A guaranty is an undertaking on the part of one person (the guarantor) that is collateral to an obligation of another person (the debtor or obligor), and which binds the guarantor to performance of the obligation in the event of default by the debtor or obligor. A guaranty agreement is a type of contract. Thus, questions relating to such matters as validity, interpretation, and enforceability of guaranty agreements are decided in accordance with basic principles of contract law.

District of Columbia Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability

Description

How to fill out Continuing Guaranty Of Business Indebtedness With Guarantor Having Limited Liability?

Selecting the ideal legal document template can be a challenge. Indeed, there are numerous templates accessible online, but how can you find the legal form you require.

Utilize the US Legal Forms website. The platform offers a multitude of templates, including the District of Columbia Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability, suitable for both business and personal purposes. All forms are vetted by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click on the Download button to retrieve the District of Columbia Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. Utilize your account to review the legal forms you have previously acquired. Visit the My documents section of your account to obtain another copy of the document you require.

Choose the file format and download the legal document template to your device. Complete, modify, print, and sign the acquired District of Columbia Continuing Guaranty of Business Indebtedness with Guarantor Having Limited Liability. US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize the service to obtain professionally crafted documents that adhere to state requirements.

- Firstly, confirm that you have selected the correct form for your city/region.

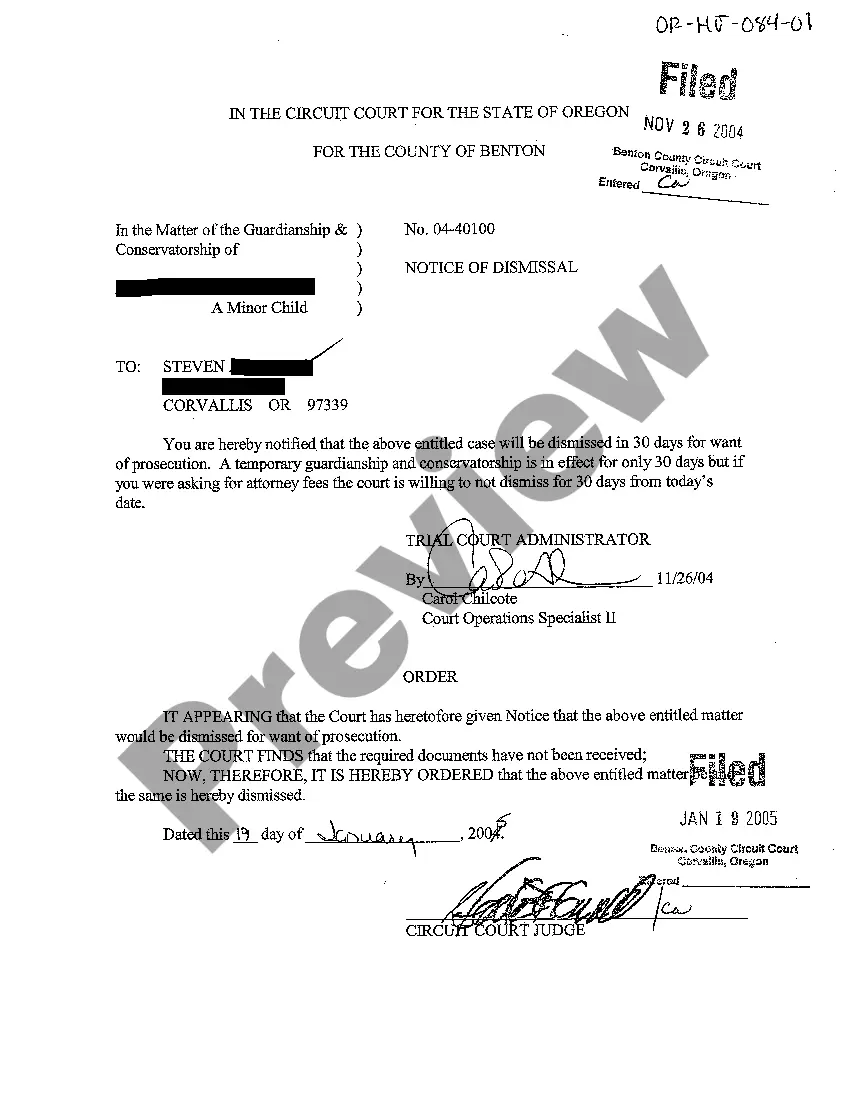

- You can preview the form using the Review button and examine the form details to ensure this is the right one for you.

- If the form does not meet your needs, use the Search bar to find the appropriate form.

- Once you are confident that the form is suitable, click the Buy now button to purchase the form.

- Select the pricing plan you wish and enter the necessary information.

- Create your account and complete the payment using your PayPal account or credit card.

Form popularity

FAQ

From the bank's point of view and the generally accepted norms, the death of a guarantor does not extinguish his liabilities. The amount in default by the borrower is essentially a responsibility of your late father also, to repay. Hence as a legal heir, you inherit the assets as well as the liabilities of your father.

The simple answer is Yes. If the consideration of the guarantee is divisible, the guarantee can be revoked once notice of the death of the Guarantor is received by the Creditor. If the consideration of the guarantee is entire, the Guarantor's estate will be liable for the total amount guaranteed.

Does a personal guarantee come to an end on the death of a guarantor? The death of the individual guarantor does not automatically discharge the guarantee obligations under the guarantee.

A surety's undertaking is an original one, by which he becomes primarily liable with the principle debtor, while a guarantor is not a party to the principal obligation and bears only a secondary liability.2 Stated somewhat differently, the distinction between a suretyship and guaranty is that a surety is in the first

Guarantor's death: The legal heirs/representatives are liable to assume the promise executed by the deceased under the guarantee, but they are not liable for future liabilities of the principal debtor after his death unless such liability on legal heirs is expressly mentioned in the guarantee contract.

Guarantor or Surety - The person who promises to take responsibility for another persons performance or obligation in case of default. Principal debtor or obligor -The person whose performance to an obligation or undertaking has been secured by a surety or guarantor.

Most guarantees in today's market are drafted as joint and several guarantees, meaning that each guarantor is both jointly liable (as a member of the group) and individually liable (on its own separately), to the lender for the repayment in full of a borrower's indebtedness.

In case of non-payment, a guarantor is liable to legal action. If the lender files a recovery case, it will file the case against both the borrower and the guarantor. A court can force a guarantor to liquidate assets to pay off the loan," added Mishra.

A surety's undertaking is an original one, by which he becomes primarily liable with the principle debtor, while a guarantor is not a party to the principal obligation and bears only a secondary liability.2 Stated somewhat differently, the distinction between a suretyship and guaranty is that a surety is in the first

Joint liability means that you and your co- guarantor are each liable up to the full amount of the guaranteed debt. Therefore, if your co- guarantor died or disappeared or was declared bankrupt, you will remain fully liable for the entire amount of the guaranteed debt.