Connecticut Mileage Reimbursement Form

Description

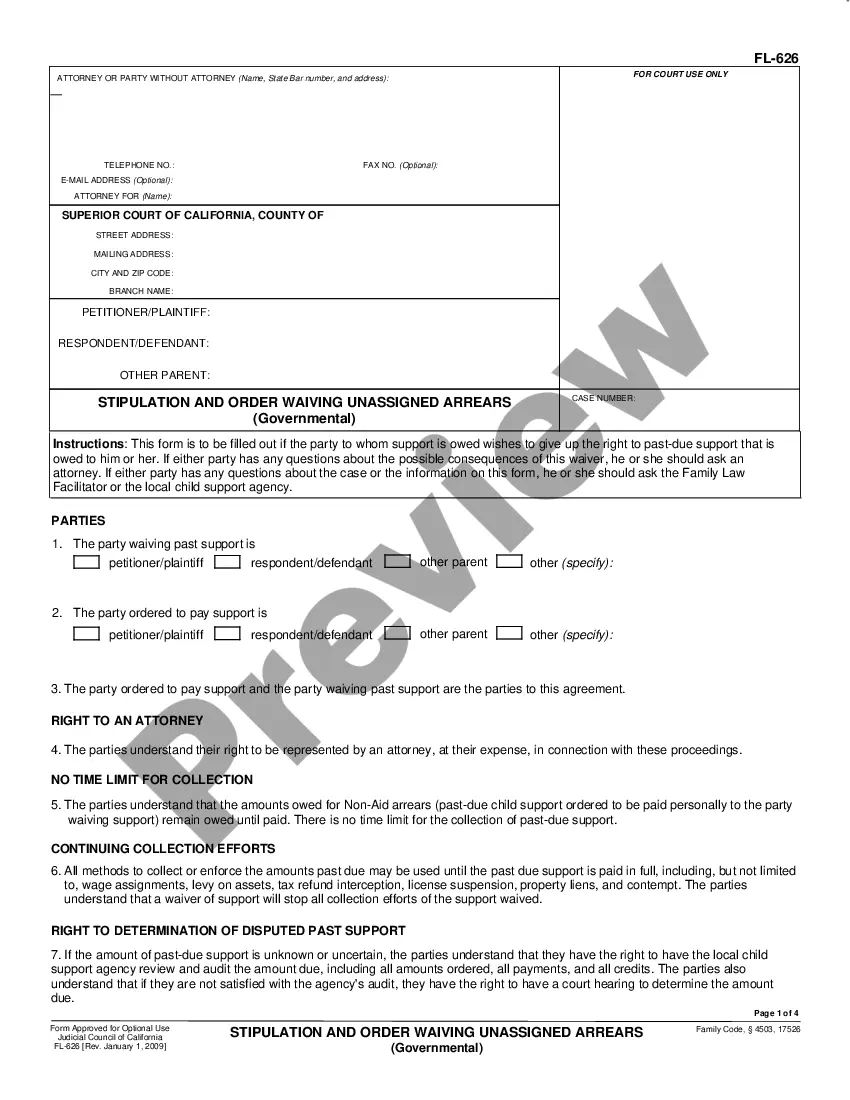

How to fill out Mileage Reimbursement Form?

If you wish to acquire, obtain, or produce valid document templates, utilize US Legal Forms, the largest selection of legal forms, which can be accessed online.

Take advantage of the site’s straightforward and user-friendly search to find the documents you require.

A selection of templates for business and personal needs are organized by categories and claims, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your information to create an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to access the Connecticut Mileage Reimbursement Form with just a few clicks.

- If you are an existing US Legal Forms customer, Log In to your account and click the Download button to retrieve the Connecticut Mileage Reimbursement Form.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are a first-time user of US Legal Forms, follow the steps outlined below.

- Step 1. Make sure you have selected the form for the appropriate city/state.

- Step 2. Use the Preview feature to review the form’s contents. Be sure to read the description.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

The mileage reimbursement rate for all travel expenses incurred on or after January 1, 2022 has risen to 58.5 cents per mile. This rate change applies to all claimants, regardless of injury date, and coincides with the federal mileage reimbursement rate pursuant to Section 31-312(a) of the Workers' Compensation Act.

What is the mileage reimbursement rate? The mileage reimbursement rate for Connecticut members is $0.54 cents per mile.

For 2020, the standard mileage rate for businesses will be 57.5 cents per mile, a decrease of 0.5 cents from 58 cents per mile in 2019. According to critics, the issue with these annually-fixed, national rates is that they do not account for variables such as location and fluctuating fuel prices.

EFFECTIVE JANUARY 1, 2021 - Mileage Rate Decreased to . 56 cents per mile.

State of Connecticut Office of the State Comptroller MEMORANDUM NO 2020-03. The Internal Revenue Service has announced that the standard mileage rate for business use of an automobile has been decreased to 57.5 cents per mile effective January 1, 2020.

EFFECTIVE JANUARY 1, 2021 - Mileage Rate Decreased to . 56 cents per mile. All mileage reimbursement submissions should be sent to the OOC Business Office Unit - In light of COVID-19 precautions, please use email only.

The federal mileage rate is used as a synonym for the IRS mileage rate, which means they are the same. The 2020 mileage rates are 57.5 cents per mile for business purposes, 17 cents per mile for medical and moving purposes, and 14 cents per mile for charity and volunteering mileage.

58.5 cents per mile driven for business use, up 2.5 cents from the rate for 2021, 18 cents per mile driven for medical, or moving purposes for qualified active-duty members of the Armed Forces, up 2 cents from the rate for 2021 and.