Connecticut Performance Evaluation for Nonexempt Employees

Description

How to fill out Performance Evaluation For Nonexempt Employees?

You can dedicate hours online searching for the legal document template that meets the state and federal criteria you require.

US Legal Forms provides a vast array of legal templates that have been evaluated by professionals.

You can conveniently download or print the Connecticut Performance Evaluation for Nonexempt Employees from our service.

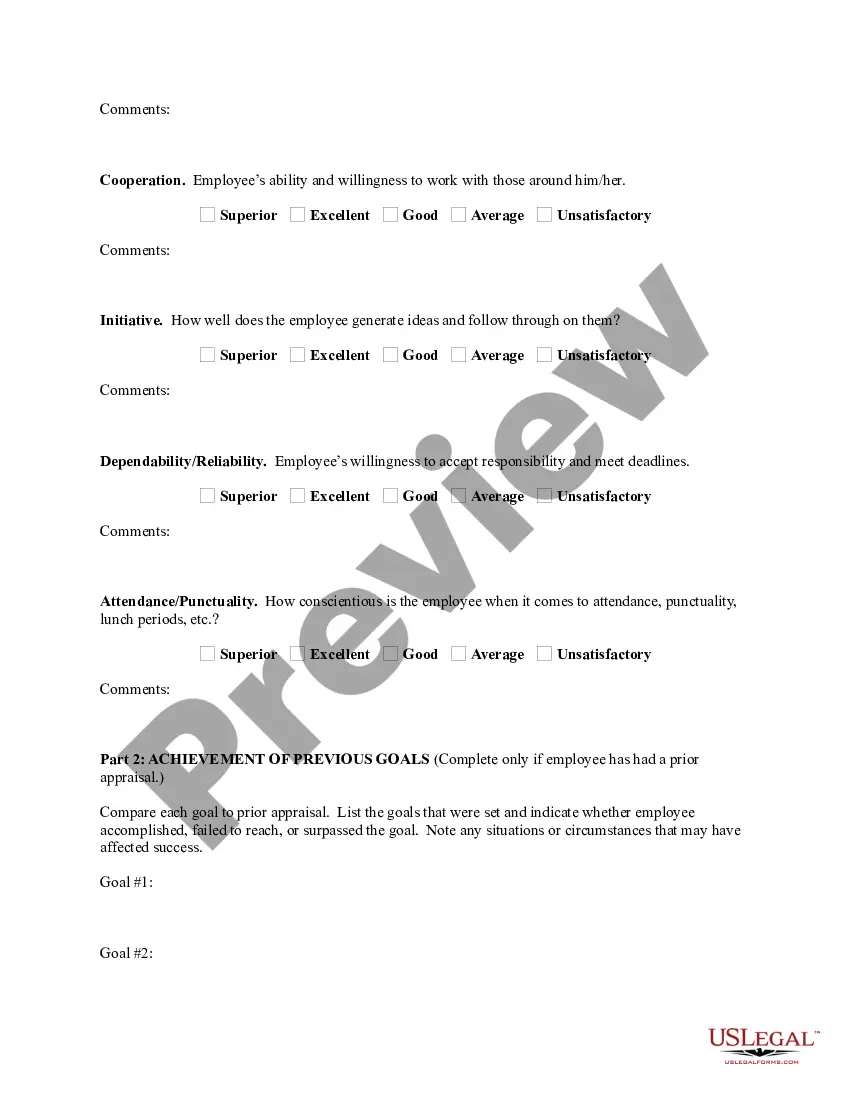

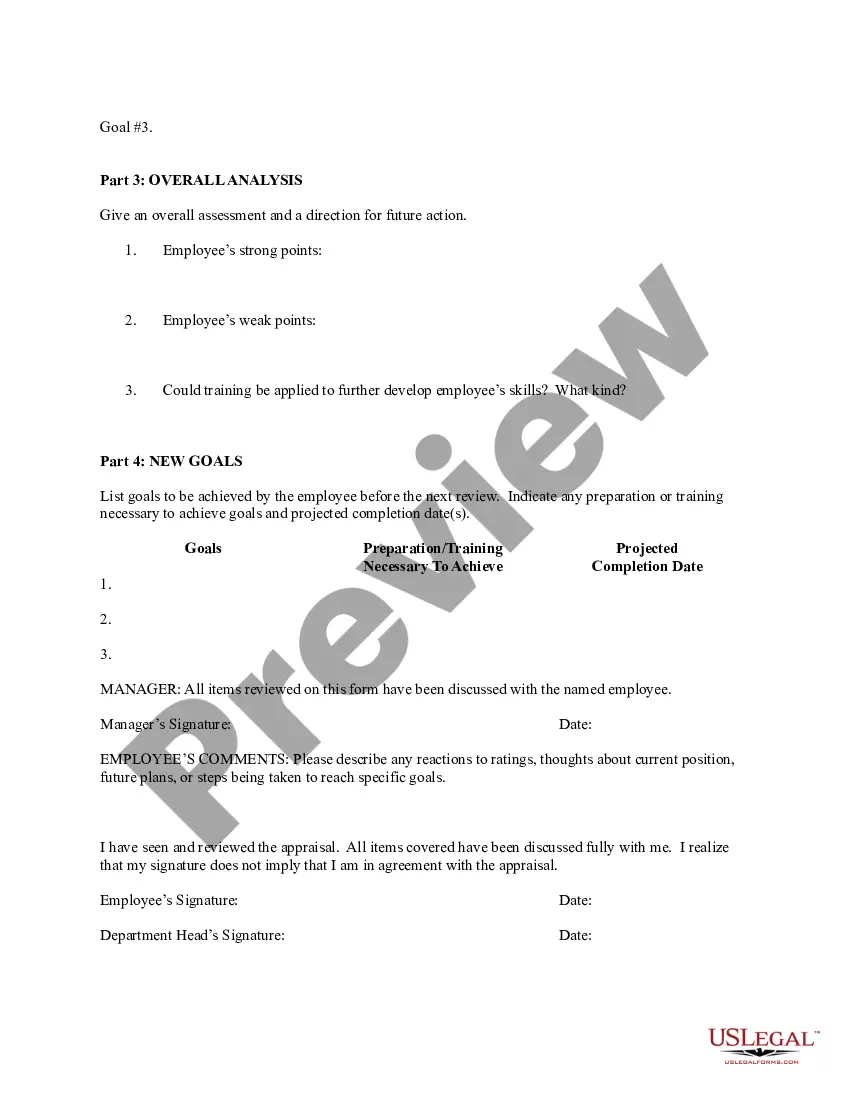

If available, use the Preview button to browse through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and then click the Acquire button.

- After that, you can complete, modify, print, or sign the Connecticut Performance Evaluation for Nonexempt Employees.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of a purchased form, visit the My documents tab and click the corresponding button.

- If it is your first time using the US Legal Forms site, follow the simple instructions below.

- First, make sure you have selected the correct document template for your state/city of choice.

- Review the form outline to ensure you have selected the correct template.

Form popularity

FAQ

As a general rule, most companies conduct performance reviews every 3-6 months. This keeps employees' focused and motivated, and ensures feedback is relevant and timely.

CT State Statute 31-58 - exempt employees not covered by minimum wage or record keeping laws. CT State Statute 31-76i - exempt employees not covered for the purpose of overtime payment.

An employer must thereafter evaluate the productivity of each worker with a disability who is paid an hourly commensurate wage rate at least every 6 months, or whenever there is a change in the methods or materials used or the worker changes jobs.

In an employee performance review, managers evaluate that individual's overall performance, identify their strengths and weaknesses, offer feedback, and help them set goals. Employees typically have the opportunity to ask questions and share feedback with their manager as well.

While the specific criteria for duties vary somewhat depending on whether exempt status is claimed as an Executive, Administrative, and/or Professional employee, examples of exempt duties include hiring and firing employees, scheduling employees, determining credit policies, formulating personnel policies, assessing

Non-Exempt Employees in ConnecticutEmployees that do not meet the requirements to classify as exempt are classified as non-exempt. This means that they are subject to overtime requirements under state and federal law.

Connecticut's short test for exemptions required a salary basis of $475 per week ($24,700 annually). The new federal rule, which will take effect on January 1, 2020, raises the minimum salary threshold to $684 per week ($35,568 annually for a full-time worker).

An exempt employee is not entitled to overtime pay according to the Fair Labor Standards Act (FLSA). To be exempt, you must earn a minimum of $684 per week in the form of a salary. Non-exempt employees must be paid overtime and are protected by FLSA regulations.

If you are a non-exempt employee, your employer must pay you at least the federal minimum wage (currently $7.25 per hour in Texas and under federal law) and must pay you overtime pay at a rate of at least one and a half times your hourly pay rate for all hours worked over 40 in each workweek.

10 Easy Ways to Evaluate an Employee's PerformanceLevel of execution.Quality of work.Level of creativity.Amount of consistent improvement.Customer and peer feedback.Sales revenue generated.Responsiveness to feedback.Ability to take ownership.More items...