Connecticut Agreement for Sales of Data Processing Equipment

Description

How to fill out Agreement For Sales Of Data Processing Equipment?

Are you presently in a situation where you need documentation for either professional or personal purposes almost all the time.

There are numerous legal document templates available online, but obtaining forms you can rely on is not simple.

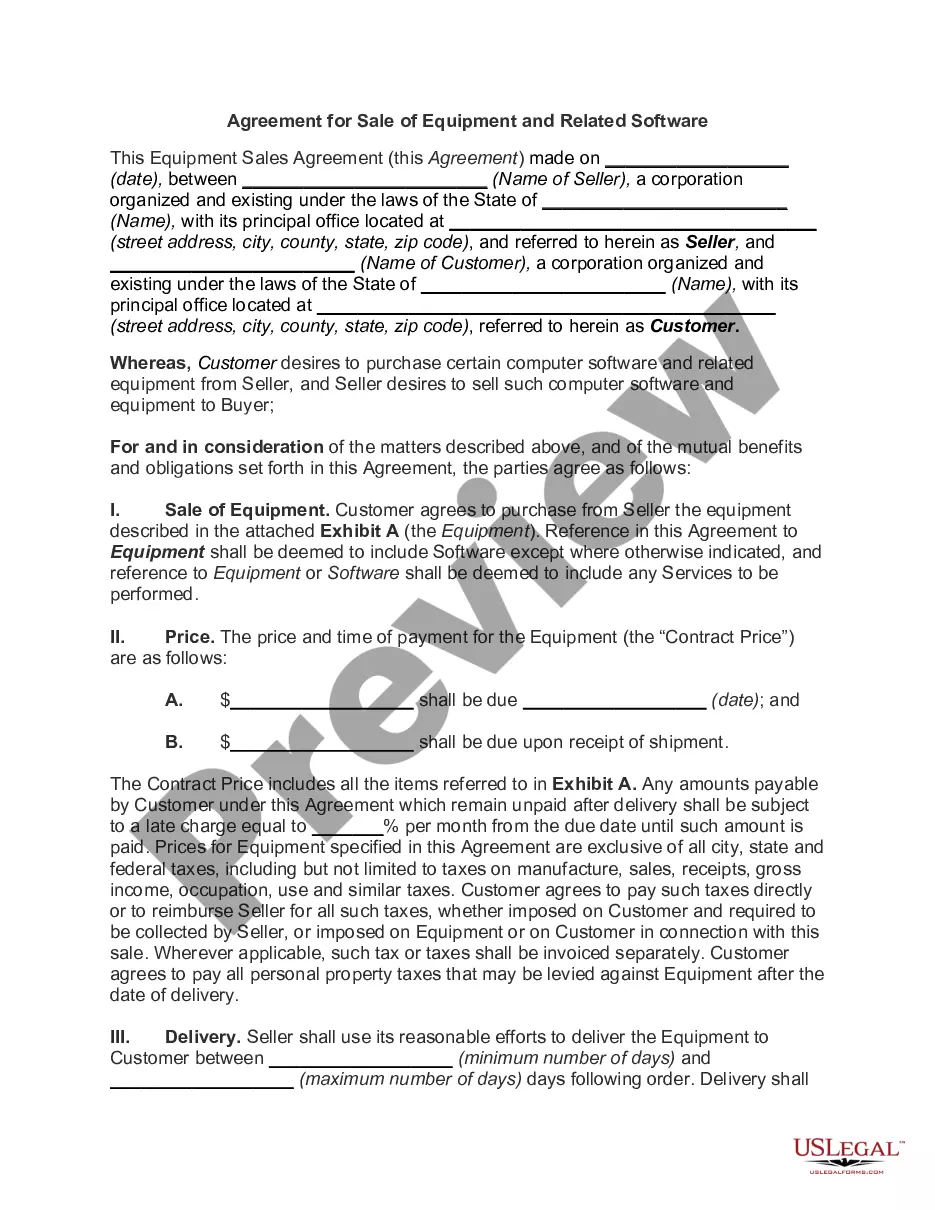

US Legal Forms offers a vast collection of form templates, such as the Connecticut Agreement for Sale of Data Processing Equipment, designed to comply with state and federal regulations.

Utilize US Legal Forms, the most extensive selection of legal forms, to save time and prevent errors.

The service offers professionally crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Connecticut Agreement for Sale of Data Processing Equipment template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it corresponds to the correct area/state.

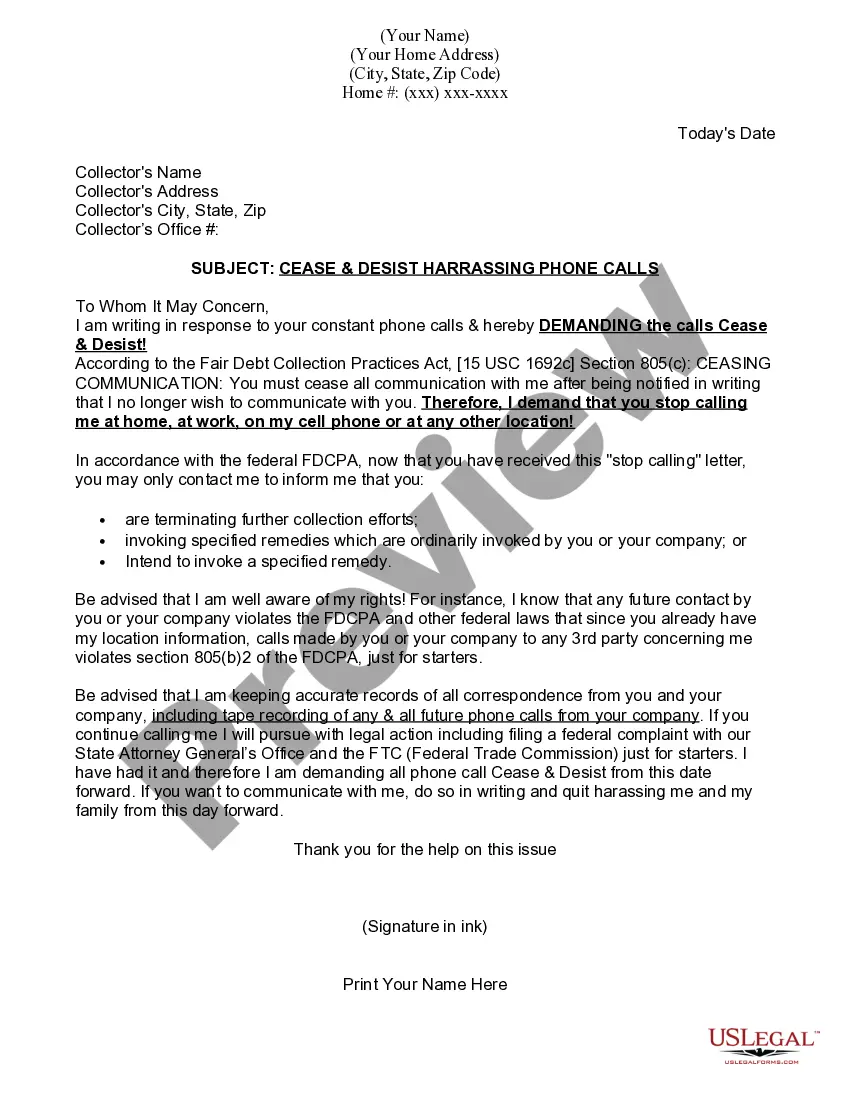

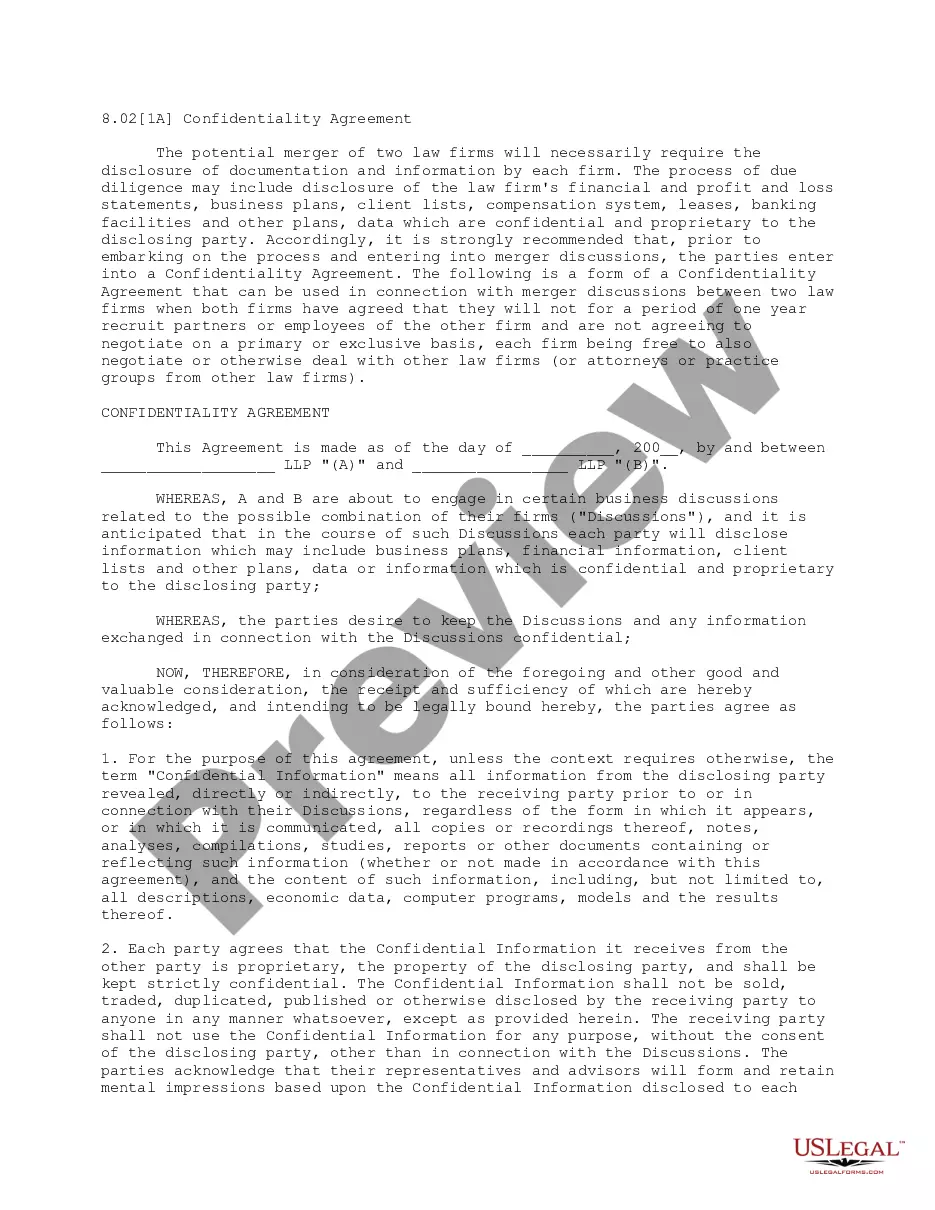

- Utilize the Review button to assess the form.

- Read the description to confirm that you have selected the right form.

- If the form is not what you're looking for, use the Search section to find the form that suits your needs and requirements.

- If you find the correct form, click on Get now.

- Choose the pricing plan you prefer, complete the required information to create your account, and pay for the order using your PayPal or credit card.

- Select a convenient document format and download your copy.

- Access all the document templates you have purchased in the My documents list. You can obtain an additional copy of the Connecticut Agreement for Sale of Data Processing Equipment anytime, if necessary. Just click on the needed form to download or print the document template.

Form popularity

FAQ

In Connecticut, certain items like groceries and prescription medications are exempt from sales tax. Additionally, some sales of data processing equipment could qualify for exemption under specific conditions outlined in the Connecticut Agreement for Sales of Data Processing Equipment. Familiarizing yourself with these exemptions can significantly impact your business operations and tax obligations.

Filling out a Connecticut resale certificate requires you to include your business details, such as name, address, and sales tax registration number. You must also specify the items for resale, like data processing equipment relevant to the Connecticut Agreement for Sales of Data Processing Equipment. This certificate will allow you to make tax-exempt purchases for items intended for resale.

The sales tax on electronics in Connecticut is currently set at 6.35%. However, there can be exemptions or different rates based on specific circumstances, particularly with data processing equipment defined by the Connecticut Agreement for Sales of Data Processing Equipment. Understanding these rates helps you budget effectively and ensures compliance during purchases.

To complete a Connecticut title, you will need to provide various details, including the vehicle identification number and information about the buyer and seller. Additionally, consider how this process may relate to the Connecticut Agreement for Sales of Data Processing Equipment if you are transferring ownership of such equipment. Following the state’s guidelines helps ensure a smooth transaction.

In Connecticut, it’s essential to maintain clear records for all transactions related to sales tax. You should keep invoices, receipts, and documentation that reflects your purchases and sales of data processing equipment. This information is crucial when reporting your sales tax and should align with the Connecticut Agreement for Sales of Data Processing Equipment. Proper record-keeping makes tax time much less stressful.

Yes, Connecticut requires businesses to present a resale certificate when purchasing items for resale. This certificate helps you avoid paying sales tax on items you intend to sell. If you're dealing with data processing equipment, understand how the Connecticut Agreement for Sales of Data Processing Equipment fits into this process. Having the proper documentation simplifies future transactions.

A range of items are exempt from sales tax in Connecticut, including most clothing and footwear, certain types of food, and some health care products. Additionally, specific exclusions may apply to data processing services under the Connecticut Agreement for Sales of Data Processing Equipment. Understanding these exemptions allows you to plan your purchases and sales effectively, maximizing your investment.

Connecticut does not impose a sales tax on various services and certain essential goods. Notably, goods like unprepared food items and most services provided by professionals are often not taxed. When considering agreements for data processing equipment in Connecticut, it is beneficial to identify which aspects of your business may qualify for tax exemptions. This knowledge can lead to better budget management.

The 7.75% tax in Connecticut applies to certain transactions within specified jurisdictions. This rate includes the standard sales tax and any additional local taxes. If your business involves a Connecticut Agreement for Sales of Data Processing Equipment, it’s crucial to know how this tax affects your sales and accounting. Awareness can prevent miscalculations and ensure proper financial reporting.

Connecticut Policy Statement PS 2006 8 outlines the state's stance on the sales tax implications of computer and data processing services. It provides clarity regarding what is taxable under state law, especially concerning the Connecticut Agreement for Sales of Data Processing Equipment. Understanding this guidance can help you navigate compliance and optimize your sales processes.