Pennsylvania Management Long Term Incentive Compensation Plan of of SCEcorp

Description

How to fill out Management Long Term Incentive Compensation Plan Of Of SCEcorp?

You are able to commit hours on the web searching for the legal record template which fits the federal and state specifications you need. US Legal Forms supplies 1000s of legal forms that happen to be examined by experts. It is simple to acquire or printing the Pennsylvania Management Long Term Incentive Compensation Plan of of SCEcorp from our assistance.

If you have a US Legal Forms bank account, you may log in and click the Down load key. Next, you may complete, change, printing, or indicator the Pennsylvania Management Long Term Incentive Compensation Plan of of SCEcorp. Each legal record template you acquire is your own property permanently. To get another duplicate associated with a bought form, visit the My Forms tab and click the related key.

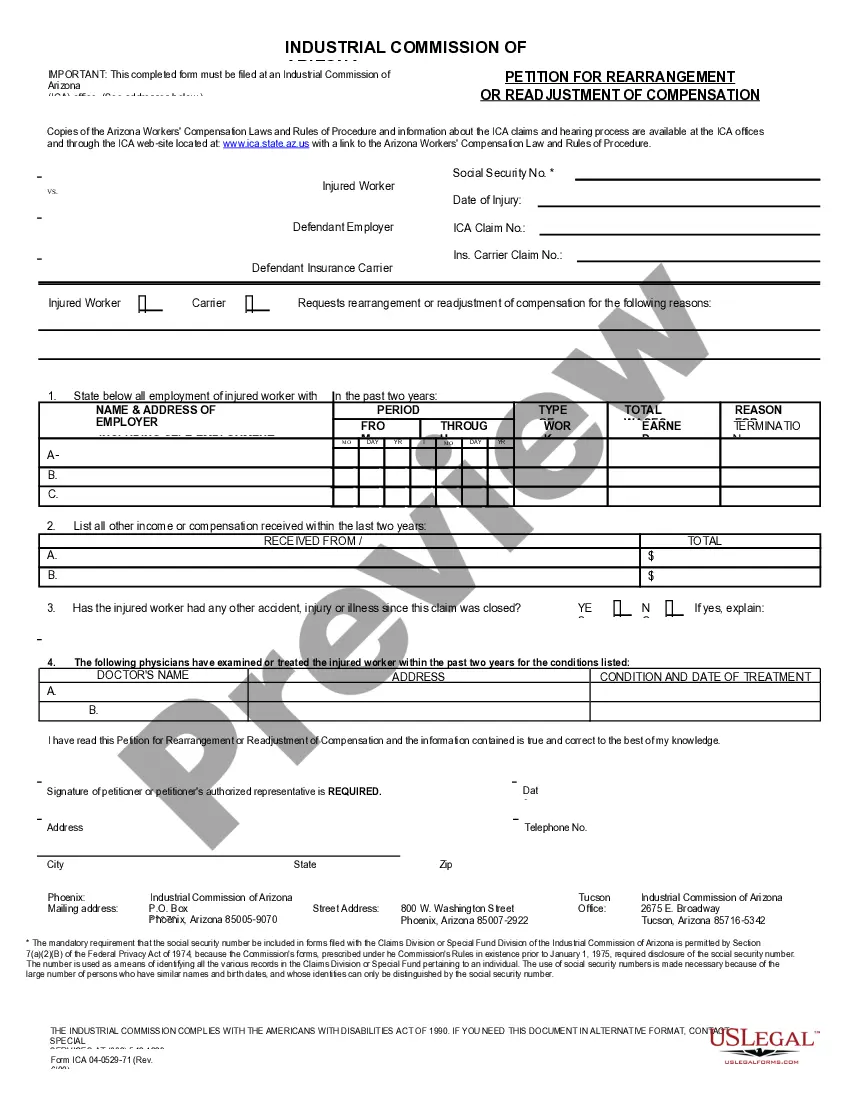

If you work with the US Legal Forms website for the first time, follow the simple recommendations below:

- First, be sure that you have chosen the right record template for that region/area of your liking. Look at the form outline to make sure you have chosen the correct form. If available, use the Review key to check from the record template at the same time.

- If you would like find another version of your form, use the Look for discipline to obtain the template that fits your needs and specifications.

- After you have identified the template you need, click on Buy now to continue.

- Find the rates program you need, type in your references, and sign up for an account on US Legal Forms.

- Total the deal. You may use your bank card or PayPal bank account to pay for the legal form.

- Find the formatting of your record and acquire it to the system.

- Make alterations to the record if necessary. You are able to complete, change and indicator and printing Pennsylvania Management Long Term Incentive Compensation Plan of of SCEcorp.

Down load and printing 1000s of record layouts utilizing the US Legal Forms web site, which offers the most important assortment of legal forms. Use professional and condition-particular layouts to take on your business or person requires.

Form popularity

FAQ

term incentive plan (LTIP) incentivizes employees to take actions that will maximize shareholder value and promote longterm growth for the organization. In a standard LTIP, the employee, who is normally a senior executive, is required to meet a number of criteria to receive the incentive.

An example of a long-term incentive could be a cash plan, equity plan or share plan. A long-term incentive plan can typically run between three years and five years before the full benefit of the incentive is received by the employee.

term incentive plan (LTIP) is a company policy that rewards employees for reaching specific goals that lead to increased shareholder value. In a typical LTIP, the employee, usually an executive, must fulfill various conditions or requirements.

There isn't a prescribed form your LTIP has to take, but usually, the employee needs to hit targets or achieve pre-agreed upon goals to earn their bonus. In essence, if your management team increases the value of your shares, an LTIP recompenses them, usually after three to five trading years.

Payout Opportunity A Participant's payout target amount under the Plan is determined by pay grade as follows: The range of incentive opportunity for a Plan Participant is 0% to 200% of the Participant's total value target. This means the maximum payout that a Participant can receive from this Plan is 200%.

In a standard LTIP, the employee, who is normally a senior executive, is required to meet a number of criteria to receive the incentive. This incentive is paid out on top of the executive's base salary and can often come in the form of a cash incentive.

term incentive plan (LTIP) is a company policy that rewards employees for reaching specific goals that lead to increased shareholder value. In a typical LTIP, the employee, usually an executive, must fulfill various conditions or requirements.

LTI Bonus Compensation means all amounts awarded to a Participant under the Company LTI (Long Term Incentive) Plan that the Company determines to be eligible as compensation for purposes of the Plan.