District of Columbia Pool Services Agreement - Self-Employed

Description

How to fill out Pool Services Agreement - Self-Employed?

Are you currently in a circumstance where you require documentation for either business or personal purposes nearly every day.

There are numerous valid document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of form templates, including the District of Columbia Pool Services Agreement - Self-Employed, which are designed to comply with federal and state regulations.

Once you find the appropriate form, click Buy now.

Choose the pricing plan you prefer, provide the necessary information to create your account, and complete the payment using your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the District of Columbia Pool Services Agreement - Self-Employed template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/region.

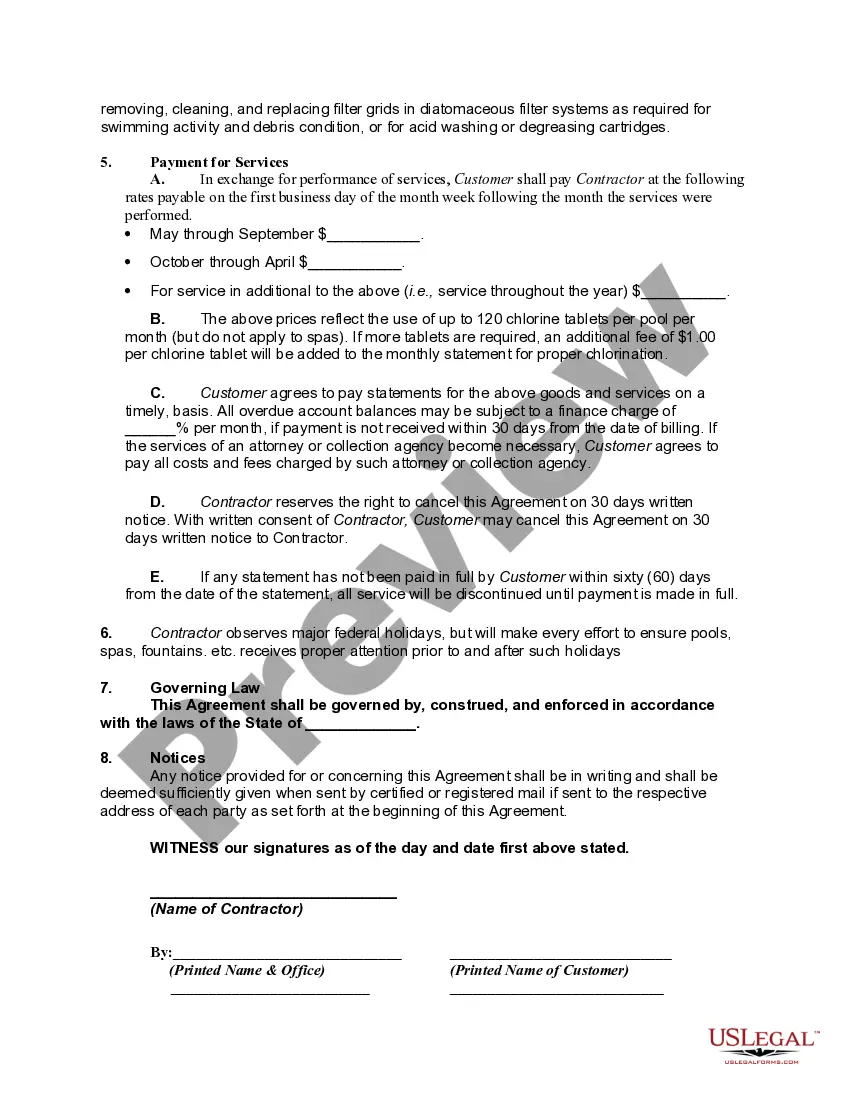

- Use the Preview button to examine the form.

- Review the details to ensure that you have selected the correct document.

- If the form is not what you are looking for, utilize the Search field to find the form that fulfills your needs and specifications.

Form popularity

FAQ

To become a street vendor in the District of Columbia, you must apply for a specific permit. Begin by checking the regulations set by the DC government regarding street vending. Complete the application and submit the necessary documents, including proof of business registration. Once you obtain your permit, you can start operating under the District of Columbia Pool Services Agreement - Self-Employed.

To become a DC vendor, start by registering your business with the DC government. After registration, access the vendor application online and complete it with the required documents. Ensure you also meet any specific requirements mentioned for your type of service. Once you receive your vendor license, you can work confidently under the District of Columbia Pool Services Agreement - Self-Employed.

Yes, contractors in Washington, DC, are required to have a valid license to operate legally. This requirement ensures that all workers meet specific standards and regulations. Obtaining a license can enhance your credibility and attract more clients while operating under the District of Columbia Pool Services Agreement - Self-Employed.

To become a vendor in the District of Columbia, you must complete the vendor registration process. First, gather the necessary documents, such as your business registration and identification. After that, fill out the vendor application available on the DC government’s website. Finally, submit your application, and once approved, you can begin offering your services under the District of Columbia Pool Services Agreement - Self-Employed.

In the District of Columbia, professional services are generally not subject to sales tax. However, there are certain exceptions, so it’s essential to review specific services you might offer. For self-employed individuals working under a District of Columbia Pool Services Agreement - Self-Employed, understanding these nuances can protect you from unexpected tax implications.

Several items are exempt from sales tax in the District of Columbia, including most food items, certain medical goods, and educational materials. This information is particularly relevant for those engaging in self-employment under a District of Columbia Pool Services Agreement - Self-Employed, as it can inform purchasing decisions and reduce potential tax liabilities.

The sales tax rate in the District of Columbia is set at 6%. Additionally, specific items, like restaurant meals and alcohol, can be taxed at higher rates. For self-employed individuals operating under a District of Columbia Pool Services Agreement - Self-Employed, understanding these rates can help streamline your budgeting and ensure you meet all tax responsibilities.

In DC, sales tax applies to tangible goods and certain services. This includes retail items, personal property, and some professional services, although exceptions exist. As you navigate your obligations under the District of Columbia Pool Services Agreement - Self-Employed, be sure to consult comprehensive resources to clarify which transactions may incur sales tax.

The tax-exempt form used in the District of Columbia is the Certificate of Exemption. This form is typically required for nonprofit organizations or qualifying purchases. Understanding and utilizing this form can be beneficial for those operating under a District of Columbia Pool Services Agreement - Self-Employed, enabling better financial management.

In DC, the sales tax rate for most food items is currently set at 0%. However, certain prepared foods may be subject to a 10% sales tax. If you are self-employed and planning to operate within the area, it’s essential to distinguish between taxed and non-taxed items to ensure compliance with the District of Columbia Pool Services Agreement - Self-Employed.