District of Columbia Irrevocable Pot Trust Agreement

Description

A Pot Trust is a trust set up for more than one beneficiary, typically children. The purpose of a Pot Trust is to keep the funds in one pot until a later event. For example, at the death of the parents, the assets may be kept in one pot until all the children have graduated from college or reached age 21.

How to fill out Irrevocable Pot Trust Agreement?

You might spend countless hours online attempting to locate the legal document template that complies with the state and federal regulations you require.

US Legal Forms offers a plethora of legal forms that can be assessed by experts.

It is easy to download or print the District of Columbia Irrevocable Pot Trust Agreement from their services.

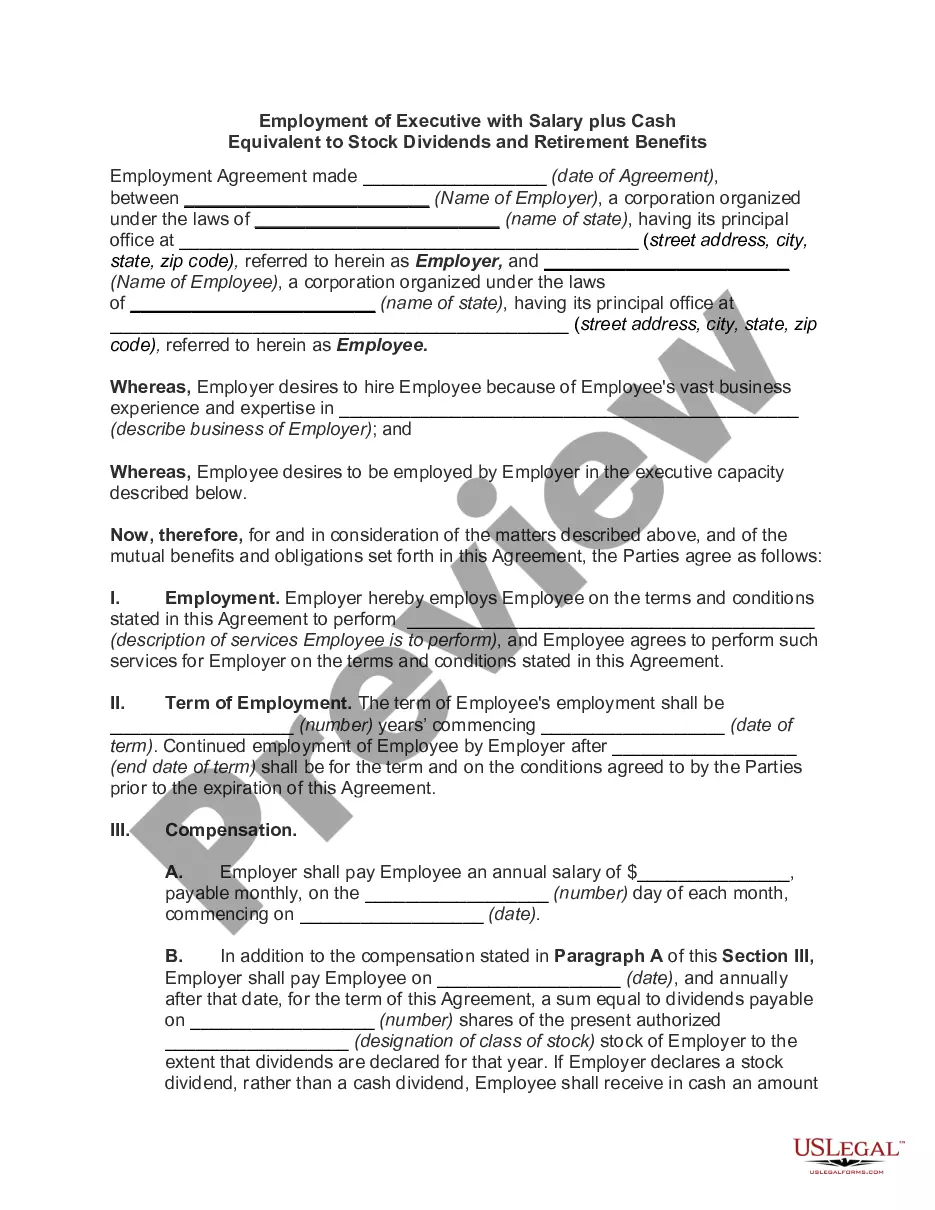

If available, utilize the Preview button to review the document template simultaneously.

- If you already have a US Legal Forms account, you can Log In and click the Obtain button.

- Then, you can fill out, modify, print, or sign the District of Columbia Irrevocable Pot Trust Agreement.

- Each legal document template you acquire is yours forever.

- To obtain another copy of any acquired form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions outlined below.

- First, ensure you have selected the correct document template for the area/city you choose.

- Review the form details to confirm you have chosen the appropriate form.

Form popularity

FAQ

Under an irrevocable trust, legal ownership of the trust is held by a trustee. At the same time, the grantor gives up certain rights to the trust.

Putting your house in an irrevocable trust removes it from your estate, reveals NOLO. Unlike placing assets in an revocable trust, your house is safe from creditors and from estate tax. If you use an irrevocable bypass trust, it does the same for your spouse.

The only three times you might want to consider creating an irrevocable trust is when you want to (1) minimize estate taxes, (2) become eligible for government programs, or (3) protect your assets from your creditors.

The trust belongs to all the beneficiaries. If the person selling property in an irrevocable trust uses the trust's money for his own needs in any way or transfers trust money to himself, he is considered by the law to be taking everyone's money, not just his own.

With an Irrevocable Trust, once you have transferred the ownership of the house to the trust, it's irrevocable, meaning you are never supposed to be able to take it back. The trust will own that house for the rest of your life.

Irrevocable Trust DisadvantagesInflexible structure. You don't have any wiggle room if you're the grantor of an irrevocable trust, compared to a revocable trust.Loss of control over assets. You have no control to retrieve or even manage your former assets that you assign to an irrevocable trust.Unforeseen changes.

Irrevocable trusts are generally set up to minimize estate taxes, access government benefits, and protect assets. This is in contrast to a revocable trust, which allows the grantor to modify the trust, but loses certain benefits such as creditor protection.