District of Columbia Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse

Description

How to fill out Marital-deduction Residuary Trust With A Single Trustor And Lifetime Income And Power Of Appointment In Beneficiary Spouse?

Are you currently within a situation the place you need documents for both company or person uses just about every day time? There are a variety of authorized papers web templates available on the net, but locating types you can rely on is not easy. US Legal Forms gives a large number of develop web templates, such as the District of Columbia Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse, that are composed in order to meet federal and state needs.

In case you are presently informed about US Legal Forms site and also have a merchant account, simply log in. Following that, you are able to download the District of Columbia Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse design.

Unless you come with an bank account and need to begin to use US Legal Forms, abide by these steps:

- Get the develop you require and make sure it is to the appropriate metropolis/state.

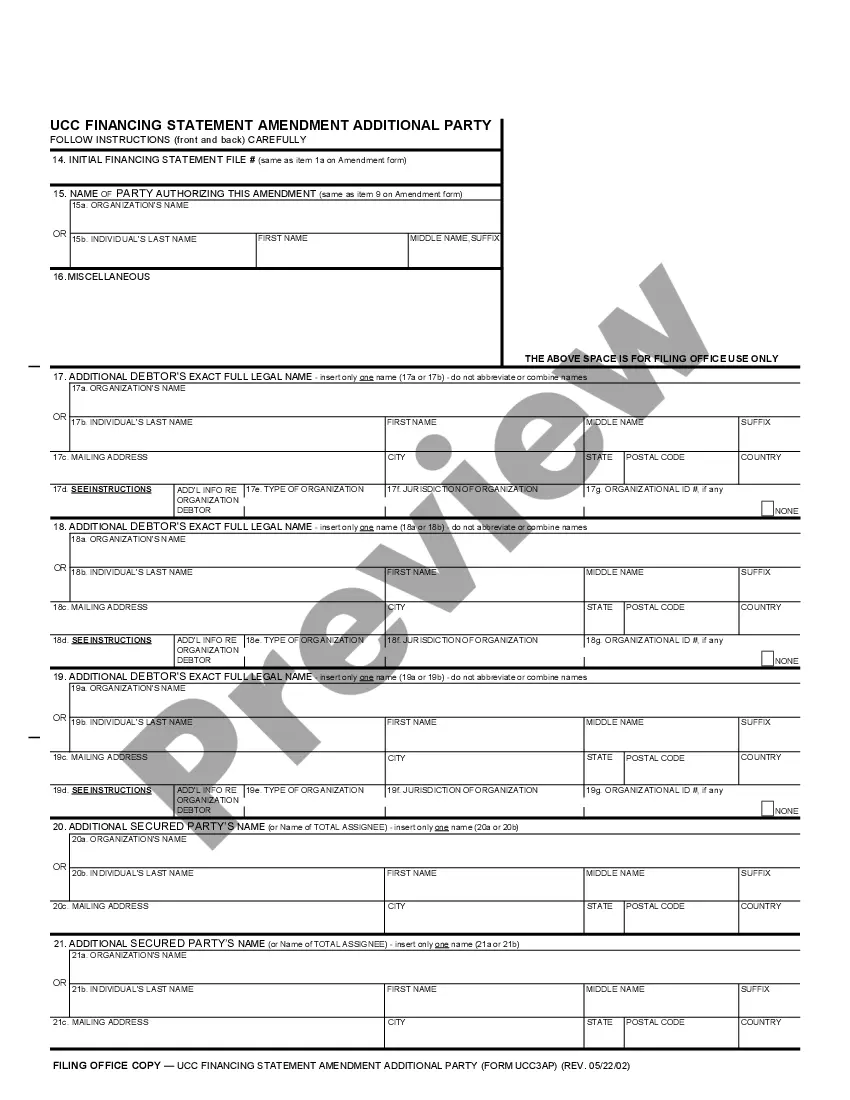

- Utilize the Review switch to check the shape.

- Read the outline to ensure that you have chosen the correct develop.

- If the develop is not what you are seeking, take advantage of the Search field to find the develop that meets your requirements and needs.

- Whenever you get the appropriate develop, simply click Acquire now.

- Opt for the costs strategy you want, submit the desired information and facts to produce your bank account, and purchase the order making use of your PayPal or credit card.

- Choose a handy document format and download your duplicate.

Get all of the papers web templates you have purchased in the My Forms menu. You can obtain a more duplicate of District of Columbia Marital-deduction Residuary Trust with a Single Trustor and Lifetime Income and Power of Appointment in Beneficiary Spouse at any time, if necessary. Just click the needed develop to download or print out the papers design.

Use US Legal Forms, the most substantial collection of authorized types, in order to save time as well as steer clear of errors. The service gives appropriately created authorized papers web templates that you can use for an array of uses. Make a merchant account on US Legal Forms and commence generating your lifestyle easier.

Form popularity

FAQ

The only potential disadvantages in general are two sub-trusts instead of one at the death of the first spouse and the requirement to file a 706 death tax return to elect QTIP treatment over the assets being funded to the QTIP Marital Trust. Married Joint Trust Marital Deduction Planning in California geigerlawoffice.com ? blog ? married-joint-t... geigerlawoffice.com ? blog ? married-joint-t...

In order to qualify the trust instrument must provide that at least one trustee be a United States citizen or domestic corporation, and that any distribution from the trust principal be subject to the United States trustee's right to withhold the estate tax due on the distribution.

The unlimited marital deduction is a provision in the U.S. Federal Estate and Gift Tax Law that allows an individual to transfer an unrestricted amount of assets to their spouse at any time, including at the death of the transferor, free from tax. What Is Unlimited Marital Deduction? How It Works and Taxation Investopedia ? terms ? unlimited-m... Investopedia ? terms ? unlimited-m...

An example of when a marital trust might be used is when a couple has children from a previous marriage and wants to pass all property to the surviving spouse upon death, but also provide for their individual children.

Formula Marital Deduction Bequests There are three basic formula clauses that normally are used: (1) pecuniary marital deduction; (2) pecuniary unified credit; and (3) fractional residuary marital reduction. Numerous variations and refinements can be applied to each. Chapter 6 Use of the Marital Deduction in Estate Planning National Timber Tax ? publications ? Cha... National Timber Tax ? publications ? Cha... PDF

The marital deduction is determinable from the overall gross estate. The total value of the assets passed on to the spouse is subtracted from that amount, giving us the marital deduction. This interspousal transfer can occur during the couple's lifetime or after one spouse's death, ing to a will.

The marital deduction, as a general rule, allows unlimited transfers between spouses during the spouse's lifetime or at death to pass, free of estate tax. However, the intention is that those assets will be taxed at the death of the surviving spouse.

Even with the increased lifetime exemption amount for 2023, over $2 million would be subject to estate taxes. Those assets could be gifted to you tax-free using the unlimited marital deduction; however, the value of your taxable estate would also be increased by the value of the assets gifted to you. Understanding the Unlimited Marital Deduction | Los Angeles Estate ... schomerlawgroup.com ? estate-planning-2 schomerlawgroup.com ? estate-planning-2