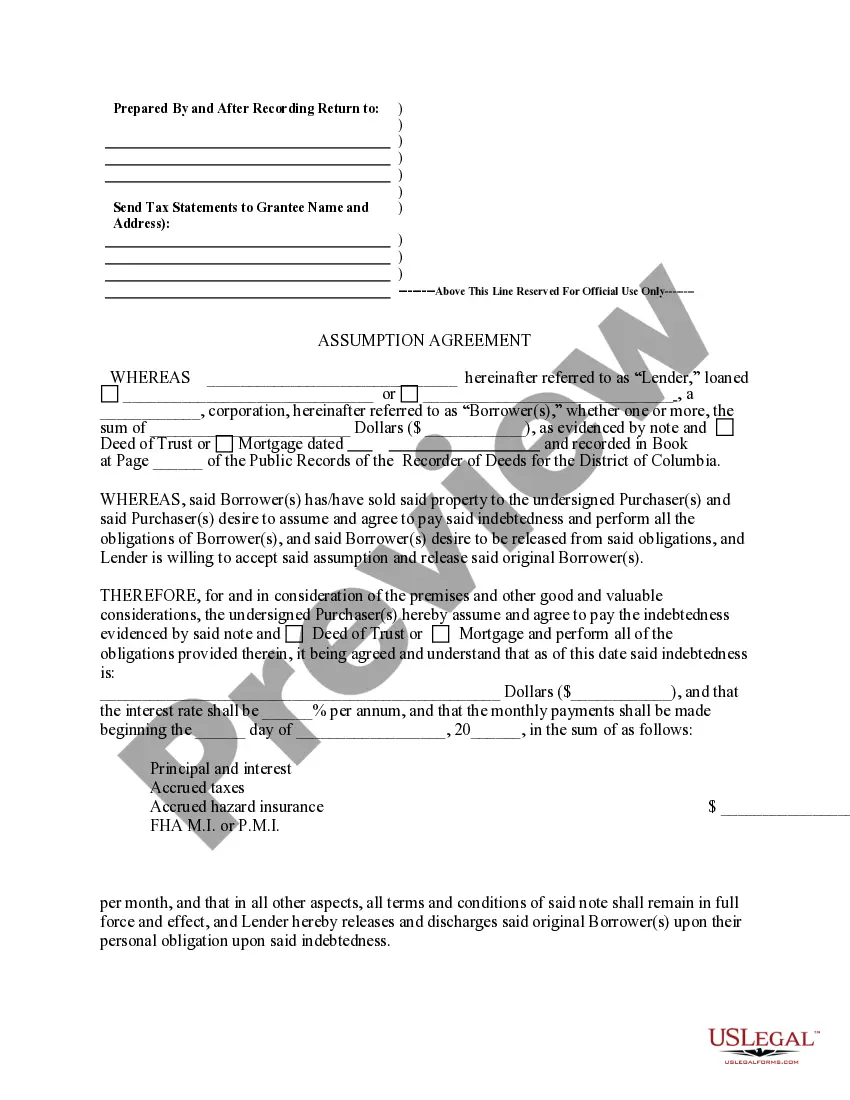

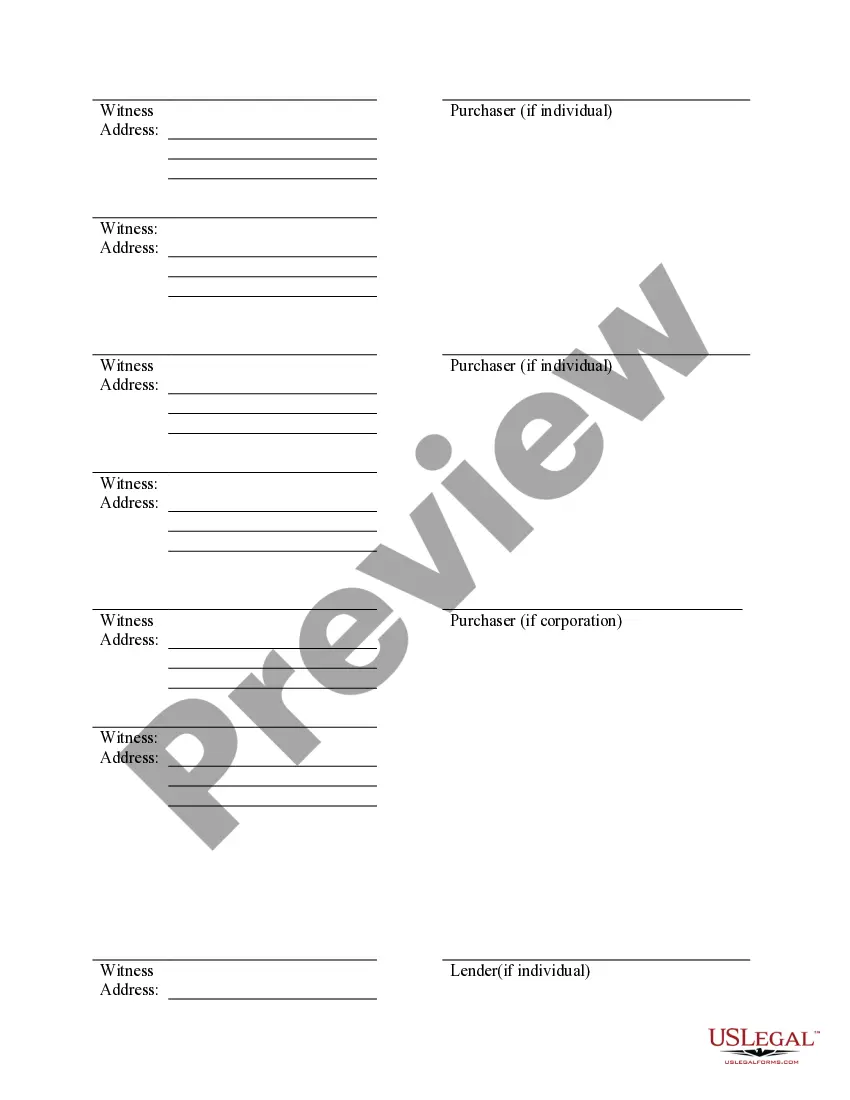

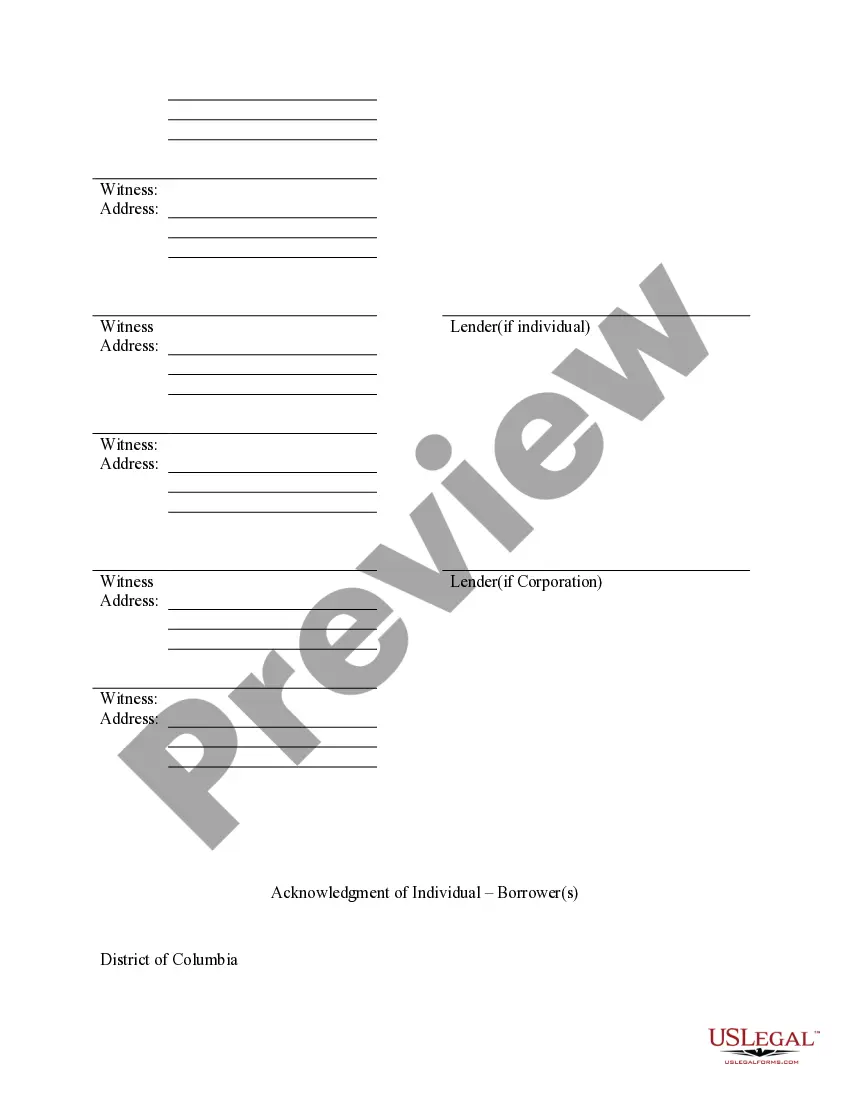

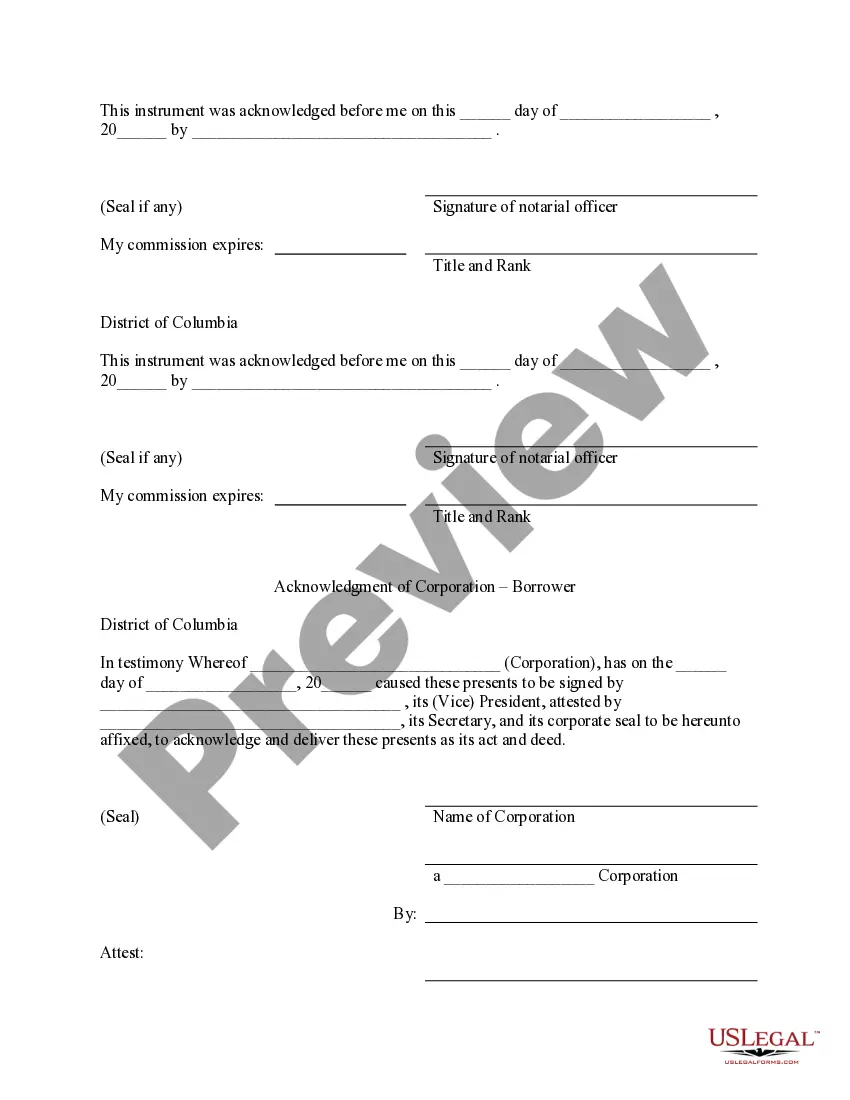

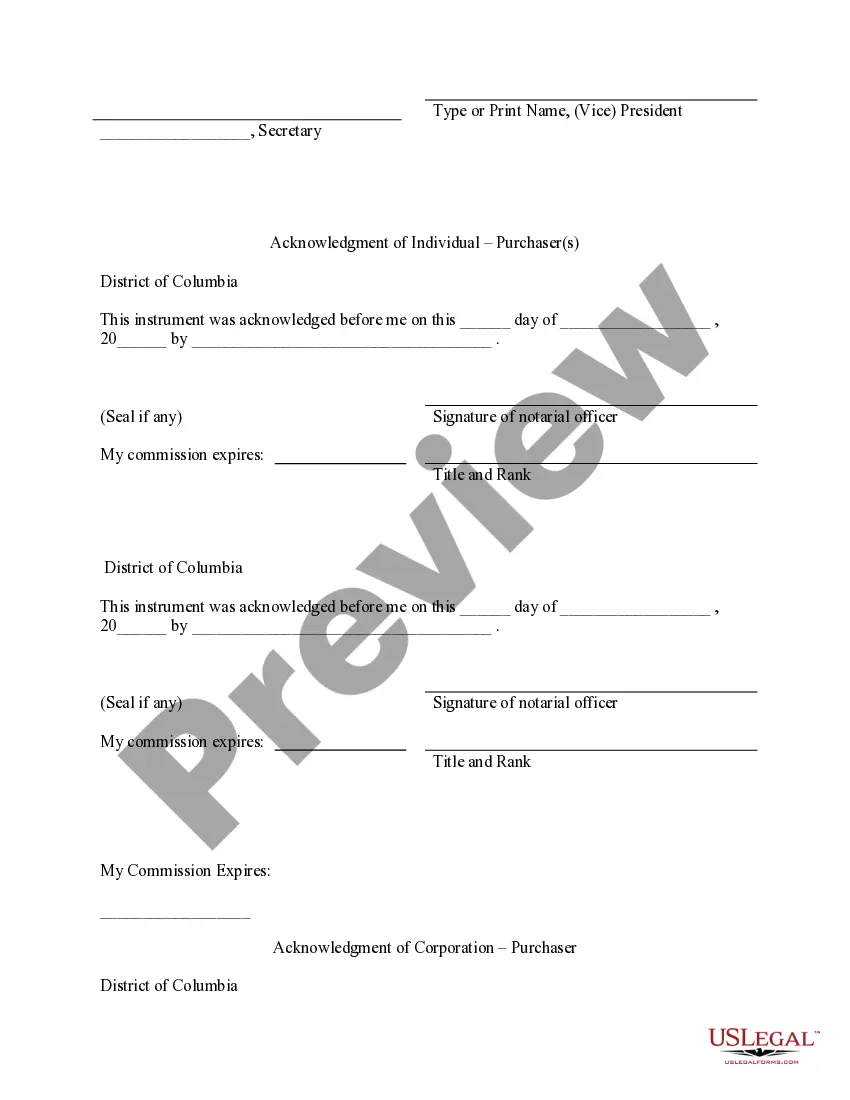

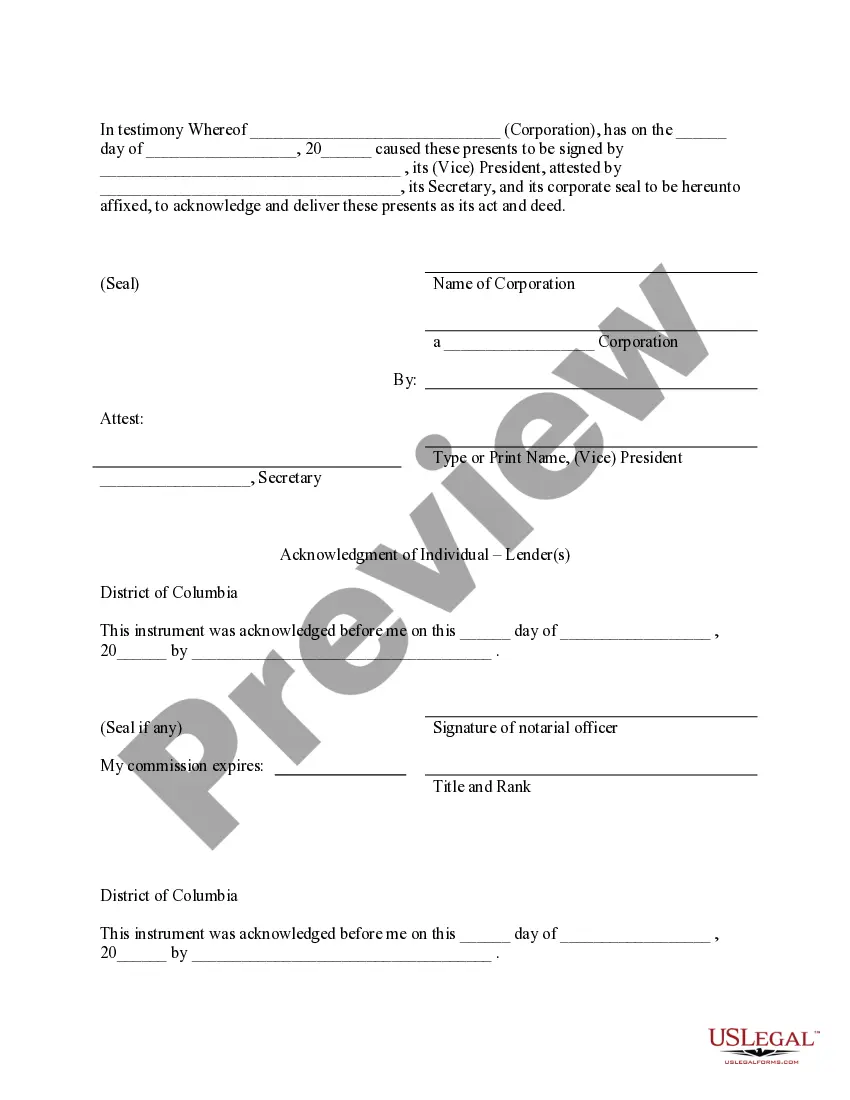

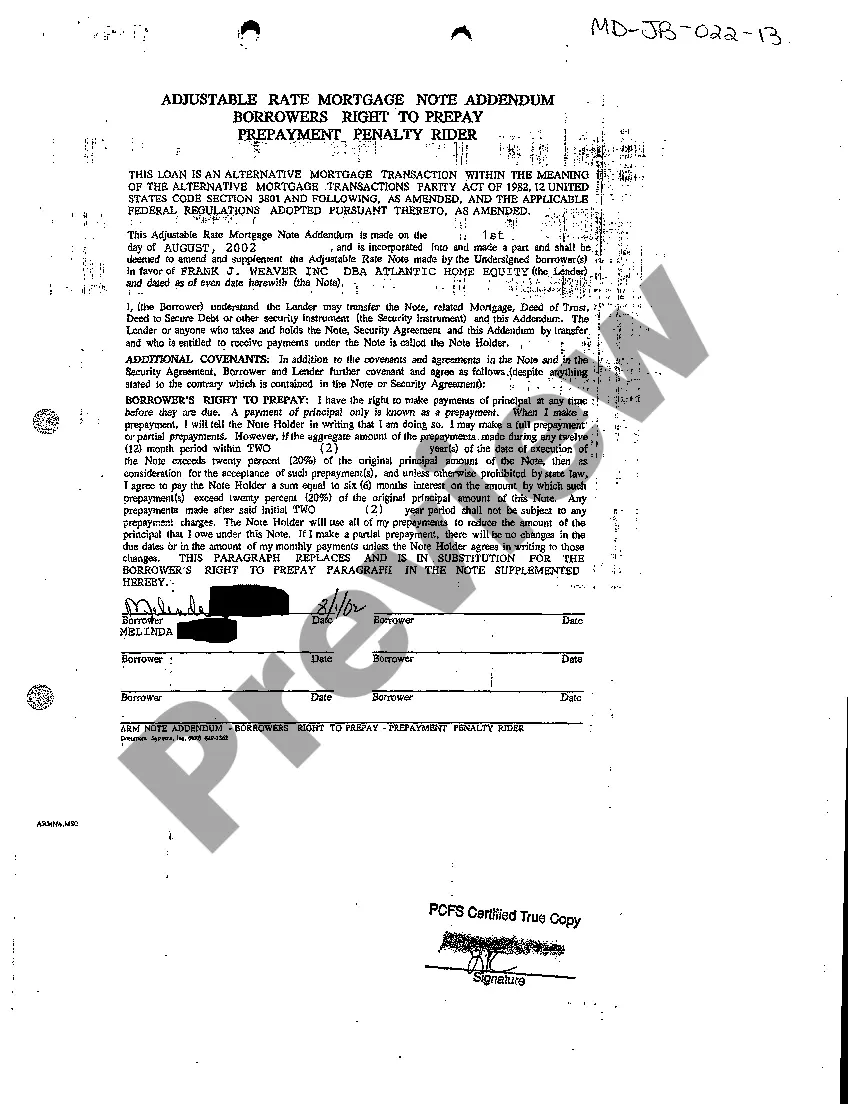

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

District of Columbia Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out District Of Columbia Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

The greater the documentation you must complete - the more anxious you become.

You can locate a vast quantity of District of Columbia Assumption Agreement of Deed of Trust and Release of Original Mortgagors templates online, but you’re unsure which ones to depend upon.

Eliminate the complexity and make obtaining samples easier with US Legal Forms.

Even when using expertly crafted templates, it's crucial to consider consulting your local attorney to double-check the completed form to ensure your document is accurately filled out. Accomplish more for less with US Legal Forms!

- Obtain precisely written documents that are structured to satisfy state requirements.

- If you already have a US Legal Forms membership, Log In to your account, and you will see the Download button on the District of Columbia Assumption Agreement of Deed of Trust and Release of Original Mortgagors’ page.

- If you’ve not utilized our service previously, follow the registration process using these instructions.

- Verify if the District of Columbia Assumption Agreement of Deed of Trust and Release of Original Mortgagors is relevant in your residing state.

- Re-confirm your choice by reviewing the description or using the Preview mode if available for the selected document.

Form popularity

FAQ

Using a deed of trust instead of a mortgage in the District of Columbia can provide you with more flexible options when securing financing. A deed of trust involves three parties, which may simplify the process of transferring interests and ensuring clear title. Furthermore, in the event of default, a deed of trust allows for a more streamlined foreclosure process, protecting your investment. This knowledge is beneficial when considering the District of Columbia Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

Lenders often prefer a deed of trust because it provides a quicker and more straightforward process for foreclosure if necessary. In the District of Columbia, a deed of trust avoids a lengthy court process by allowing the trustee to facilitate the sale of the property. This efficiency reduces costs and expedites recovery of funds for the lender. This is an essential aspect to remember when discussing the District of Columbia Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

One disadvantage of a trust deed is that it can result in a quicker foreclosure process compared to a mortgage. This is because the lender does not have to go through a court process to reclaim the property. For individuals involved in the District of Columbia Assumption Agreement of Deed of Trust and Release of Original Mortgagors, understanding these nuances is crucial for making informed choices.

Typically, the lender or their representative files the deed of trust with the appropriate local authority. This filing officially records the lender's interest in the property. If you're navigating the District of Columbia Assumption Agreement of Deed of Trust and Release of Original Mortgagors, working with legal professionals can ensure all documents are filed correctly and timely.

Usually, the seller or borrower pays for the recording fees associated with the deed and deed of trust. However, this can vary based on agreements made during the sale or refinancing process. Considering the District of Columbia Assumption Agreement of Deed of Trust and Release of Original Mortgagors, it is essential to clarify these costs upfront to avoid misunderstandings.

A quitclaim deed in the District of Columbia is a legal document that transfers ownership interest in real property. Unlike a warranty deed, a quitclaim deed does not guarantee that the title is clear of claims. It’s often used during situations like divorce or inheritance and is simple to execute when discussing the District of Columbia Assumption Agreement of Deed of Trust and Release of Original Mortgagors.

A deed of release is not the same as a deed; rather, it serves a different purpose. A deed establishes ownership of property, while a deed of release officially terminates a lien or mortgage against that property. In cases involving the District of Columbia Assumption Agreement of Deed of Trust and Release of Original Mortgagors, understanding these distinctions can help clarify your property rights and obligations.

Removing someone from a deed of trust usually involves drafting a new deed or executing a release. Both parties must agree to the change and may require legal assistance to ensure all documentation is completed correctly. If you’re managing a District of Columbia Assumption Agreement of Deed of Trust and Release of Original Mortgagors, it's wise to consult with a legal expert or a professional service to navigate the process smoothly.

You can typically find the title deed to your house through your local county recorder's office or the title company that handled your closing. Online databases are also available that allow you to search for property records. If you’re navigating a District of Columbia Assumption Agreement of Deed of Trust and Release of Original Mortgagors, the title company can assist you in locating these important documents.

Release of a deed of trust occurs when the borrower has fully repaid the mortgage. Once the payment is made, the lender will issue a release document, officially removing the lien on the property. In the context of the District of Columbia Assumption Agreement of Deed of Trust and Release of Original Mortgagors, this release is essential to ensure clear ownership of the property.