District of Columbia Receipt Template for Small Business

Description

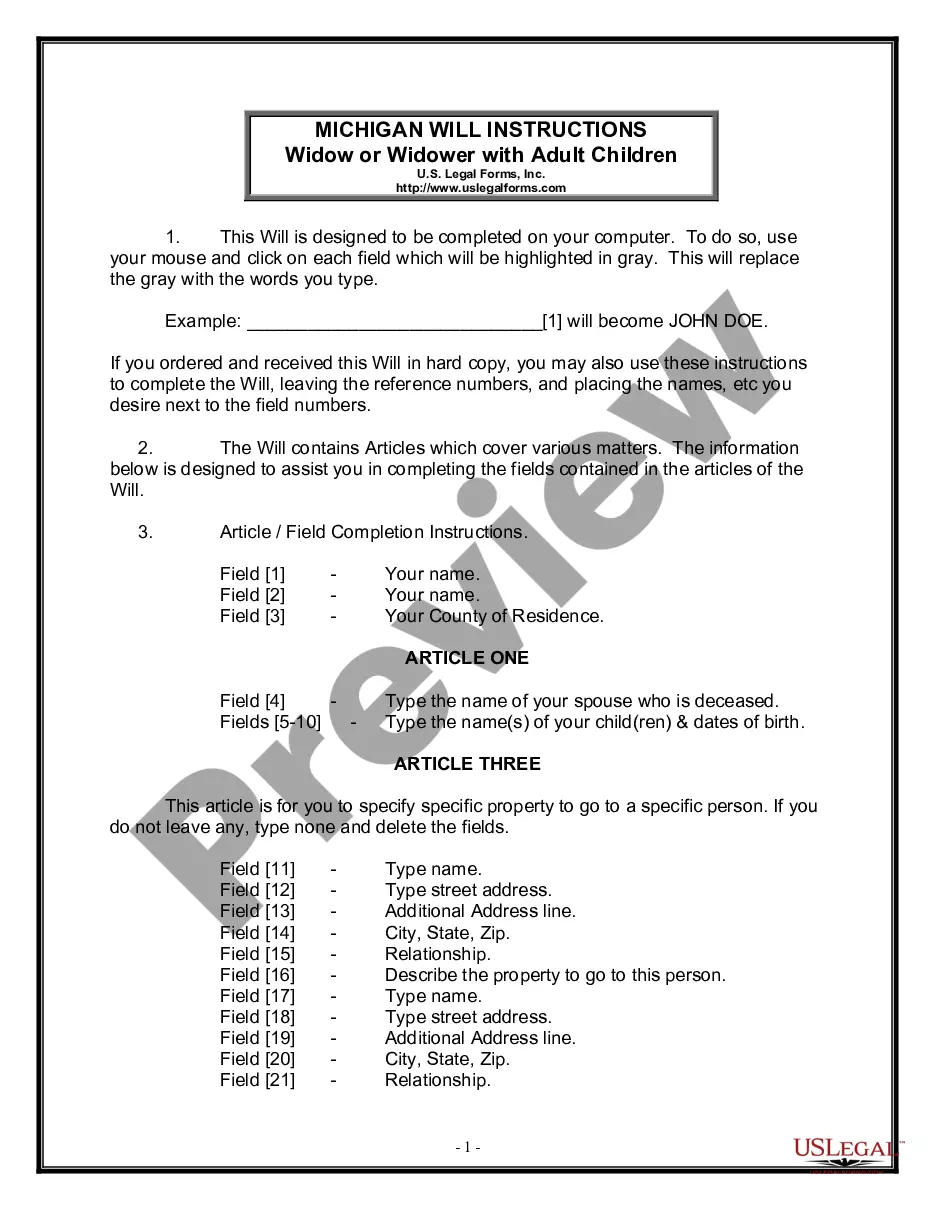

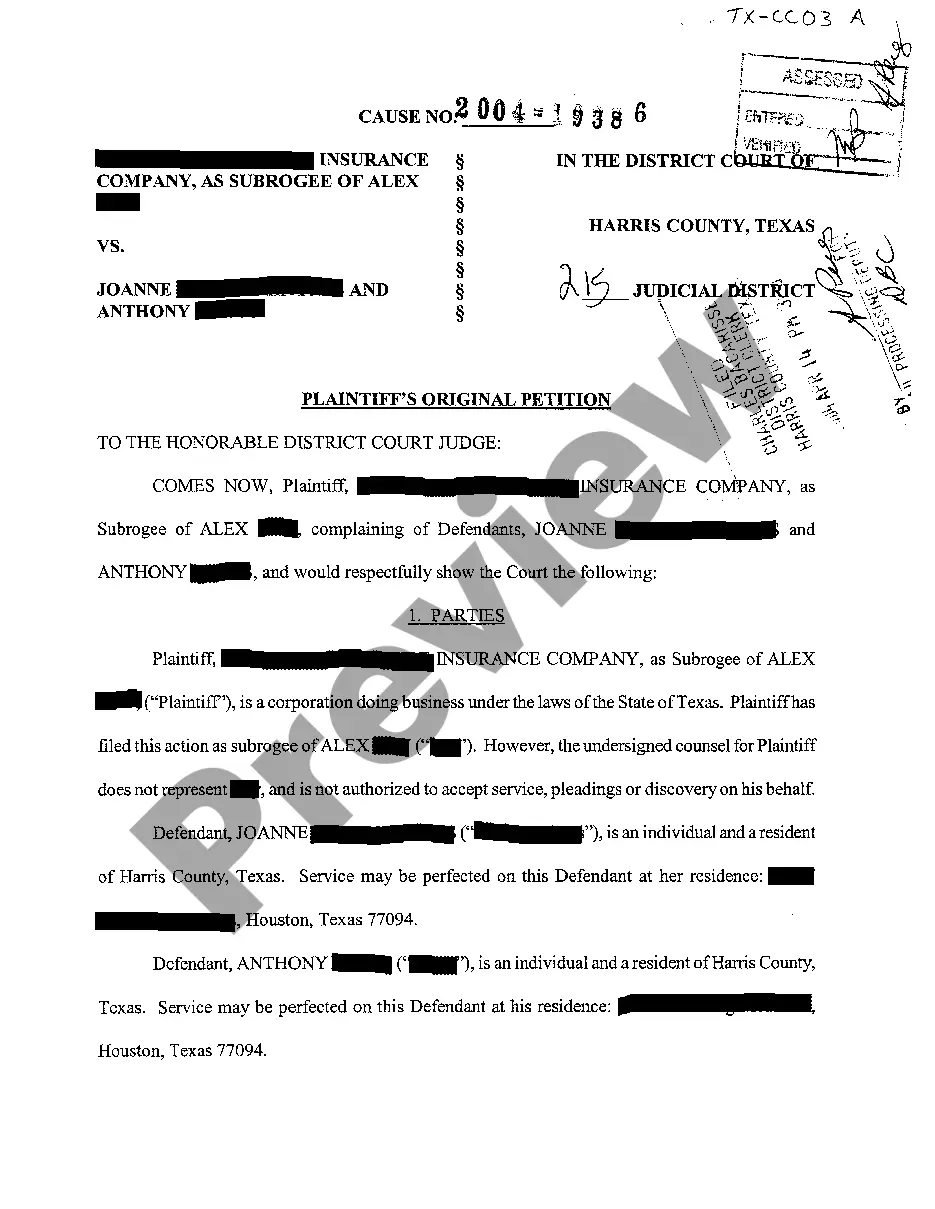

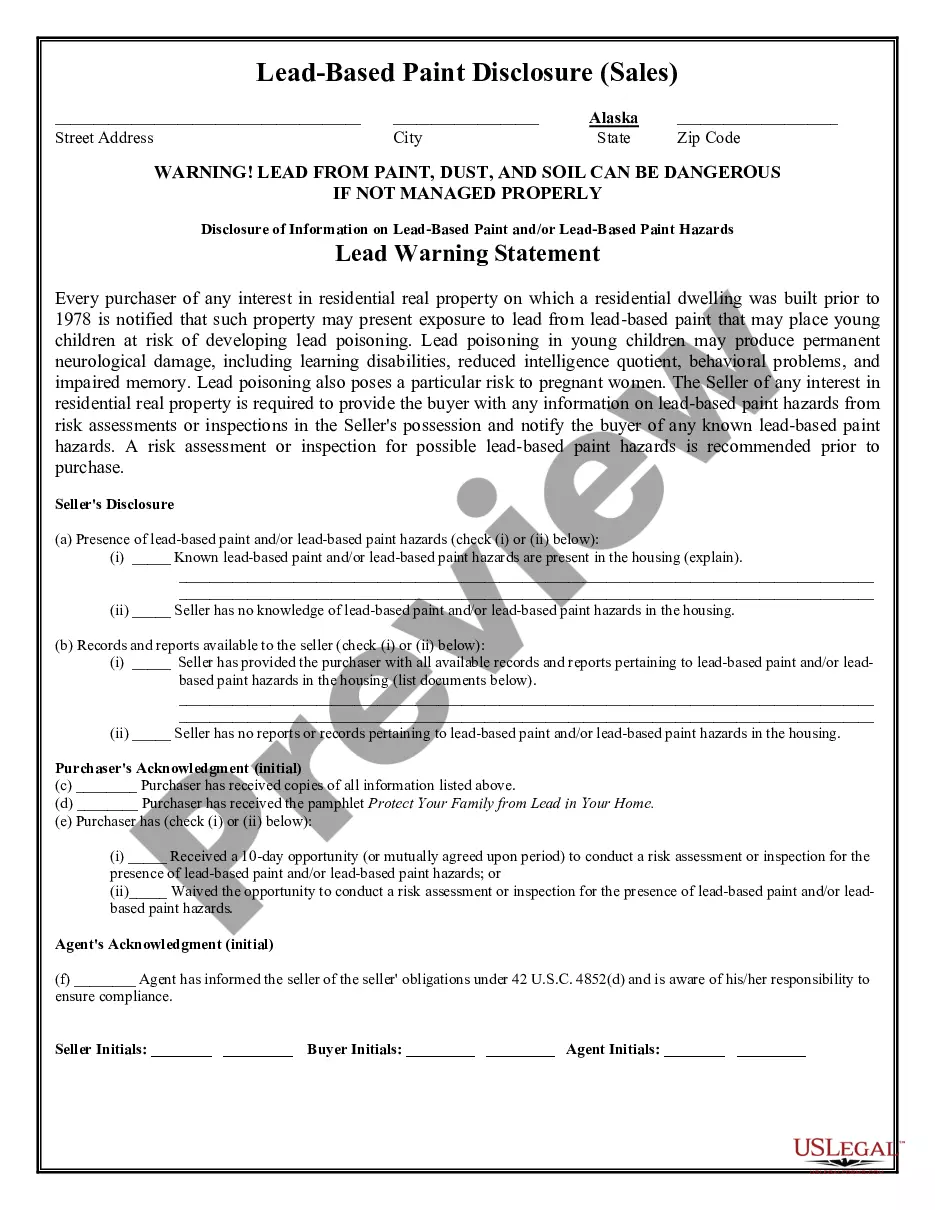

How to fill out Receipt Template For Small Business?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a selection of legal form templates you can download or print.

On the website, you can discover a vast number of forms for professional and personal purposes, categorized by types, states, or keywords.

You can access the most recent versions of forms such as the District of Columbia Receipt Template for Small Business in moments.

Examine the form description to confirm that you have chosen the appropriate form.

If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

- If you already have a monthly subscription, sign in and retrieve the District of Columbia Receipt Template for Small Business from your US Legal Forms library.

- The Acquire button will appear on each form you view.

- You can access all previously obtained forms from the My documents tab in your account.

- If you want to use US Legal Forms for the first time, here are some simple steps to guide you.

- Ensure you have selected the correct form for your city/area.

- Click the Preview button to check the form's content.

Form popularity

FAQ

Yes, Washington, DC has various city taxes, including income and sales taxes that affect both individuals and businesses. These taxes are essential for funding local services and infrastructure. As a small business owner in DC, understanding these taxes can help you navigate your financial obligations. Our District of Columbia Receipt Template for Small Business can assist you in keeping track of taxable transactions.

An unincorporated business in Washington, DC, refers to a business that operates without formal incorporation or registration as a corporation or LLC. These businesses are typically sole proprietorships or partnerships. It's crucial for such businesses to maintain clear financial records, including receipts and expenses. Utilizing a District of Columbia Receipt Template for Small Business can simplify your record-keeping process.

The gross receipts tax in Washington state is a tax levied on the total revenue a business generates, without deductions for costs. This tax applies to businesses operating within the state, including those in the District of Columbia. As a business owner, it’s essential to be aware of these taxes to ensure compliance. Our District of Columbia Receipt Template for Small Business can help you track your earnings accurately.

The filing threshold for businesses in the District of Columbia ensures that entities generating a minimum level of gross receipts report their income. This threshold may change over time, so it's important to stay updated with the latest regulations. For your small business, maintain clear records using a District of Columbia Receipt Template for Small Business to determine if you meet the filing requirements.

A DC 30 is a specific form used by corporations and unincorporated businesses to report their income in the District of Columbia. It details revenue, expenses, and other financial data for the tax year. Familiarizing yourself with the DC 30 will help you navigate the tax landscape effectively, ensuring that your submissions are accurate and compliant.

To file DC sales tax, you need to complete the sales and use tax return, typically submitted on a monthly or quarterly basis, depending on your collected sales. Ensure you report the total sales and the tax collected accurately to avoid issues. Consider using a District of Columbia Receipt Template for Small Business to track your sales, making the filing process much simpler.

Every business that owns personal property in the District of Columbia must file a personal property tax return. This requirement includes small businesses with tangible assets like furniture, equipment, and inventory. If you’re unaware of how to manage these filings, a District of Columbia Receipt Template for Small Business can be beneficial in organizing your asset records.

Yes, you can file your DC taxes online, which makes the process more convenient and efficient. The DC Office of Tax and Revenue provides online services that allow you to submit your tax forms and payments securely. Utilizing a digital District of Columbia Receipt Template for Small Business can complement your online filing, helping you keep track of your transactions.

The DC D-30 filing requirement mandates that eligible businesses file an annual income tax return, reporting their earnings and expenses. This filing helps the District of Columbia assess your tax liability based on your business activities over the year. To effectively manage your business's finances, consider using a District of Columbia Receipt Template for Small Business for accurate record-keeping.

Businesses operating in the District of Columbia must file a DC D-30 if they are considered corporations or unincorporated businesses. This requirement applies to both resident and non-resident entities that generate income within DC. If you run a small business, it’s essential to understand your obligations to ensure compliance and avoid penalties.