District of Columbia Renunciation And Disclaimer of Property received by Intestate Succession

Definition and meaning

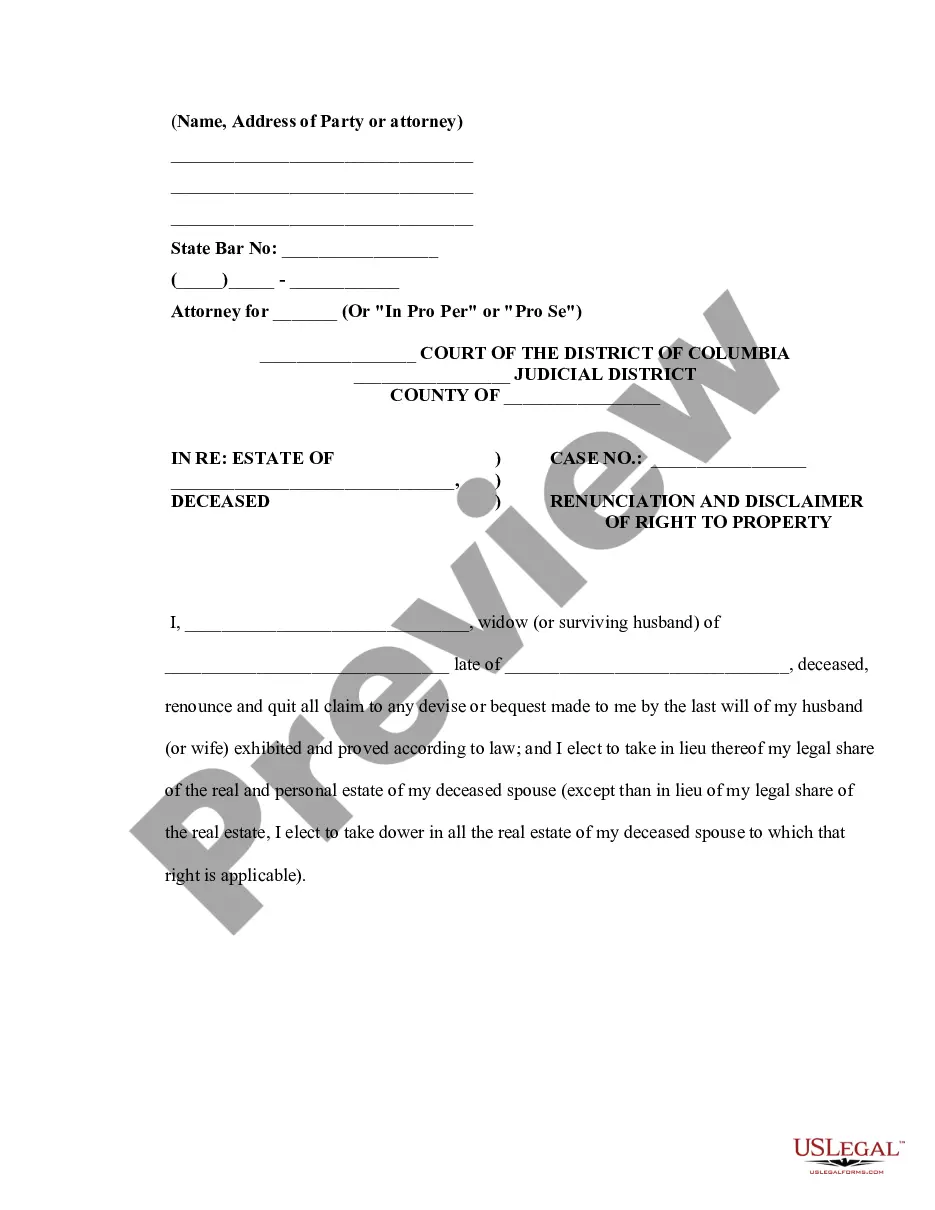

The District of Columbia Renunciation and Disclaimer of Property received by Intestate Succession is a legal document that allows an individual, typically a surviving spouse or family member, to legally refuse their inheritance from a deceased person's estate. This can be crucial in situations where the individual does not wish to accept the property due to various reasons, such as tax implications or personal preferences. It is particularly relevant when a person dies without a will, as the property is distributed according to intestate succession laws.

How to complete a form

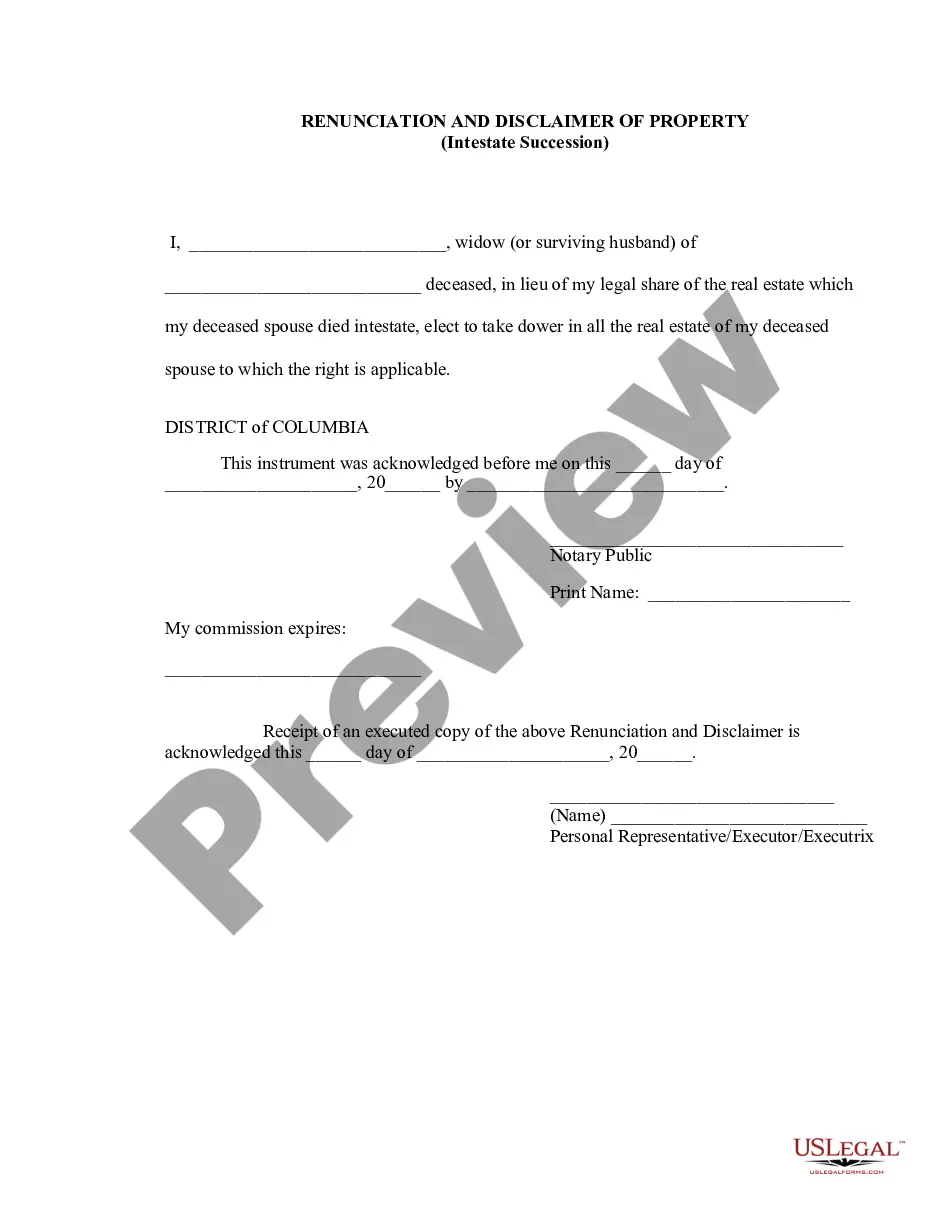

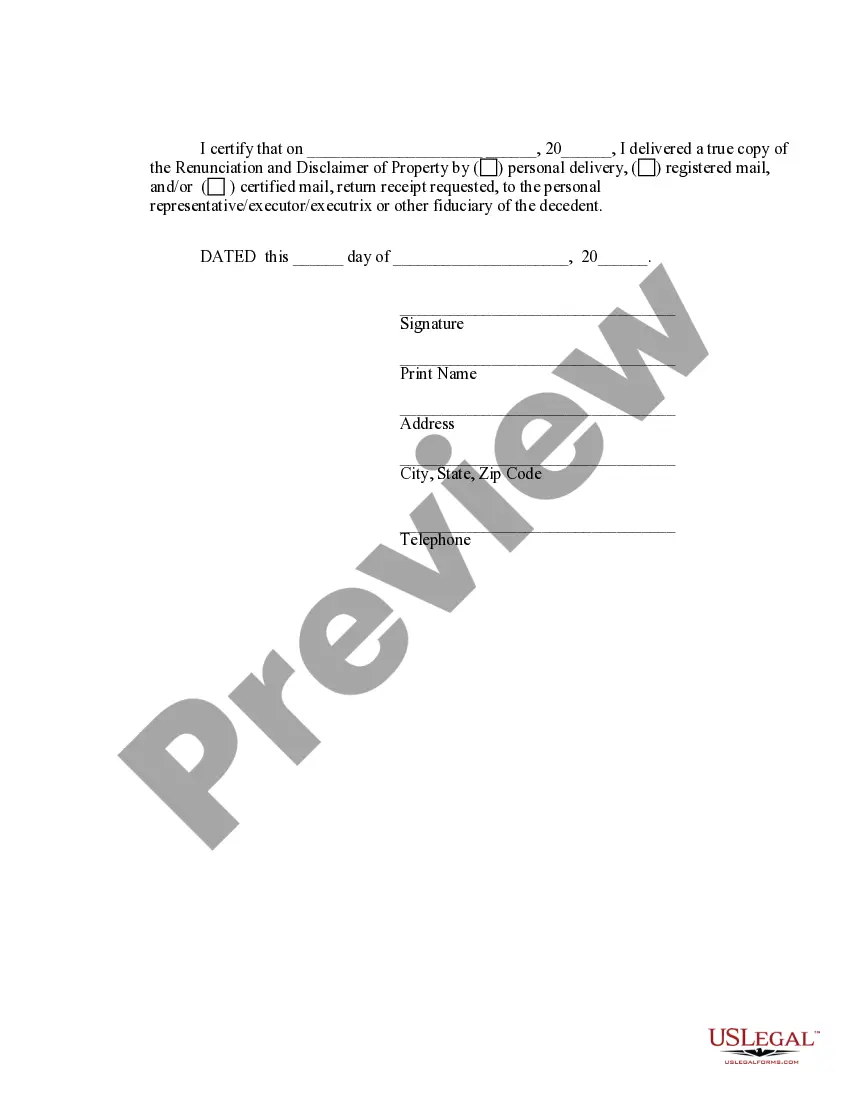

To complete the District of Columbia Renunciation and Disclaimer of Property form, follow these steps:

- Fill in your name as the renouncing party.

- Provide the name of the deceased.

- Specify your relationship to the deceased.

- Sign and date the document in the presence of a notary public.

- Ensure that you receive a copy of the executed form for your records.

It's vital to ensure that all information is accurate to avoid complications with the estate distribution process.

Who should use this form

This form is applicable for individuals who are heirs or beneficiaries of an intestate estate in the District of Columbia. Typically, this includes:

- Surviving spouses

- Children of the deceased

- Siblings or other relatives designated under intestate succession laws

If you are unsure about your eligibility or the implications of renouncing your inheritance, it may be beneficial to consult with a legal professional.

Legal use and context

The legal context of the District of Columbia Renunciation and Disclaimer of Property is linked to intestate succession laws, which govern how assets are distributed when a person dies without a will. This form serves as a formal declaration of an heir's decision to refuse their share, which can impact the distribution of the estate. Understanding the legal implications of using this form is crucial, as it may affect other beneficiaries and the overall distribution of the estate.

Common mistakes to avoid when using this form

When completing the District of Columbia Renunciation and Disclaimer of Property form, avoid these common errors:

- Failing to accurately provide the names of involved parties.

- Neglecting to sign the form in front of a notary public.

- Overlooking the requirement to submit the form within a specific timeframe after the deceased's passing.

- Not keeping a copy of the executed form for personal records.

Carefully review the form for completeness to ensure it is legally effective.

What documents you may need alongside this one

Along with the District of Columbia Renunciation and Disclaimer of Property form, you may need to gather additional documents, such as:

- Death certificate of the deceased

- Any existing wills or trusts

- Proof of relationship to the deceased (e.g., marriage certificate or birth certificate)

Having these documents prepared can help streamline the process and ensure that you meet all legal requirements.

What to expect during notarization or witnessing

During the notarization of the District of Columbia Renunciation and Disclaimer of Property form, you will be required to present valid identification to the notary public. The notary will verify your identity, witness your signature, and then affix their official seal to the document. This process helps ensure the authenticity of the form and can prevent future disputes regarding its validity.

Form popularity

FAQ

In the District of Columbia, you typically have nine months from the date of the decedent's death to file a disclaimer of inheritance. This is a crucial timeframe, as failing to act within this limit may result in the acceptance of the inheritance automatically. By using the services at USLegalForms, you can ensure you meet the necessary deadlines and further understand the District of Columbia Renunciation and Disclaimer of Property received by Intestate Succession process.

Intestate succession in the District of Columbia refers to the distribution of a deceased person’s assets when they have not left a will. The laws define the order of inheritance, which typically prioritizes spouses, children, and close relatives. Understanding these laws is essential, especially when considering the District of Columbia Renunciation and Disclaimer of Property received by Intestate Succession, as this impacts how property is passed on when a disclaimer is involved.

Writing a disclaimer of inheritance involves crafting a formal statement that clearly states your refusal to accept the inheritance. The document should include your name, a description of the property you are disclaiming, and a statement indicating your decision to renounce the inheritance. It's crucial to follow the guidelines set by the District of Columbia Renunciation and Disclaimer of Property received by Intestate Succession, and USLegalForms can provide useful templates to assist you.

To disclaim an inheritance under IRS guidelines, you must submit a written disclaimer that meets specific requirements. This document should include your intent not to accept the inheritance and indicate that it will pass to the next beneficiary according to state law. In the District of Columbia, a valid disclaimer must also align with the rules surrounding the District of Columbia Renunciation and Disclaimer of Property received by Intestate Succession. Utilizing resources like USLegalForms can help streamline this process.

D.C. Code 20 1301 addresses the procedures and requirements related to wills and the estate settlement process in the District of Columbia. This code can be an important resource when you are managing an estate or processing a disclaimer. When dealing with District of Columbia Renunciation And Disclaimer of Property received by Intestate Succession, you'll find relevant guidelines that will inform your efforts in handling property.

Becoming an executor in Washington D.C. involves several key steps: First, you must be named in the decedent's will or petition the court for appointment as an administrator if no will exists. Next, file the appropriate probate forms with the D.C. Superior Court, and after being appointed, you will manage the estate’s obligations. Understanding the nuances of laws such as District of Columbia Renunciation And Disclaimer of Property received by Intestate Succession is crucial for effectively fulfilling this role.

DC Code 20 101 G pertains to the regulations surrounding the appointment and duties of guardians and conservators. While this may not directly relate to property disclaimers, understanding these codes can help inform your actions. If you are dealing with property inherited under District of Columbia Renunciation And Disclaimer of Property received by Intestate Succession, it is worthwhile to know the relevant laws.

To qualify as an executor of an estate in the District of Columbia, you must be at least 18 years old and possess the legal capacity to handle the estate's financial matters. Additionally, you should not have a felony conviction, as this may disqualify you. Adequate understanding of the responsibilities involved, such as navigating District of Columbia Renunciation And Disclaimer of Property received by Intestate Succession, will serve you well in this role.

D.C. Code 22 1001 generally pertains to violations related to controlled substances. This code details the penalties for unlawful activities involving drugs. While it is not directly related to inheritance matters, understanding local laws can be beneficial when navigating property disclaimers, including District of Columbia Renunciation And Disclaimer of Property received by Intestate Succession.

The D.C. code for drug paraphernalia is outlined in the municipal regulations, specifically addressing items used in the consumption or distribution of illegal substances. If you are dealing with issues of inheritance or property disclaimers, it is essential to know the law, but this topic generally falls outside the scope of District of Columbia Renunciation And Disclaimer of Property received by Intestate Succession.