Connecticut Restated Limited Liability Company Agreement of LLC

Description

How to fill out Restated Limited Liability Company Agreement Of LLC?

Are you in a place that you need files for both organization or person purposes nearly every day? There are tons of legal record layouts accessible on the Internet, but discovering versions you can depend on isn`t straightforward. US Legal Forms offers a large number of form layouts, just like the Connecticut Restated Limited Liability Company Agreement of LLC, which can be written in order to meet state and federal requirements.

If you are previously acquainted with US Legal Forms web site and have a free account, merely log in. Following that, it is possible to acquire the Connecticut Restated Limited Liability Company Agreement of LLC template.

If you do not come with an accounts and wish to start using US Legal Forms, abide by these steps:

- Find the form you will need and make sure it is for that proper area/county.

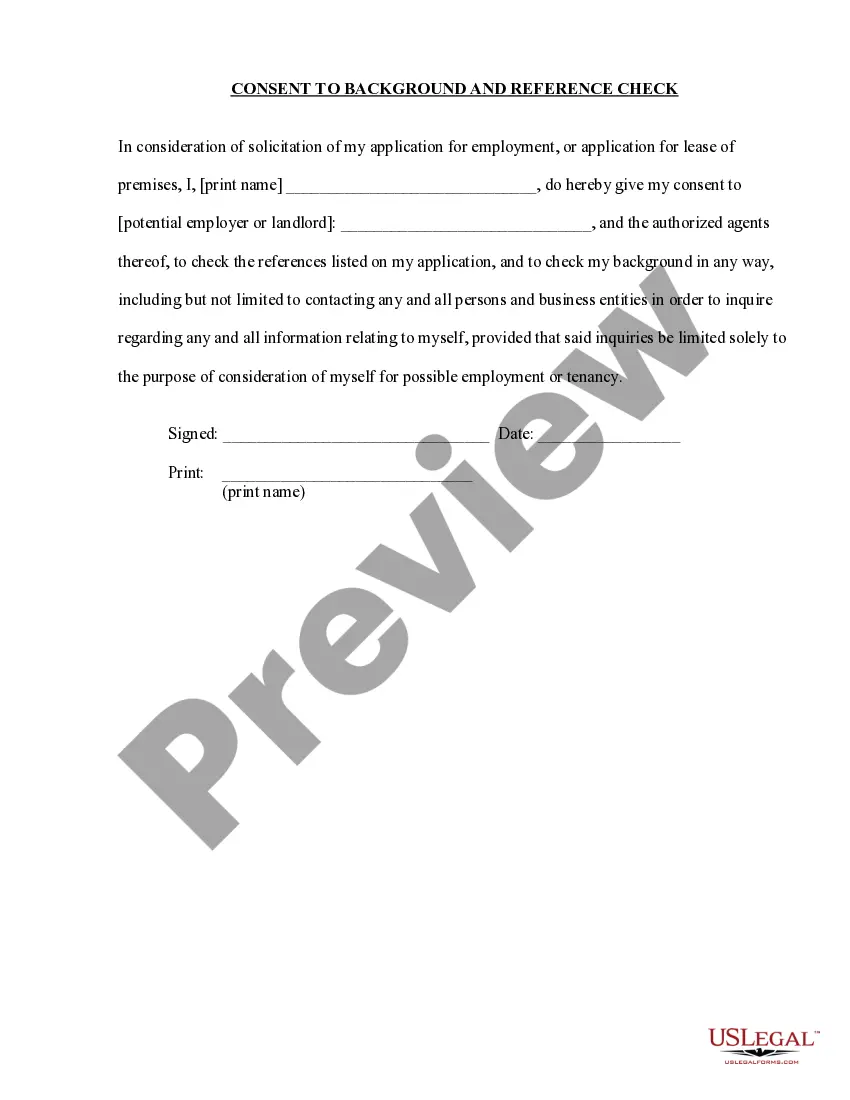

- Use the Review switch to examine the shape.

- Look at the information to ensure that you have chosen the correct form.

- In case the form isn`t what you`re searching for, take advantage of the Research industry to discover the form that suits you and requirements.

- If you obtain the proper form, simply click Get now.

- Select the rates plan you need, fill out the desired information to produce your money, and purchase an order utilizing your PayPal or credit card.

- Select a practical paper file format and acquire your backup.

Find every one of the record layouts you may have bought in the My Forms food selection. You can get a extra backup of Connecticut Restated Limited Liability Company Agreement of LLC anytime, if necessary. Just click on the needed form to acquire or print out the record template.

Use US Legal Forms, the most substantial collection of legal varieties, to save lots of efforts and prevent faults. The service offers skillfully created legal record layouts that you can use for a selection of purposes. Produce a free account on US Legal Forms and begin making your life easier.

Form popularity

FAQ

To amend the Certificate of Organization for your Connecticut LLC, you'll need to file a Certificate of Amendment with the Connecticut Secretary of State. Along with the amendment, you'll need to pay a $120 filing fee.

One way to transfer ownership in a Connecticut LLC is a partial transfer. Essentially, this is accomplished by all members of the LLC making a deal to ?buy out? the member who wishes to leave the LLC. Ownership is then split amongst the remaining members of the LLC. How to Transfer LLC Ownership in Connecticut - ZenBusiness ZenBusiness ? transfer-llc-ownership-... ZenBusiness ? transfer-llc-ownership-...

To officially dissolve your LLC, you must follow certain steps. Step 1: Follow the process in your Operating Agreement. ... Step 2: Check your business tax accounts. ... Step 3: Close your tax and state accounts. ... Step 4: Close your business tax withholdings. ... Step 5: Close your unemployment tax account.

To amend the Certificate of Organization for your Connecticut LLC, you'll need to file a Certificate of Amendment with the Connecticut Secretary of State. Along with the amendment, you'll need to pay a $120 filing fee. Here is a free guide filing your Certificate of Amendment. How to File a Connecticut LLC Amendment Northwest Registered Agent ? llc ? ame... Northwest Registered Agent ? llc ? ame...

One way to transfer ownership in a Connecticut LLC is a partial transfer. Essentially, this is accomplished by all members of the LLC making a deal to ?buy out? the member who wishes to leave the LLC. Ownership is then split amongst the remaining members of the LLC.

There are various ways of changing the members or managers of a Connecticut LLC. First, you can do this by filing an amendment. An alternative is to file an Interim Notice of Change of Manager or Member. Another way of doing this is to make the changes in the annual report of the LLC. Connecticut Amendment And What You Need To File DoMyLLC.com ? amendment ? connecticut-... DoMyLLC.com ? amendment ? connecticut-...

The most common way is to sell the business to another person or company. If you own the business along with partners, you may reapportion ownership among the multiple partners. Another way is to gift the business to someone else. You can also transfer ownership through a merger or acquisition. How To Transfer Business Ownership | Lendio lendio.com ? blog ? how-to-transfer-busines... lendio.com ? blog ? how-to-transfer-busines...

Under Connecticut law, an LLC is not required to have an operating agreement. In 2017, Connecticut enacted the Connecticut Uniform Limited Liability Company Act (?CULLCA?), which applies to all limited liability companies in Connecticut.