Kentucky Direct Deposit Form for Employees

Description

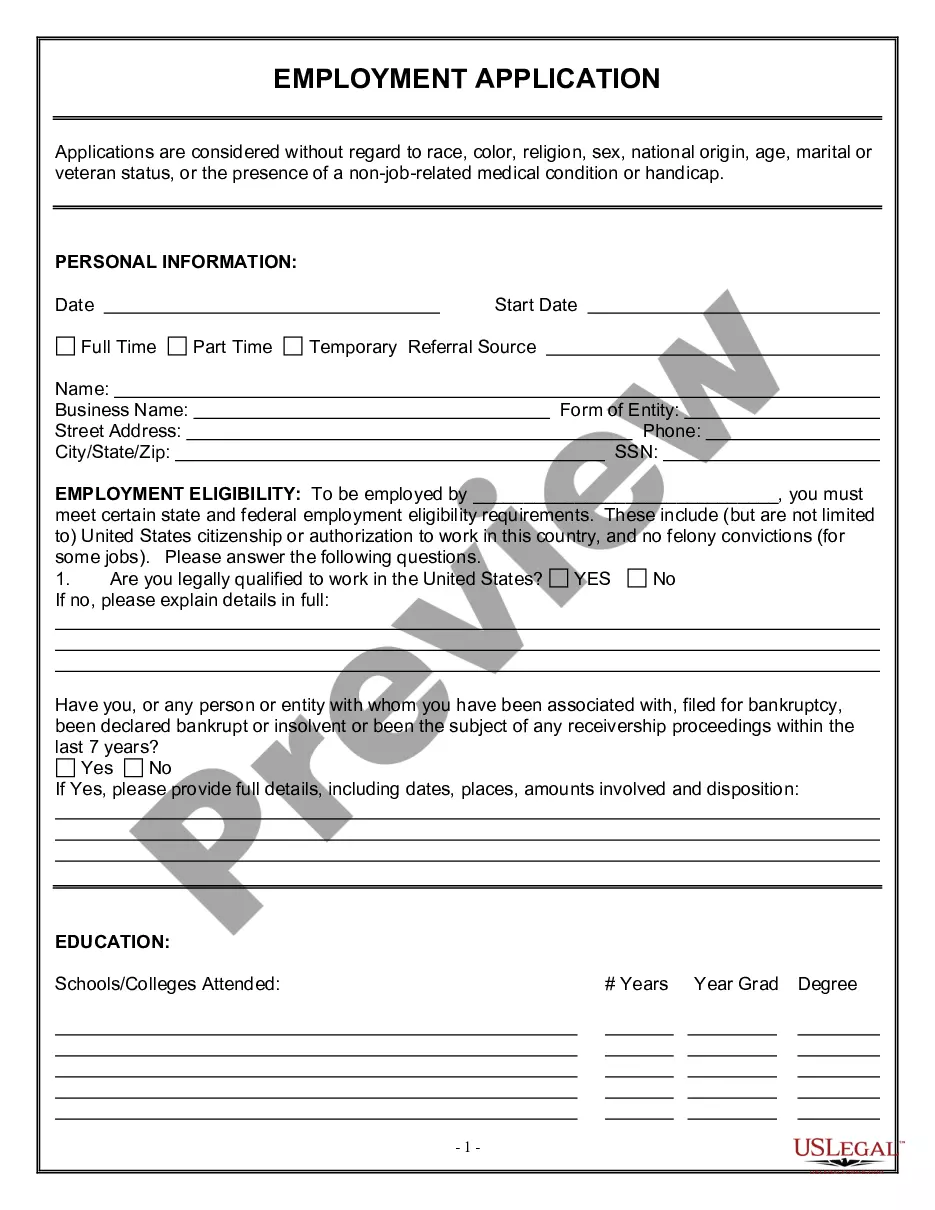

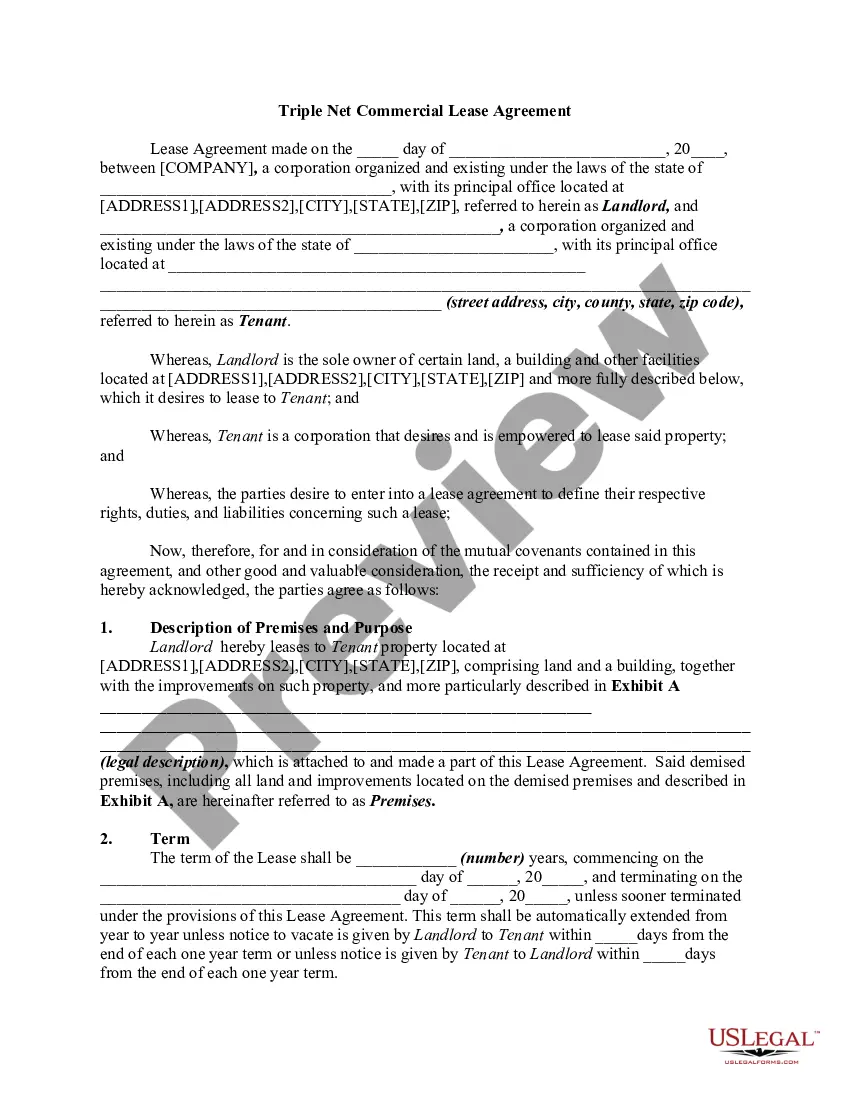

How to fill out Direct Deposit Form For Employees?

It is feasible to spend hours online searching for the legal documents template that fulfills the state and federal criteria you require.

US Legal Forms offers numerous legal forms that are reviewed by experts.

You can easily download or print the Kentucky Direct Deposit Form for Employees from the service.

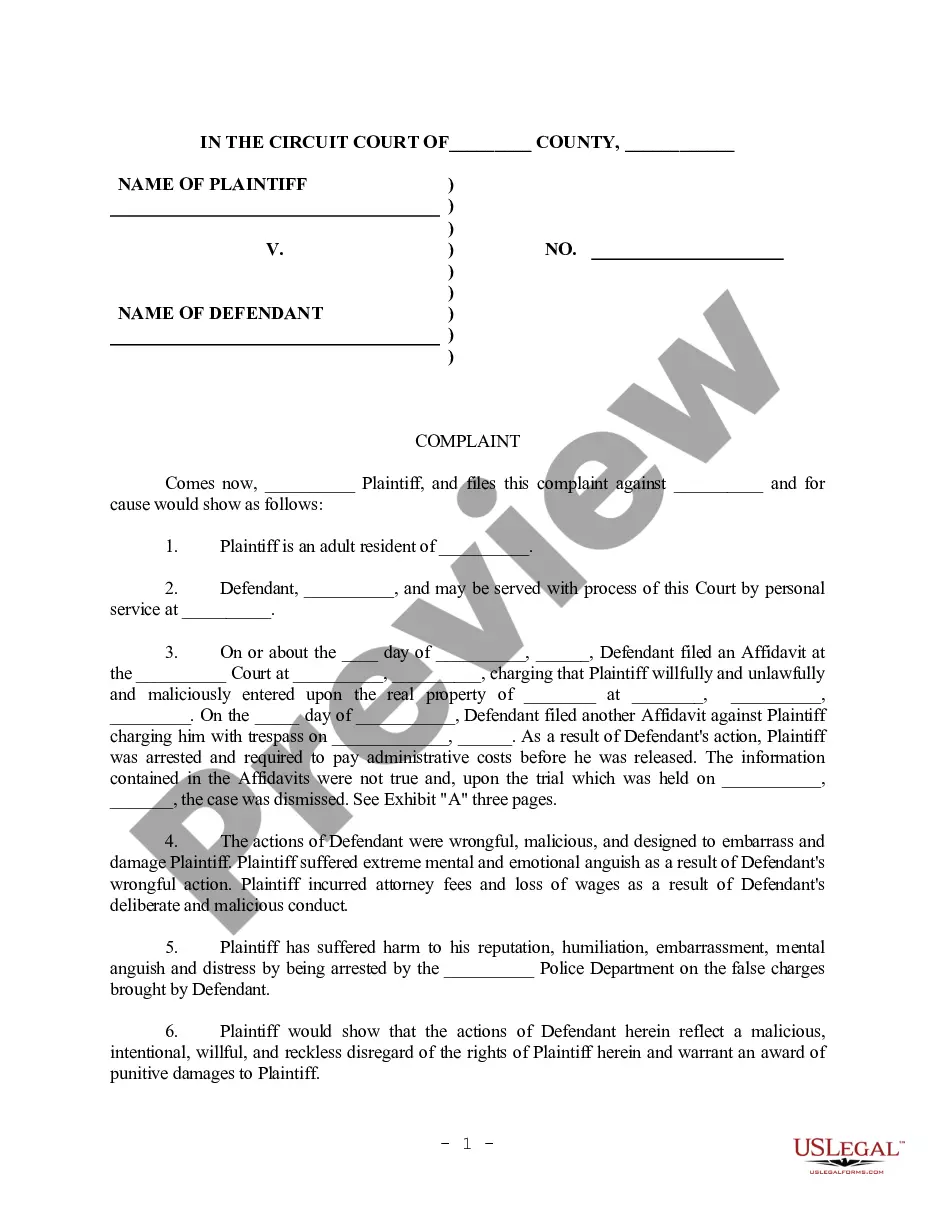

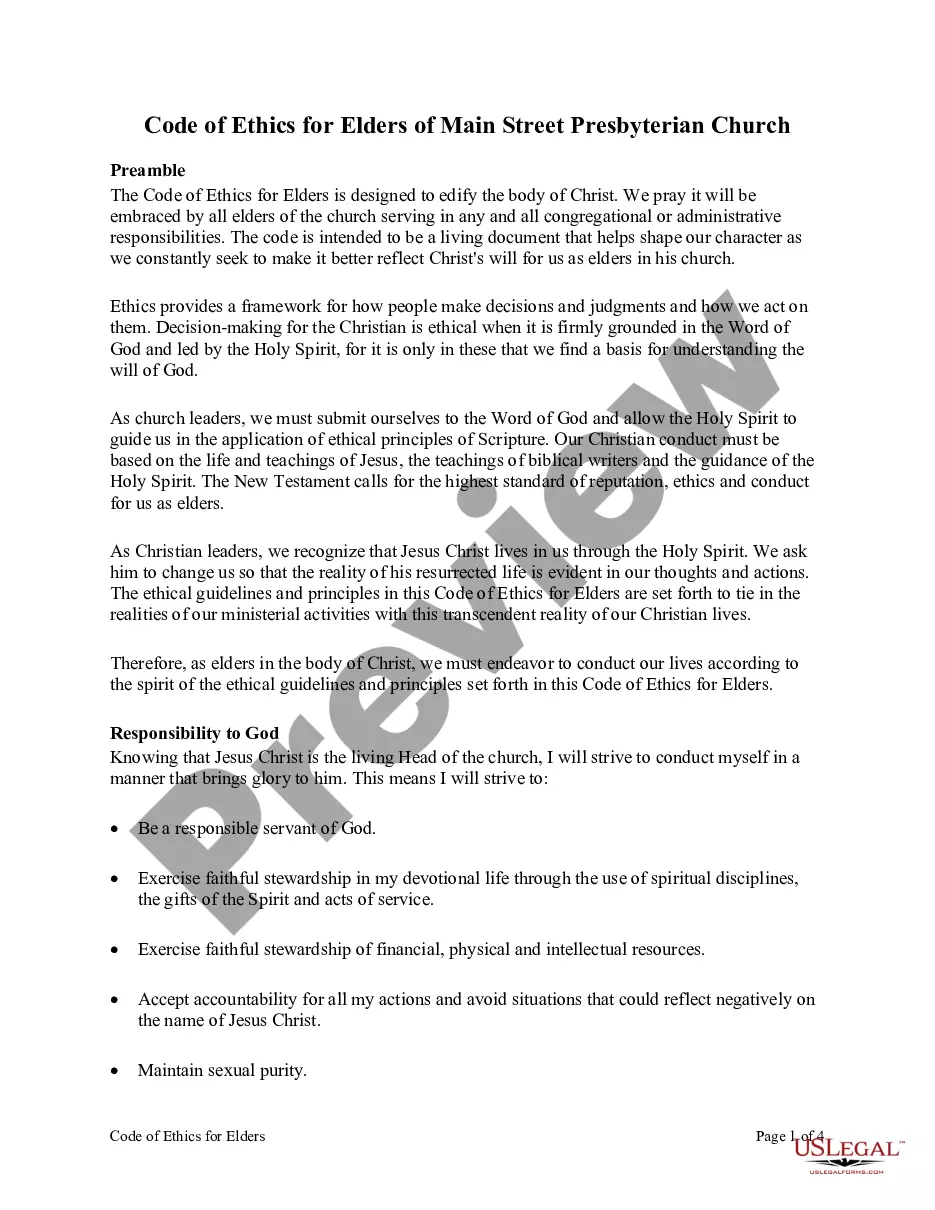

If available, utilize the Review option to examine the document template as well. If you wish to find another version of the form, use the Search field to locate the template that meets your needs and specifications.

- If you already possess a US Legal Forms account, you can Log In and click the Download option.

- Then, you can complete, modify, print, or sign the Kentucky Direct Deposit Form for Employees.

- Each legal document template you acquire is yours forever.

- To obtain another copy of any purchased form, go to the My documents tab and click the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your county/city of choice.

- Check the form details to confirm you have selected the right form.

Form popularity

FAQ

Filling out an employee direct deposit form is straightforward. Begin by entering the employee's personal information, such as their name, address, and Social Security number. Then, provide the banking details, including the bank name, account number, and routing number. Finally, ensure that the employee signs the Kentucky Direct Deposit Form for Employees to authorize the direct deposit, and submit it to your payroll department for processing. This ensures accurate and timely payments.

To set up direct deposit for your employees, first, gather the necessary details, including your employees' bank account information and a completed Kentucky Direct Deposit Form for Employees. Next, contact your bank to ensure they support direct deposit services and follow their specific setup procedures. Once you have the required information and permissions, submit the Kentucky Direct Deposit Form for Employees to your payroll department or service provider. This streamlined process will help you efficiently manage employee payments.

To set up direct deposit for your employees, start by providing them with a Kentucky Direct Deposit Form for Employees. Collect the completed forms and ensure all information is accurate. Submit these forms to your payroll provider to initiate the direct deposit process. Using tools from uslegalforms can simplify form creation and help you maintain compliance throughout the setup.

While you can encourage employees to use direct deposit, you cannot force them to do so. However, providing a Kentucky Direct Deposit Form for Employees and explaining the benefits can make it more appealing. Many employees appreciate the convenience and security of direct deposit, which can lead to higher adoption rates. Clear communication about the advantages can help facilitate this transition.

Yes, you can easily print a Kentucky Direct Deposit Form for Employees online. Various platforms, including uslegalforms, offer customizable templates that you can fill out and print. This option saves time and ensures that your forms meet legal requirements. Make sure to verify that the form is up-to-date with current regulations.

To get direct deposit for your employees, you need to complete a Kentucky Direct Deposit Form for Employees. This form requires information such as your employees' bank account details. After gathering the necessary information, submit the form to your payroll provider. Utilizing platforms like uslegalforms can streamline this process and ensure compliance with state regulations.

Yes, Kentucky allows direct deposit for employees. Employers can use a Kentucky Direct Deposit Form for Employees to set this up. This method provides a secure and convenient way for employees to receive their wages directly into their bank accounts. It simplifies the payroll process, making it easier for both employers and employees.