Connecticut Self-Employed Independent Contractor Pyrotechnician Service Contract

Description

How to fill out Self-Employed Independent Contractor Pyrotechnician Service Contract?

Are you in the situation where you will require documents for either organization or specific purposes almost every working day? There are numerous legal document templates available online, but finding ones you can trust isn’t easy. US Legal Forms provides thousands of form templates, such as the Connecticut Self-Employed Independent Contractor Pyrotechnician Service Contract, which can be customized to meet federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. Then, you can download the Connecticut Self-Employed Independent Contractor Pyrotechnician Service Contract template.

If you do not have an account and wish to start using US Legal Forms, follow these steps: Find the form you need and ensure it is for the correct city/region. Use the Review option to evaluate the document. Check the description to confirm that you have selected the right form. If the form isn’t what you’re looking for, utilize the Search feature to locate the document that fits your needs and requirements. Once you find the correct form, click Purchase now. Choose the pricing plan you prefer, enter the necessary information to create your account, and complete the transaction with your PayPal or credit card. Select a convenient document format and download your copy.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- Access all the document templates you have purchased in the My documents menu.

- You can retrieve another version of the Connecticut Self-Employed Independent Contractor Pyrotechnician Service Contract anytime, if needed.

- Click on the desired form to download or print the document template.

- Utilize US Legal Forms, one of the largest collections of legal documents, to save time and avoid mistakes.

- The service offers properly crafted legal document templates that can be used for a variety of purposes.

- Create an account on US Legal Forms and begin simplifying your life.

Form popularity

FAQ

Becoming an independent contractor in Connecticut involves several steps. First, decide on your business structure and register your business name if needed. Then, consider obtaining liability insurance and ensure you understand local tax implications. Finally, a well-drafted Connecticut Self-Employed Independent Contractor Pyrotechnician Service Contract will clarify your relationship with clients and set clear expectations.

To become authorized as an independent contractor in the US, you must ensure you have the necessary business licenses and permits specific to your industry. Registration with local and state government agencies is crucial, and compliance with IRS regulations is essential. Remember, having a Connecticut Self-Employed Independent Contractor Pyrotechnician Service Contract can also reinforce your legitimacy and professionalism.

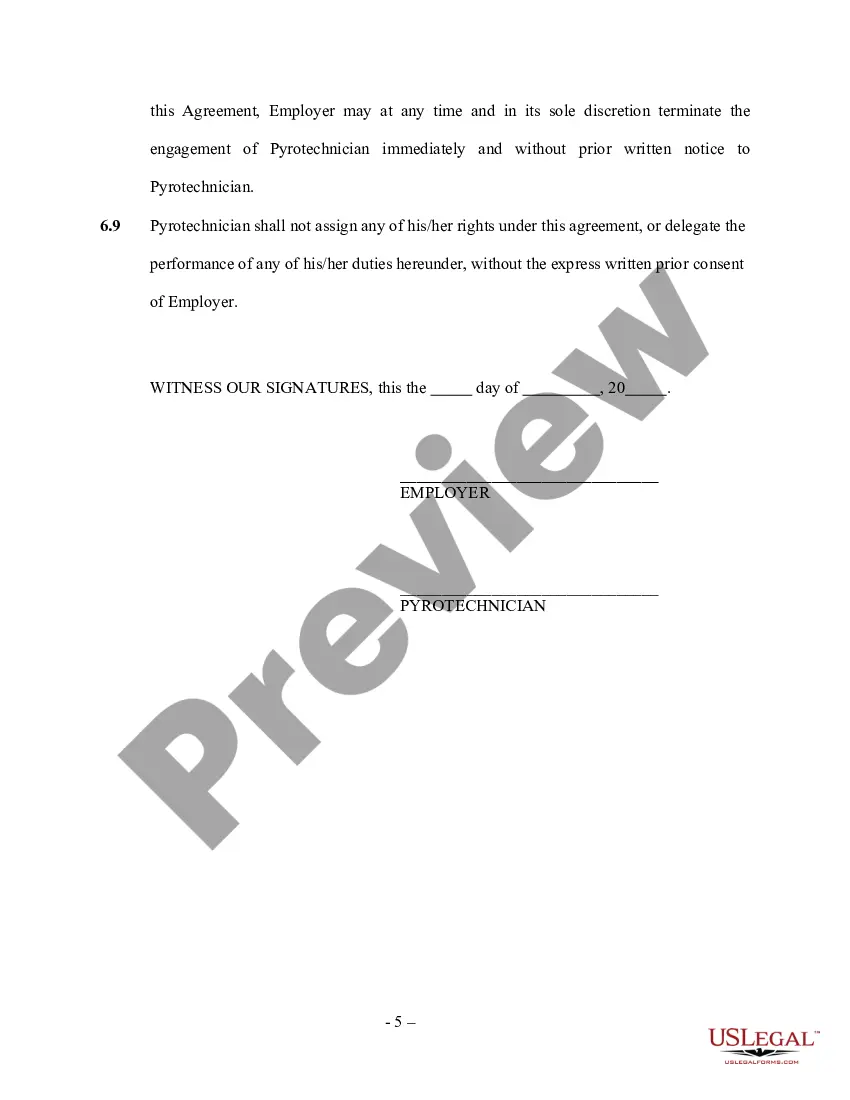

To create a Connecticut Self-Employed Independent Contractor Pyrotechnician Service Contract, begin by outlining the scope of work clearly. Include payment terms, duration, and any specific responsibilities. You can also define confidentiality and liability clauses to protect both parties. Utilizing a platform like US Legal Forms can simplify the process, providing you with templates tailored to your needs.

Writing an independent contractor agreement involves detailing the rights and responsibilities of both parties. Start by listing the contractor's services, payment terms, and timelines. Make sure to include provisions for confidentiality and intellectual property rights, if applicable. A good approach is to use a pre-designed Connecticut Self-Employed Independent Contractor Pyrotechnician Service Contract to ensure you cover all essential elements.

To become an independent contractor in Connecticut, you must first understand the legal definitions and requirements for your service. Register your business with the state and acquire any necessary permits or licenses, especially for pyrotechnical work. You also need to prepare your contracts and keep thorough financial records. Adopting a structured approach, such as using a Connecticut Self-Employed Independent Contractor Pyrotechnician Service Contract, can facilitate a smooth start.

To fill out an independent contractor agreement, start by including the names and contact information of both parties involved. Clearly outline the scope of work, payment terms, and deadlines. Additionally, include clauses for termination and dispute resolution to protect both parties. Utilizing a template for a Connecticut Self-Employed Independent Contractor Pyrotechnician Service Contract can simplify this process.

To fire an independent contractor without a contract, it’s best to communicate directly and explain your reasons for the termination. Provide constructive feedback and ensure you settle any outstanding payments. Document the conversation for your records, and consider drafting a Connecticut Self-Employed Independent Contractor Pyrotechnician Service Contract for any future agreements to avoid similar issues.

You can terminate a contractor without a contract, but it may lead to legal complications depending on state laws. Be prepared for potential disputes regarding payment and termination terms. Having a Connecticut Self-Employed Independent Contractor Pyrotechnician Service Contract can provide clarity and protect both parties in such situations.

Generally, independent contractors do not qualify for unemployment benefits after termination. Many states, including Connecticut, require a traditional employer-employee relationship for unemployment eligibility. To safeguard your finances, consider having a Connecticut Self-Employed Independent Contractor Pyrotechnician Service Contract that outlines the terms of your work engagement.

Independent contractors must meet certain legal requirements, including proper tax registrations and compliance with labor laws. Depending on your state, additional requirements may apply. A Connecticut Self-Employed Independent Contractor Pyrotechnician Service Contract ensures you adhere to these laws while providing a solid foundation for your business relationships.