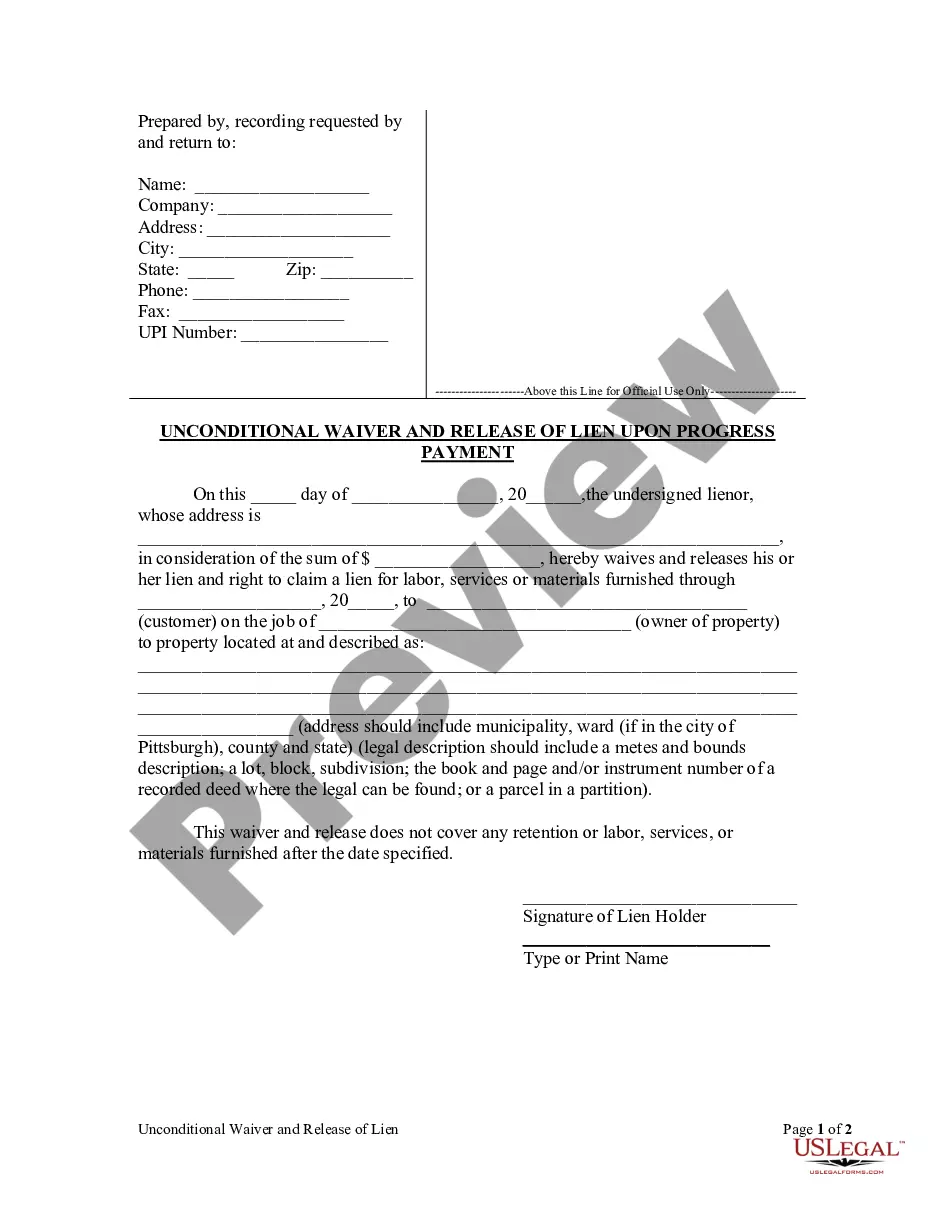

An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

District of Columbia Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary

Description

How to fill out Assignment By Beneficiary Of An Interest In The Trust Formed For The Benefit Of Beneficiary?

You can spend numerous hours online looking for the legal document template that meets the state and federal criteria you need.

US Legal Forms provides a vast array of legal documents that are vetted by professionals.

You can effortlessly access or create the District of Columbia Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary through the service.

To search for another version of the form, utilize the Search field to find the template that meets your needs and specifications.

- If you possess a US Legal Forms account, you can sign in and select the Download option.

- Afterwards, you can complete, modify, generate, or sign the District of Columbia Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary.

- Every legal document template you acquire is yours indefinitely.

- To obtain another copy of a purchased form, go to the My documents section and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow these straightforward instructions.

- Firstly, ensure you have selected the correct document template for the county/town of your choice.

- Check the form description to confirm that you have chosen the right template.

Form popularity

FAQ

A trust is a legal arrangement where one party holds property for another's benefit. In contrast, a beneficiary is the individual or entity entitled to benefit from the trust. Understanding the distinction is crucial for proper asset management, particularly under the District of Columbia Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary. If you require assistance with trust documents, uslegalforms offers valuable resources to guide you.

When a trust is named as a beneficiary, the trust receives the assets outlined in the trust document. This setup allows for the distribution of assets according to the trust's terms, which can often protect those assets from probate. The District of Columbia Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary may become relevant if the trust wishes to assign its interest further. Engaging with uslegalforms can assist you with the necessary documentation for this process.

Yes, a beneficiary can assign their interest in a trust to another party. This process involves a legal document known as the District of Columbia Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary. While assignment is typically allowed, it is essential to review the trust document and state laws to ensure compliance. Utilizing uslegalforms can simplify this process and ensure that the assignment is executed correctly.

The trustee holds legal authority and control over the trust assets, while the beneficiary possesses beneficial interest in those assets. This means the trustee manages the trust in accordance with its terms, while beneficiaries receive benefits as specified. Clearly understanding the roles within the District of Columbia Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary can help you navigate potential conflicts and ensure the trust operates smoothly.

Distributing trust property involves following the terms outlined in the trust document. The trustee is responsible for ensuring that assets are transferred according to the instructions set in the trust. When dealing with the District of Columbia Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, it's essential to adhere to legal guidelines for a smooth distribution process.

Filing taxes for a trust involves completing a special tax return, known as IRS Form 1041. The trustee is responsible for ensuring the trust adheres to tax laws and reporting income generated by trust assets. If you are managing a trust under the District of Columbia Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, consulting with a tax professional can simplify this process.

A beneficiary is an individual who receives assets or benefits from a trust. In contrast, a beneficiary trust is a legal entity that holds those assets for the benefit of the named beneficiaries. Understanding this distinction is crucial when navigating the District of Columbia Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, as it defines roles and expectations in the trust structure.

To list a trust as a beneficiary, you need to provide the trust's name and identification number in your designation form. Properly naming the trust ensures that assets are distributed according to the terms outlined in the District of Columbia Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary. This step helps avoid legal complications down the line. For precise instructions and templates, consider utilizing resources available at uslegalforms.

The three types of beneficiaries include primary, contingent, and residual beneficiaries. Primary beneficiaries receive the benefits directly from the trust, while contingent beneficiaries receive benefits if the primary beneficiaries cannot. Residual beneficiaries receive any remaining assets after all primary and contingent distributions. Understanding these distinctions is vital for effective estate planning, and uslegalforms can help clarify concepts related to the District of Columbia Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary.

Filling out a beneficiary designation form involves providing specific details about the beneficiaries and the trust. It is important to accurately complete the District of Columbia Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary to ensure that your intentions are clear and legally binding. You should include your name, the trust's name, and the beneficiaries' information. For streamlined assistance, uslegalforms provides templates that simplify this process.