District of Columbia Instructions to Clients with Checklist - Long

Description

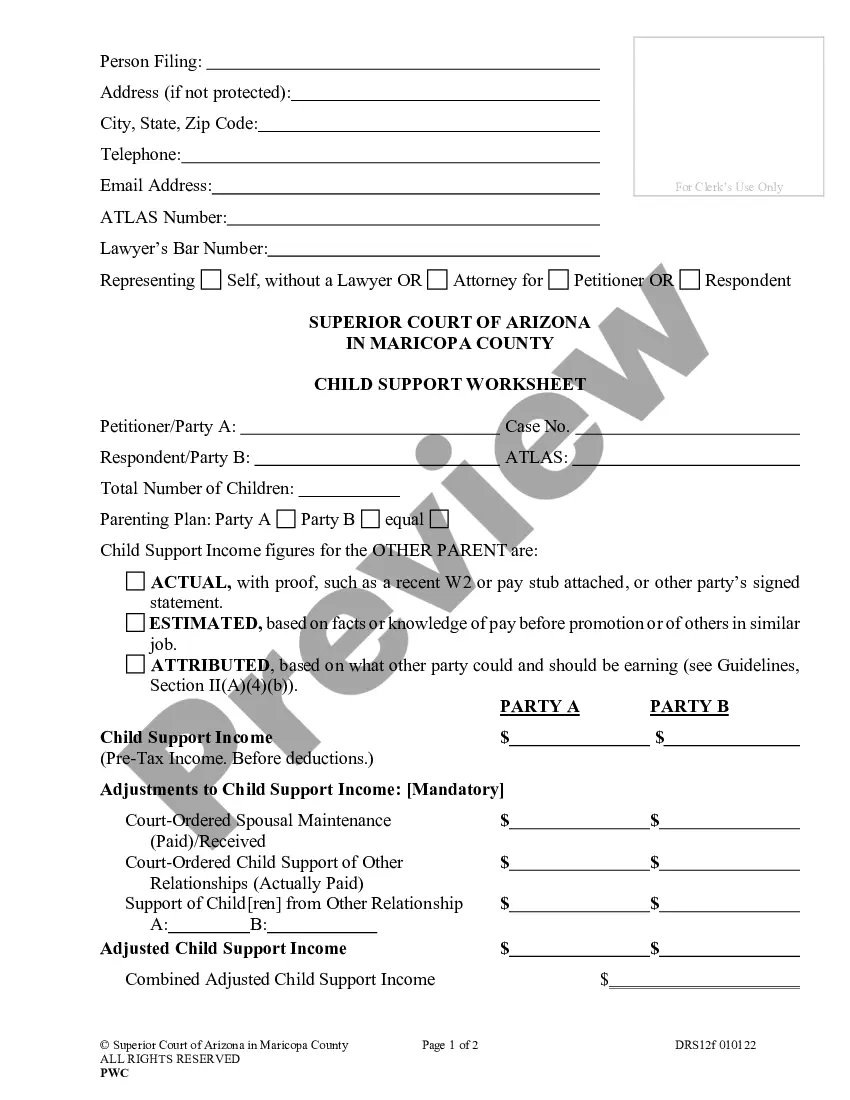

How to fill out Instructions To Clients With Checklist - Long?

Finding the correct legal document template can be quite a challenge. Of course, there are numerous templates available online, but how can you locate the legal form you require? Utilize the US Legal Forms website. The service offers thousands of templates, such as the District of Columbia Instructions to Clients with Checklist - Long, that can be utilized for both business and personal purposes. All forms are reviewed by professionals and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the District of Columbia Instructions to Clients with Checklist - Long. Use your account to browse through the legal forms you have previously purchased. Proceed to the My documents section of your account and download another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the correct form for your city/state. You can preview the form using the Preview option and review the form summary to confirm this is the right one for you. If the form does not meet your requirements, use the Search field to find the appropriate form. Once you are confident that the form is suitable, click the Get now button to download the form. Choose the pricing plan you need and enter the necessary information. Create your account and pay for the transaction with your PayPal account or credit card. Select the document format and download the legal document template to your device. Finally, complete, edit, print, and sign the downloaded District of Columbia Instructions to Clients with Checklist - Long.

Overall, US Legal Forms provides a comprehensive solution for obtaining legal documents tailored to your needs.

- US Legal Forms is the largest repository of legal forms where you can find numerous document templates.

- Utilize the service to download professionally crafted documents that comply with state requirements.

- Make sure to check for the latest updates on templates.

- Consider reading user reviews for guidance on selecting the right form.

- Explore different categories to find forms that suit your specific needs.

- Take advantage of customer support if you encounter any issues.

Form popularity

FAQ

FP-31 Tax Return The FP-31 tax return is essential for individuals who use property for business purposes in D.C. This includes rental property owners, freelancers, contractors, and 1099-NEC employees.

If you need to change or amend an accepted Washington, D.C. State Income Tax Return for the current or previous Tax Year you need to complete Form D-40. Form D-40 is used for the Tax Return and Tax Amendment.

File Form D-4 whenever you start new employment. Once filed with your employer, it will remain in effect until you file a new certificate. You may file a new withholding allowance certificate any time the number of withholding allowances you are entitled to increases.

If you are not liable for DC income taxes because you are a nonresident or military spouse, you must file Form D-4A, Certificate of Nonresi- dence in the District of Columbia, with your employer. When should you file? File Form D-4 whenever you start new employment.

Nonresidents are not required to file a DC return. If you work in DC but are a resident of another state, you are not subject to DC income tax. Nonresidents may request a refund of erroneously withheld DC tax withheld or mistakenly made DC estimated payments by filing Form D-40B, Nonresident Request for Refund.

Four-sided dice, abbreviated d4, are the lowest number range version of the classic RPG dice set. This seemingly simple tetrahedron (pyramid shape) is one of the most confusing in the lineup, primarily because there are two main styles of d4s.

How is the 183 days residency rule applied to tax returns? Every day that a taxpayer is in the District of Columbia and maintains a place of residency for an aggregate of 183 days or more, including days of temporary absence is counted towards the 183 days residency rule.

Withholding Forms and Certificates of Nonresidence If you are a resident of DC, MD or VA, you must file a state withholding form to notify Payroll Services of the correct amount of state tax to withhold from your compensation.