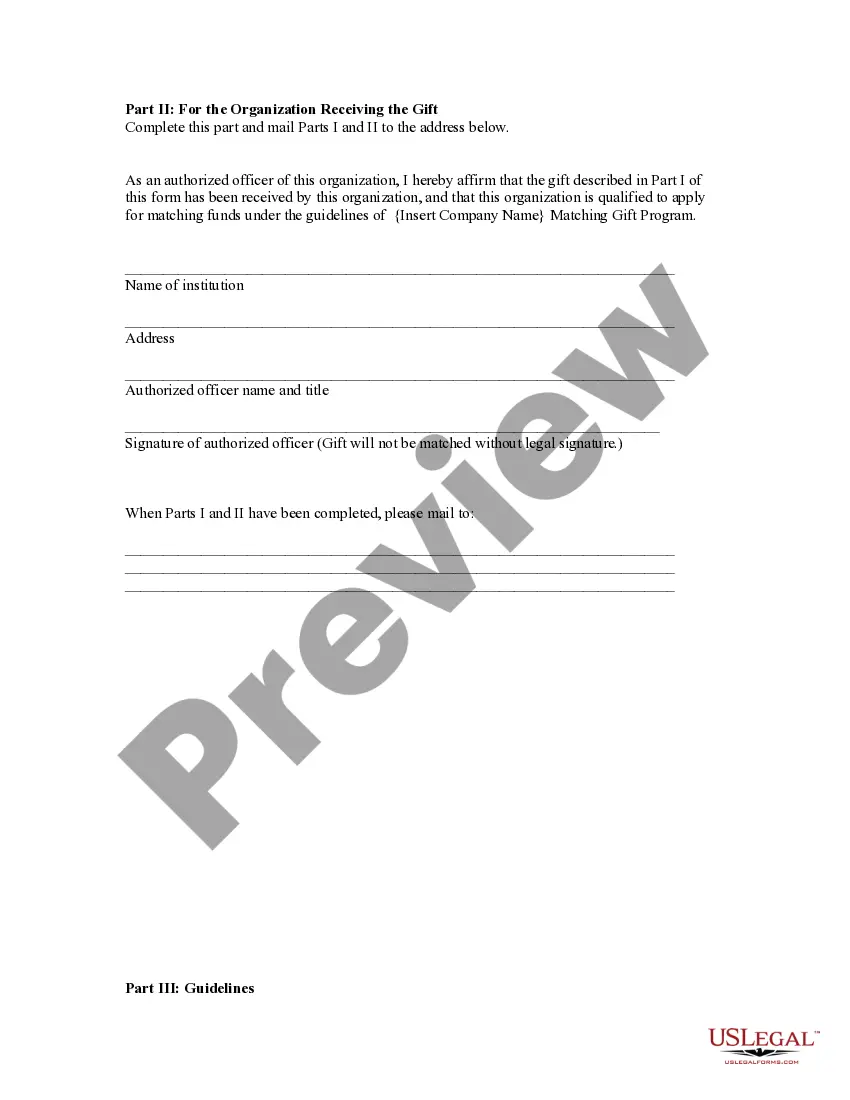

Connecticut Matching Gift Form

Description

How to fill out Matching Gift Form?

Are you in a situation where you often need documents for business or personal purposes? There is a multitude of legal document templates accessible online, but locating ones you can trust is challenging.

US Legal Forms provides thousands of form templates, including the Connecticut Matching Gift Form, designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. Then, you can obtain the Connecticut Matching Gift Form template.

Access all the templates you have purchased in the My documents section. You can retrieve an additional version of the Connecticut Matching Gift Form whenever needed. Simply select the desired form to download or print the document template.

Utilize US Legal Forms, the most extensive collection of legal documents, to save time and reduce errors. The service provides expertly crafted legal document templates for various needs. Create an account on US Legal Forms and start simplifying your life.

- Identify the form you require and confirm it's for the correct city/state.

- Click the Review button to inspect the form.

- Check the summary to ensure that you have selected the appropriate document.

- If the form isn't what you're looking for, utilize the Search field to find the document that meets your needs.

- Once you locate the correct form, click Get now.

- Select the pricing plan you prefer, enter the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- Choose a convenient file format and download your copy.

Form popularity

FAQ

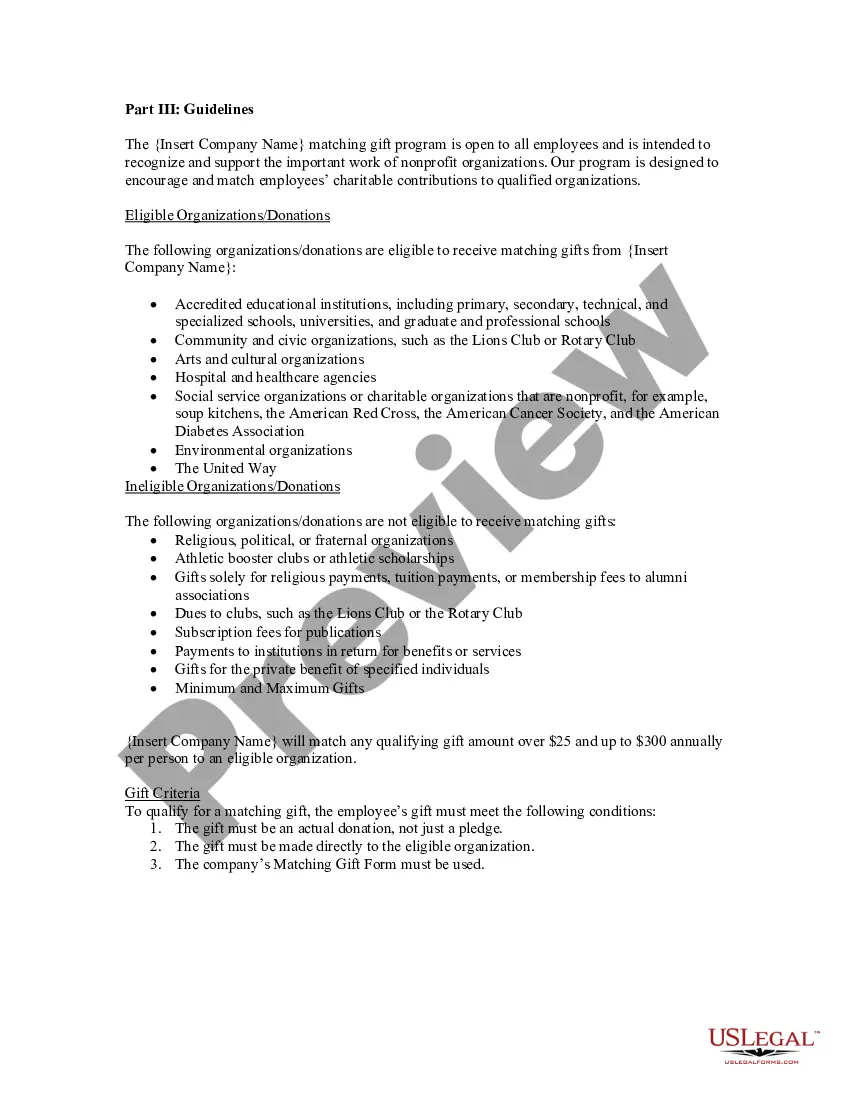

What are matching gifts? Corporate matching gifts are a type of philanthropy in which companies financially match donations that their employees make to nonprofit organizations. When an employee makes a donation, they'll request the matching gift from their employer, who then makes their own donation.

Nationwide: Gifts from eligible donors may be designated for a specific use, but the Foundation's matching gifts will be unrestricted for educational purposes.

Matching gift campaigns are a popular fundraising strategy used by charities to incentivize public donations with donations offered by one or more match donors. Types of Campaigns. The core of a matching gift campaign is that a match donor offers to make a donation in connection with donations made by the public.

Matching gift campaigns are a popular fundraising strategy used by charities to incentivize public donations with donations offered by one or more match donors. Types of Campaigns. The core of a matching gift campaign is that a match donor offers to make a donation in connection with donations made by the public.

Corporate matching gifts are a type of philanthropy in which companies financially match donations that their employees make to nonprofit organizations. When an employee makes a donation, they'll request the matching gift from their employer, who then makes their own donation.

Matching gifts are a type of giving program that is set up by companies and corporations as an employee benefit. After an employee donates to a nonprofit, they can submit a matching gift request to their employer and the company will make an additional donation to that nonprofit.

What Is Donation Matching? Donation matching is a corporate giving initiative in which an employer matches their employee's contribution to a specific cause, increasing the gift. For example, if a Kindful employee donates $50 to a local organization, the matching gift would be Kindful's additional donation of $50.

Since a matching gift is technically a donation, companies can deduct the matches they make from their reported income. Decreasing reported income means a company will not have to pay taxes on the donated money.

Follow these tips, lean back in your seat, and watch the credits roll!Study Up on Matching Gifts.Appoint a Matching Gift Specialist.Raise Awareness About Matched Giving.Collect Donor Employer Details.Strive for Easy Accessibility.Keep Records of the Individuals' Matching Gift Statuses.More items...?

A challenge campaign is just what it sounds like: A 'challenge' is given to donors to raise a certain amount of money by a certain amount of time. If the challenge is complete, there is typically a matching donor(s) that will then match the gifts raised either dollar for dollar or at a certain percentage point.