District of Columbia Receipt Template for Cash Payment

Description

How to fill out Receipt Template For Cash Payment?

If you need to finish, acquire, or print sanctioned record formats, utilize US Legal Forms, the most extensive collection of sanctioned forms, that are available online.

Take advantage of the website's straightforward and user-friendly search to locate the documents you require.

Various formats for business and personal purposes are organized by categories and claims, or keywords.

Step 4. Once you have located the form you need, click on the Acquire now button. Choose the pricing plan you prefer and provide your credentials to sign up for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Utilize US Legal Forms to access the District of Columbia Receipt Template for Cash Payment in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click the Obtain button to find the District of Columbia Receipt Template for Cash Payment.

- You can also reach forms you previously stored in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the appropriate city/state.

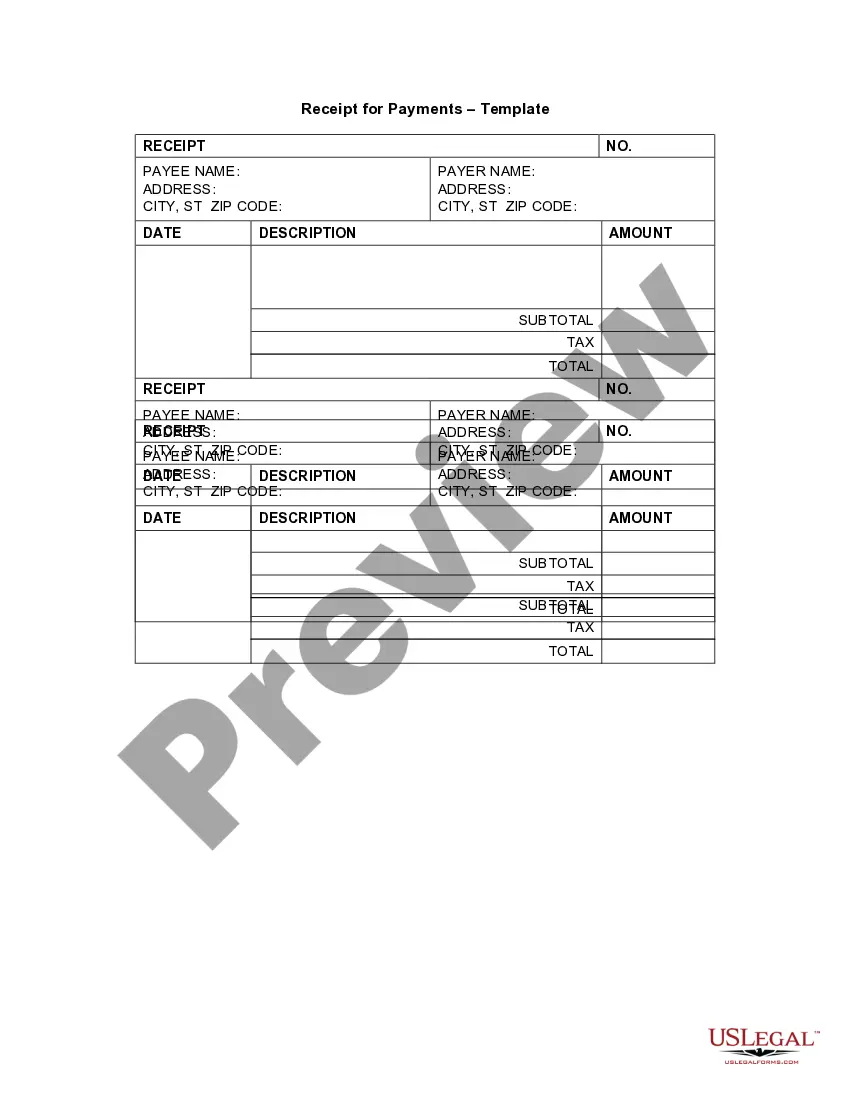

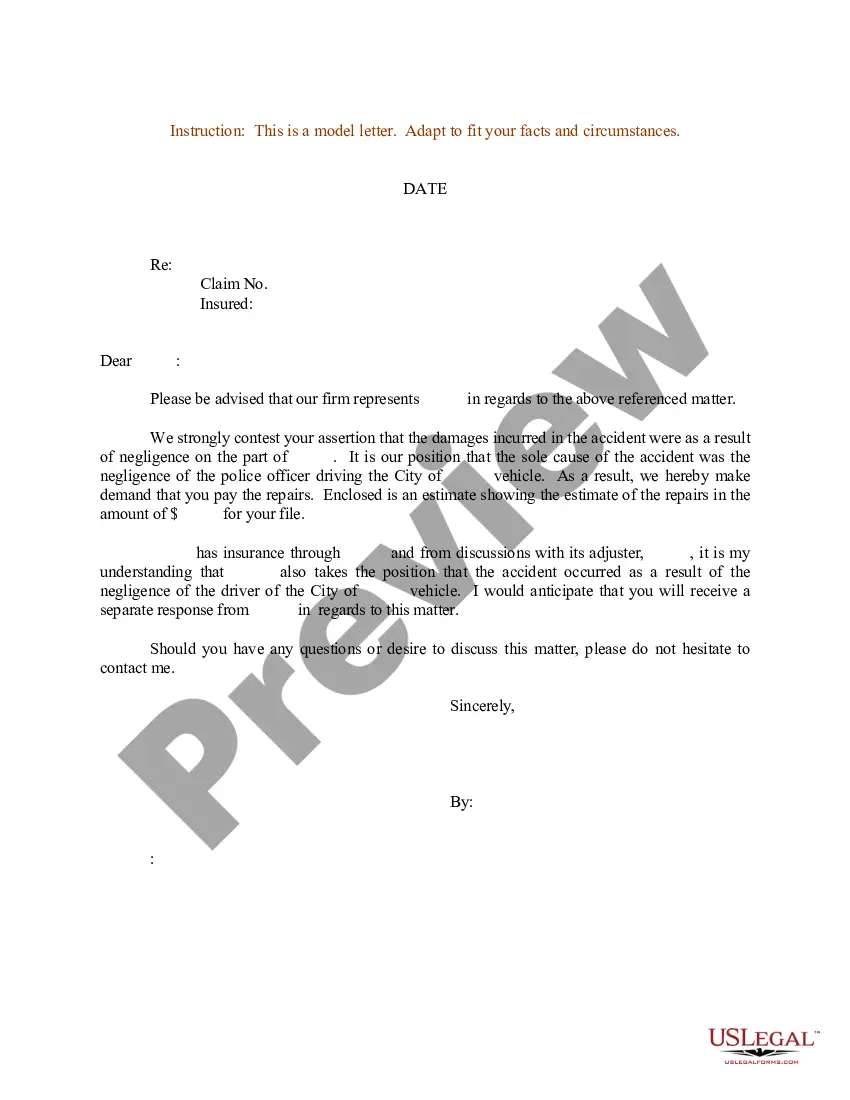

- Step 2. Use the Preview option to review the form's content. Do not forget to read the information.

- Step 3. If you are not satisfied with the form, use the Lookup field at the top of the screen to search for other types of your legal form template.

Form popularity

FAQ

Form D-30 can be e-filed. Refer to this article for information on the date you can begin e-filing this form. Generally, an unincorporated business with gross income over $12,000 from D.C. sources must file a D-30, regardless of whether it has net income.

People report the payment by filing Form 8300, Report of Cash Payments Over $10,000 Received in a Trade or BusinessPDF. A person can file Form 8300 electronically using the Financial Crimes Enforcement Network's BSA E-Filing System. E-filing is free, quick and secure.

DC does not allow NOL carry backs. Therefore, you may not claim a NOL carry back for DC tax purposes.

Generally, an unincorporated business, with gross income (Line 10) more than $12,000 from District sources, must file a D-30 (whether or not it has net income). This includes any business carrying on and/or engaging in any trade, business, or commercial activity in DC with income from DC sources.

Generally, an unincorporated business, with gross income (Line 10) more than $12,000 from District sources, must file a D-30 (whether or not it has net income). This includes any business carrying on and/or engaging in any trade, business, or commercial activity in DC with income from DC sources.

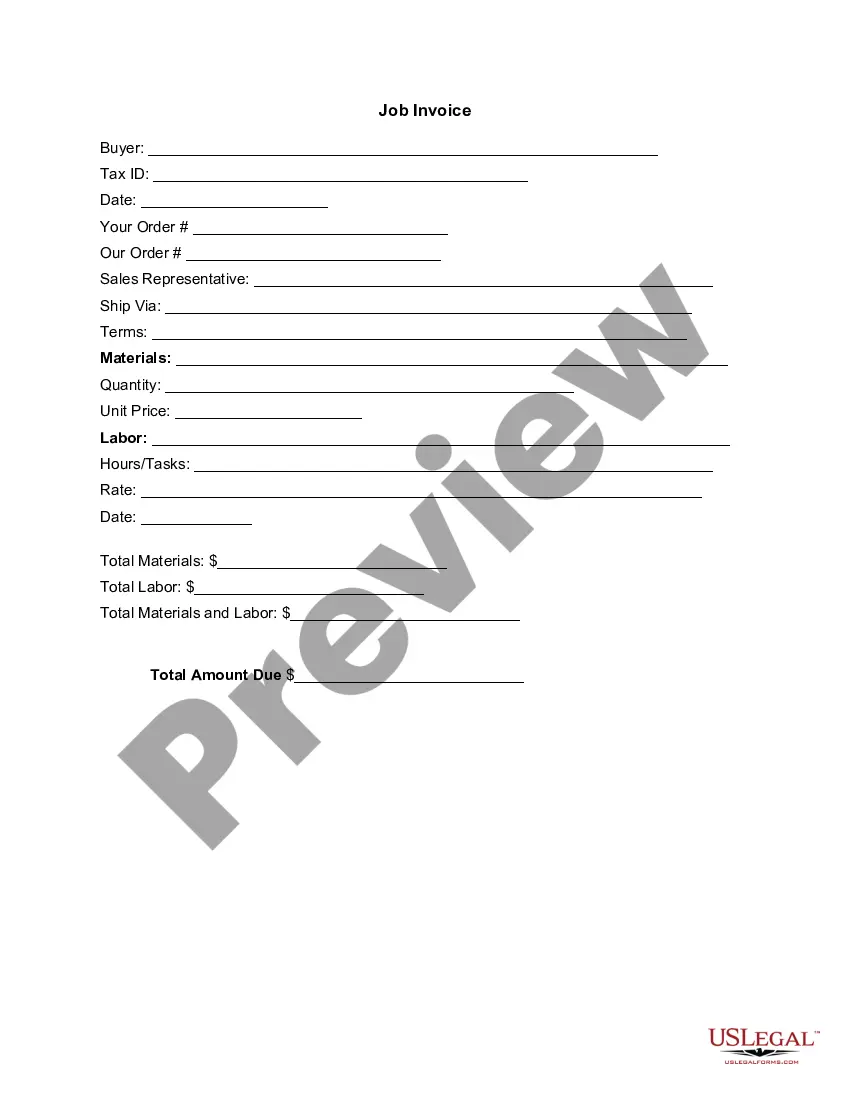

How do you write a receipt for a cash payment? If you are writing out a receipt for a cash payment, include the date, items purchased, quantity of each item, price of each item, total price, type of payment and payment amount, and your business name and contact information.

The basic components of a receipt include:The name and address of the business or individual receiving the payment.The name and address of the person making the payment.The date the payment was made.A receipt number.The amount paid.The reason for the payment.How the payment was made (credit card, cash, etc)More items...

Just make sure they include:The date of payment,A description of the services or goods purchased,The amount paid in cash, and.The name of the company or person paid.

To prove that cash is income, use:Invoices.Tax statements.Letters from those who pay you, or from agencies that contract you out or contract your services.Duplicate receipt ledger (give one copy to every customer and keep one for your records)