himself or herself therefrom.

Do I have to file a DC income tax return? You must file a DC tax return if: You were a resident of the District of Columbia and you were required to file a federal tax return. Your permanent residence was in the District of Columbia for either part of or the full taxable year.

You must file a DC return if: You lived in the District of Columbia for 183 days or more during the taxable year, even if your permanent residence was outside the District of Columbia.

(A resident is an individual domiciled in DC at any time during the taxable year); You maintained a place of abode in DC for a total of 183 days or more even if your permanent home was outside of DC; You were a part-year resident of DC (see instructions for part-year residents);

A DC Resident is an individual that maintains a place of abode within DC for 183 days or more. If the individual is domiciled in the state at anytime, you are considered to be a DC resident. A DC Nonresident is an individual that did not spend any time domiciled in the state.

An individual must demonstrate ties to a house or apartment in the United States that are consistent with ties that a resident with legal domicile would possess. There is no minimum time required to establish residence, but a credible demonstration of an actual residence in the United States is required.

Any non-resident of DC claiming a refund of DC income tax with- held or paid by estimated tax payments must file a D-40B. A non-resident is anyone whose permanent home was outside DC during all of 2022 and who did not maintain a place of abode in DC for a total of 183 days or more during 2022.