In a security agreement, the debtor grants a "security interest" in the personal property in order to secure payment of the loan. Granting a security interest in personal property is the same thing as granting a lien in personal property. This form is a sample of a security agreement in farm products that may be referred to when preparing such a form for your particular state.

District of Columbia Security Agreement with Farm Products as Collateral

Description

How to fill out Security Agreement With Farm Products As Collateral?

Have you ever been in a situation where you need documents for both business or personal reasons nearly every workday.

There are numerous legal document templates available online, but finding forms you can trust is not simple.

US Legal Forms offers thousands of form templates, including the District of Columbia Security Agreement with Farm Products as Collateral, which can be drafted to meet federal and state requirements.

- If you are already acquainted with the US Legal Forms website and possess an account, just Log In.

- After that, you can download the District of Columbia Security Agreement with Farm Products as Collateral template.

- If you do not have an account and need to begin using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

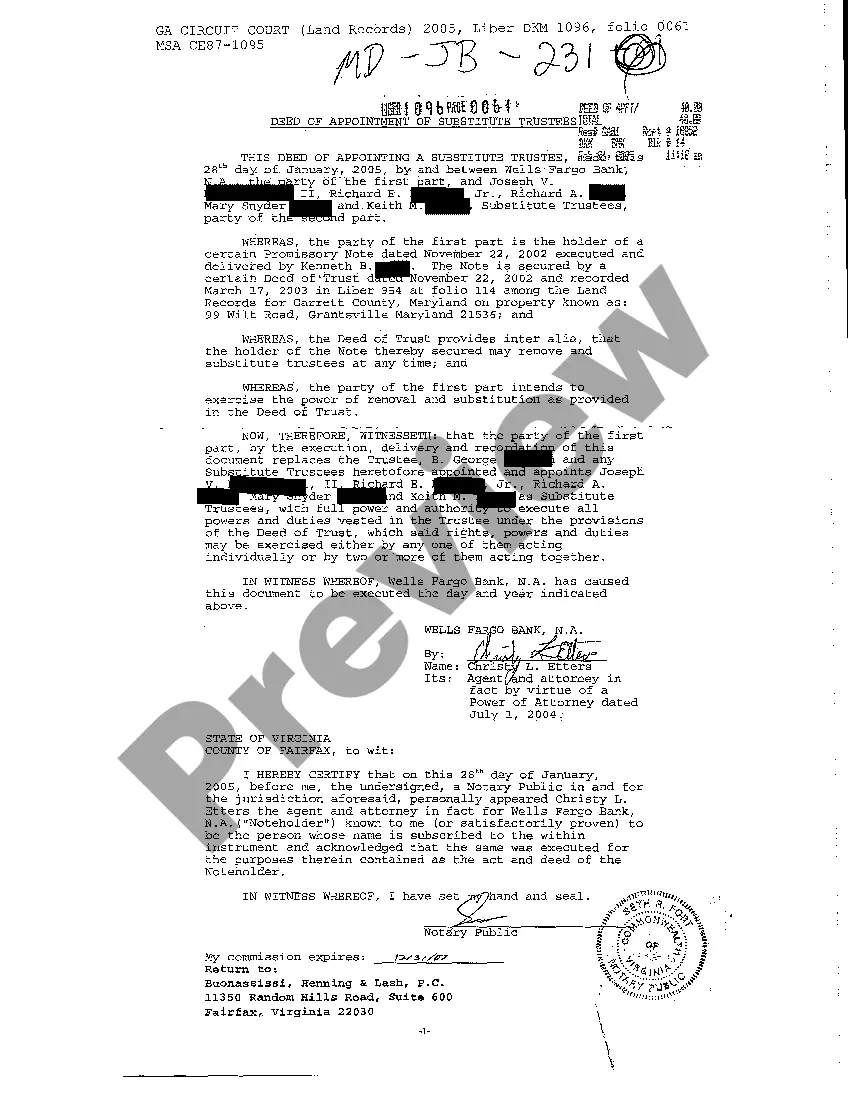

- Utilize the Review button to examine the form.

- Check the description to ensure you have selected the right form.

- If the form is not what you are looking for, use the Lookup field to find the form that matches your needs.

- Once you find the appropriate form, click Get now.

- Choose the pricing plan you want, complete the required information to create your account, and pay for the order using your PayPal or credit card.

- Select a convenient file format and download your copy.

- You can find all of the document templates you have acquired in the My documents section. You are free to download another copy of the District of Columbia Security Agreement with Farm Products as Collateral at any time if needed. Just follow the required form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors.

- The service offers expertly crafted legal document templates that you can use for various purposes.

- Create an account on US Legal Forms and start making your life a little easier.

Form popularity

FAQ

A security agreement must include identification of the parties, a description of the collateral, and the terms of the security interest. These details ensure that all legal requirements are met, particularly in the context of a District of Columbia Security Agreement with Farm Products as Collateral. This thorough approach helps in safeguarding the rights of the lender.

To perfect a pledge, you must deliver the pledged property to the lender or a third party. This act gives the lender a secured interest in the asset specified in the District of Columbia Security Agreement with Farm Products as Collateral. Proper documentation and a clear description of the collateral are vital to ensure your rights.

To perfect a security interest in a contract under the District of Columbia Security Agreement with Farm Products as Collateral, you must file a financing statement. This process establishes your legal claim to the collateral if the borrower defaults. Ensure all details are accurate, including the description of the collateral to avoid complications.

A security agreement outlines the terms between a borrower and a lender regarding collateral, such as farm products in the District of Columbia Security Agreement with Farm Products as Collateral. Conversely, a financing statement is a public record that a creditor files to give notice of their interest in the collateral. While the security agreement establishes the rights, the financing statement serves to notify third parties.

A security financial collateral arrangement involves using specific assets as collateral to secure a financial obligation. Under the District of Columbia Security Agreement with Farm Products as Collateral, it allows borrowers to use farm products not just as inventory but also as collateral for loans. This arrangement provides lenders with assurance while giving borrowers access to essential financing.

To create a security interest, a debtor must grant a secured party specific rights to collateral. This requires an agreement, which is often documented through a District of Columbia Security Agreement with Farm Products as Collateral. Additionally, the secured party must take possession or control of the collateral or file a financing statement to perfect their interest.

In the context of the District of Columbia Security Agreement with Farm Products as Collateral, the rules of priority under the Uniform Commercial Code (UCC) determine the order of claims against collateral. Generally, a secured party has priority over unsecured creditors. Also, if two parties have security interests in the same collateral, the one who filed first typically has the superior claim.

A security interest is perfected by taking specific legal steps that enhance the lender's rights to the collateral. This often includes filing a financing statement under the Uniform Commercial Code or taking possession of the collateral. In a District of Columbia Security Agreement with Farm Products as Collateral, proper perfection ensures that the lender's claim is prioritized over other creditors.

The perfection of security interest in proceeds refers to the legal process of ensuring that a lender's interest in the collateral is recognized and enforceable. In the context of a District of Columbia Security Agreement with Farm Products as Collateral, this means that if the farm products are sold or transformed, the security interest continues in the proceeds. It protects the lender by allowing them to claim the proceeds from the sale of the collateral.