Connecticut Release of Liens for Vendor's Lien and Deed of Trust Lien

Description

How to fill out Release Of Liens For Vendor's Lien And Deed Of Trust Lien?

You are able to commit hours online looking for the legal record template that meets the state and federal requirements you require. US Legal Forms offers thousands of legal kinds that are examined by experts. You can actually download or printing the Connecticut Release of Liens for Vendor's Lien and Deed of Trust Lien from my assistance.

If you already possess a US Legal Forms accounts, you are able to log in and then click the Obtain button. Following that, you are able to complete, modify, printing, or sign the Connecticut Release of Liens for Vendor's Lien and Deed of Trust Lien. Every single legal record template you purchase is yours forever. To acquire one more copy of any acquired kind, go to the My Forms tab and then click the corresponding button.

If you work with the US Legal Forms website the very first time, follow the easy guidelines under:

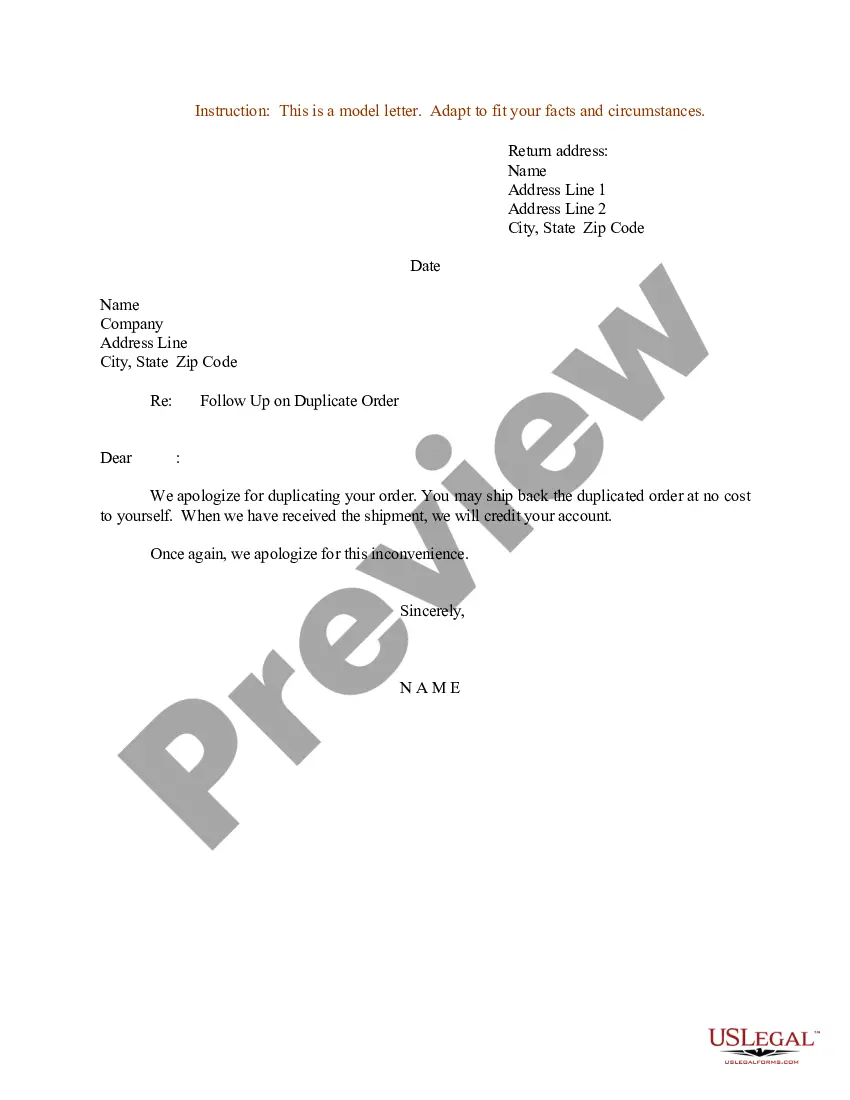

- First, ensure that you have selected the proper record template to the state/metropolis of your liking. Read the kind explanation to make sure you have selected the appropriate kind. If available, make use of the Preview button to search throughout the record template also.

- If you would like find one more variation of the kind, make use of the Lookup area to discover the template that fits your needs and requirements.

- Upon having located the template you want, simply click Purchase now to move forward.

- Find the prices prepare you want, key in your accreditations, and sign up for an account on US Legal Forms.

- Total the purchase. You should use your credit card or PayPal accounts to fund the legal kind.

- Find the file format of the record and download it to your device.

- Make changes to your record if required. You are able to complete, modify and sign and printing Connecticut Release of Liens for Vendor's Lien and Deed of Trust Lien.

Obtain and printing thousands of record themes utilizing the US Legal Forms web site, which offers the largest collection of legal kinds. Use professional and status-certain themes to tackle your small business or person needs.

Form popularity

FAQ

Which lien usually would be given highest priority in disbursing funds from a foreclosure sale? The answer is real estate taxes due. Unpaid real estate taxes take priority when property is liquidated at a foreclosure sale. They are a statutory lien with priority over liens created by contract, such as mortgages.

If the vehicle is, or was financed, the lienholder's name appears in the legal owner section and their release with counter signature is required in the lien of release on the front of the title. In order to release the liability of your vehicle you'll need to remove the license plates and turn them in to a DMV office.

Chapter 847 - Liens. Section 49-35 - Notice of intent. Liens of subcontractors and materialmen. The right of any person to claim a lien under this section shall not be affected by the failure of such affidavit to conform to the requirements of this section.

There are a few options for removing liens, that include: Paying off the debt. Filling out a release-of-lien form. Having the lien holder sign the release-of-lien form in front of a notary. Filing the lien release form.

To determine is there is a lien on your property you may either come down to the Town Clerk's Office during regular business hours or you may search our land indices on-line. When searching on-line select the volume number to see the grantor/grantee information.

4 steps to file a mechanics lien in Connecticut Prepare the lien form. First, make sure you are using a lien form that meets the statutory requirements in Connecticut. ... Sign & notarize the form. ... Deliver the lien to the town clerk. ... Serve a copy on the property owner.

A Connecticut taxable estate must file Form CT-4422 UGE with DRS to request the release of a lien. A separate Form CT-4422 UGE must be filed for each property address requiring a release of lien. Form CT-4422 UGE will be considered incomplete if an affirmation box agreeing to payment is not checked.