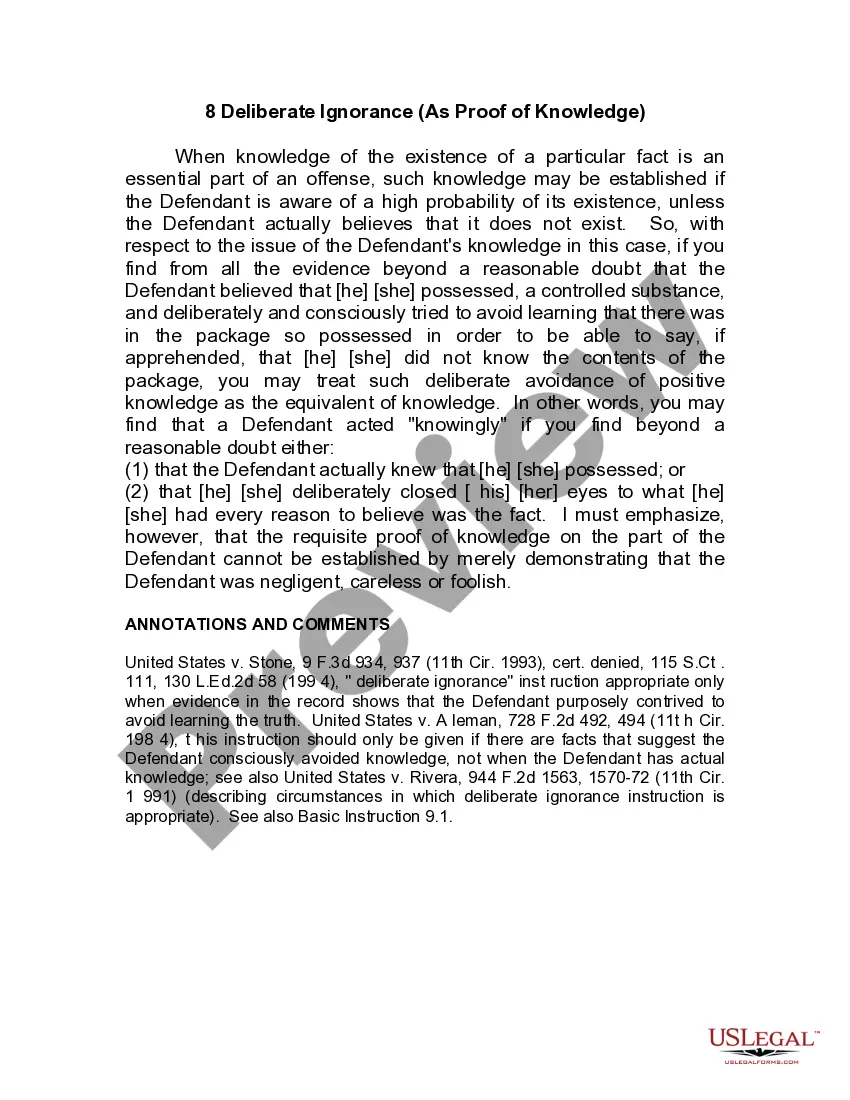

Connecticut Proposed acquisition of property

Description

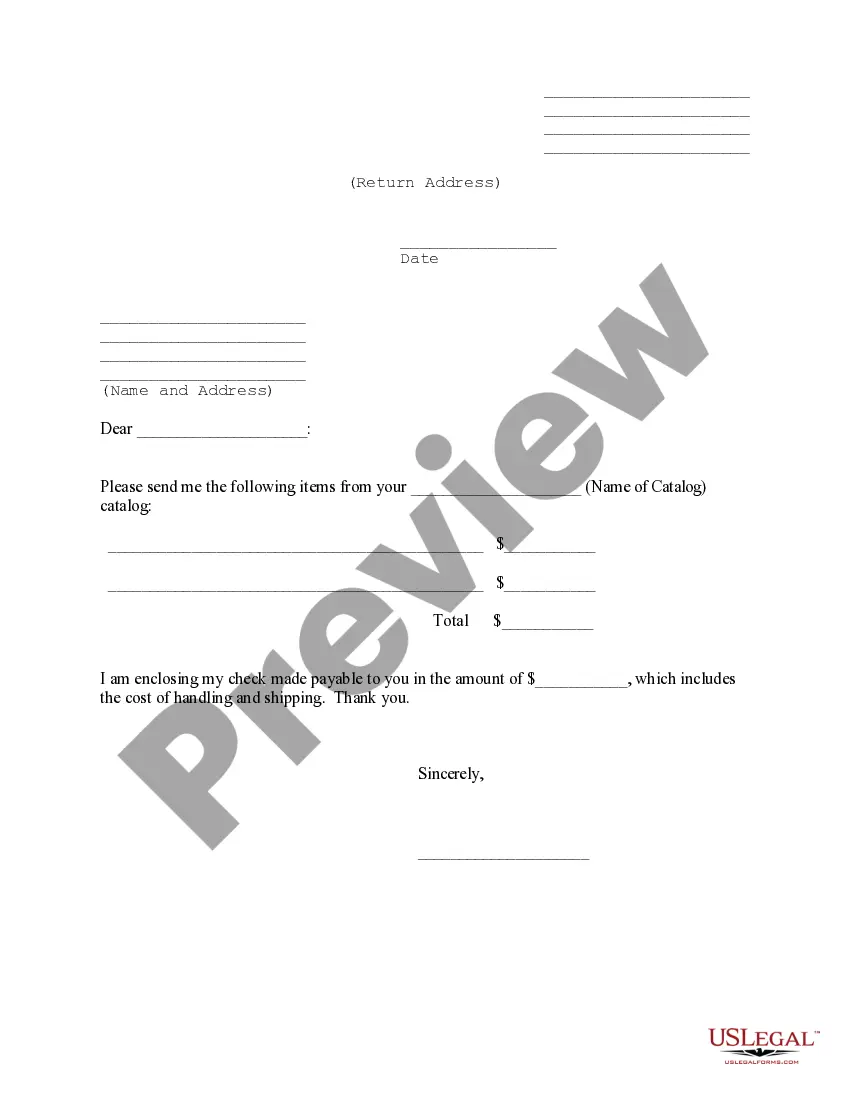

How to fill out Proposed Acquisition Of Property?

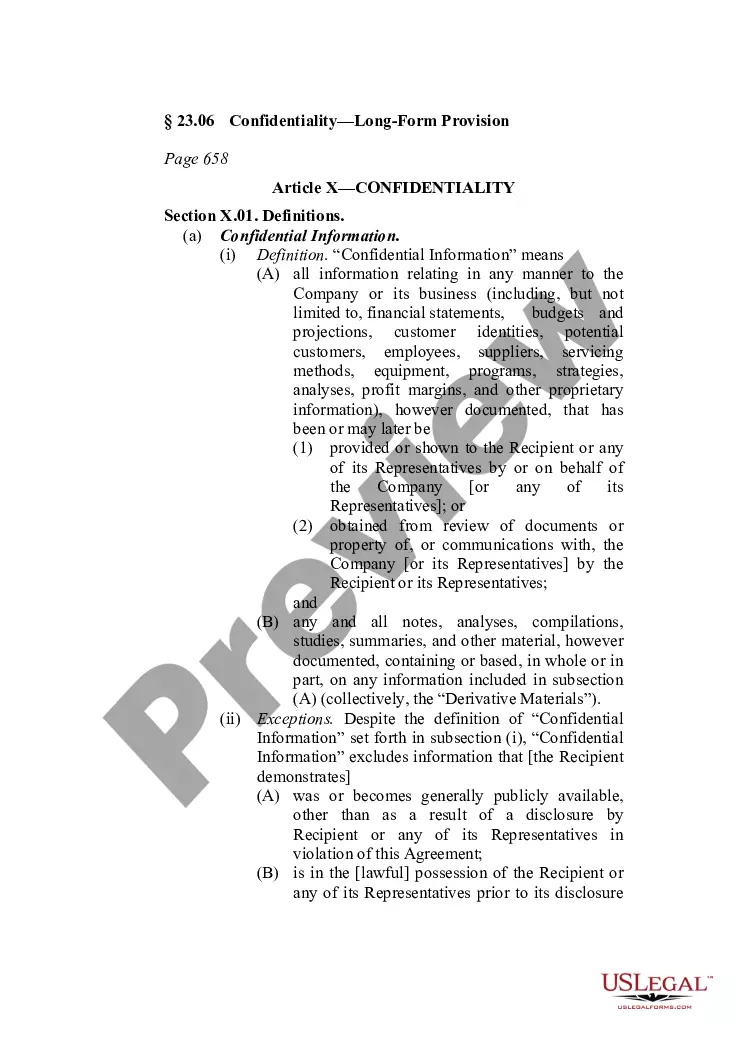

Choosing the best authorized file template might be a have a problem. Of course, there are tons of templates available on the net, but how can you discover the authorized develop you will need? Make use of the US Legal Forms site. The service delivers 1000s of templates, such as the Connecticut Proposed acquisition of property, that can be used for organization and personal demands. All the forms are checked out by experts and meet federal and state specifications.

When you are already signed up, log in to your bank account and click the Acquire option to have the Connecticut Proposed acquisition of property. Make use of bank account to appear through the authorized forms you may have acquired formerly. Go to the My Forms tab of your own bank account and get another version from the file you will need.

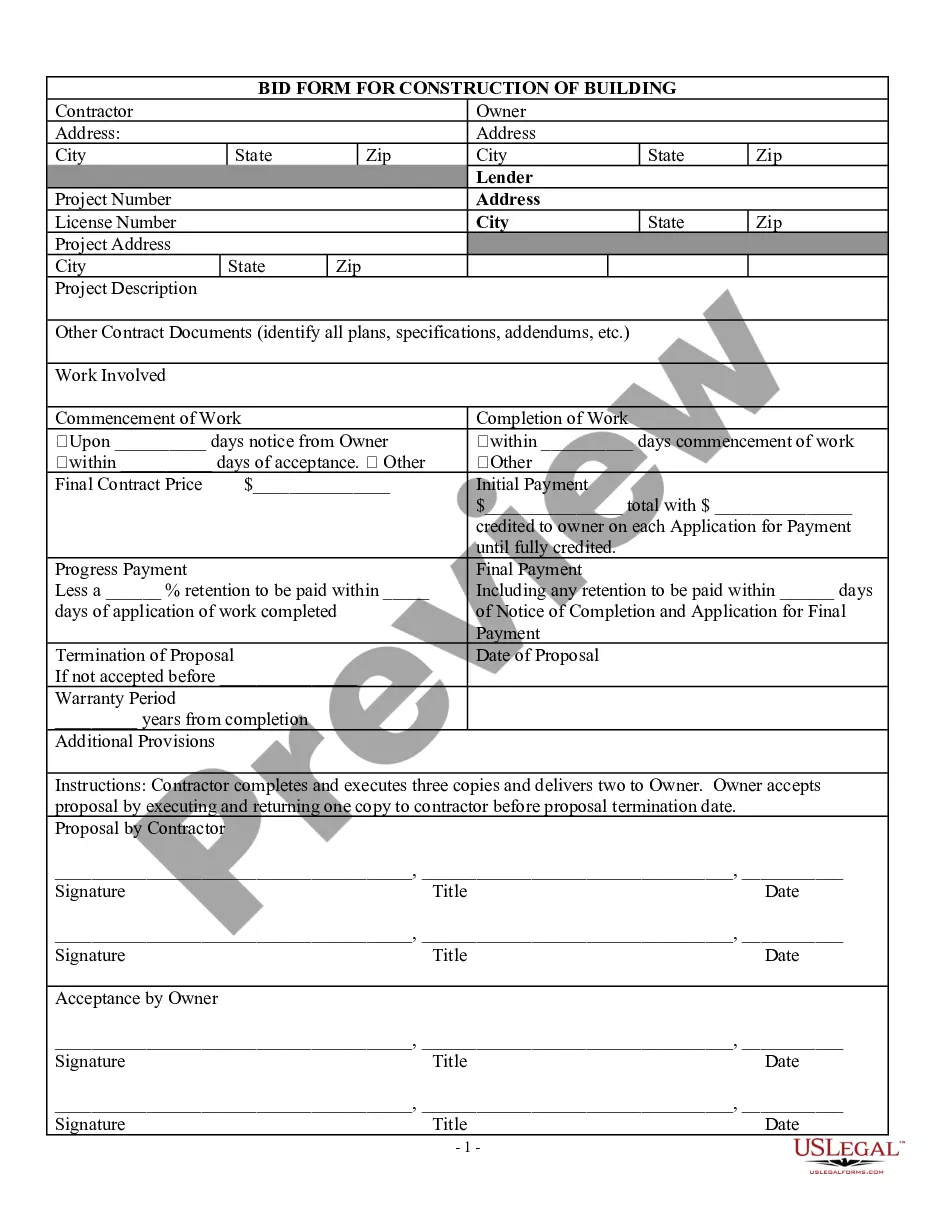

When you are a brand new end user of US Legal Forms, listed below are simple directions that you should adhere to:

- First, ensure you have selected the right develop for the area/area. You may examine the form while using Review option and look at the form description to make certain it will be the best for you.

- In the event the develop is not going to meet your requirements, utilize the Seach field to obtain the right develop.

- Once you are sure that the form would work, click the Acquire now option to have the develop.

- Choose the rates strategy you desire and enter in the needed information and facts. Create your bank account and buy the order making use of your PayPal bank account or charge card.

- Select the submit formatting and acquire the authorized file template to your system.

- Full, edit and print out and indication the received Connecticut Proposed acquisition of property.

US Legal Forms will be the largest local library of authorized forms in which you can see numerous file templates. Make use of the service to acquire appropriately-manufactured paperwork that adhere to status specifications.

Form popularity

FAQ

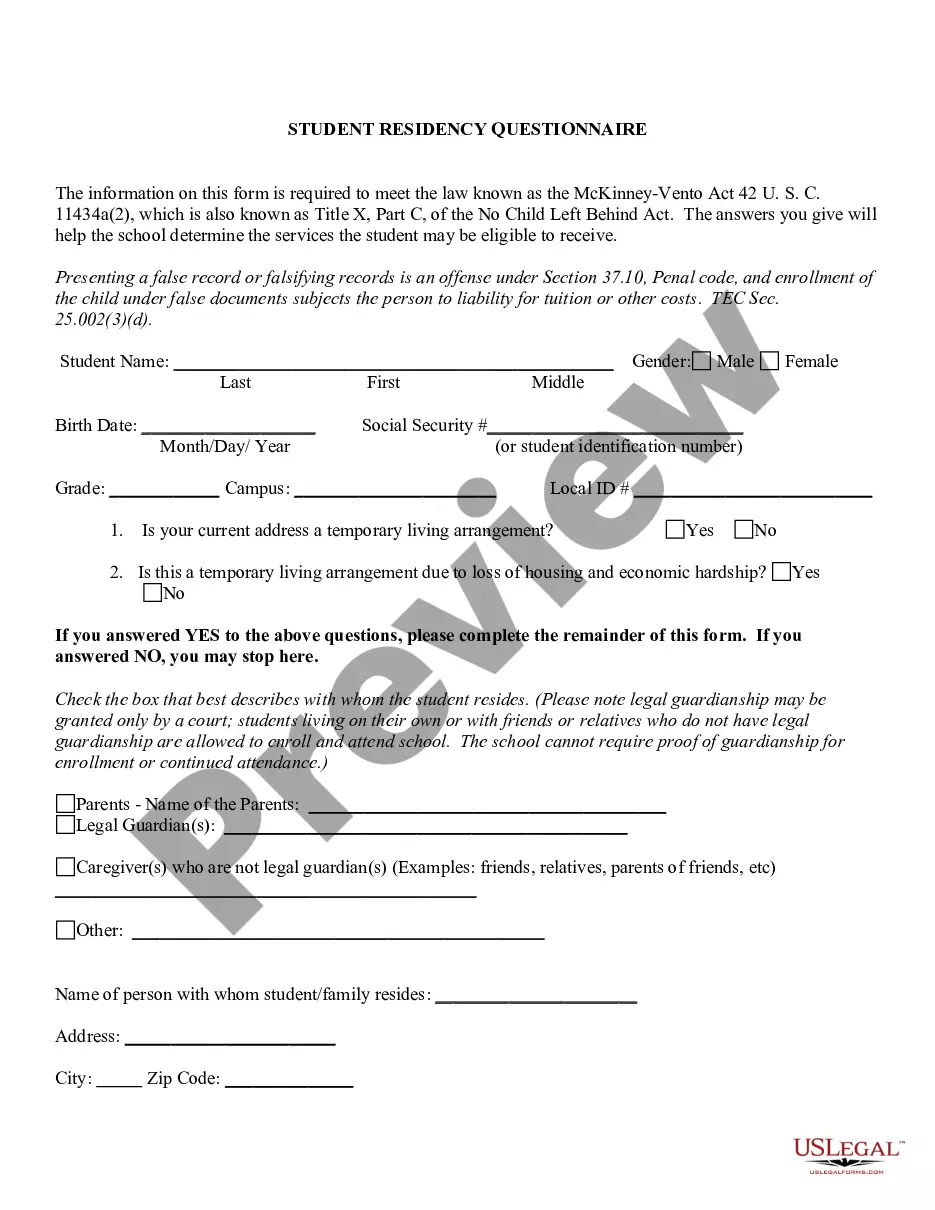

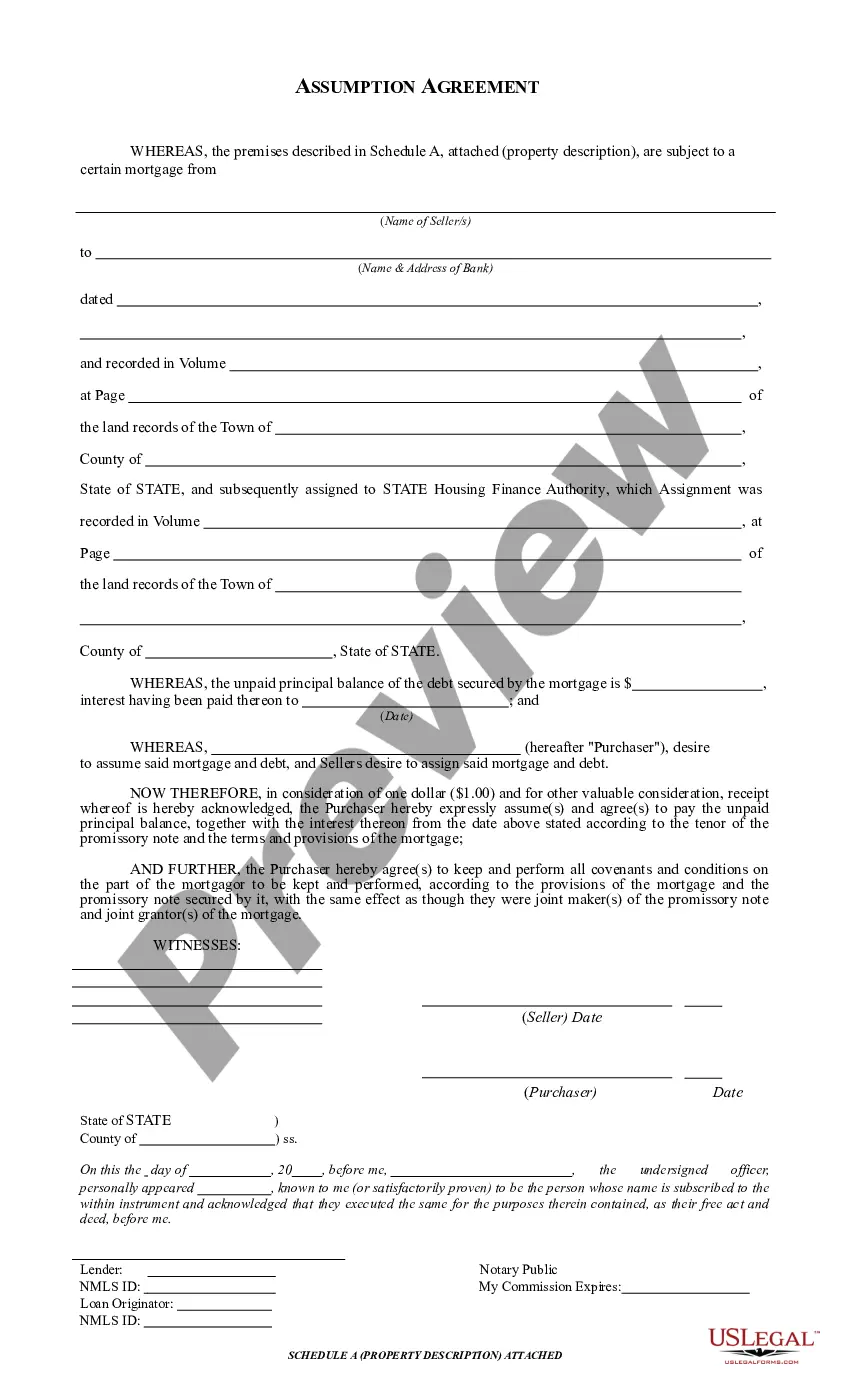

Know Connecticut Taxes Connecticut has the third-highest property tax rate in the country at 2.24%. While there is no transfer tax on properties below $2.5 million, any property that exceeds that sale price carries a 2.25% transfer, or conveyance, tax.

These are taxes paid to the Town and State on the sale of real estate. They are generally paid by the seller from the closing and given to the town clerk when the transaction is recorded.

Connecticut Facts. Connecticut is known for its beautiful fall foliage, its cultural heritage, its manufacturing industry, Yale University, and being the home of ESPN, the famous American cable sports channel.

The Land Registry is valuable for many reasons. It provides a public record and notice of title, conservation purpose, funding amounts, and land management plans, when applicable.

The closing cost in Connecticut for buyers are approximately 2%?5% of the home's agreement value. While the sellers are expected to pay around 6%?10% of the home's purchase price.

Connecticut's capital gains tax is 6.99%.

Connecticut Property Taxes On a nationwide scale, Connecticut homeowners pay the fourth highest property taxes in the U.S. The state's average effective property tax rate is 1.96%, which is double the 0.99% national average. Connecticut is unusual in that counties are not responsible for administering property taxes.

In Connecticut, sellers are typically responsible for paying real estate commissions (usually around 6 percent of the purchase price in total) and a conveyance tax that ranges between 1 and 2.75 percent of the purchase price.