Connecticut Leave of Absence Salary Clarification

Description

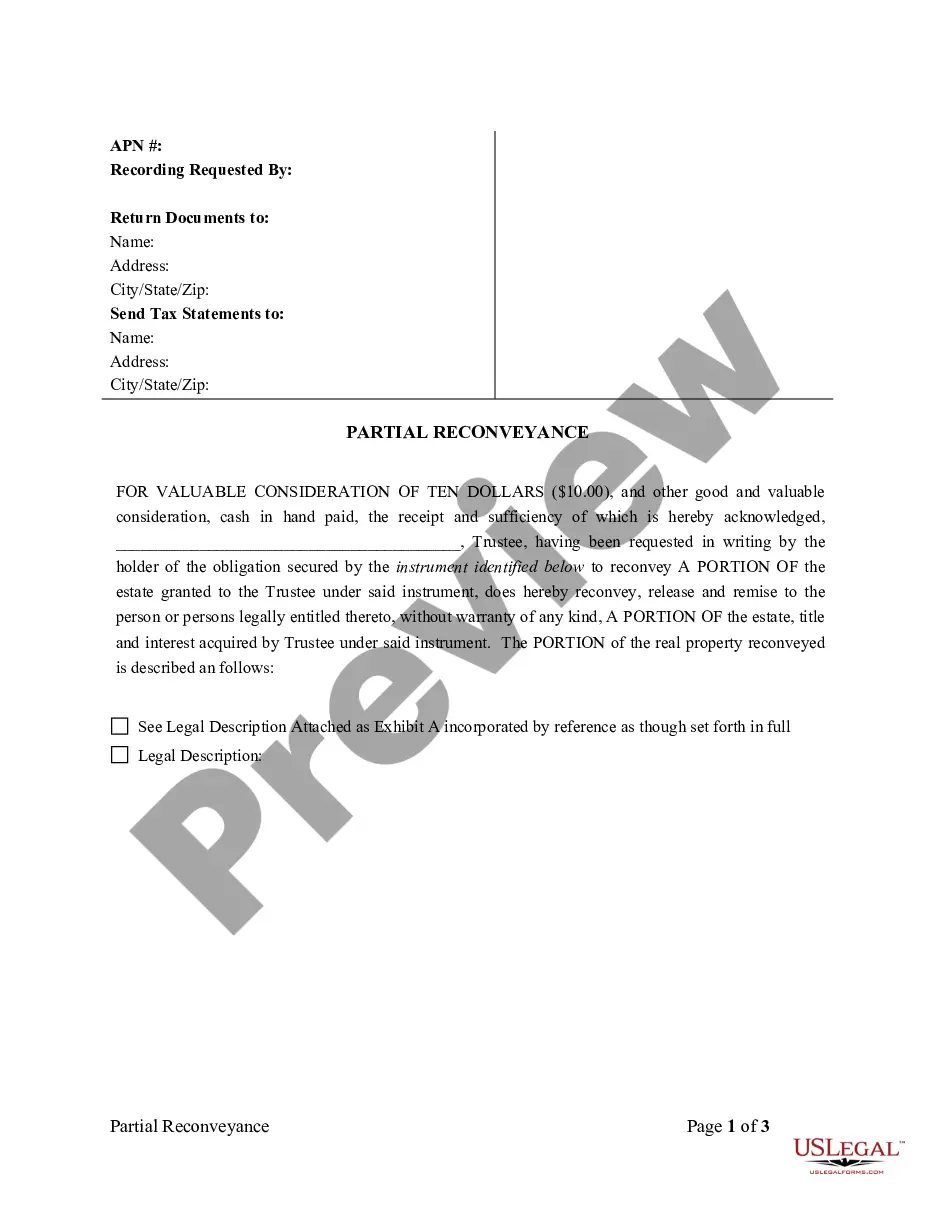

How to fill out Leave Of Absence Salary Clarification?

Locating the correct valid document template can be a challenge. Clearly, there are numerous designs accessible online, but how do you locate the authentic template you seek.

Utilize the US Legal Forms website. The platform provides thousands of designs, including the Connecticut Leave of Absence Salary Clarification, which you can use for both business and personal purposes.

All of the forms are reviewed by experts and comply with federal and state regulations.

Once you are confident that the form is suitable, click the Purchase now button to obtain the document. Choose the pricing plan you prefer and enter the required information. Create your account and complete the order using your PayPal account or credit card. Select the document format and download the legal document template to your device. Fill out, modify, print, and sign the acquired Connecticut Leave of Absence Salary Clarification. US Legal Forms is the largest repository of legal forms where you can discover various document templates. Use the service to download properly created documents that meet state requirements.

- If you are currently registered, Log In to your account and click the Download button to retrieve the Connecticut Leave of Absence Salary Clarification.

- Use your account to verify the legal forms you have obtained previously.

- Visit the My documents section of your account and download another copy of the document you require.

- If you are a first-time user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the appropriate template for your city/state. You can preview the form using the Preview button and read the form description to confirm this is indeed the right one for you.

- If the form does not fulfill your requirements, use the Search field to find the appropriate form.

Form popularity

FAQ

When you take a leave of absence, your employer typically provides you with a formal notice outlining your rights and obligations. You may remain eligible for certain benefits, depending on your company's policy and the nature of your leave. Understanding the Connecticut Leave of Absence Salary Clarification is crucial, as it helps you navigate how your salary may be affected during this time. Platforms like US Legal Forms can assist you in ensuring you have the right documentation and support for your leave.

When requesting a medical leave, it is essential to provide documentation that supports your need for the leave. Generally, you will need a letter from your healthcare provider detailing your condition and the recommended duration of your absence. This documentation plays a critical role in understanding the Connecticut Leave of Absence Salary Clarification, as it ensures you receive the financial support you deserve during your time away. If you need help with the paperwork, UsLegalForms offers various resources to guide you through the process effectively.

Covered employees working in Connecticut are eligible for benefits under PFMLA if they have earned wages of at least $2,325 in the highest- earning quarter of the first four of the five most recently completed quarters (the base period) and are currently employed, or have been employed within the last 12 weeks.

You may be able to get paid while on FMLA leave by substituting your accrued paid time off for all or a portion of your unpaid leave.

The CT Paid Leave Authority notes that 40 times the minimum wage is currently equal to $520. If a person earns minimum wage and applies to receive leave benefits, they will receive 95 percent of $520, or $494 weekly.

As a covered employee, your benefit rate will be calculated in the following ways: If your wages are less than or equal to the Connecticut minimum wage multiplied by 40, your weekly benefit rate under the PFMLA will be 95% of your average weekly wage.

The CT Paid Leave Act states that an employee can receive benefits from the CT Paid Leave program at the same times that they receive employer-provided income replacement benefits, as long as the total amount cannot be more than the employee's regular wages.

You can apply online or call the toll-free application line at (877) 499-8606. To apply online, create an account with CT Paid Leave. Get started with this step-by-step instructional video. If you know when you will be taking leave, submit your application no more than 30 days before the leave start date.

How much leave can I get? The federal FMLA allows up to 12 weeks of unpaid leave in a 12-month period. The state of Connecticut FMLA allows up to 16 weeks of unpaid leave in a 24-month period (or up to 24 weeks if you are a state of Connecticut employee).

A paid family leave law described as one of the most generous in the country goes into effect for Connecticut workers on January 1, 2022. Workers will be able to take 12 weeks of paid leave in 12 months for personal and family health needs.