District of Columbia Revocable Living Trust for Single Person

Description

How to fill out Revocable Living Trust For Single Person?

It is feasible to invest multiple hours online attempting to locate the sanctioned document template that complies with the state and federal requirements you desire.

US Legal Forms offers a vast array of legal forms that are assessed by experts.

You can download or print the District of Columbia Revocable Living Trust for a Single Person from my service.

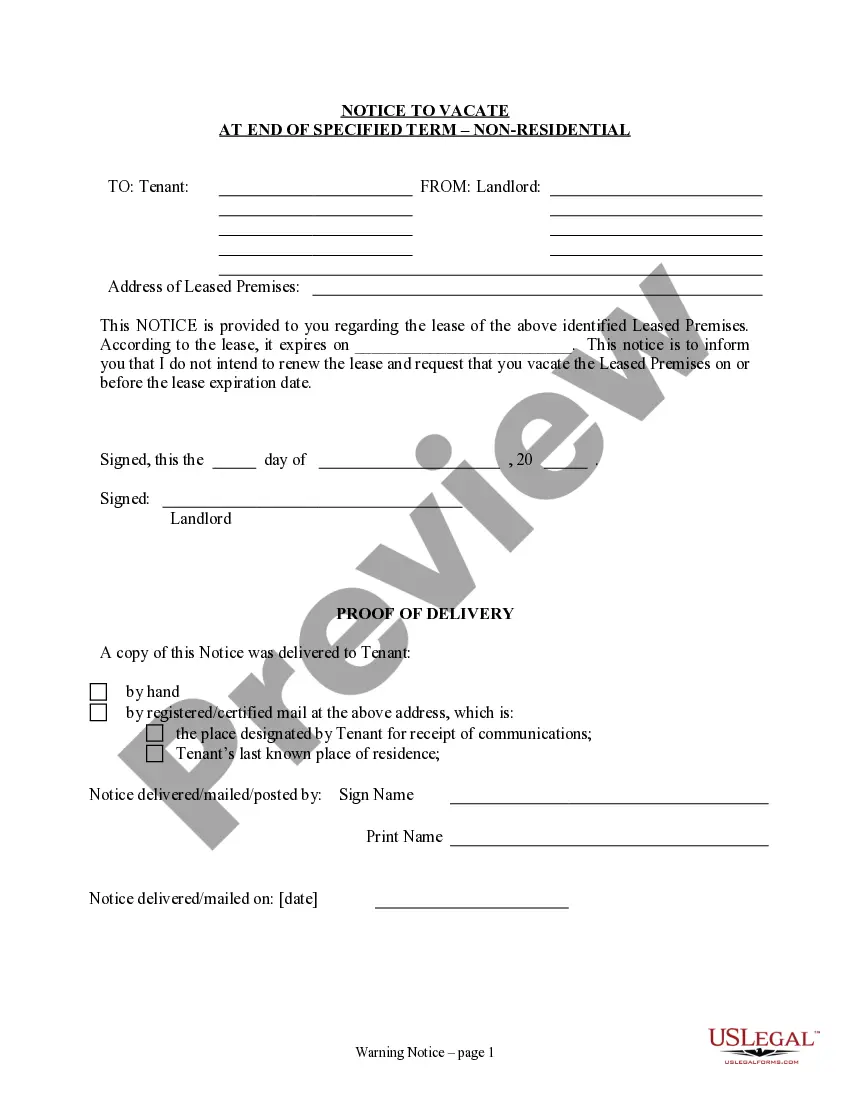

If available, utilize the Review button to examine the document template as well.

- If you already possess a US Legal Forms account, you can sign in and then hit the Acquire button.

- Then, you can complete, modify, print, or sign the District of Columbia Revocable Living Trust for a Single Person.

- Every legal document template you purchase is your own for a lifetime.

- To obtain an additional copy of the acquired form, go to the My documents section and click the appropriate button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your preferred region/area.

- Review the form description to verify that you have chosen the correct form.

Form popularity

FAQ

One disadvantage of a deed of trust is that it can lead to the foreclosure process if the borrower defaults. This action can result in the borrower losing their property, which can be distressing. Additionally, managing a deed of trust can complicate estate planning. When considering a District of Columbia Revocable Living Trust for Single Person, it's advisable to consult a professional to navigate these potential pitfalls and ensure your assets are protected.

Suze Orman advocates for the use of a District of Columbia Revocable Living Trust for Single Person, emphasizing its importance in comprehensive estate planning. She highlights how this type of trust allows individuals to control their assets and avoid the lengthy probate process. Understanding her perspective can help you create a more effective estate plan that meets your needs.

Putting your house in a District of Columbia Revocable Living Trust for Single Person can complicate the refinancing process or obtaining a home equity line of credit. Moreover, the trust may not provide tax benefits during your lifetime. Always weigh these considerations carefully with a financial advisor to determine the best plan for your assets.

Certain assets should generally be kept outside of a District of Columbia Revocable Living Trust for Single Person. For example, retirement accounts, such as IRAs and 401(k)s, often have designated beneficiaries and may not need to be included. Additionally, life insurance policies and real estate held in joint tenancy with rights of survivorship are typically better maintained outside the trust.

A single revocable trust allows an individual to manage their assets during their lifetime, and it can be changed or revoked at any time. In the context of a District of Columbia Revocable Living Trust for Single Person, it provides flexibility and control over your estate planning. This type of trust is particularly useful for those who wish to outline their desires for asset distribution without the complexities of probate.

The main downside of a District of Columbia Revocable Living Trust for Single Person is that it does not provide asset protection from creditors. Additionally, since you can modify the trust at any time, it might not encourage you to plan for incapacity or death as thoroughly. It's important to consult with an estate planning attorney to understand how a revocable trust fits into your overall financial strategy.

The best place to set up a trust often depends on your residence and the specific legal requirements involved. For those considering a District of Columbia Revocable Living Trust for Single Person, consulting with a legal professional who understands both local laws and your unique situation is advisable. Additionally, platforms like US Legal Forms offer resources and templates that can simplify the trust setup process, making it more accessible and efficient for individuals.

When considering estate planning options in Washington state, it's essential to understand the differences between a will and a trust. A District of Columbia Revocable Living Trust for Single Person can offer benefits such as avoiding probate and providing privacy for your estate. While a will directs the distribution of assets after death, a trust allows for more control and flexibility during your lifetime and beyond. Ultimately, the choice depends on your individual circumstances and goals.

Creating a living trust in DC involves several steps, starting with defining your assets and determining your beneficiaries. You will typically need to draft a trust document that outlines the terms and appoints a trustee, which can be yourself initially. A District of Columbia Revocable Living Trust for Single Person is particularly beneficial for maintaining control over your assets while ensuring they pass seamlessly upon your death. Using platforms like USLegalForms can simplify this process, providing templates and guidance tailored to your needs.

An irrevocable trust is owned by the trust itself, and the grantor cannot change the terms or pull assets out without the consent of the beneficiaries. Essentially, once you create a District of Columbia Revocable Living Trust for Single Person and convert it to an irrevocable trust, you relinquish control over the assets. This separation can provide certain benefits, such as asset protection and tax advantages. Understanding your ownership rights is crucial, so consider working with professionals for clarity.