Statutory Guidelines [Appendix A(2) Tres. Reg 104-1] regarding compensation for injuries or sickness under workmen's compensation acts, damages, accident or health insurance, etc. as stated in the guidelines.

Connecticut Compensation for Injuries or Sickness Treasury Regulation 104.1

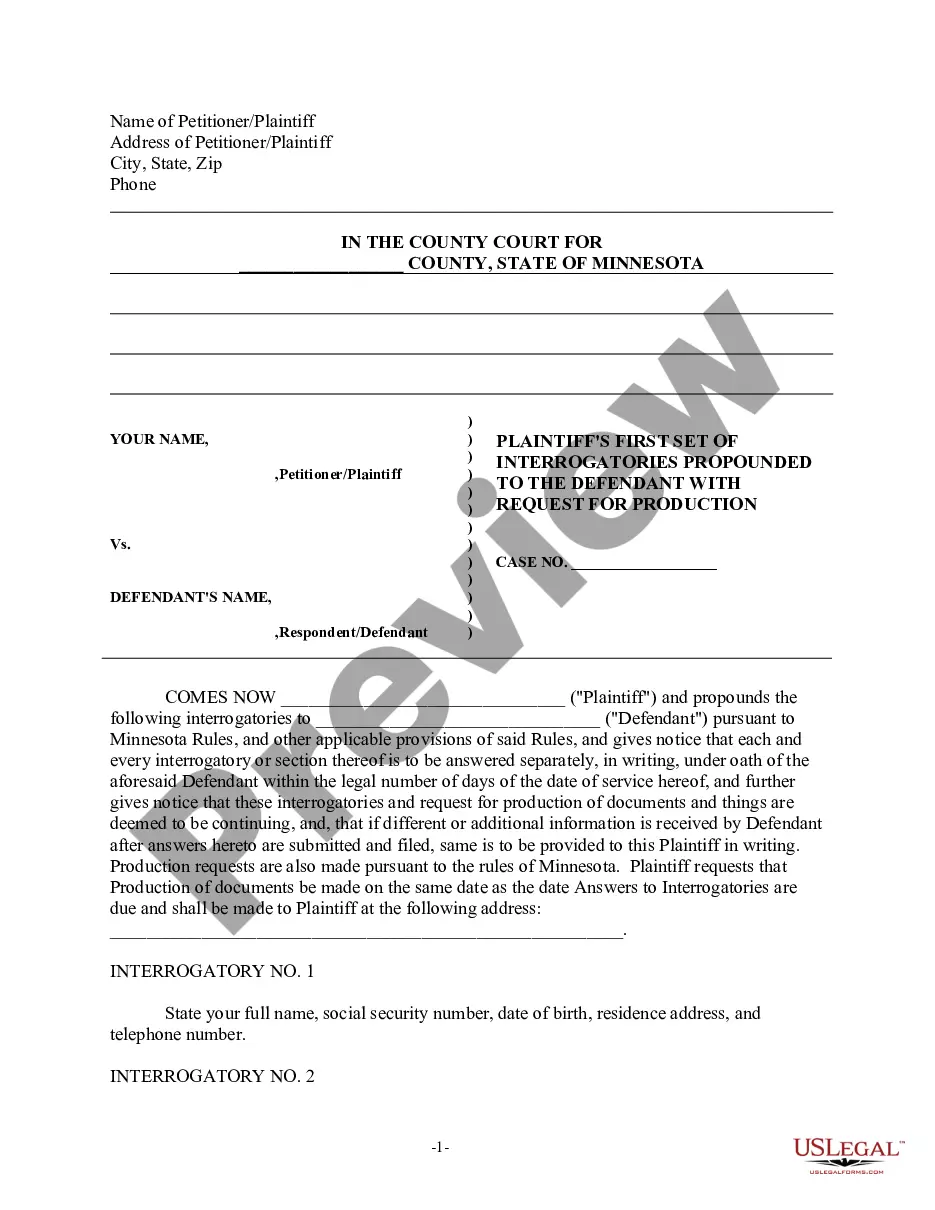

Description

How to fill out Compensation For Injuries Or Sickness Treasury Regulation 104.1?

Discovering the right legal file web template might be a have difficulties. Needless to say, there are plenty of templates available on the Internet, but how can you find the legal type you will need? Take advantage of the US Legal Forms website. The assistance gives thousands of templates, including the Connecticut Compensation for Injuries or Sickness Treasury Regulation 104.1, that can be used for organization and private needs. Every one of the varieties are examined by experts and meet federal and state demands.

When you are currently signed up, log in to the accounts and click on the Download option to have the Connecticut Compensation for Injuries or Sickness Treasury Regulation 104.1. Utilize your accounts to appear with the legal varieties you might have bought formerly. Visit the My Forms tab of your respective accounts and have another backup of your file you will need.

When you are a brand new end user of US Legal Forms, allow me to share basic guidelines that you should stick to:

- Initially, make sure you have selected the right type for your city/county. It is possible to look over the form making use of the Preview option and read the form information to guarantee it is the best for you.

- When the type is not going to meet your expectations, utilize the Seach area to obtain the correct type.

- Once you are certain the form would work, select the Get now option to have the type.

- Opt for the rates strategy you desire and enter the needed information and facts. Create your accounts and buy an order using your PayPal accounts or credit card.

- Choose the file structure and down load the legal file web template to the system.

- Full, revise and produce and indicator the obtained Connecticut Compensation for Injuries or Sickness Treasury Regulation 104.1.

US Legal Forms may be the biggest local library of legal varieties that you can discover different file templates. Take advantage of the service to down load skillfully-produced papers that stick to status demands.

Form popularity

FAQ

The Form 30C is to be completed and filed by a claimant (employee) or claimant's attorney/representative for making a claim for workers' compensation benefits.

No. It is illegal for an employer to fire you simply for filing a workers' compensation claim, which means your employer must provide another justifiable reason for your termination.

The Connecticut Workers' Compensation Act states that an employer may not discharge or discriminate against an employee because they have filed a workers' compensation claim or are exercising their rights under the act.

How Does Workers' Comp Work in CT? Workers' compensation in CT requires employees to immediately report an injury or illness to their employer. The state requires all employing state agencies to accept all injury reports. State agencies can't keep an employee from filing a workers' comp claim.

Promptly file a Written Notice of Claim: In Connecticut, you must file Form 30C, which gives notice to the Workers' Compensation Commission that you are claiming benefits. Although you notified your employer that you were injured, you must file the Written Notice, Form 30C, as well.

The Form 43 is to be completed by the respondent (employer/workers' compensation insurance carrier) to notify the Administrative Law Judge, the claimant (employee/decedent), and all parties to the claim of its intention to deny the compensability of all or part of the claimant's claim to workers' compensation benefits.

Connecticut General Statutes Section 31-284b requires covered employers to continue insurance coverage for employees eligible to receive workers compensation.

How Long Does It Take to Reach a Settlement for Workers' Comp in Connecticut ? The entire settlement process?from filing your claim to having the money in your hands?can take around 12-18 months depending on the details of your case and whether or not you have legal representation.