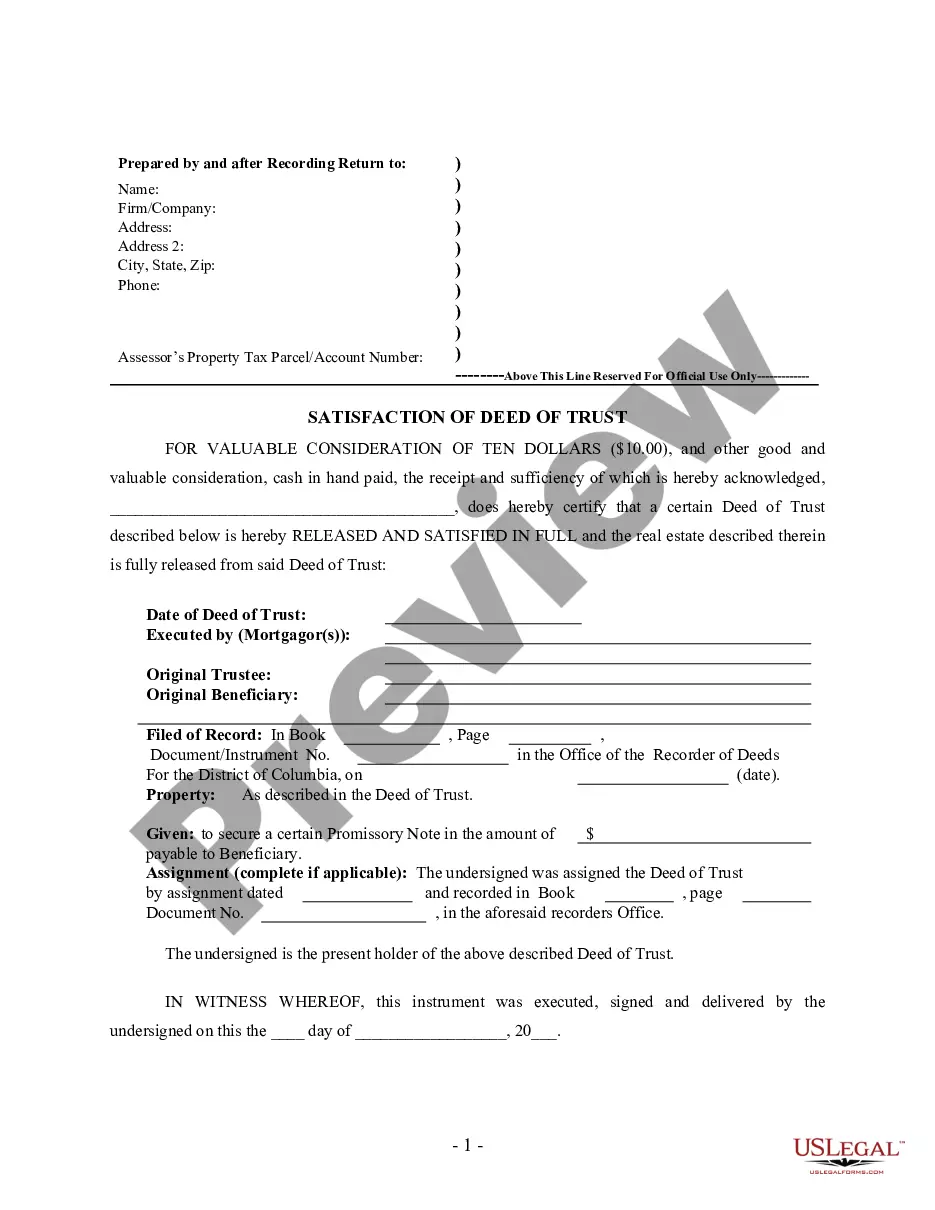

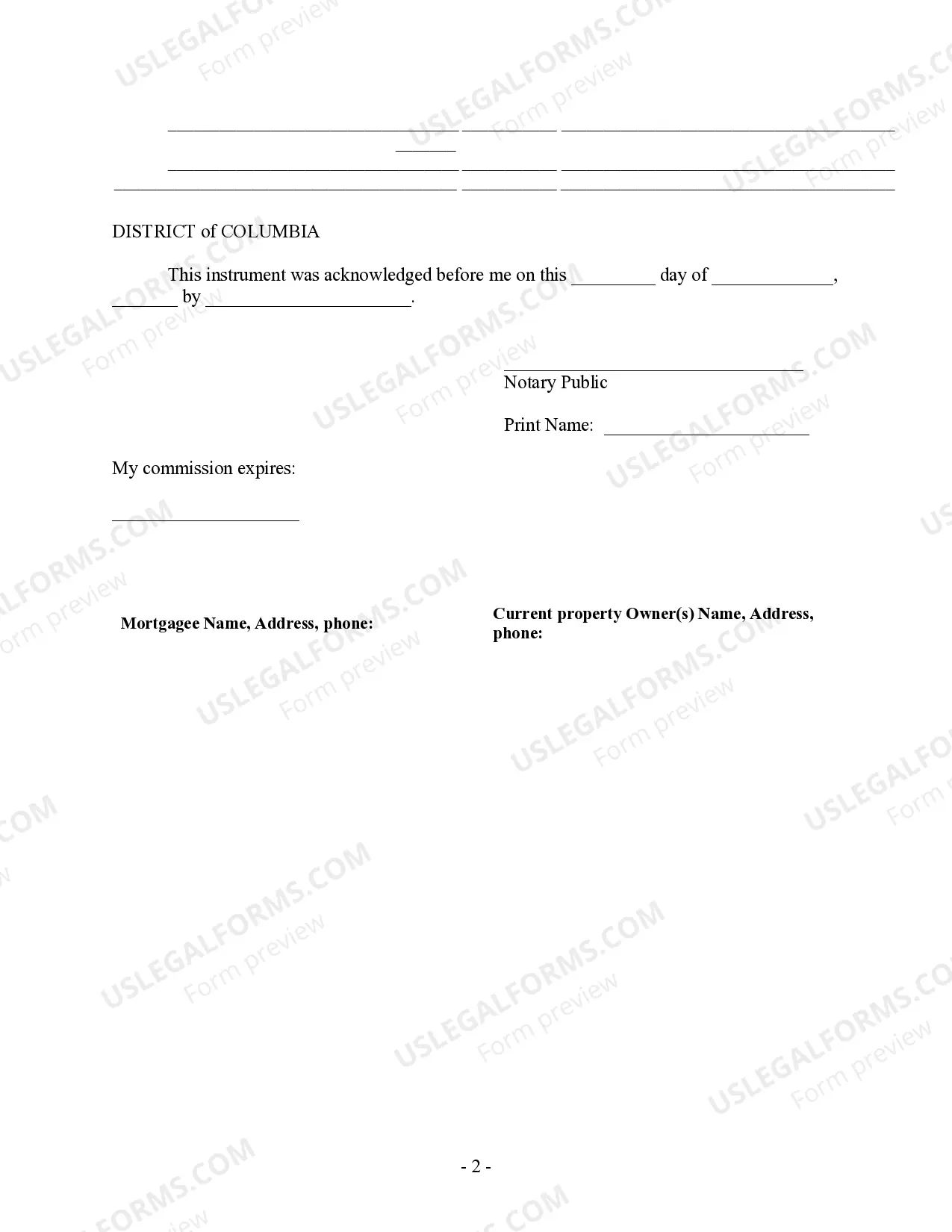

This form is for the satisfaction or release of a mortgage for the District of Columbia by an Individual. This form complies with all state statutory laws and requires signing in front of a notary public. The described real estate is therefore released from the mortgage.

District of Columbia Satisfaction, Release or Cancellation of Deed of Trust by Individual

Description

How to fill out District Of Columbia Satisfaction, Release Or Cancellation Of Deed Of Trust By Individual?

The larger quantity of documentation you have to produce - the more anxious you feel.

You can find a vast collection of District of Columbia Satisfaction, Release or Cancellation of Deed of Trust by Individual templates online, but you’re unsure which ones to rely on.

Eliminate the stress and simplify obtaining samples with US Legal Forms.

Simply select Buy Now to initiate the registration process and pick a pricing plan that fits your needs. Submit the required information to set up your account and complete the purchase with PayPal or credit card. Choose a convenient file format and retrieve your copy. Access every template you acquire in the My documents section. Navigate there to complete a new copy of your District of Columbia Satisfaction, Release or Cancellation of Deed of Trust by Individual. Even with the well-prepared templates, it remains crucial to consider consulting your local attorney to review the completed form to ensure your document is correctly filled out. Achieve more for less with US Legal Forms!

- Obtain accurately composed documents that meet state requirements.

- If you already possess a US Legal Forms subscription, Log In to your account, and you'll find the Download option on the District of Columbia Satisfaction, Release or Cancellation of Deed of Trust by Individual’s page.

- If you haven’t utilized our platform before, follow these steps to register.

- Verify that the District of Columbia Satisfaction, Release or Cancellation of Deed of Trust by Individual is applicable in your state.

- Re-confirm your choice by reviewing the description or using the Preview feature if available for the particular record.

Form popularity

FAQ

To remove someone from a deed of trust, you must execute a release or cancellation process, which involves formal documentation. Both parties generally need to agree to the change, ensuring all legal requirements are satisfied. Engaging with a professional service that specializes in the District of Columbia Satisfaction, Release or Cancellation of Deed of Trust by Individual can provide clarity and assistance. This approach ensures that all actions are performed correctly, protecting your interests.

Typically, the lender manages the deed of trust process, ensuring that all terms are met. If the borrower satisfies their obligations, the lender is responsible for initiating the release. It's essential to engage in clear communication with involved parties to ensure a straightforward resolution. When dealing with the District of Columbia Satisfaction, Release or Cancellation of Deed of Trust by Individual, having an experienced service like uslegalforms can guide you through each step.

Yes, a release must be documented as a deed to ensure it is legally binding. This formalizes the release, providing proof that the obligations outlined in the original trust deed have been satisfied. By adhering to District of Columbia Satisfaction, Release or Cancellation of Deed of Trust by Individual requirements, you ensure the release is recognized in legal terms. Working with professionals or platforms like uslegalforms can help streamline this process.

The release clause in a trust deed allows the lender to release a borrower from the obligation of the deed under certain conditions. Essentially, it signifies that the borrower has fulfilled their repayment duties, thus enabling them to regain their property's title. This process plays a crucial role in ensuring peace of mind for individuals who have successfully settled their debts. Understanding the District of Columbia Satisfaction, Release or Cancellation of Deed of Trust by Individual will make this transition smoother.

One of the primary disadvantages of a deed of trust is that it can provide less security than a traditional mortgage. If you default, the trustee can sell your property without going through the courts, which can be rapid and overwhelming. Additionally, this process in the District of Columbia may result in unclear title issues if not properly handled. Being mindful of these risks can help you make informed decisions.

A quitclaim deed is a legal document used to transfer interest in a property without guaranteeing that the title is clear. In the District of Columbia, this type of deed is often utilized among family members or when transferring property within a trust. It can provide a simple way to transfer property rights, although it does not offer the same level of protection as other forms, like warranty deeds. Understanding the implications of a quitclaim deed is essential before proceeding.

When the debt secured with a deed of trust is satisfied, the lender must provide a release document, which serves as proof that the obligation is fulfilled. This document can be filed with the appropriate government office in the District of Columbia. By recording this release, you ensure that the property's title is clear of the encumbrance from the deed of trust. This process marks the conclusion of your financial obligation.

A deed of release example would include a document that states the lender releases their claim to the property after debt repayment. It usually includes property details, borrower and lender information, and a statement indicating the deed of trust is no longer in effect. This type of documentation is vital in the District of Columbia to ensure clear property ownership. US Legal can guide you in drafting and filing these important legal documents seamlessly.

A deed of trust satisfaction occurs when the borrower pays off their debt, resulting in the lender formally acknowledging that the debt has been fulfilled. This satisfaction is typically documented through a specific legal form that the lender files with the local government. In the context of the District of Columbia, this step is crucial for clearing property titles. Using US Legal forms can help you create the correct documentation without complications.

Dissolving a trust can vary in difficulty based on the trust's complexity and the agreements in place. Generally, if all beneficiaries agree and the legal obligations are clear, the process can be straightforward. Utilizing resources from US Legal Forms may simplify the dissolution process, especially regarding the District of Columbia satisfaction, release, or cancellation of deed of trust by individual.