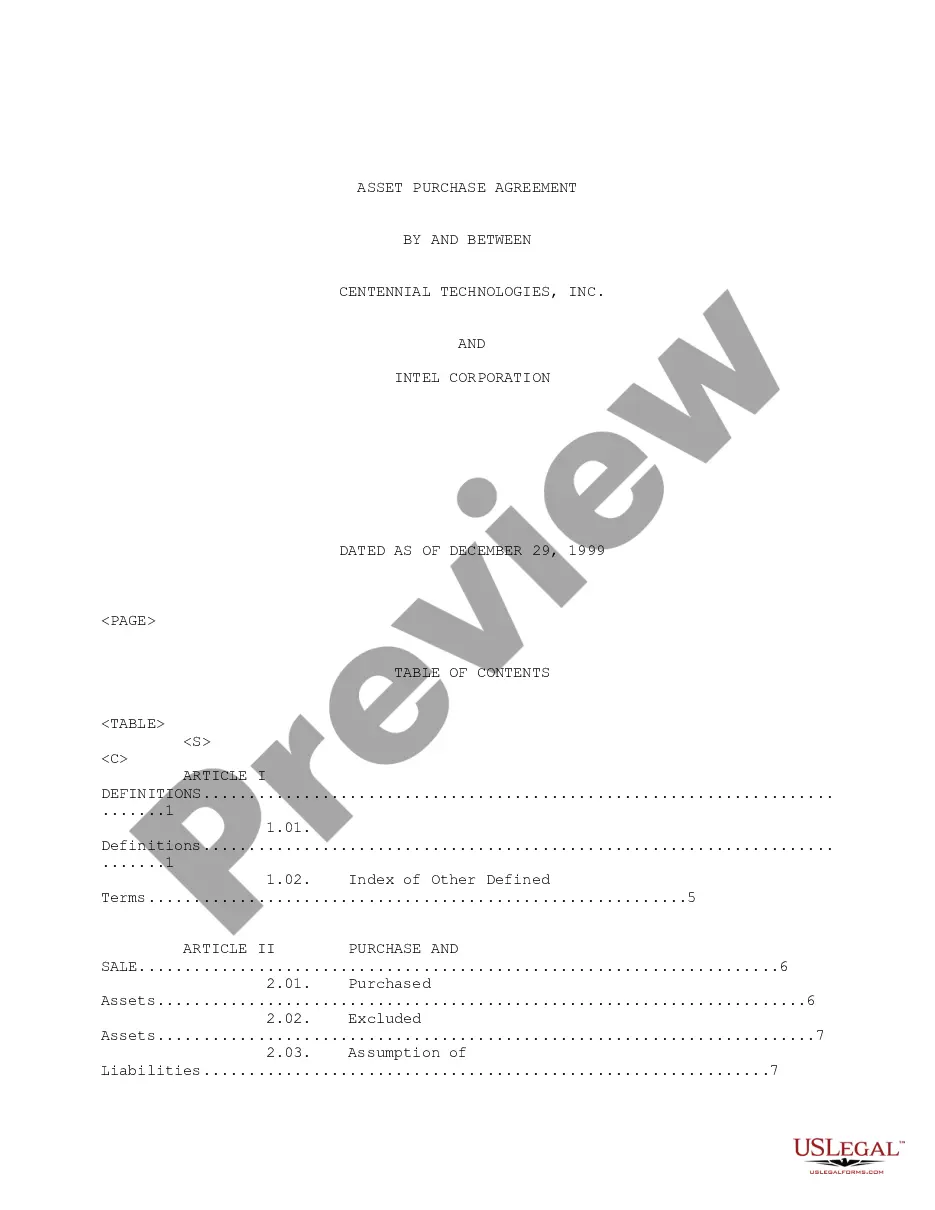

Connecticut Term Sheet - Convertible Debt Financing

Description

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status."

How to fill out Term Sheet - Convertible Debt Financing?

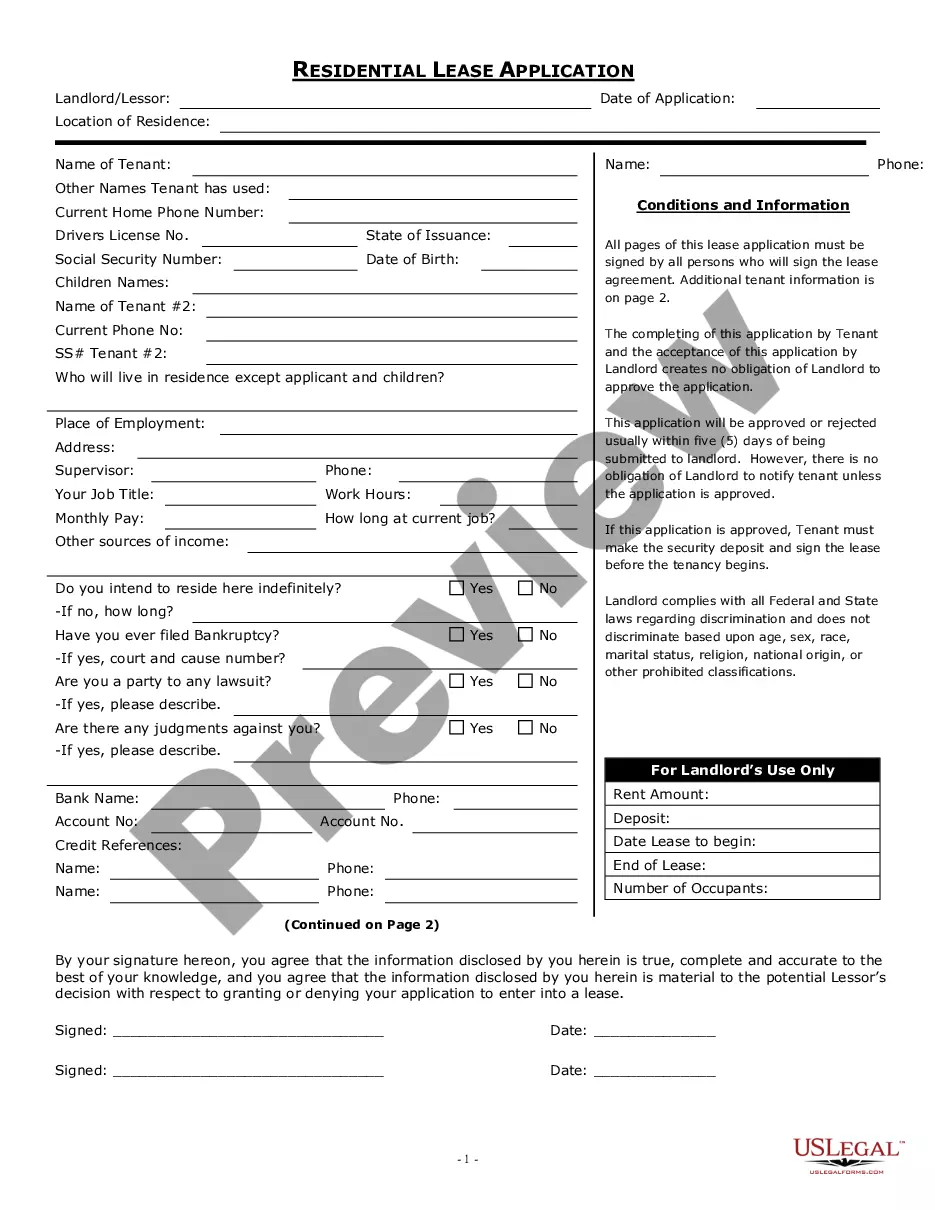

Choosing the right lawful document template can be quite a have difficulties. Obviously, there are a lot of templates available on the Internet, but how do you obtain the lawful kind you want? Take advantage of the US Legal Forms site. The services gives 1000s of templates, like the Connecticut Term Sheet - Convertible Debt Financing, that can be used for enterprise and private requires. Every one of the kinds are checked by specialists and satisfy federal and state requirements.

In case you are currently authorized, log in for your account and then click the Down load button to find the Connecticut Term Sheet - Convertible Debt Financing. Use your account to look through the lawful kinds you might have acquired previously. Go to the My Forms tab of your respective account and get another version from the document you want.

In case you are a brand new customer of US Legal Forms, listed here are simple instructions that you can follow:

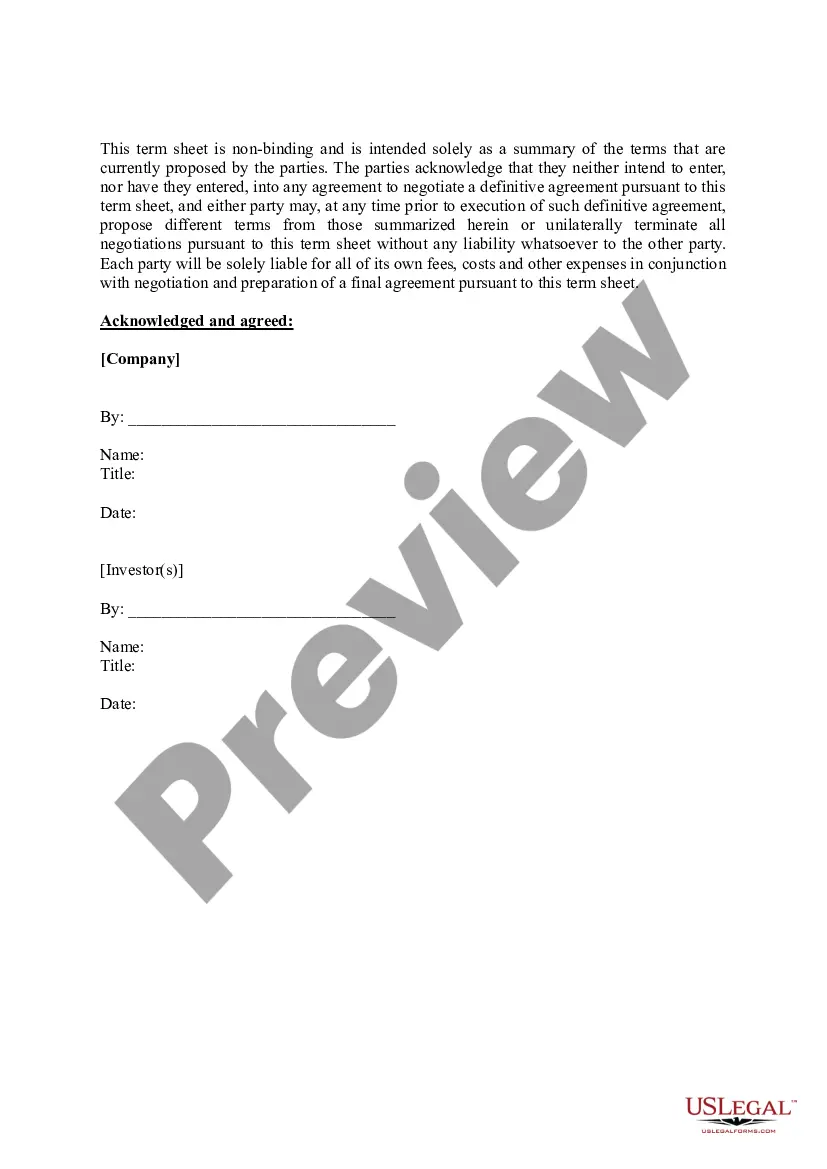

- Initially, be sure you have chosen the correct kind for your personal town/county. It is possible to look over the shape using the Review button and study the shape outline to guarantee it will be the best for you.

- In case the kind will not satisfy your needs, take advantage of the Seach industry to find the appropriate kind.

- Once you are sure that the shape is proper, go through the Acquire now button to find the kind.

- Opt for the pricing plan you desire and enter the necessary details. Build your account and pay for your order using your PayPal account or Visa or Mastercard.

- Select the submit format and down load the lawful document template for your device.

- Complete, modify and produce and sign the acquired Connecticut Term Sheet - Convertible Debt Financing.

US Legal Forms is definitely the largest local library of lawful kinds for which you can see different document templates. Take advantage of the service to down load appropriately-manufactured papers that follow status requirements.

Form popularity

FAQ

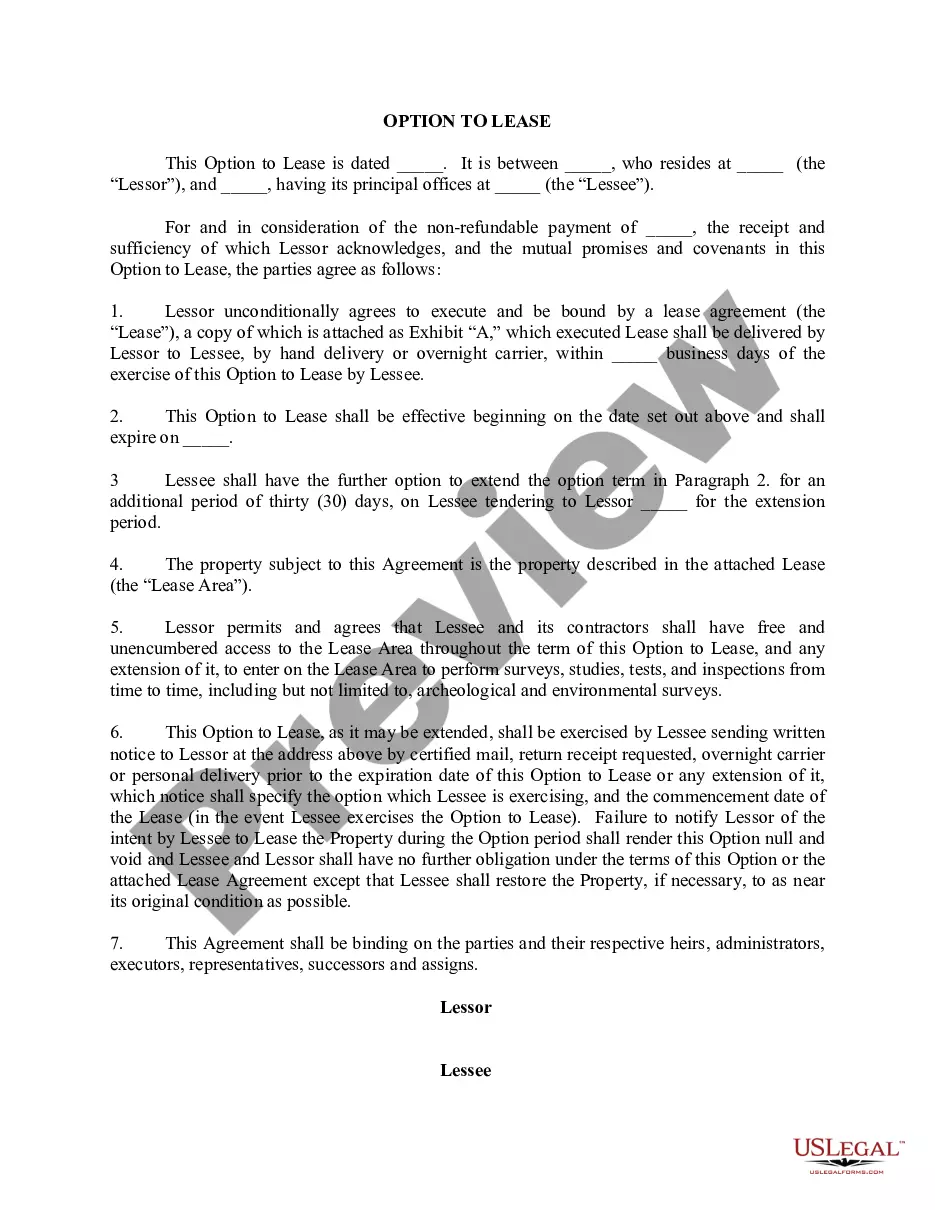

Although it is customary to forego a term sheet, in some cases it may be required if the parties need to negotiate certain terms. It can be advantageous to use a term sheet for the company to easily summarize the terms of the notes for potential other investors purchasing a convertible note.

Convertible notes are recorded as debt on the company's balance sheet up until the conversion event. After conversion, they become equity in the company. As debt instruments, convertible notes also have a maturity date and can earn interest (two key differences with SAFEs, as outlined further down).

A convertible note should be classified as a Long Term Liability that then converts to Equity as stipulated from the contract (usually a new fundraising round).

Convertible Notes are loans ? so they are recorded on the Balance Sheet of a company as a liability when they are made. Depending on the debt's maturity date, they can either be shown as a current liability (loans maturing within 12 months) or as a Long-term liability (loans maturing over 12 months).

Copyright PURE Asset Management 2022. A convertible note, also called a hybrid security or hybrid, refers to a debt instrument that can be converted into equity (ownership in a company) at some point in time in the future.

For tax purposes, the tax basis of the convertible debt is the entire proceeds received at issuance of the debt. Thus, the book and tax bases of the convertible debt are different. ASC 740-10-55-51 addresses whether a deferred tax liability should be recognized for that basis difference.

The value of the note is equal to the present value of the future income that the convertible note will receive, discounted to the present value based on its associated risk.

Are SAFE Notes Debt? No, SAFEs should not be accounted for as debt but instead as equity. Experienced venture capitalists expect to see SAFE notes in the equity section of a company's balance sheet - therefore, they should be classified as equity, not debt.