Computer software is a general term used to describe a collection of computer programs, procedures and documentation that perform some tasks on a computer system. Software is considered personal property and may be assigned.

District of Columbia Assignment of Software

Description

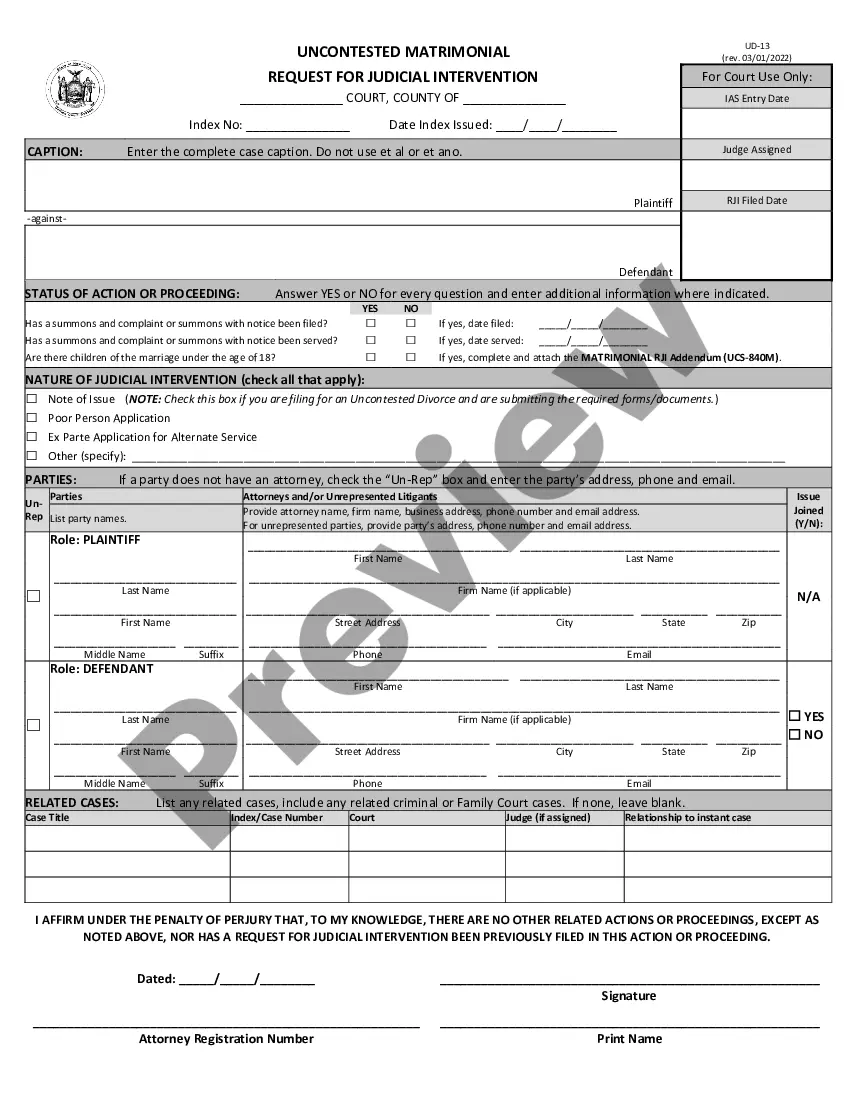

How to fill out Assignment Of Software?

US Legal Forms - one of the most prominent repositories of legal templates in the United States - offers a variety of legal document formats that you can download or print. Through the website, you can discover thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms such as the District of Columbia Assignment of Software in moments.

If you already have a subscription, Log In and download the District of Columbia Assignment of Software from your US Legal Forms library. The Download button will appear on every document you view. You can access all previously downloaded forms in the My documents section of your account.

If you want to use US Legal Forms for the first time, here are straightforward instructions to get started: Ensure you have selected the appropriate form for your city/county. Click on the Preview button to review the form's details. Check the form description to confirm that you have chosen the correct document. If the form does not meet your requirements, utilize the Search box at the top of the screen to find the one that does.

Access the District of Columbia Assignment of Software with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are satisfied with the form, confirm your choice by clicking the Download now button.

- Next, select the pricing plan you prefer and provide your credentials to sign up for an account.

- Process the transaction. Use your credit card or PayPal account to complete the transaction.

- Choose the format and download the form to your device.

- Make modifications. Fill out, edit, print, and sign the downloaded District of Columbia Assignment of Software.

- Every template you added to your account has no expiration date and is yours indefinitely. Thus, if you wish to download or print another copy, just visit the My documents section and click on the form you need.

Form popularity

FAQ

Tax Payments To remit payment, please log in to your MyTax.DC.gov account, which allows you to pay directly from your bank account without any fees. To remit payment, please log in to your MyTax.DC.gov account. You will be charged a fee that is paid directly to the District's credit card service provider.

As long as your tax return has been processed, you may call (202) 727-4TAX to find out the status of your refund. You may check your refund status online at MyTax.DC.gov.

What is the Phone Number to Find Out the Taxes You Owe? Individual taxpayers may call 1-800-829-1040, Monday through Friday, 7 a.m. to 7 p.m. local time. Taxpayers representing a business may call 1-800-829-4933, Monday through Friday, 7 a.m. to 7 p.m. local time.

MyTax.DC.gov Visit the District's new online tax portal to view and pay your taxes.

SaaS and other digital products are generally taxable in the District of Columbia, and thus subject to the District's 6% sales tax rate.

Under D.C. Mun. Regs. 9 §474.4, the sale, rental, or maintenance of computer software continues to be subject to sales tax in the District whether the software is canned, prepackaged, or customized.

Contact Us For assistance with MyTax.DC.gov or account-related questions, please contact our e-Services Unit at (202) 759-1946 or email e-services.otr@dc.gov, am to pm, Monday through Friday.

Overview of District of Columbia Taxes Washington, D.C. residents pay a progressive district income tax if they've lived there for at least 183 days out of the year.