Connecticut Self-Employed Seasonal Picker Services Contract

Description

How to fill out Self-Employed Seasonal Picker Services Contract?

Have you ever been in a location where you require documents for business or personal purposes nearly every day? There are numerous legal document templates available online, but finding trustworthy ones can be challenging.

US Legal Forms offers a vast array of form templates, including the Connecticut Self-Employed Seasonal Picker Services Contract, which can be tailored to meet state and federal requirements.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. After that, you will be able to access the Connecticut Self-Employed Seasonal Picker Services Contract template.

Choose a convenient file format and download your copy.

Find all the document templates you have purchased in the My documents menu. You can access an additional copy of the Connecticut Self-Employed Seasonal Picker Services Contract anytime, if required. Just select the desired form to download or print the document template. Use US Legal Forms, the most extensive collection of legal documents, to save time and minimize mistakes. The service provides professionally crafted legal document templates that can be utilized for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/county.

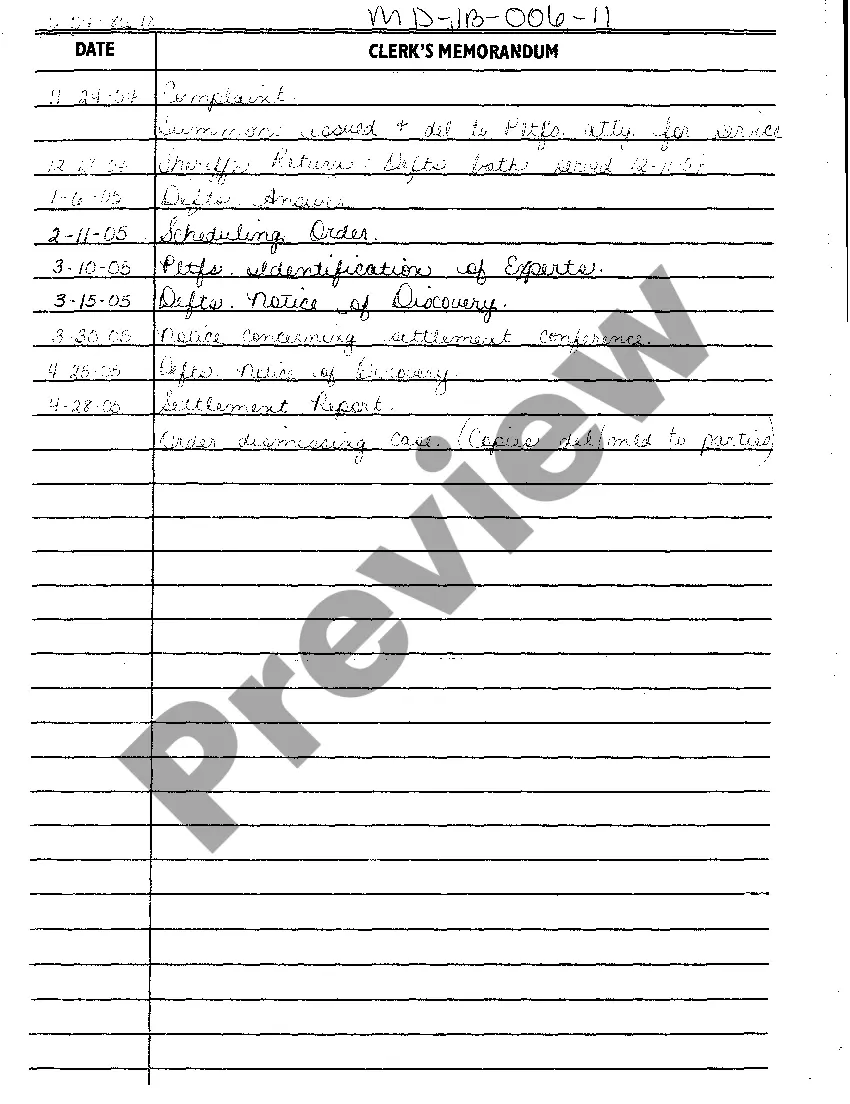

- Utilize the Review button to examine the document.

- Check the description to confirm that you have selected the correct form.

- If the form does not meet your needs, use the Search section to find the document that fits your criteria and requirements.

- Once you have the appropriate form, click on Buy now.

- Select the pricing plan you want, fill out the necessary information to create your account, and pay for your order using your PayPal or credit card.

Form popularity

FAQ

Another name for a temporary contract is a fixed-term contract, which signifies employment for a specific duration. In the context of seasonal jobs, this could also be the Connecticut Self-Employed Seasonal Picker Services Contract. Understanding the terminology helps both employers and employees navigate the nuances of temporary employment arrangements effectively.

A seasonal work contract is a legal document that outlines the terms of employment for workers hired during specific seasons. This type of contract, like the Connecticut Self-Employed Seasonal Picker Services Contract, details work duration, payment rates, and job responsibilities. It is vital for both employers and employees to have this document, as it provides clarity and helps prevent misunderstandings.

A temporary contract is frequently referred to as a short-term employment agreement. In the context of seasonal work, this may specifically be a Connecticut Self-Employed Seasonal Picker Services Contract. This type of agreement allows employers to hire staff for a defined period, ensuring that both parties understand their obligations and rights during the employment term.

Employers often provide a Connecticut Self-Employed Seasonal Picker Services Contract to individuals working on a seasonal or temporary basis. This contract serves as a formal agreement that specifies the nature of the temporary employment. It helps protect the rights of both the employer and employee, ensuring compliance with state regulations while defining work expectations.

The most common contract type for employees engaged in seasonal or temporary work is the Connecticut Self-Employed Seasonal Picker Services Contract. This contract outlines the specific terms of employment for seasonal workers, ensuring clarity and legal protection for both parties. It typically includes details about work duration, compensation, and responsibilities, making it an essential document for seasonal businesses.

The primary difference between an independent contractor and an employee in Connecticut lies in the level of control over the work. Independent contractors, like those who operate under a Connecticut Self-Employed Seasonal Picker Services Contract, retain control over how they perform their tasks, while employees must follow the direction of their employers. Additionally, independent contractors are responsible for their own taxes and benefits, whereas employees typically receive these through their employers. Understanding these distinctions can help you make informed decisions about your work status.

Qualifying as an independent contractor in Connecticut involves demonstrating that you operate independently and provide services based on a contract, such as a Connecticut Self-Employed Seasonal Picker Services Contract. You must have control over how you complete your work, rather than being directed by an employer. Additionally, you should have the ability to work for multiple clients, which showcases your independence. Consulting resources from USLegalForms can help you understand the specific criteria.

To become an independent contractor in Connecticut, start by deciding on the services you will offer, like those outlined in a Connecticut Self-Employed Seasonal Picker Services Contract. Next, register your business with the state, and obtain any necessary licenses or permits. It’s also important to set up a proper accounting system to manage your income and expenses. Platforms like USLegalForms can guide you through the paperwork needed for your contracting business.