As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books. An audit performed by employees is called "internal audit," and one done by an independent (outside) accountant is an "independent audit." Auditors may refuse to sign the audit to guarantee its accuracy if only limited records are produced.

District of Columbia Report of Independent Accountants after Audit of Financial Statements

Description

How to fill out Report Of Independent Accountants After Audit Of Financial Statements?

Finding the appropriate legitimate document template can be a challenge. There is indeed a wide selection of templates accessible online, but how can you obtain the specific legal form you need? Utilize the US Legal Forms website.

The platform offers an extensive collection of templates, such as the District of Columbia Report of Independent Accountants following the Audit of Financial Statements, suitable for both business and personal needs. All forms are reviewed by experts and comply with federal and state regulations.

If you're already registered, Log In to your account and click on the Download button to locate the District of Columbia Report of Independent Accountants after Audit of Financial Statements. Use your account to search through the legal forms you have previously purchased. Navigate to the My documents tab in your account to obtain another copy of the document you need.

Select the file format and download the legal document template to your device. Complete, modify, print, and sign the received District of Columbia Report of Independent Accountants after Audit of Financial Statements. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Use the service to download properly crafted documents that adhere to state requirements.

- Firstly, confirm that you have selected the correct form for your city/area.

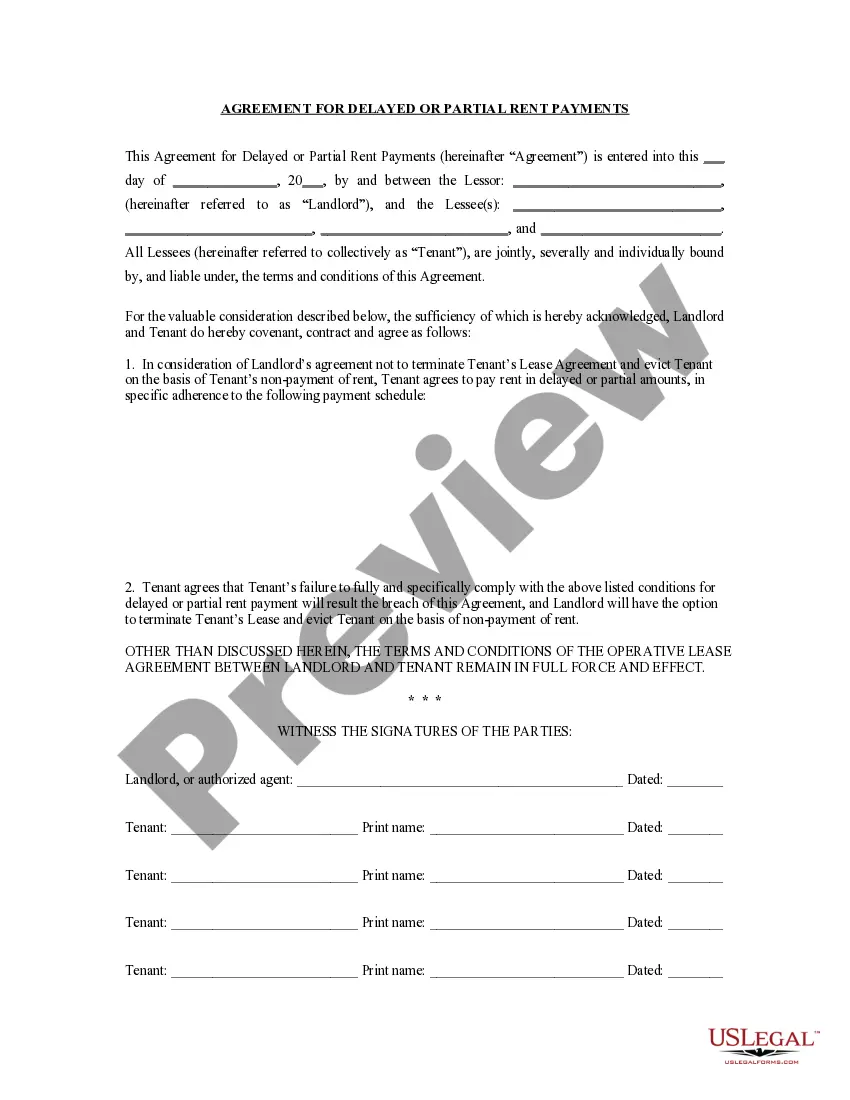

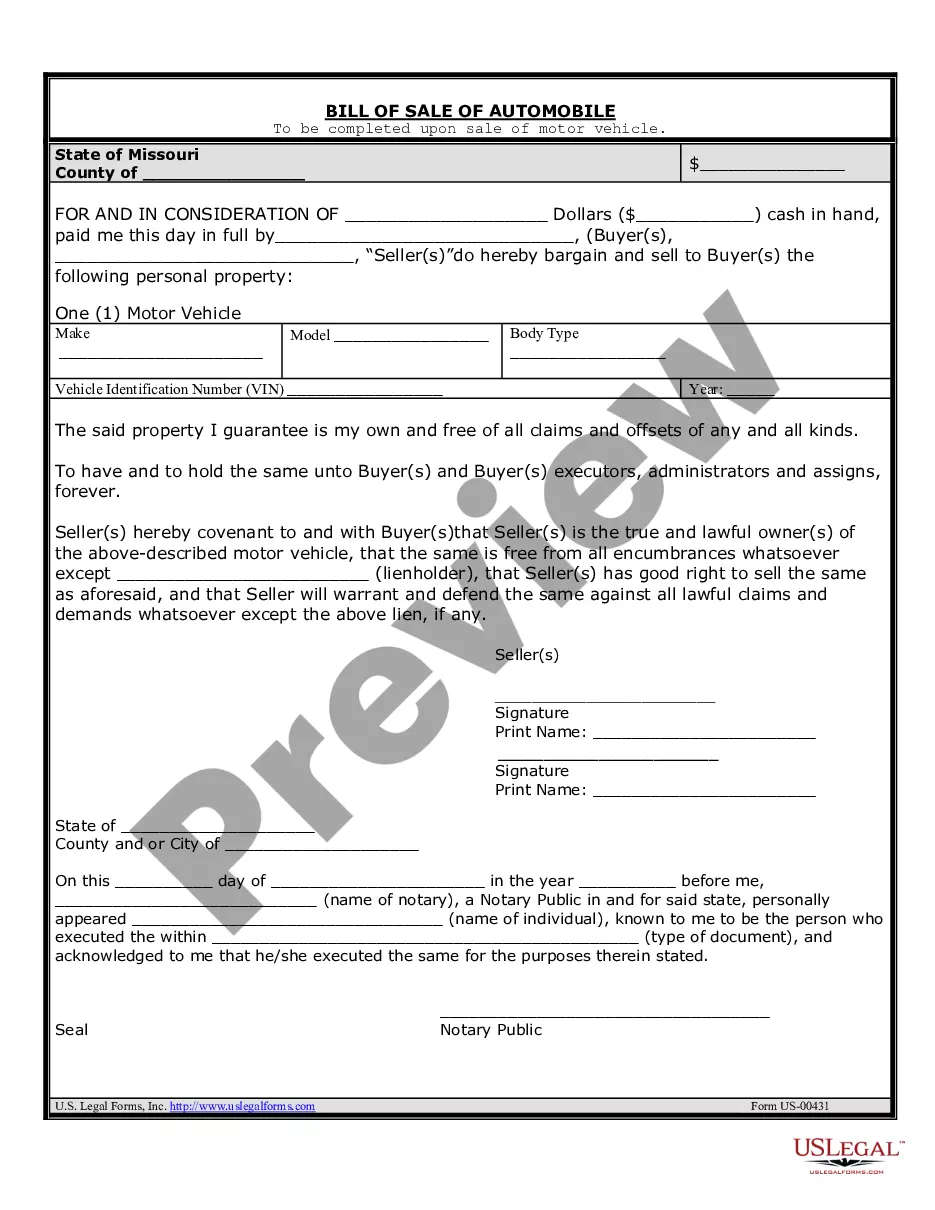

- You can review the form using the Preview button and examine the form description to ensure this is the right match for you.

- If the form does not suit your needs, use the Search field to find the appropriate form.

- Once you are confident the form is suitable, click on the Acquire now button to obtain the form.

- Choose the pricing plan you prefer and enter the necessary information.

- Create your account and process your order using your PayPal account or credit card.

Form popularity

FAQ

The five key contents of an audit report include the auditor's opinion, basis for the opinion, management's responsibilities, auditor's responsibilities, and the signature of the auditor. Each section serves a specific purpose in conveying the adequacy and compliance of the financial statements. The District of Columbia Report of Independent Accountants after Audit of Financial Statements encapsulates these elements effectively.

Writing a financial report example involves creating document sections that cover revenues, expenses, and any significant financial events. Ensure you use clear language and accurate figures, while providing context to make the information relatable. For a complete framework, refer to the District of Columbia Report of Independent Accountants after Audit of Financial Statements.

To fill out a financial report, you need to compile and organize financial data systematically. Begin with a summary of the organization’s income and expenses, then outline assets and liabilities in a clear format. Using the District of Columbia Report of Independent Accountants after Audit of Financial Statements can provide you with structured guidelines.

The independent auditor's primary responsibilities include examining the financial statements and ensuring their accuracy and compliance with accounting standards. They also provide an opinion on whether the statements present an accurate view of the entity's financial position. Their work culminates in the District of Columbia Report of Independent Accountants after Audit of Financial Statements, which serves as an assurance for stakeholders.

Filling out a financial statement involves gathering accurate financial data, including income, expenses, assets, and liabilities. You must clearly categorize each entry to provide a comprehensive view of your financial situation. For assistance with this process, consider using the District of Columbia Report of Independent Accountants after Audit of Financial Statements as a guideline.

An independent CPA is associated with the financial statements when an audit, review, or compilation is performed. This relationship establishes a level of credibility and assurance in the financial data presented. By obtaining the District of Columbia Report of Independent Accountants after Audit of Financial Statements, organizations can ensure thorough evaluation and trustworthiness in their financial reporting.

An independent CPA is associated with the financial statements of a publicly held entity when an audit or review is required by regulatory bodies. This association ensures compliance with stringent reporting standards. The District of Columbia Report of Independent Accountants after Audit of Financial Statements plays a critical role in satisfying regulatory requirements and maintaining investor confidence.

Yes, a CPA can prepare personal financial statements, offering valuable assistance in managing personal finances. By preparing these statements, a CPA can help individuals understand their financial situation and future goals. Through the insights gained from the District of Columbia Report of Independent Accountants after Audit of Financial Statements, individuals can achieve better financial planning.

An independent accountant's review report offers a less extensive level of assurance compared to an audit. This report evaluates the financial statements through analytical procedures and inquiries. Utilizing the District of Columbia Report of Independent Accountants after Audit of Financial Statements can serve to enhance credibility and consistency in financial practices.

The SA 700 audit report is a standard that outlines the auditor's opinion on the financial statements. It provides essential insights into whether the statements present a true and fair view of the entity's financial position. By relying on the District of Columbia Report of Independent Accountants after Audit of Financial Statements, businesses can ensure their reports meet necessary auditing standards.