If you need to complete, down load, or print legal papers themes, use US Legal Forms, the largest selection of legal types, which can be found on the web. Use the site`s simple and hassle-free lookup to obtain the documents you will need. Numerous themes for company and personal functions are categorized by classes and states, or keywords and phrases. Use US Legal Forms to obtain the District of Columbia Security Agreement in Accounts and Contract Rights with a number of mouse clicks.

When you are currently a US Legal Forms buyer, log in in your bank account and click on the Acquire button to find the District of Columbia Security Agreement in Accounts and Contract Rights. You may also entry types you in the past saved within the My Forms tab of your respective bank account.

Should you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Ensure you have selected the shape for the correct metropolis/land.

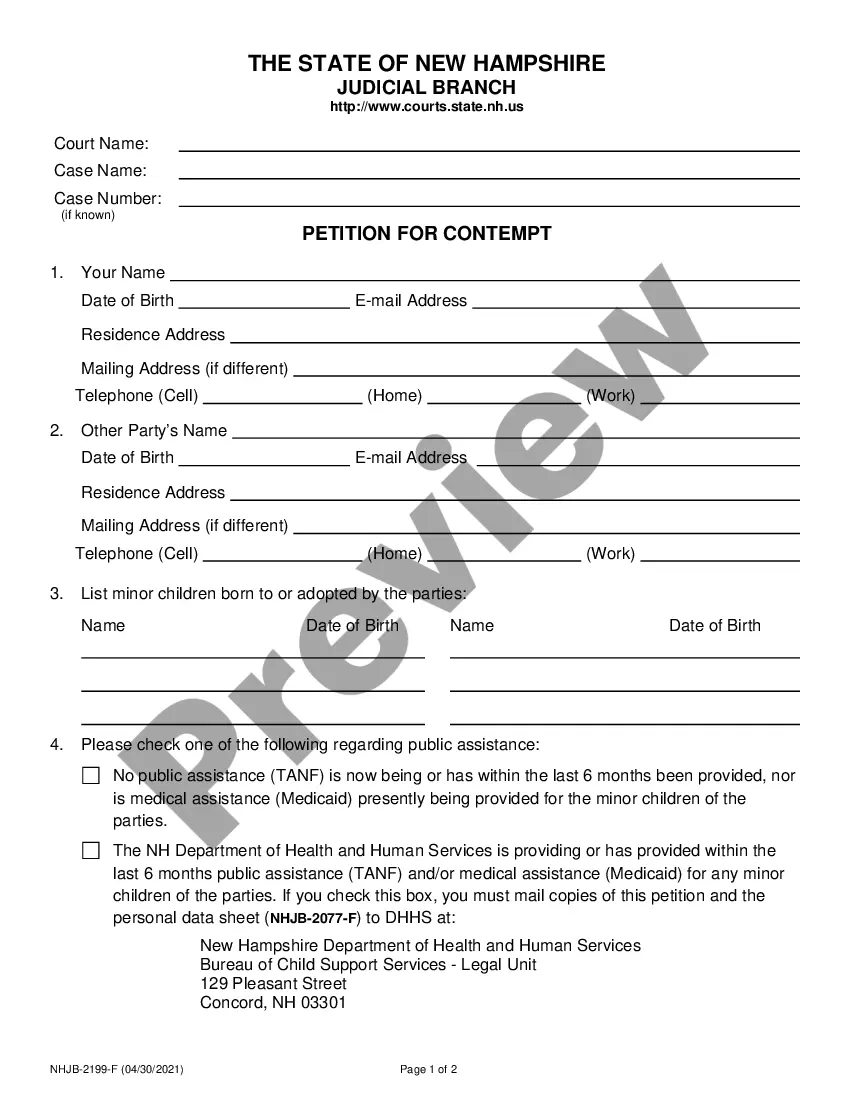

- Step 2. Make use of the Review method to look over the form`s articles. Don`t forget about to read through the description.

- Step 3. When you are unhappy with the type, take advantage of the Search discipline at the top of the display to find other models in the legal type format.

- Step 4. Upon having discovered the shape you will need, select the Get now button. Select the pricing program you choose and put your credentials to register for an bank account.

- Step 5. Procedure the financial transaction. You can use your credit card or PayPal bank account to finish the financial transaction.

- Step 6. Find the file format in the legal type and down load it on your device.

- Step 7. Full, modify and print or indicator the District of Columbia Security Agreement in Accounts and Contract Rights.

Every single legal papers format you purchase is the one you have for a long time. You possess acces to each type you saved inside your acccount. Click on the My Forms area and decide on a type to print or down load once again.

Be competitive and down load, and print the District of Columbia Security Agreement in Accounts and Contract Rights with US Legal Forms. There are thousands of expert and express-certain types you can utilize to your company or personal requires.