Connecticut Form of Anti-Money Laundering Policy

Description

How to fill out Form Of Anti-Money Laundering Policy?

If you have to complete, obtain, or print legitimate document layouts, use US Legal Forms, the biggest assortment of legitimate kinds, that can be found on-line. Utilize the site`s simple and handy lookup to discover the papers you need. A variety of layouts for company and individual reasons are categorized by groups and states, or keywords. Use US Legal Forms to discover the Connecticut Form of Anti-Money Laundering Policy with a number of mouse clicks.

When you are presently a US Legal Forms customer, log in to the bank account and then click the Obtain key to get the Connecticut Form of Anti-Money Laundering Policy. Also you can entry kinds you previously acquired within the My Forms tab of your own bank account.

Should you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Be sure you have selected the form for the appropriate town/region.

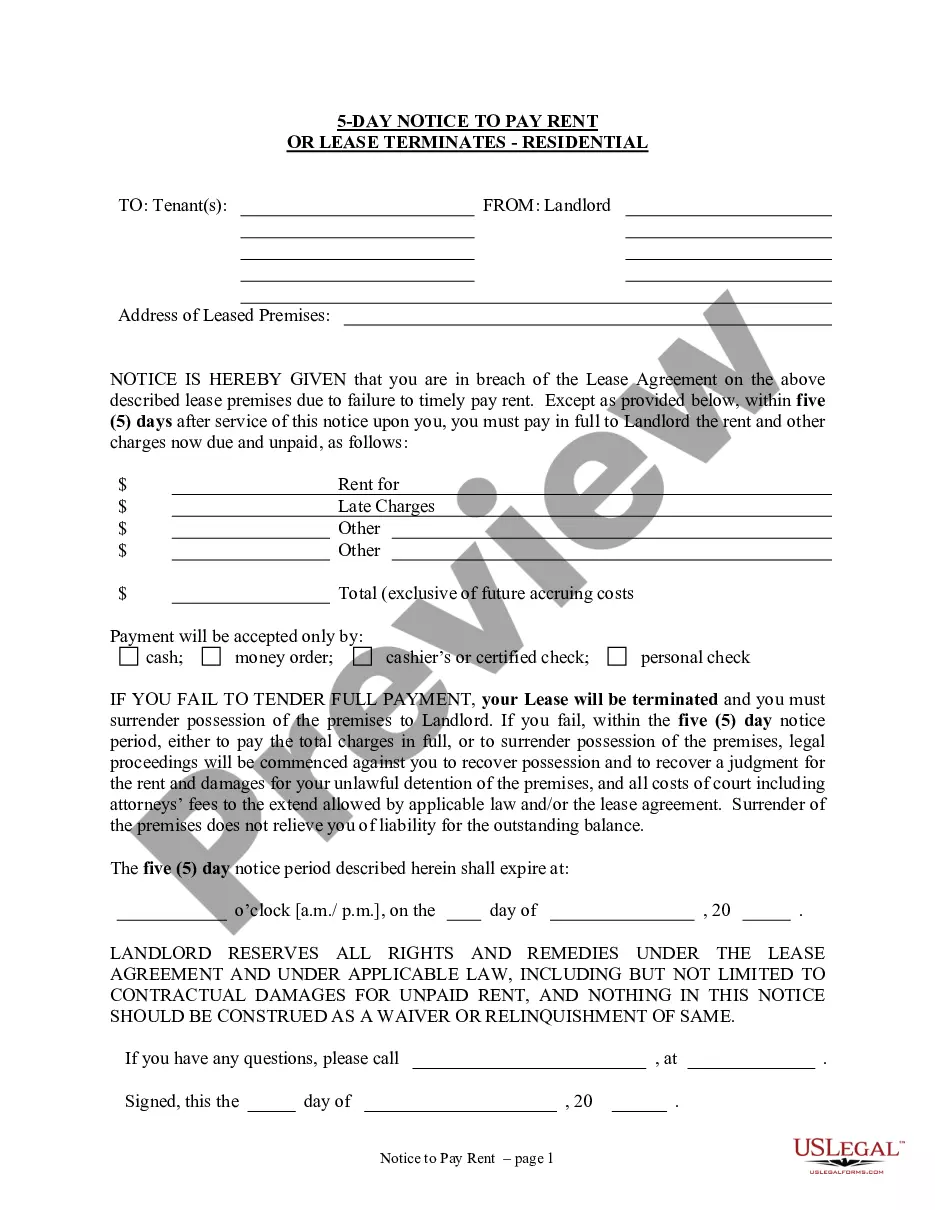

- Step 2. Make use of the Preview option to examine the form`s articles. Do not neglect to read the information.

- Step 3. When you are not happy together with the develop, use the Look for area near the top of the monitor to discover other variations in the legitimate develop design.

- Step 4. Upon having identified the form you need, select the Purchase now key. Choose the pricing prepare you choose and add your qualifications to register to have an bank account.

- Step 5. Procedure the deal. You can utilize your credit card or PayPal bank account to accomplish the deal.

- Step 6. Pick the format in the legitimate develop and obtain it on your product.

- Step 7. Full, modify and print or sign the Connecticut Form of Anti-Money Laundering Policy.

Each and every legitimate document design you purchase is the one you have permanently. You have acces to every develop you acquired inside your acccount. Click on the My Forms segment and decide on a develop to print or obtain again.

Compete and obtain, and print the Connecticut Form of Anti-Money Laundering Policy with US Legal Forms. There are thousands of specialist and status-specific kinds you can utilize for the company or individual requires.

Form popularity

FAQ

There are three stages of money laundering introducing laundered funds into the financial system: Placement. Layering. Integration/extraction.

Stages of anti-money laundering The money laundering process includes 3 stages: Placement, Layering, and Integration. Placement puts the "dirty cash" into the legitimate financial system and at the same time, hiding its source.

The 6 Ways That Money Is Laundered Banking system. The major channel for money laundering is the banking system. ... Cash intensive businesses. ... Gaming sector. ... International trade or investment. ... Professional advisers. ... Unregulated financial services.

Anti-Money Laundering Form (RIGHT TO BUY)

The three stages of money laundering Placement. Money laundering begins by moving the criminal proceeds into a legitimate source of income. ... Layering. Once the money has been put in place, the second stage is called layering or structuring. ... Integration.

Money laundering schemes vary in their complexity and methods, but there are three common stages for successful laundering: Placement, Layering and Integration. Let us look at the individual stages.

Placement: where the illicit funds enter the legitimate financial system. Layering: where the funds are moved around to create confusion and distance them from their criminal origin. Integration: where the money is reintroduced into the economy in a way that makes it appear to have come from legitimate sources.

Anti-Money Laundering (AML) is a set of policies, procedures, and technologies that prevents money laundering. There are three major steps in money laundering (placement, layering, and integration), and various controls are put in place to monitor suspicious activity that could be involved in money laundering.

Firms must comply with the Bank Secrecy Act and its implementing regulations ("AML rules"). The purpose of the AML rules is to help detect and report suspicious activity including the predicate offenses to money laundering and terrorist financing, such as securities fraud and market manipulation.