Connecticut Business Deductibility Checklist

Description

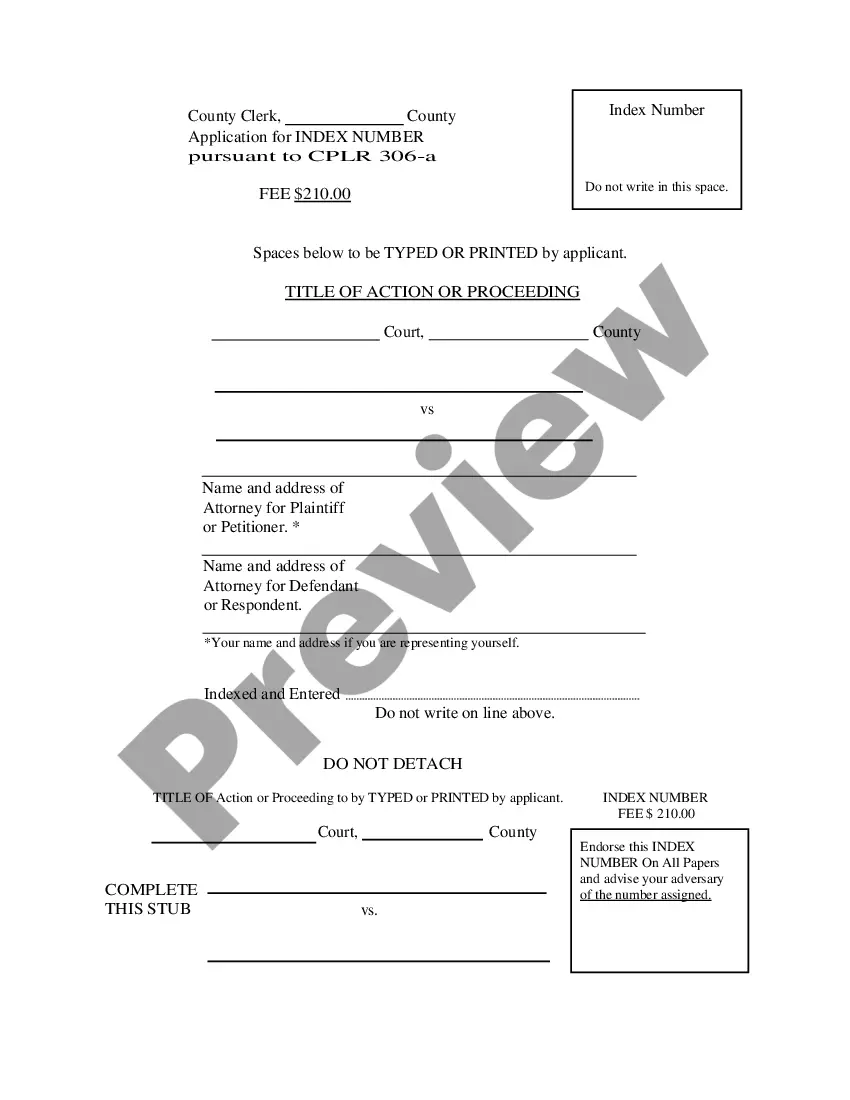

How to fill out Business Deductibility Checklist?

Selecting the optimal legal document format can be challenging.

Undoubtedly, there are numerous templates accessible online, but how can you acquire the legal form you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Connecticut Business Deductibility Checklist, which can be utilized for business and personal purposes.

First, ensure you have selected the right form for your region/state. You can examine the form using the Review button and read the form description to confirm it is suitable for you.

- All documents are reviewed by professionals and comply with state and federal regulations.

- If you are currently registered, Log In to your account and click the Download button to obtain the Connecticut Business Deductibility Checklist.

- Use your account to review the legal forms you have previously purchased.

- Navigate to the My documents tab in your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, follow these simple steps.

Form popularity

FAQ

Filling out an SST form, or Streamlined Sales and Use Tax form, requires clear and precise information. Begin by entering your business information, including address and tax identification number. Next, outline your sales transactions and the states where you sold goods. Refer to the Connecticut Business Deductibility Checklist for additional insights, ensuring your form is complete and compliant to help streamline your tax process.

Do you have to pay for a Connecticut LLC every year? Connecticut LLCs must pay an $80 annual report fee every year. Visit our Connecticut LLC annual report guide for more information.

While the state doesn't have a standard deduction, the personal exemption is $15,000 for single taxpayers and $24,000 for married couples. Connecticut also has a policy known as tax benefit recapture, in which many high-income taxpayers pay the maximum tax rate on all income, not just the amount above the threshold.

Pass-through income is only subject to a single layer of income tax and is generally taxed as ordinary income up to the maximum 37 percent rate. However, certain pass-through income is eligible for a 20 percent deduction, which reduces the top tax rate to a maximum of 29.6 percent.

The State of Connecticut requires you to file an annual report for your LLC. Annual report forms or notifications are automatically sent to your LLC's mailing address. You can file your annual report online at the SOTS website. The annual report is due by the end of the anniversary month of your LLC's formation.

Under the new legislation, a tax is now imposed on the LLC at a rate of 6.99%, for $6,990 of Connecticut income taxes. The LLC will deduct this amount on its federal income tax return, reducing its net income to $93,010.

By imposing an income tax directly on the pass-through entity, which is not limited in the amount of state taxes that it can deduct for federal income tax purposes, state tax on pass-through entity income now becomes a deduction for the pass-through entity for federal income tax purposes.

N/A Connecticut does not have a standard or itemized deduction. Instead, it starts with the federal taxable income, since the deductions have already been taken out. No individual income tax. No Deductions must match the federal return.

The Internal Revenue Service (IRS) released Notice 2020-75 on November 9, 2020, which validates the federal income tax deductibility of the payment of the Connecticut Pass-Through Entity Tax (the PET).

A PE's required annual payment is equal the lesser of: 90% of the PE Tax shown on the PE's current year Connecticut PE Tax return; or. 100% of the PE Tax shown on the PE's prior year Connecticut PE Tax return if the PE filed a prior year return that covered a 12-month period.