Statutory Guidelines [Appendix A(7) IRC 5891] regarding rules for structured settlement factoring transactions.

Connecticut Structured Settlement Factoring Transactions

Description

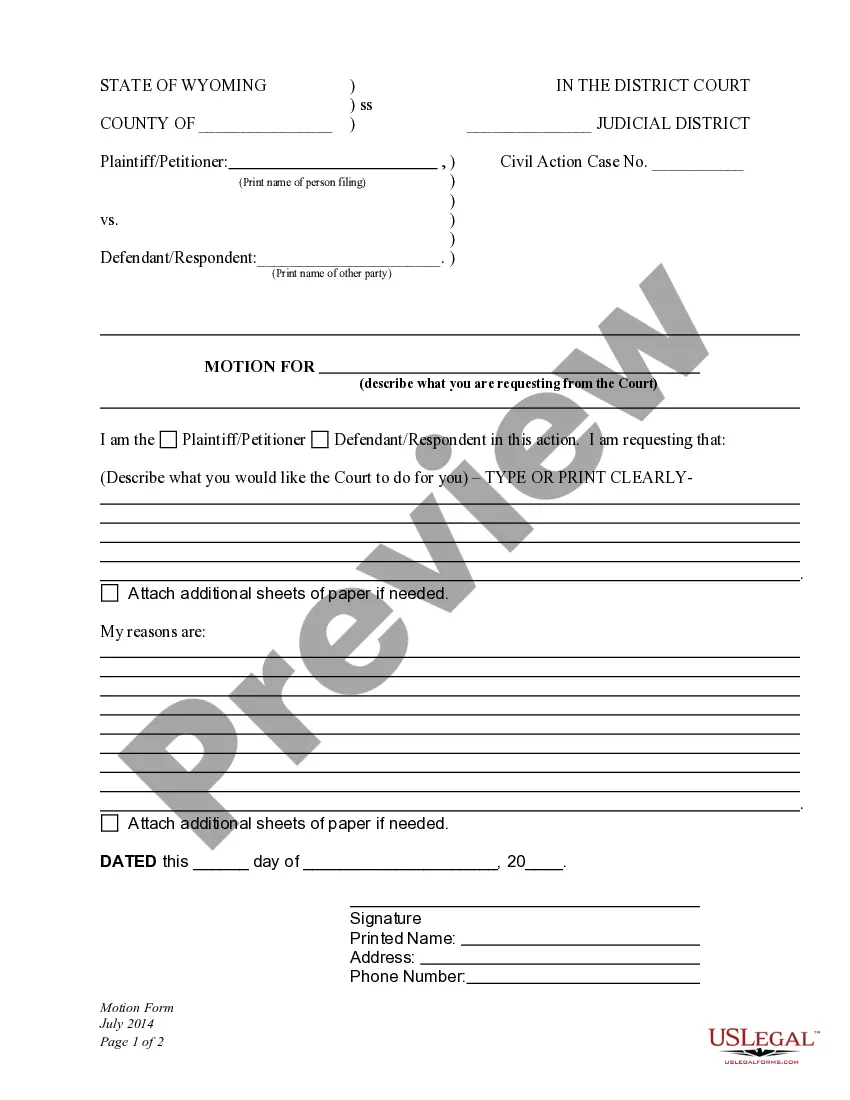

How to fill out Structured Settlement Factoring Transactions?

Are you presently inside a situation where you need to have papers for either company or person reasons just about every day time? There are a lot of legitimate document web templates accessible on the Internet, but getting kinds you can trust isn`t effortless. US Legal Forms offers 1000s of type web templates, such as the Connecticut Structured Settlement Factoring Transactions, which are composed to meet federal and state needs.

In case you are already familiar with US Legal Forms site and have a merchant account, merely log in. Afterward, you may acquire the Connecticut Structured Settlement Factoring Transactions format.

Should you not provide an profile and need to begin to use US Legal Forms, follow these steps:

- Discover the type you will need and ensure it is to the proper city/county.

- Use the Preview switch to check the form.

- Browse the explanation to actually have selected the right type.

- When the type isn`t what you`re looking for, use the Search field to get the type that suits you and needs.

- Once you obtain the proper type, simply click Purchase now.

- Select the prices program you need, fill out the necessary information and facts to create your account, and pay money for an order using your PayPal or credit card.

- Pick a hassle-free file format and acquire your version.

Locate all the document web templates you might have purchased in the My Forms menu. You may get a extra version of Connecticut Structured Settlement Factoring Transactions any time, if needed. Just click the required type to acquire or printing the document format.

Use US Legal Forms, the most substantial assortment of legitimate varieties, to save lots of efforts and prevent errors. The assistance offers expertly created legitimate document web templates which can be used for a selection of reasons. Generate a merchant account on US Legal Forms and start creating your life a little easier.

Form popularity

FAQ

Different Types of Structured Settlement Payouts Temporary life annuity. Joint and survivor annuity. Deferred lump-sum. Percentage increase annuity. Step annuities.

The term ?structured settlement factoring transaction? means a transfer of structured settlement payment rights (including portions of structured settlement payments) made for consideration by means of sale, assignment, pledge, or other form of encumbrance or alienation for consideration.

Selling a Structured Settlement Contact Your Personal Injury or Civil Attorney. ... Evaluate Your Reasons for Selling. ... Research Structured Settlement Buyers. ... Apply for Legal Funding for Advanced Financial Relief. ... Get Your Structured Settlement Purchase Agreement Notarized.

Taxes when selling structured settlements By law, under most circumstances the IRS is not permitted to tax income from a structured settlement regardless of whether it's paid out over a series of payments or in one lump sum.

The Five Steps for Selling a Structured Settlement: Check with a lawyer and local laws to find out if your settlement can be sold. Decide if selling is a good idea, depending on your goals and financial situation. Research quotes and pick a trustworthy company. Attend your court date.

You cannot borrow against your structured settlement, but you can sell all or a portion of it for a lump sum of cash. You can also seek pre-settlement funding or lawsuit advances to cover legal bills prior to a lawsuit settlement.

Structured settlements can provide long-term monthly payments in workers' compensation/medical malpractice cases. With a structured settlement annuity, there's no risk of outliving the money. Future payments can last for the claimant's lifetime.

The Five Steps for Selling a Structured Settlement: Check with a lawyer and local laws to find out if your settlement can be sold. Decide if selling is a good idea, depending on your goals and financial situation. Research quotes and pick a trustworthy company. Attend your court date.