Connecticut Articles of Dissolution (Domestic LLC) is a legal document that is filed with the Connecticut Secretary of State to dissolve a limited liability company (LLC). This document is used to formally dissolve the LLC, terminate its legal existence, and close its affairs. The Articles of Dissolution must include the name of the LLC, the date on which it was formed, and the information of the LLC's registered agent. In Connecticut, there are two types of Articles of Dissolution: (1) the Standard Articles of Dissolution and (2) the Short Form Articles of Dissolution. The Standard Articles of Dissolution requires the LLC to provide detailed information regarding the dissolution of the LLC, including the name, address, and purpose of the LLC, the date of dissolution, and the name and address of the LLC's registered agent. The Short Form Articles of Dissolution require only the name of the LLC, the date of dissolution, and the name and address of the LLC's registered agent.

Connecticut Articles of Dissolution (Domestic LLC)

Description

How to fill out Connecticut Articles Of Dissolution (Domestic LLC)?

Preparing formal documentation can be quite challenging if you lack accessible fillable templates. With the US Legal Forms online library of official paperwork, you can trust the forms you receive, as all of them adhere to federal and state laws and are reviewed by our experts.

Obtaining your Connecticut Articles of Dissolution (Domestic LLC) from our collection is as simple as pie. Previously authorized users with a valid membership just need to Log In and hit the Download button once they find the appropriate template.

Previewing your document and reviewing its general overview will assist you in achieving just that. Should there be any discrepancies, search the library using the Search tab at the top of the page until you discover a fitting template, and click Buy Now when you find the one you require.

- Afterwards, if necessary, users can select the same document from the My documents section of their account.

- However, even if you are not familiar with our service, signing up with a valid subscription will only take a few moments.

- Here’s a brief guide for you.

- You should carefully examine the details of the form you wish to ensure it meets your requirements and adheres to your state laws.

Form popularity

FAQ

To file an LLC in Connecticut, you need to begin by choosing a unique name for your business that complies with state regulations. Next, you must file the Certificate of Organization with the Secretary of the State, which includes essential information about your LLC. Once formed, if you decide to dissolve your LLC, you will need to prepare and submit the Connecticut Articles of Dissolution (Domestic LLC) to officially terminate your business. Utilizing platforms like US Legal Forms can simplify this process, ensuring everything is completed accurately.

Yes, Connecticut allows the domestication of a Limited Liability Company (LLC). This means an LLC from another state can change its registration to Connecticut and function as a Connecticut LLC. To complete this process, you will need to file the Connecticut Articles of Dissolution (Domestic LLC) as part of the transition. Utilizing resources like the US Legal Forms platform can simplify this process and ensure compliance with state regulations.

The articles of termination end the existence of an LLC in Connecticut, while articles of dissolution specifically communicate the intent to dissolve the business. In essence, dissolution is the process, and termination results in the legal conclusion of that process. Knowing this distinction helps ensure that you file the correct documents based on your specific needs.

Dissolving an LLC can be straightforward if you follow the correct procedures. While it does involve paperwork and ensuring all obligations are met, the process itself is manageable. Utilizing resources like US Legal Forms can simplify the filing of the Connecticut Articles of Dissolution and guide you step by step.

Partnership dissolution refers to the process of winding down business affairs and settling debts, which can lead to termination. Termination, on the other hand, signifies the legal end of business operations, which can occur independently of the dissolution process. Understanding these concepts helps clarify the legal aspects of business closure, particularly when dealing with Connecticut Articles of Dissolution for a Domestic LLC.

The articles of dissolution is a formal document required to dissolve a Domestic LLC in Connecticut. It notifies the state of your decision to close the business legally. This document serves as an official record, providing protection for LLC members from future liabilities related to the business.

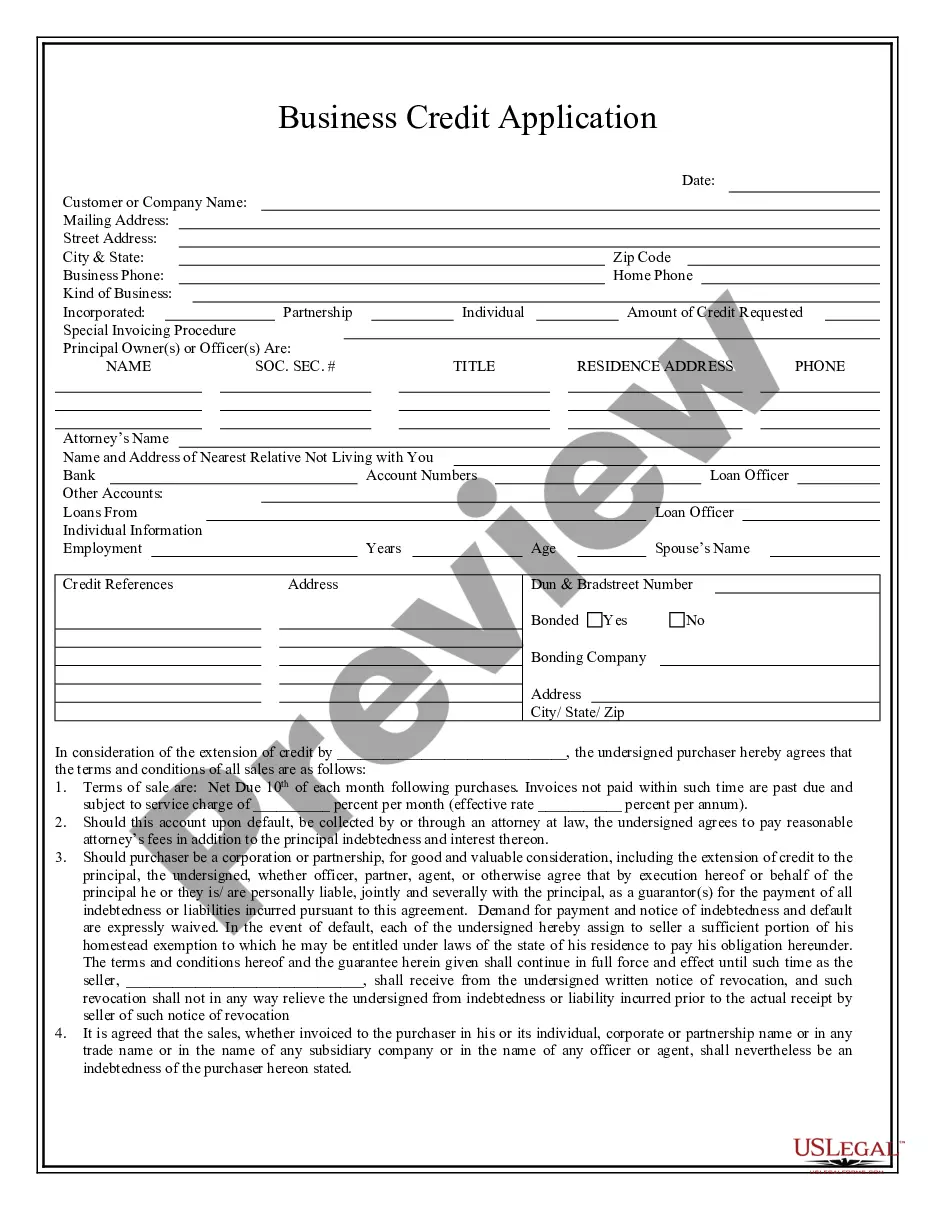

When filling out the Connecticut Articles of Dissolution form, provide essential details including your LLC's name, the reason for dissolution, and confirmation that all debts have been addressed. Ensure that you have the required signatures from all members. If you need assistance, US Legal Forms offers a user-friendly platform to guide you through this process.

To dissolve an LLC in Connecticut, begin by ensuring that all debts and obligations are settled. Next, file the appropriate Connecticut Articles of Dissolution form with the Secretary of State. This formal submission initiates the dissolution process, effectively marking the legal end of your LLC.

The three types of dissolution for a Domestic LLC in Connecticut are voluntary dissolution, administrative dissolution, and judicial dissolution. Voluntary dissolution occurs when the members make a collective decision to dissolve the LLC. Administrative dissolution happens when the state dissolves the LLC for failing to meet legal requirements, while judicial dissolution involves a court order to dissolve the LLC.

Deciding whether to dissolve your LLC or leave it inactive depends on your future plans and financial obligations. If you do not intend to operate the business again, filing Connecticut Articles of Dissolution (Domestic LLC) protects you from ongoing fees and liabilities. Conversely, if you plan to reactivate the business, keeping it inactive might be a suitable option. To make an informed decision, consider consulting uslegalforms for clarity on both paths.