Connecticut Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust

Description

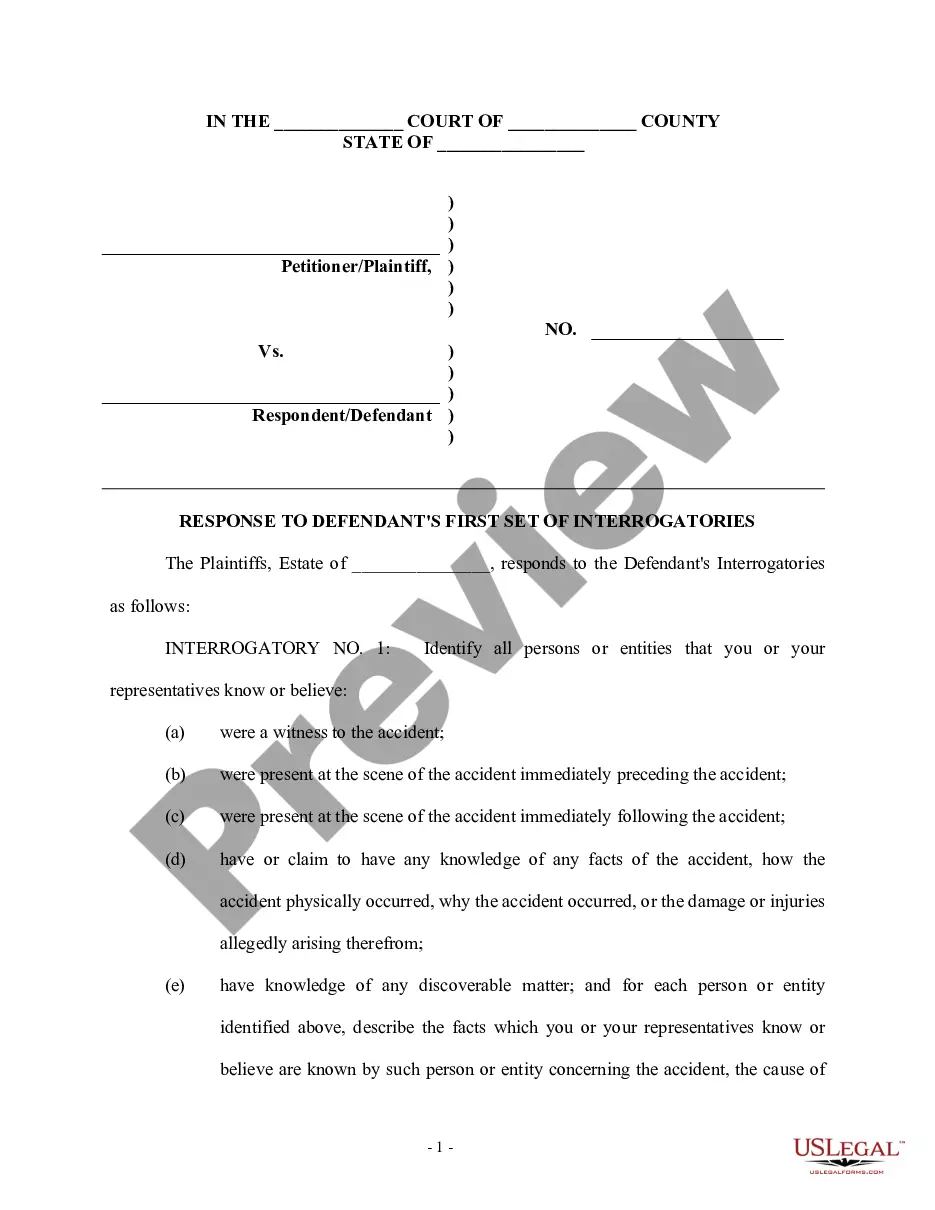

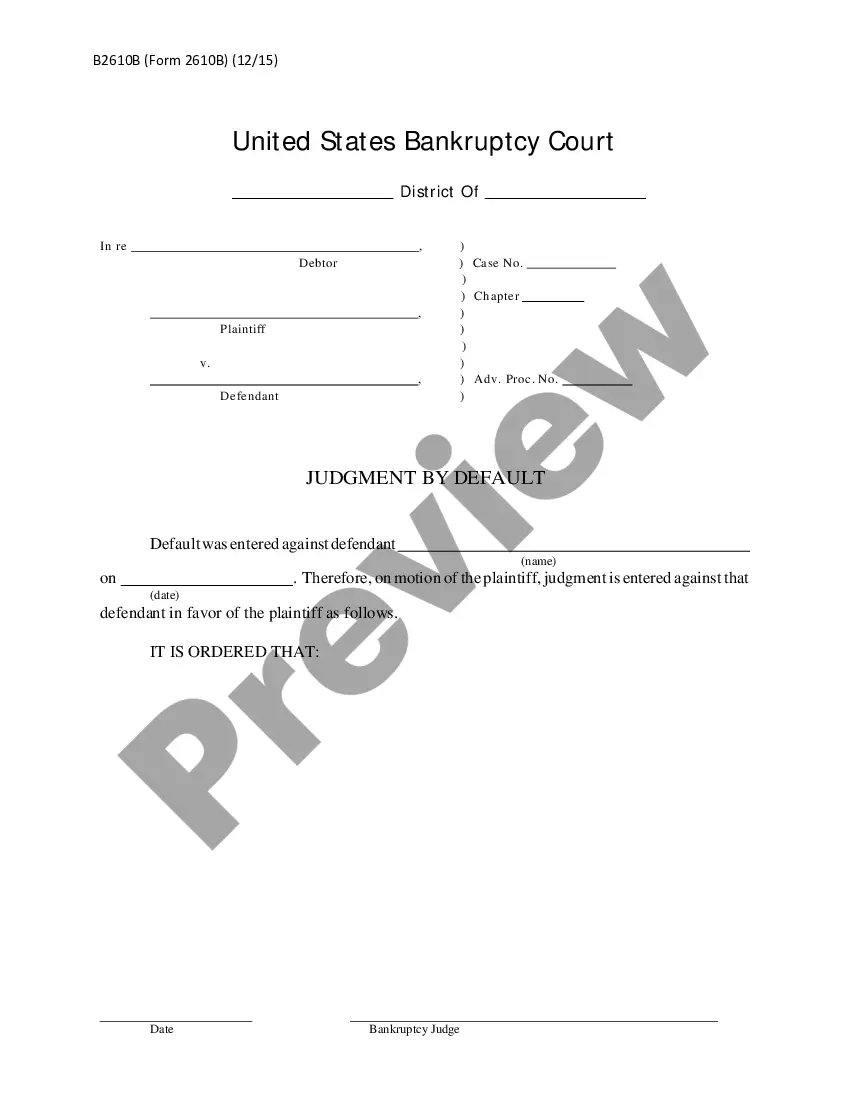

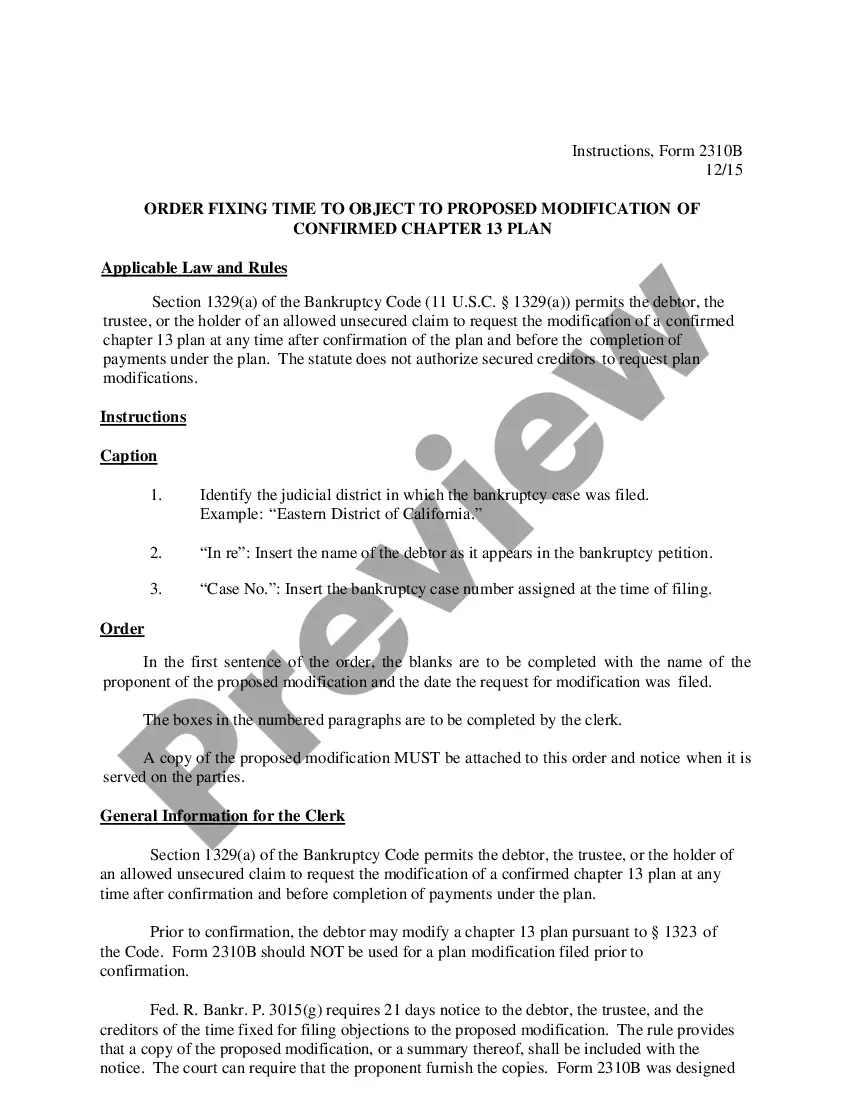

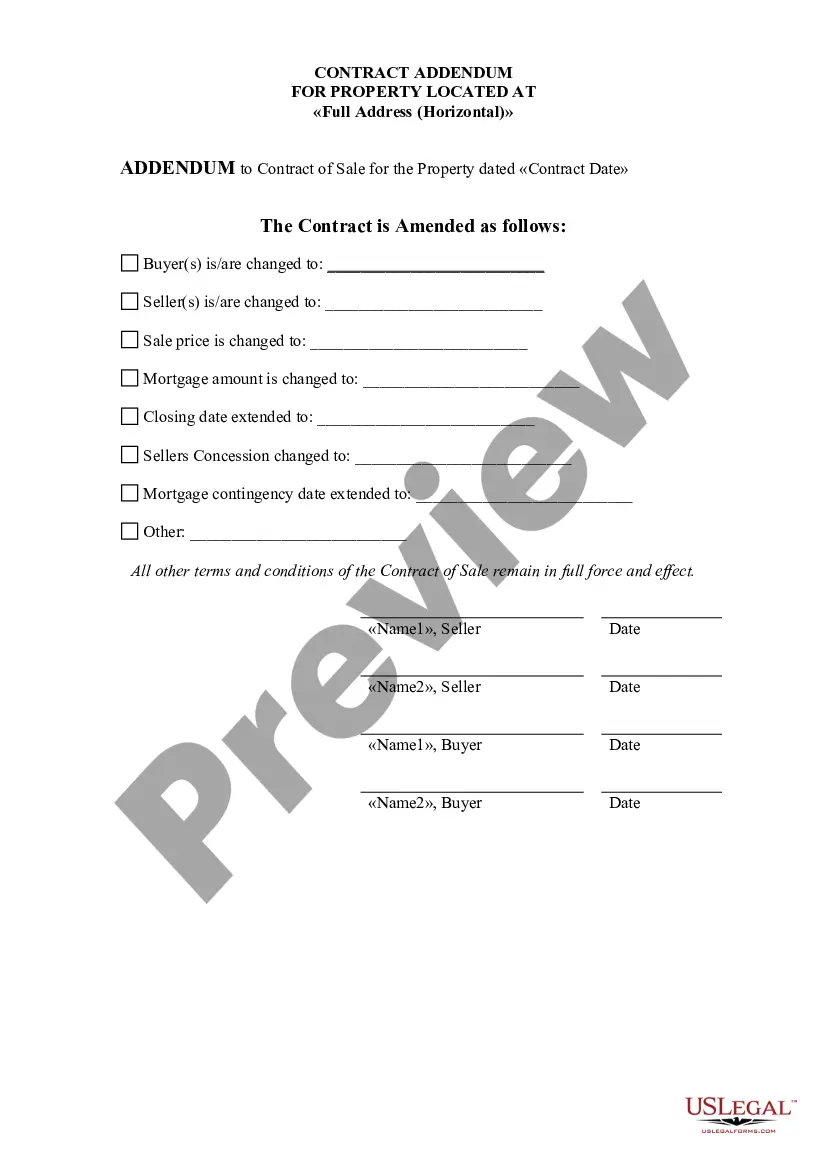

How to fill out Disclaimer Of Right To Inherit Or Inheritance - All Property From Estate Or Trust?

If you wish to comprehensive, download, or produce legal record web templates, use US Legal Forms, the greatest variety of legal types, which can be found on the Internet. Make use of the site`s simple and easy convenient look for to find the papers you require. Various web templates for organization and individual reasons are sorted by groups and claims, or key phrases. Use US Legal Forms to find the Connecticut Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust with a number of clicks.

In case you are presently a US Legal Forms buyer, log in to your accounts and click on the Acquire button to find the Connecticut Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust. You may also gain access to types you formerly saved in the My Forms tab of your accounts.

If you are using US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have chosen the form to the right area/land.

- Step 2. Take advantage of the Preview solution to look through the form`s articles. Do not forget about to read the information.

- Step 3. In case you are not happy with all the kind, take advantage of the Search area on top of the screen to locate other variations from the legal kind format.

- Step 4. After you have discovered the form you require, select the Acquire now button. Select the rates strategy you prefer and add your credentials to register to have an accounts.

- Step 5. Process the transaction. You can use your bank card or PayPal accounts to complete the transaction.

- Step 6. Pick the formatting from the legal kind and download it on your own system.

- Step 7. Full, edit and produce or indicator the Connecticut Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust.

Each and every legal record format you get is your own permanently. You have acces to each and every kind you saved in your acccount. Select the My Forms area and decide on a kind to produce or download once more.

Contend and download, and produce the Connecticut Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust with US Legal Forms. There are many professional and condition-particular types you can use for your personal organization or individual demands.

Form popularity

FAQ

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ...

If the decedent is survived by: Estate is divided as follows: Spouse, and the children* of both decedent and spouse -Spouse takes first $100,000 plus ½ of the remainder. Children* take the other ½ of the remainder. Spouse, and children* of decedent, one or more of whom is not the child of the spouse ? Spouse takes ½.

Spouse and children -- spouse takes 1/2 the estate. If the children are also the spouse's, the spouse also takes $100,000. If they are not, spouse only takes 1/2. Whatever remains is divided equally among the children in the same generation.

Trusts can be used in estate planning to give individuals and couples greater control over how assets are transferred to heirs with the fewest tax consequences. Sometimes, however, disclaiming assets makes the most sense. No special form or document must be completed to disclaim inherited assets.

Example: Father's Will states that a house passes to his Wife, but if she disclaims, the house passes into a Disclaimer Trust for Daughter. At Father's death, Wife files a formal disclaimer, disclaiming the house. The house pours into the Disclaimer Trust for Daughter.

Since Connecticut is not a state that imposes an inheritance tax, the inheritance tax in 2023 is 0% (zero).

How much does an estate have to be worth to go to probate in Connecticut? In the state of Connecticut, the minimum value of the deceased's assets is $40,000.

There is no inheritance tax in Connecticut. However, another state's inheritance tax may apply to you if your grantor lived in a state that has an inheritance tax. In Kentucky, for instance, the inheritance tax applies to all in-state property, even if the inheritor lives in another state.