Connecticut Self-Employed Groundskeeper Services Contract

Description

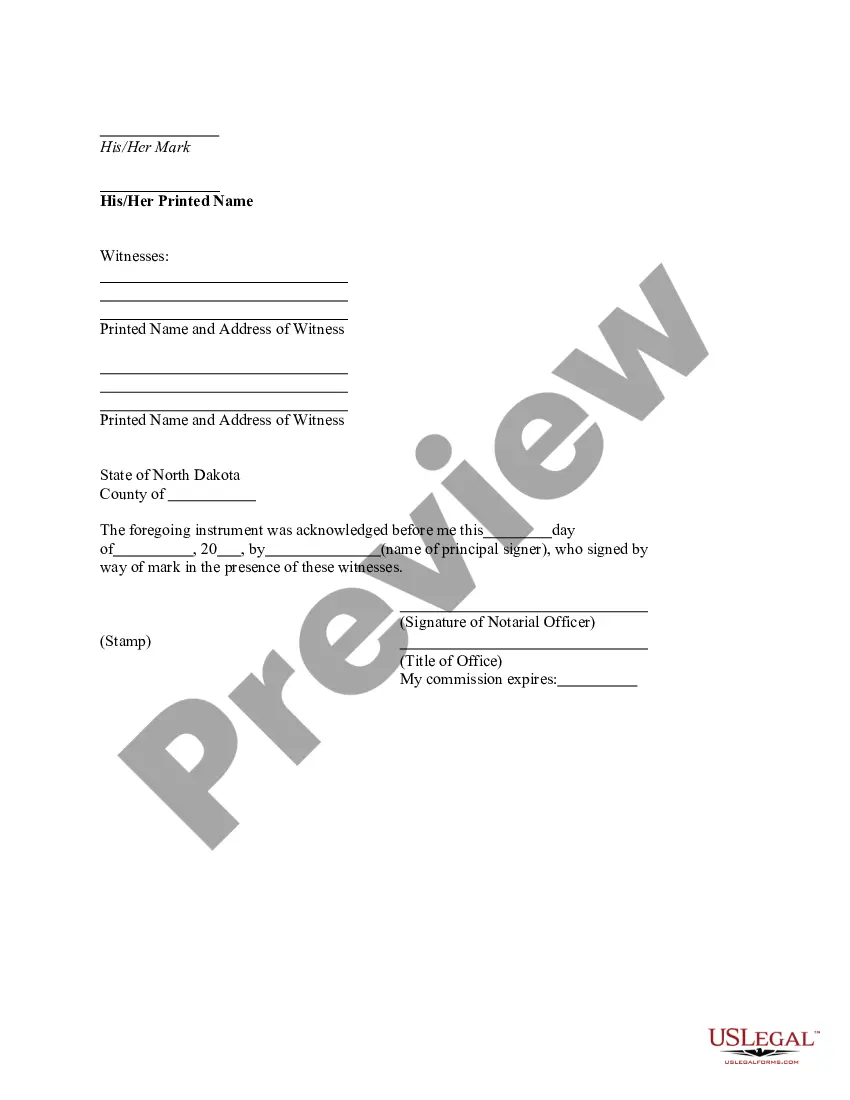

How to fill out Self-Employed Groundskeeper Services Contract?

If you need to compile, retrieve, or create legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online. Take advantage of the site's simple and convenient search feature to locate the documents you require. Various templates for business and personal applications are organized by categories and states, or keywords. Use US Legal Forms to find the Connecticut Self-Employed Groundskeeper Services Contract in just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Connecticut Self-Employed Groundskeeper Services Contract. You can also access forms you have previously saved from the My documents tab of your account.

If you are using US Legal Forms for the first time, follow the steps below: Step 1. Ensure you have selected the form for your correct city/state. Step 2. Utilize the Preview option to review the form's content. Don't forget to read the description. Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find alternative versions of the legal form template. Step 4. Once you have found the form you need, click the Get now button. Choose your preferred pricing plan and enter your details to create an account. Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, edit, and print or sign the Connecticut Self-Employed Groundskeeper Services Contract.

Avoid altering or deleting any HTML tags. Only synonymize plain text outside of the HTML tags.

- Each legal document template you purchase is yours to keep for a long time.

- You have access to every form you saved in your account.

- Visit the My documents section and select a form to print or download again.

- Complete and download, and print the Connecticut Self-Employed Groundskeeper Services Contract with US Legal Forms.

- There are thousands of professional and state-specific forms available for your personal or business needs.

- Utilize the extensive library to ensure legal compliance.

- Easily manage your document requirements in one place.

Form popularity

FAQ

Creating a lawn service contract is straightforward when you follow a few key steps. First, clearly outline the services you will provide, such as mowing, trimming, or fertilizing. Next, specify the payment terms, including the amount, due dates, and any additional fees. Finally, ensure both parties understand the contract terms by including sections on liability, termination, and dispute resolution. For a reliable template, consider using a Connecticut Self-Employed Groundskeeper Services Contract from US Legal Forms, which offers customizable options tailored to your needs.

Writing a basic contract agreement involves detailing the parties' identities and their intentions. Clearly define the services, payment terms, and duration of the contract. It's important to include clauses that cover termination and liability. A Connecticut Self-Employed Groundskeeper Services Contract can provide a solid foundation for your agreement and help protect your interests.

To write a simple contract for services, begin with a straightforward introduction stating the parties involved. Clearly outline the services offered, payment methods, and timelines. Make sure to include a section on dispute resolution to address any potential issues. Using a Connecticut Self-Employed Groundskeeper Services Contract template can simplify the process and ensure all key elements are covered.

The 5 C's of a contract are clarity, completeness, consideration, compliance, and context. Clarity ensures all terms are easily understood, while completeness guarantees all necessary elements are included. Consideration refers to the mutual benefits for both parties. Compliance ensures the contract adheres to relevant laws, and context sets the framework for the agreement. A Connecticut Self-Employed Groundskeeper Services Contract embodies these principles effectively.

To create a service contract agreement, start with a clear title and the names of the parties involved. Outline the services to be performed, payment details, and timelines. Include terms for alterations and cancellation to accommodate any changes. A Connecticut Self-Employed Groundskeeper Services Contract can serve as an excellent example and guide for your needs.

Lawn care contracts outline the agreement between you and the groundskeeper regarding the services provided. They typically detail the services to be rendered, payment arrangements, and the duration of the agreement. These contracts protect both parties by ensuring everyone understands their responsibilities. A Connecticut Self-Employed Groundskeeper Services Contract can simplify these terms and create a professional understanding.

To write a contract for lawn service, start by clearly defining the scope of work, including specific tasks and schedules. Specify payment terms, including rates and due dates, to ensure clarity. Additionally, include terms for contract termination and any warranties. Using a Connecticut Self-Employed Groundskeeper Services Contract template can help streamline this process.