This pamphlet provides an overview of disclaimers by those who inherit assets they choose not to accept. Topics included cover why a disclaimer may be made and the general rules for making a disclaimer. A link to state-specific information is provided.

Connecticut USLegal Pamphlet on Disclaiming an Inheritance

Description

How to fill out USLegal Pamphlet On Disclaiming An Inheritance?

If you need to total, download, or produce authorized record layouts, use US Legal Forms, the largest assortment of authorized varieties, which can be found on the Internet. Make use of the site`s basic and convenient research to discover the paperwork you want. Numerous layouts for company and personal reasons are sorted by classes and says, or keywords and phrases. Use US Legal Forms to discover the Connecticut USLegal Pamphlet on Disclaiming an Inheritance with a few click throughs.

In case you are already a US Legal Forms customer, log in to the bank account and click on the Down load option to get the Connecticut USLegal Pamphlet on Disclaiming an Inheritance. You can also access varieties you previously downloaded inside the My Forms tab of your respective bank account.

If you work with US Legal Forms the first time, refer to the instructions under:

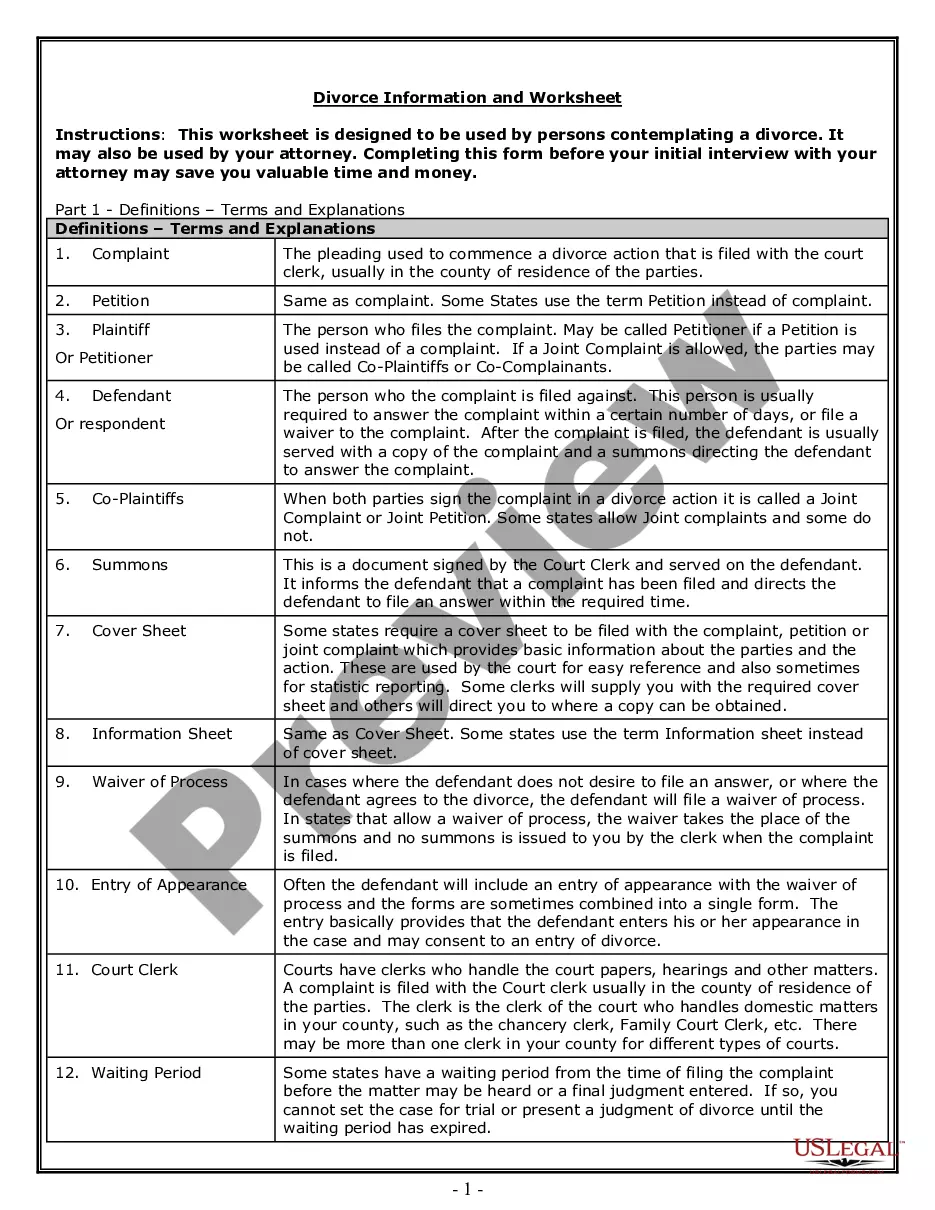

- Step 1. Be sure you have selected the shape to the correct town/region.

- Step 2. Make use of the Preview option to look over the form`s information. Never overlook to see the information.

- Step 3. In case you are not satisfied together with the type, use the Research industry towards the top of the display screen to discover other models in the authorized type web template.

- Step 4. After you have identified the shape you want, go through the Acquire now option. Opt for the costs prepare you like and add your credentials to register on an bank account.

- Step 5. Method the transaction. You should use your credit card or PayPal bank account to complete the transaction.

- Step 6. Choose the structure in the authorized type and download it on your own device.

- Step 7. Complete, edit and produce or sign the Connecticut USLegal Pamphlet on Disclaiming an Inheritance.

Each and every authorized record web template you purchase is the one you have for a long time. You have acces to each type you downloaded with your acccount. Click the My Forms portion and choose a type to produce or download once more.

Contend and download, and produce the Connecticut USLegal Pamphlet on Disclaiming an Inheritance with US Legal Forms. There are millions of expert and state-particular varieties you may use for your company or personal demands.

Form popularity

FAQ

Answer: Just because you are nominated as executor of a Will does not mean that you must serve. You can renounce your rights as executor and decline to act by simply signing and having notarized a Renunciation of Nominated Executor form and filing it with the Surrogate's Court in the county in which your aunt resided.

In order to disclaim an inheritance, you will need to write a Disclaimer, which states that you are disclaiming your inheritance in writing. Within your Disclaimer, you will need to explain what is being disclaimed, whether it is only part of your inheritance or all of it, as well as sign the document to make it legal.

A spouse can just receive the assets directly and pay the subsequent estate taxes, or the spouse can disclaim the assets, in which case the deceased spouse's will directs them into a disclaimer trust and avoids estate taxes for the surviving spouse.

Renouncing an estate is relatively simple. Your notary will ask you for the copies of the will searches and the death certificate and will then have you sign an estate renunciation deed. If one or several heirs or successors remain identifiable, the estate will belong to them de facto.

What Happens After a Beneficiary Refuses Inheritance. Once you refuse an inheritance you lose all control over who receives it in your place. A grantor's Will generally includes contingent beneficiaries ? people who should receive assets if any of the primary beneficiaries cannot receive the money.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ...

Once you disclaim an inheritance, it's permanent and you can't ask for it to be given to you. If you fail to execute the disclaimer after the nine-month period, the disclaimer is considered invalid.

The following are the requirements that must be met for a disclaimer to be qualified: The beneficiary must not have accepted any of the inherited assets prior to the disclaimer. The beneficiary must provide an irrevocable and unqualified (unconditional) refusal to accept the assets. The refusal must be in writing.