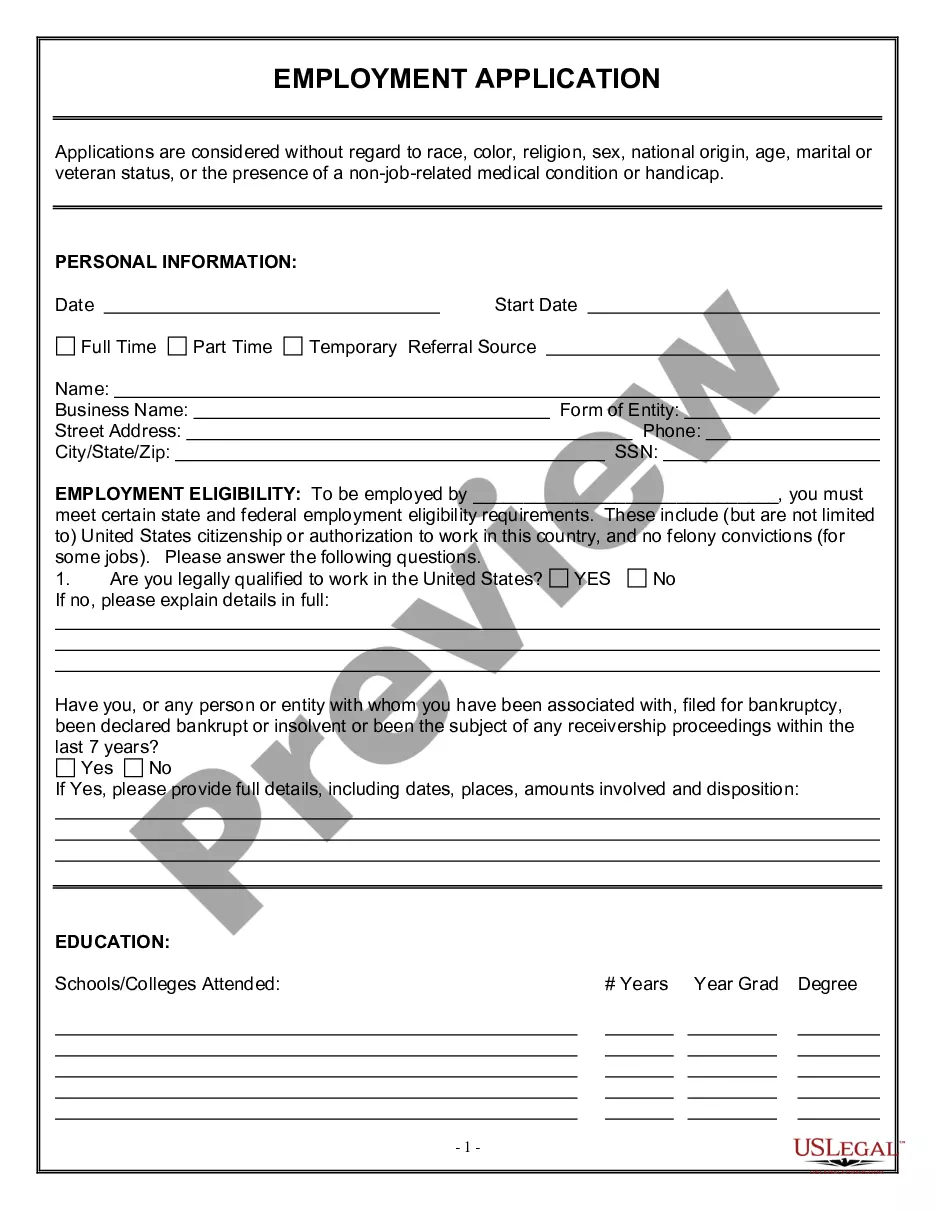

Connecticut Job Description Format II

Description

How to fill out Job Description Format II?

Locating the appropriate legal document template can be a challenge.

Indeed, there are numerous templates accessible online, but how can you find the legal form you require.

Take advantage of the US Legal Forms website. This service offers a multitude of templates, such as the Connecticut Job Description Format II, which you can utilize for both business and personal needs.

You can examine the form using the Preview option and read the form description to confirm it suits your needs.

- All forms are validated by professionals and comply with state and federal regulations.

- If you are currently registered, Log In to your account and click the Download button to access the Connecticut Job Description Format II.

- Use your account to review the legal forms you may have purchased previously.

- Check the My documents section of your account to obtain another copy of the document you require.

- If you are a new user of US Legal Forms, here are easy steps to follow.

- First, ensure you have chosen the correct form for your state/region.

Form popularity

FAQ

CT. Cognitive Turnover (work psychology)

C Married, filing jointly, and spouse is not employed; this the default when the federal marital status is M. D Married, filing jointly, both work, and combined income. is more than $100,500; or there is significant non-wage income; this code also applies to nonresident employees.

City Compensatory Allowance (CCA) is a type of allowance offered by companies to their employees to compensate for the high cost of living in metropolises and large cities. This is typically offered to employees staying in Tier 1 cities and in some cases Tier 2 cities at the discretion of the employer.

CT - Consultant Team. CTBO - Carbon Takeback Obligation.

Form CT-W4, Employee's Withholding Certificate, provides your employer with the necessary information to withhold the correct amount of Connecticut income tax from your wages to ensure that you will not be underwithheld or overwithheld.

If you are a married individual filing jointly and you and your spouse both select Withholding Code A, you may have too much or too little Connecticut income tax withheld from your pay. This is because the phase2011out of the personal exemption and credit is based on your combined incomes.

Corporation Tax (CT)

Form CT-W4NA, in addition to Form CT-W4, Employee's Withholding Certificate, will assist your employer in withholding the correct amount of Connecticut income tax from your wages for services performed in Connecticut.

CT stands for computed tomography.

For those classifications for which a full time schedule is considered 35 hours per week this period is 914 hours. For those classifications for which a full time schedule is considered 37.5 hours per week the period is 979 hours.